But Youll Never Get A Lower 15

- The other side of the coin

- Is you might never get a 15-year fixed this low again

- So you could argue to get one while you can

- Or miss out on the low rate forever

On the other hand, you could argue that its always a good time to take out a shorter-term loan. After all, youll pay a lot less interest.

Were talking a ton of money on a mortgage because theyre such large loan amounts relative to anything else.

Additionally, youll own your home free and clear that much faster, assuming its one of your financial goals. Freedom is good.

And lets face it, there are plenty of folks out there who dont do much with their extra cash.

Often its sitting in a megabank checking or savings account earning 0.10% APY or something absurdly low. For these homeowners, the 15-year mortgage is going to save them a ton of money without question.

As noted, youll probably never see a lower 15-year fixed mortgage rate so why not get it while it lasts?

Ultimately, that decision is yours to make but either way your mortgage rate is probably going to look pretty darn attractive in a few years whichever you choose. Youll just have one longer.

Calculate Your Mortgage Payment

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford.

You can use a mortgage calculator to estimate your monthly mortgage payment based on factors including your interest rate, purchase price and down payment.

Gather these data points to calculate your monthly mortgage payment:

- Interest rate

- Insurance

- HOA fees

What you can afford depends on a number of factors, including your income, debt, debt-to-income ratio, down payment and credit score.

You also want to consider closing costs, property taxes, insurance costs and ongoing maintenance expenses.

The type of loan you choose can also affect how much house you can afford. When shopping for a loan, think about whether a conventional mortgage, FHA loan, VA loan or USDA loan is best for your particular situation.

Working With Sammamish Mortgage

At Sammamish Mortgage, all of our Loan Officers are salaried. This means they always put the client first, making sure you get the best loan for your budget, not the biggest one to earn a commission.

We offer some of the most competitive rates in the nation, and its our goal to give you a hassle-free home loan experience. Were proud to say we close most of our loans in 30 days or less. We offer a wide variety of 15-year fixed rate home loans, including FHA and VA loans, so you can start looking for a home as soon as possible.

For more information on your fixed rate mortgage options, feel free to contact us today. We currently lend in all of Washington, Oregon, Idaho, and Colorado and have been providing mortgage programs to borrowers since 1992. Our friendly team of experienced mortgage professionals will advise you on which home loan program best meets your needs.

Are you ready to apply for your home loan and lock in a low interest rate? If so, Sammamish Mortgage can help you get started. Get in touch with us today!

Recommended Reading: What Banks Look For When Applying For A Mortgage

Don’t Compromise Your Savings

While there are benefits to taking out a 15-year mortgage when buying a home a bit later in life, if your higher monthly payment creates a scenario where you don’t have money left over to sock away for retirement, then accelerating your propertyâs payoff isn’t worth it. You need independent savings going into retirement, and if you sign up for too high a mortgage payment, you could end up harming your long-term finances more so than helping them.

One final note: If you’re planning to sell your home before retirement, and you only plan to live in it for a short while, then a 30-year loan could make more sense. In that scenario, the pressure to pay off your home before your career draws to a close is off. So, you might as well take advantage of the financial leeway that comes with having lower monthly payments.

How To Qualify For A Fifteen Year Fixed Rate Mortgage

Many home buyers prefer a 15-year fixed-rate mortgage loan to the 30-year fixed-rate variety. The benefit is obvious: You’ll pay off your home loan faster when you take out a 15-year loan. By doing this, you can save more than $150,000 in interest payments during the life of your loan depending on its size and the interest rate that you get with your 15-year mortgage. To qualify for a 15-year mortgage loan, though, you’ll have to prove to your bank or lender that you can afford to make the higher monthly payment that comes with this shorter-term mortgage.

1

Make copies of the financial paperwork that you’ll use to prove that you can afford the monthly payment on a 15-year fixed-rate mortgage loan. These documents include your last two paychecks, last two federal income tax returns and your most current bank savings and checking account statements. Make copies, too, of your most recent credit card and other loan statements.

2

Shop around for the right mortgage lender or bank for you. Different banks and lenders charge different fees and offer different interest rates. When you find a lender with whom you are comfortable, tell your loan officer that you are interested in taking out a 15-year fixed-rate mortgage.

