Investment Property Mortgage Rates Explained

Investment property mortgage rates are becoming more relevant as people buy second properties. Rental and investment properties can help you to earn lots of money. When buying investment properties at a good price, and then financing it correctly, these opportunities can generate almost immediate income. Check out Investment property mortgage rates.

But securing cheap mortgage rates for an investment or rental is harder when compared to primary residences. This is because most lenders charge an extra fee for non-owner-occupied transactions for a property that you are not living in.

Despite the higher rates, choosing to invest in real estate is usually a good option for the long term. Here is more information on the 2021 prices to finance your cash flow in the future with investment property mortgage rates.

Top 5 Things To Know About Buying A Rental Income Property

When purchasing a rental property, you need a minimum down payment of 20%of the purchase value for single family homes/duplexes and a minimum of 25% of the purchase value for multi-unit complexes.

You cannot use your RRSPs, which means youâll need to tap into your other savings or the equity of your home for your down payment.

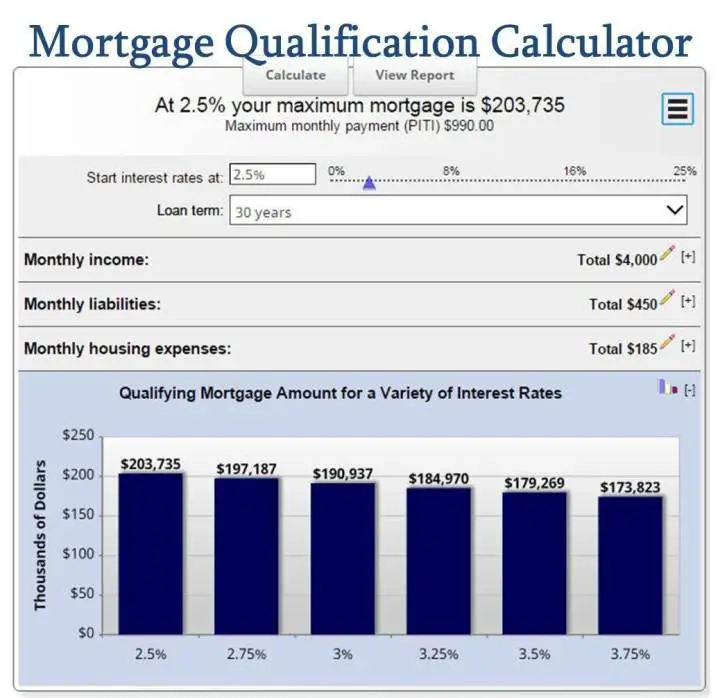

Before hunting for your rental property, itâs important to apply to get pre-approved. This will confirm the maximum mortgage you can afford and will make you a more attractive buyer since your financing has already been pre-approved with a financial institution.

As a rental property owner, you will have regular operating costs associated with your property.

You should budget about 1% of the propertyâs value annually for maintenance and have a plan in place. Youâll also want to know the cost of property taxes. In general, budget around 50% of your total rental income for operating expenses.

Consider what type of tenants you are looking to attract to narrow down your search to the most suitable neighbourhoods. Research rent costs in the area to make sure you will be able to turn a profit with your rental property.

You can complete the mortgage process with us without needing to come into a branch. You can meet with an advisor via video and we can send the mortgage documentation to your lawyer for signature. Single family and duplex properties can also apply online.

How To Get A Mortgage

A mortgage is a type of loan designed for buying a home. Mortgage loans allow buyers to break up their payments over a set number of years, paying an agreed amount of interest.