3

4

5

Sign the closing papers that make your new 15-year fixed-rate mortgage a reality if your credit scores and gross monthly income are high enough to earn you an approval from your lender.

References

Read Also: Are Mortgage Discount Points Worth It

Its Time To Get You Your Dream Home

Home is where the heart is. We’ll work with you to help get you that dream home you’ve been eyeing.

The interest rate displayed is for informational purposes only, and is subject to change without notice. APR is the Annual Percentage Rate based on excellent credit . Your actual rate may vary based on your factors.

The rates provided assume the purpose of the loan is to purchase a property, with a loan amount of $200,000 and an estimated property value of $250,000. The property is located in zip code 78732. The property is an existing single family home and will be used as a primary residence. The rate lock period is 45 days and the assumed credit score is 740.

A mortgage of $125,000 for 30 years at 3.87% APR requires a P& I payment of $587.80 per month. Taxes and insurance for escrow payment are not included your actual payment obligation will be higher. Assumes closing costs paid out of pocket and tax and insurance escrow account created. All rates and programs subject to loan underwriting and approval and may be subject to change depending on individual credit profile and other qualifications

** Amplifyâs performance record for closing real estate loans starting from loan application to loan closing. Events outside of Amplifyâs control, including but not limited to: market conditions, appraised values, escrow or title delays, or weather-related issues may prolong the process. Your experience may vary.

What Is The Difference Between A Fixed Interest Rate Mortgage And Arm

Unlike a 15-year fixed rate mortgage, the amount of interest paid on adjustable rate mortgages fluctuates after a given period of time. The required payment for these loans increases and decreases depending on external economic conditions, making the adjustable rate mortgage structure one of the riskier options for prospective homebuyers.

If the index that governs ARM rates changes, so do the monthly minimum payments for ARM borrowers. Since its difficult to predict the volatility of the market and impossible to control the state of the economy, homeowners with ARMs are left to hope these factors remain in their favor.

After a 5-year or 7-year ARM adjusts, the interest rate could change, possibly eating up an even larger chunk of the buyers monthly income. This can make financial planning even more difficult, as the mortgage bill on a given month could differ widely from what is required two or three years down the line.

One reason borrowers opt for adjustable rate mortgages is the possibility of saving money at the loans conclusion. This type of financing usually comes with a lower initial interest rate than fixed repayment models. Following the fixed rate period on an ARM, mortgage rates could continue to drop. In this scenario, an adjusted interest rate would be even lower than when the repayment plan began.

Don’t Miss: Can There Be A Cosigner On A Mortgage

/1 Adjustable Rate Mortgage Moves Upward +001%

The average rate on a 5/1 adjustable rate mortgageis 2.80 percent, up 1 basis point since the same time last week.

Adjustable-rate mortgages, or ARMs, are mortgage loans that come with a floating interest rate. In other words, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate loans. These loan types are best for people who expect to refinance or sell before the first or second adjustment. Rates could be materially higher when the loan first adjusts, and thereafter.

Monthly payments on a 5/1 ARM at 2.80 percent would cost about $409 for each $100,000 borrowed over the initial five years, but could ratchet higher by hundreds of dollars afterward, depending on the loans terms.

How To Compare 15

When shopping for the best mortgage rate you need to consider the overall cost of the loan, not just the interest rate. Mortgage closing costs can be 3%-6% of the loan amount and the fees you pay vary by lender. The lender with the lowest rate could be more expensive overall if it is charging higher origination fees or adding in discount points. This is why you should compare annual percentage rates , which factor in certain fees in addition to the interest rate, as opposed to just the interest rate.

You can compare interest rates and fees by looking at the Loan Estimate, which the lender must provide within three business days from when you submit a mortgage application. Since all lenders are required to use the same Loan Estimate form, its easy to evaluate multiple offers.

Don’t Miss: What Does A Mortgage Consist Of

How To Get The Lowest 15

by Christy Bieber | Updated Sept. 10, 2021 – First published on Aug. 20, 2020

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

With a 15-year mortgage, you pay off your home faster while keeping borrowing costs down. Here’s how to get the lowest 15-year mortgage rate.

A 15-year mortgage loan can be a great option for homebuyers hoping to become debt-free as soon as possible. You’ll pay off your loan in half the time of the more popular 30-year mortgage, and will generally qualify for lower rates because you’re borrowing for a shorter amount of time. That can make total repayment costs much lower.