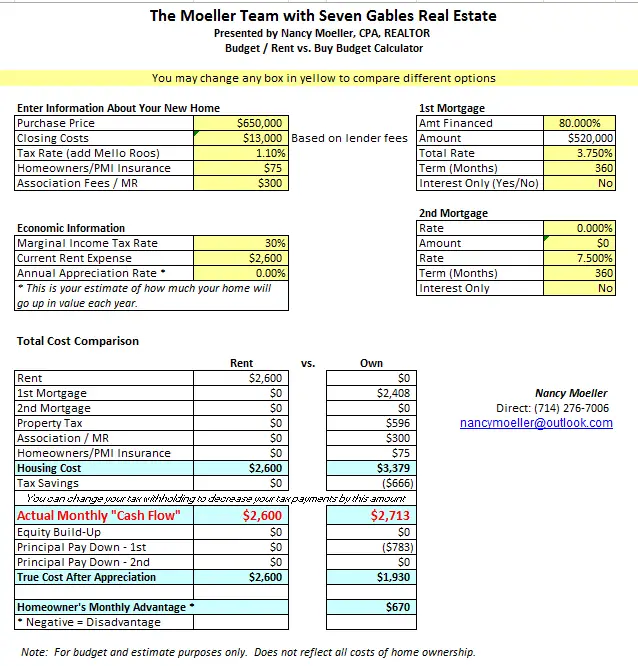

Because a home is typically the biggest purchase a person makes, a mortgage is usually a households largest chunk of debt. Getting the best possible terms on your loan can mean a difference of hundreds of extra dollars in or out of your budget each month, and tens of thousands of dollars in or out of your pocket over the life of the loan. Its important to prepare for the mortgage application process to ensure you get the best rate and most affordable monthly payments.

Here are quick steps to prepare for a mortgage:

Different types of mortgages

There are many different types of mortgages, broadly put into three buckets: conventional, government-insured and jumbo loans, also known as non-conforming mortgages. There are also different loan terms within these categories, such as 15 years or 30 years, and different interest rate structures, generally either fixed or adjustable .

Don’t Miss: Should You Do A 15 Or 30 Year Mortgage

How To Get The Best Mortgage Rate

Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower’s personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:

How To Finance A Rental Property

Choosing a Loan Type

So, you are looking to buy an investment property and you want to compare investment property mortgage rates. What are your options? You basically have three different types of rental loans, including:

Agency or qualified mortgage Bank portfolio mortgage Non-bank, non-qualifying mortgage

Agency Loans

An Agency Loan is eligible to be purchased or guaranteed by Fannie Mae or Freddie Mac, often referred to as GSEs or government-sponsored enterprises. When you think of this type of mortgage, you should think about the process you underwent in obtaining the mortgage on your primary residence. You will qualify based on your ability to repay the loan from all of your sources of income along with the strength of your credit. As part of the underwriting process, youll need to provide pay stubs, tax returns , bank statements, retirement states, and brokerage statements.

Bank Loans

A Bank Loan is not eligible for sale to or guarantee by a GSE, so the bank has to hold the loan on their balance sheet in their own loan portfolio. Most local banks focus on financing commercial real estate and small businesses. Some allocate a portion of their assets for residential mortgage lending, including on rental properties. Often these loans are reserved for existing customers.

Non-QM Loans

If youre interested in beginning the rental property loan process, contact us today to get started.

Comparing Investment or Rental Property Mortgage Rates

Bank Loan:

Recommended Reading: How Much Income Do I Need For A 50k Mortgage

You May Have To Make A Larger Down Payment

In most cases, the minimum down payment required for investment property is 15% to 20%. You can make a down payment on your own home of as little as 3% in some cases.

However, for a down payment lower than 20% on your own home, a borrower is required to pay for private mortgage insurance , which can cost between 0.25% and 2% of the loan balance per year. PMI does not cover investment property, so investors must make a larger down payment.

âBorrowers usually get the best deal on an interest rate if they put down at least 25%,â Dalzell says. She recommends asking a lender to work up an estimate for both 20% down and 25% down, so you can see the difference in interest rates and payments.

Can I Get A 30

Yes, there are 30-year loan options on investment properties. 30-year mortgages are a common loan type when it comes to second homes. However, there are also terms of 10, 15, 20, or 25 years available.

The loan term that is right for you on an investment property depends on the interest rate, your monthly budget, and the purchase price. A shorter loan term or higher interest rate usually translates into increased monthly payments. 30-year loans on investment properties will typically translate into more affordable monthly payments. However, the interest that you are paying will be more over the period of your loan.