There is a big downside with a 15-year mortgage loan, though — you’ll have much higher monthly payments. To make sure you’re saving as much as possible on interest and keeping your monthly costs as low as you can, it’s important to find the lowest 15-year mortgage rate.

This guide will help you get that rate. There are five key steps to take to score the most affordable mortgage loan possible.

What You Need To Qualify For A 15

The primary difference between qualifying for a 15-year versus a 30-year mortgage is that for the former, your lender has to make sure you can afford larger monthly payments, and usually that means having a higher income and a lower debt-to-income ratio.

If your DTI ratio is on the higher side, you can work to increase your income or pay down your debt. Some ways you can pay down debt include:

Also Check: Is Closing Cost Part Of Mortgage

Use As A Retirement Tool

If you plan on retiring in under 30 years, paying off your mortgage in 15 years could eliminate your monthly mortgage payment by the time you retire.

To get a 15 year fixed mortgage, the first step is getting preapproved for the loan. A preapproval can help you:

- Know ahead of time how much home you can afford

- Save time shopping for homes in your range

- Show home sellers and Real Estate Agents that you’re a serious buyer

- Speed up the loan closing process and get your loan funded faster

Take Time To Explore All Of Our Different Loan Options

Ready to buy a home and have at least a 620 credit score? You may qualify for a conventional loan with as low as a 3% down payment.

If you live in a high-cost area or need a mortgage that exceeds conforming loan limits, a jumbo loan might be the right product for you.

Certain buyers may benefit from a USDA loan depending upon their income or the homes location. Another bonus: No down payment is needed.

ARMs often start out with lower interest rates than fixed-rate loans. You may want to consider an ARM if you believe your income may grow as the interest rate and payment increases.

If making a down payment is difficult or your credit has taken some hits, consider an FHA loan. These flexible government loans could be a budget-friendly option.

If making a down payment is difficult or your credit has taken some hits, consider an FHA loan. These flexible government loans could be a budget-friendly option.

15-Year Mortgage Rates

A 15-year mortgage is a home loan that is calculated to be paid off within 15 years. These loan types often come with higher monthly payments and lower interest rates than longer-term home loans. Its important that your choice reflects your long-term financial goals when choosing a home loan option.