Read Also: What Does Apr Mean On Mortgage Rates

Why Choose Westpac For Your Investment

Discounts for diligent investors

Get additional interest rate discounts by paying 12 months interest in advance on Fixed Rate Investment Property Loans with Interest Only in Advance.***

Best Investor Lender two years running

Awarded at RFi Group Australian Lending Awards, 2020 & 2021 for Best Investor Lender

Know the property inside out

Search an address or suburb for the sale history, price guide, expected capital gain and rental income with our full online Property Report.

What Makes A Rental Property Mortgage Different

âMortgage lending is all about risk levels,â says Brooke Dalzell, director of production at Minute Mortgage in Scottsdale, Arizona. âA mortgage for an investment property carries a higher level of risk than a mortgage for a primary home, simply because the mortgage holder isnât living in the home.â

Here are three ways a rental property mortgage differs from a mortgage for your primary residence.

Also Check: How Much Do You Pay Back On A Mortgage

Should You Pay Off The Rental Property Mortgage

If your property generates cash flow – meaning profits, you should keep your mortgage. However, paying off the mortgage could be a good idea if your property is losing money. In general, mortgage debt enhances your return on investment because you only need a small down payment to receive the total property appreciation and rental income. There are also the tax benefits of mortgage debt, such as deductions.

If your property generates profits, your money would be better spent as a down payment for another rental property. Instead of one fully paid off property, you could have two that appreciate in value and still provide you with rental income.

Each year, you will receive a T5013 slip from your mortgage lender showing the amount of interest paid. You must fill outLine 8710with the appropriate amount to claim the mortgage interest payments. Additionally, you may claim the costs directly associated with receiving the mortgage, such as:

- Mortgage broker fees

- Application & processing fees

With the deduction, you will lower the total amount of tax you need to pay. Some otherpopular rental expenses you can deduct in Canadainclude:

Are The Mortgage Rates Higher For Investment Properties

Yes, the mortgage rates will always be higher for an investment property. The mortgage rates for investment properties for single-family buildings are around 0.50% to 0.75% higher when compared to owner-occupied residential loan rates. If you buy a 2 to 4-unit building, the lender will add another 0.125% to 0.25% to the interest rate.

Don’t Miss: Will Applying For A Mortgage Affect My Credit

Reduce Your Existing Debt

Your debt-to-income ratio compares your monthly debt repayments to your monthly gross income. Lenders use your DTI to determine the loan amounts youll have access to, and it shouldnt exceed 43% for most types of loans.

Lowering your DTI shows lenders that you have plenty of room in your budget not only for monthly mortgage payments, but for other property management costs, too. These include homeowners insurance, property taxes, and ongoing maintenance and repairs.

Types Of Rental Property Loans

When you get a mortgage for your primary home, you have several options, including government-backed loans such as those provided by the Federal Housing Administration , Veterans Administration and U.S. Department of Agriculture . But because these types of loans are restricted to financing primary residences, you canât use them to purchase a rental property unless itâs a multi-unit property and youâll be living in one of the units.

Generally, the loans most available for rental properties are conventional mortgages and jumbo loans. If you already own a home, you may be able to access the equity in your current home to purchase a rental property. You can access your home equity through a home equity loan or home equity line of credit.

Read Also: How To Get A Mortgage Loan

Your Mortgage Rate Likely Will Be Higher

In a low interest rate environment, the interest rate on a mortgage for a rental property is still relatively low. For most borrowers, the rate will be about three-quarters of a percentage point higher for an investment property than it would be for a primary home, Dalzell says, or about the mid-3% range currently.

Is It A Good Time To Take Out A Rental Property Loan

Even if it requires extra paperwork and documentation, getting a mortgage for an income-producing rental property may be a good idea, especially at the moment. Low mortgage rates help make purchasing real estate more affordable, while economic uncertainty may make it appealing to have a passive income stream available through a rental property.

âIf the property in question provides a solid cash flow and is in a desirable location, this can be a solid long-term investment,â McCormick says. âMedian rents have increased steadily over the past 50 years, providing a nice income stream to rental property owners.â

Low rates are driving interest from a wide variety of real estate investors, but rental properties are one of the safer bets.