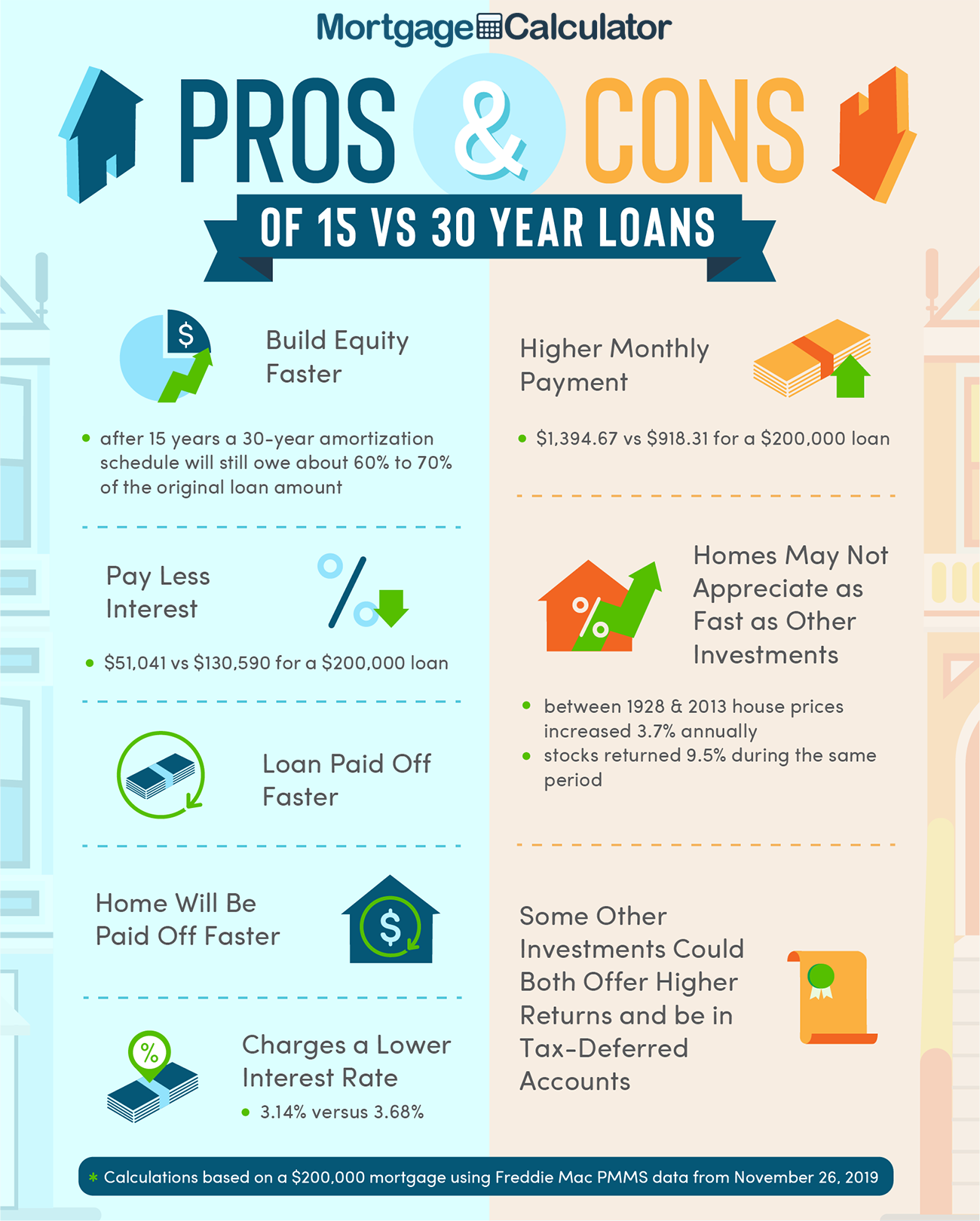

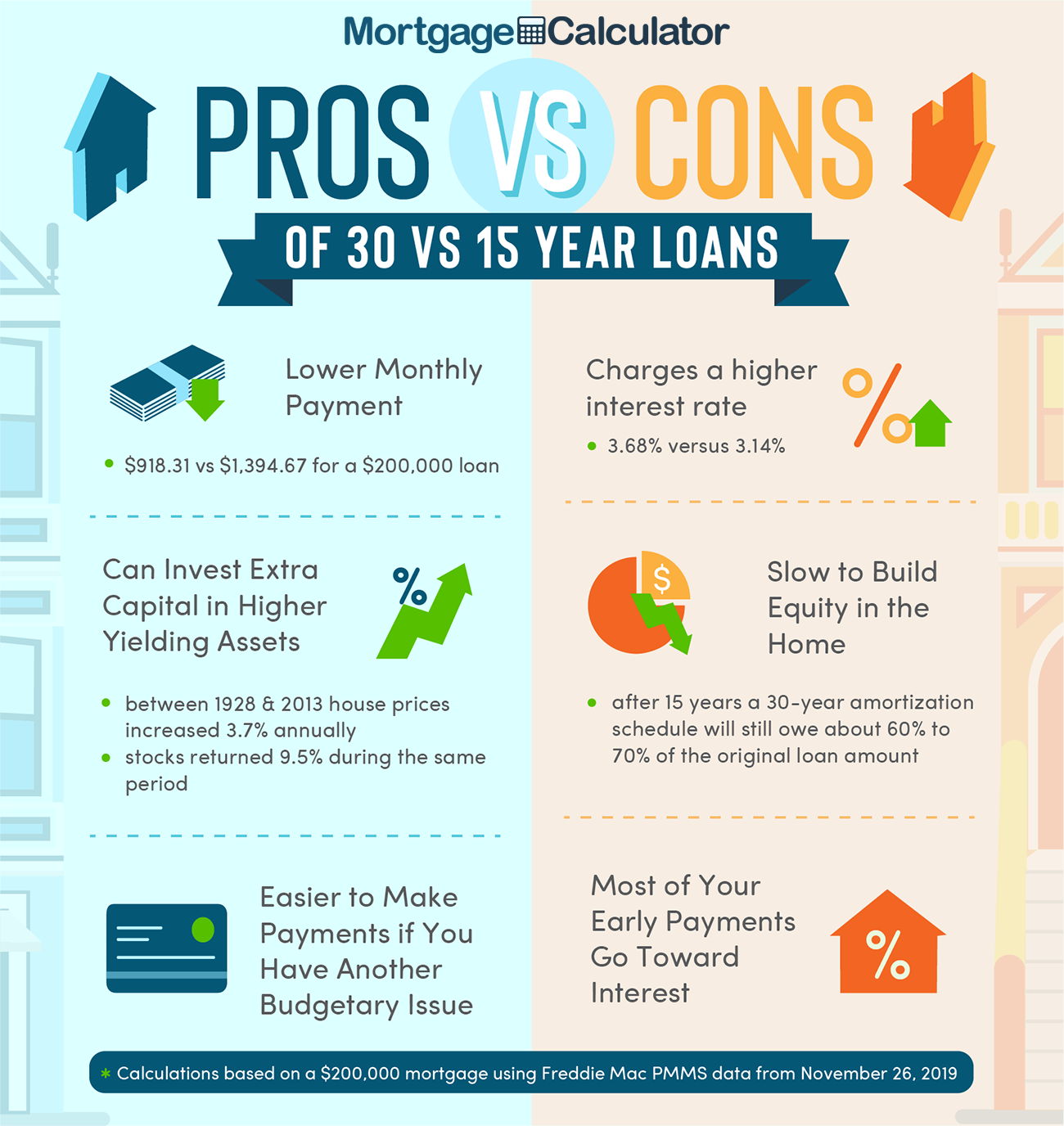

15-Year Mortgage Rates Pros and Cons

Just as with any loan option, there are pros and cons to consider. Here are some of the benefits and considerations of 15-year mortgage rates and terms:

Pros

Cons

- Higher Monthly Payment Than 20- or 30-Year Loans

Read Also: How 10 Year Treasury Affect Mortgage Rates

How To Pay Off A 30

A few options exist as realistic ways to pay off a mortgage sooner than the 30-year term.

Options to pay off your mortgage faster include:

- Adding a set amount each month to the payment

- Making one extra monthly payment each year

- Changing the loan from 30 years to 15 years

- Making the loan a bi-weekly loan, meaning payments are made every two weeks instead of monthly.

There are advantages to each approach. The choice comes down to careful study and a decision based on your financial position and the benefits of paying off a mortgage early.

How To Get A Low 15

If you want to lower the cost of homeownership, you can start by finding a way to lower your mortgage rate. The higher your mortgage rate, the more interest youll pay over the life of your home loan. Thats why its important to compare mortgage rates before committing to working with a specific lender.

The homebuyers who qualify for the lowest mortgage rates tend to have good credit scores. According to the FICO scoring model, youll likely need to have a credit score of at least 740 if you want access to the best rates. Of course, the exact credit score youll need to qualify for a 15-year fixed-rate mortgage will depend on the mortgage lender you choose to work with.