âInvesting in a real estate property for a short-term purpose, such as a flip, would likely be far riskier in the current real estate environment,â McCormick says. âThere is likely to be an influx of real estate supply through foreclosures, which could depress prices and have a negative impact on real estate speculation in 2021. This may be offset by the large demand we have continued to see in the past several months for real estate, but nevertheless remains a risk.â

You May Like: How To Get A 15 Year Fixed Mortgage

Save Thousands Withour Low Mortgage Rates

*At Cambrian, qualifying single family and duplex rental income properties receive our low residential mortgage rates, saving you interest costs.And when it comes to the cost of your mortgage, a lower mortgage rate makes a big difference.

For example, the difference between 5.65% and 6.50% on a $500,000 mortgage would be an interest savings of approximately $20,550 over a 5 year term.

3 Year Closed

5 Year Variable Closed Mortgage

5.55

Where To Get Financing For Investment Properties

Financing an investment property can often be a challenge. Not only because of the stricter terms and conditions required to qualify for the mortgage, but also because rental financing may not always available from the buyer’s bank of choice.

Consequently, buyers often have to look at other lending avenues to secure the financing they need. The most common mortgage providers for rental properties include:

You May Like: How To Shop Multiple Mortgage Lenders

Consider Your Timeframe And Don’t Buy Unless You’re Planning On Keeping The Property For At Least 5 Years

“I truly believe it’s still a good time to buy and I’m not saying that because I’m an agent,” 25-year-old realtor and investor Karina Mejia told Insider. She owns homes in Boston, where she lives, and Augusta, Georgia.

The housing market is finally cooling after nearly two years of frenzied bidding wars.

Up until recently, “you could not get your offer accepted if you didn’t go significantly above ask and waive inspections and appraisals,” said Mejia. “Now buyers have an opportunity to do the things that they should have been doing, like inspection contingencies and appraisal contingencies, and they have an opportunity to get a deal. Now you actually can negotiate and get homes at a discount.”

That said, it’s more expensive to own a home when rates are higher, monthly mortgage payments are higher and you shouldn’t buy unless you absolutely can afford to.

“I think it would be a disservice to say that it’s a great time to buy for everybody,” said Mejia. “You don’t want to get into a monthly payment that doesn’t work for you. That’s especially important to be mindful of in today’s economy, in which people might lose their jobs.”

As a prospective buyer, you want to consider your timeframe: Are you looking to stay in your home for the next five to 10 years? Or do you think you’ll make a move within two to three years?

Features And Benefits Of An Investment Property Mortgage

The RBC Investment Property Mortgage can provide financing for up to 80% of the appraised value of your rental property.

A Mortgage Solution to Meet Your Needs

Offering competitive rates and a range of terms, the RBC Investment Property Mortgage may be the ideal solution if you’re considering:

- Acquiring a rental portfolio of one or more properties to build income and equity

- Converting your current home to a rental property

- Purchasing a property for your child to live in

How to Qualify for an Investment Property Mortgage

To qualify for an RBC Investment Property Mortgage, you must have a good credit history, demonstrate sufficient rental income , and have enough non-rental income to meet the obligations of the mortgage.

Not sure where to start? Talk to an RBC mortgage specialist, who can help you decide whether an investment property is right for you.

You May Like: How To Figure Out Mortgage Rates

How Are Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE: Get your credit score for free

Claiming Mortgage Payments On Rental Property

You can deduct mortgage interest payments to lower yourtaxable income in Canada. However, you can only do this with investment properties and not primary residences. You must factor out your proportionate square foot percentage from the deduction if you live in a unit. For example, if you own a 5,000 sq ft. rental property and inhabit a 1,250 sq ft. unit, then you can only deduct 80% /5000) of themortgage interest costs.

Don’t Miss: How Much Mortgage Could I Get Approved For

Todays Rental Property Rates

Since rental properties fall under the investment category, they present greater risk. Their higher interest rates are the result. Still, a rental property can pay dividends. A higher mortgage rate may be inessential based on the asset’s return on investment significance.

The best way to determine rental property rates is by obtaining multiple quotes. Mortgage rates always shift, so contacting by phone or online is the quickest approach to gather and compare rates. Contact a Wesley Mortgage representative today to learn more.