If your credit score isnt as high as it could be, it might be a good idea to work on improving your credit before you apply for a mortgage. Eliminating debt, paying bills every month on time and in full and keeping your below 30% are all things you can do to boost your credit score and put you in the best position to get a favorable mortgage rate.

While its possible to qualify for a mortgage with a low credit score , itll be more challenging and could result in a high interest rate. If this is your situation, your best bet might be to go for an FHA loan or a USDA loan. The former is designed for first-time homebuyers, while the latter is built for those buying a home in a rural area.

You May Like: Is 720 A Good Credit Score For Mortgage

How To Get One Of Those Record

In the days before the pandemic, 15-year mortgages with their usually stiff monthly payments were far too expensive for many people refinancing their homes. Borrowers often just grabbed another 30-year home loan, America’s go-to mortgage.

But with the COVID crisis keeping mortgage rates in the cellar, even the 15-year option has been looking cheap. That’s especially true right now, with 15-year rates at an all-time low in the latest survey from mortgage giant Freddie Mac.

More borrowers have been choosing the shorter-term loans: In May, 15-year mortgages accounted for 15.8% of all home loan originations, up from just 5.5% in May 2019, according to the latest data from the Urban Institute.

Here’s how to evaluate if a 15-year fixed-rate mortgage is right for you and how to land one of today’s all-time-low 15-year rates.