Time To Buy Or Refinance

While the U.S. economy may be in a spin due to the pandemic, lower mortgage rates are enticing for homebuyers and those interested in refinancing. It’s possible that the Federal Reserve will keep mortgage rates low, but it’s debatable how long they’ll be able to sustain that.

If you’re in the position to, investing in real estate is a great way to build financial independence. Whether you’re buying your first home or an investment property, energy prices and interest rates may not stay this low.

So How Are Mortgage Rates Set

- There are a variety of factors involved, including the state of the economy

- Related bond yields like the 10-year Treasury

- And lender and investor appetite for mortgage-backed securities

- Your borrower/property-specific loan attributes will also come into play

Nows let discuss how mortgage rates are determined.

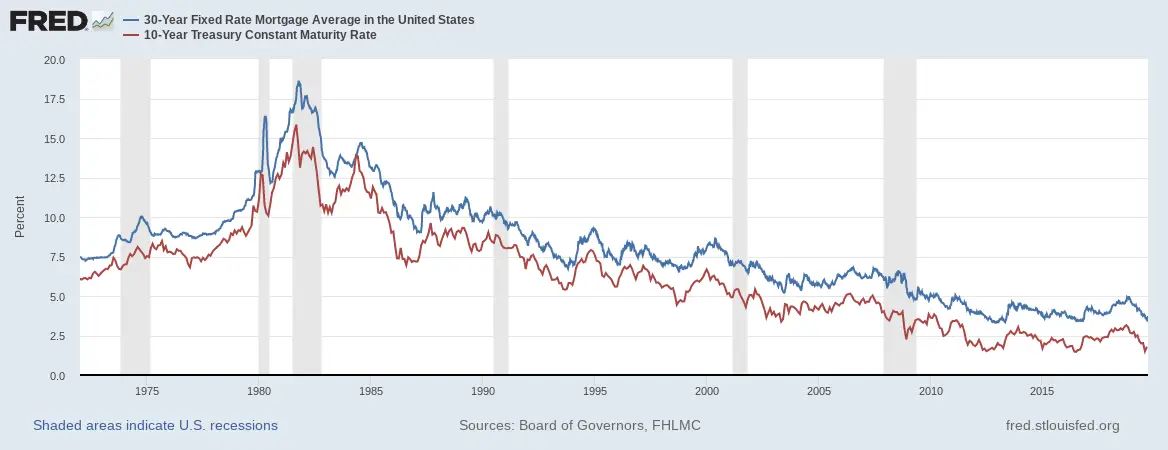

Although there are a variety of different factors that affect interest rates, the movement of the 10-year Treasury bond yield is said to be the best indicator to determine whether mortgage rates will rise or fall. But why?

Well, even though most mortgages are packaged as 30-year products, the average mortgage is paid off or refinanced within 10 years.

So the 10-year bond can be a great bellwether to gauge the direction of interest rates on home loans.

Treasuries are also backed by the full faith and credit of the United States, making them the benchmark for many other bonds as well.

Additionally, 10-year Treasury bonds, also known as Intermediate Term Bonds, and long-term fixed mortgages, which are packaged into mortgage-backed securities , compete for the same investors because they are fairly similar financial instruments.

However, treasuries are 100% guaranteed to be paid back on schedule, while mortgage-backed securities are not, for reasons such as payment default and early repayment.

As a result, mortgage bonds carry more risk and must be priced higher to compensate investors.

What Is A 10

A 10-year Treasury is a bond that guarantees interest plus repayment of the borrowed money in a decade. The 10-year Treasury is just one of a handful of securities issued by the U.S. government. Others include:

Treasury bills, also known as T-bills, are short-term securities, with maturities that range from a few days to 52 weeks. Treasury bills are sold at a discount to their face value, meaning they provide investors with returns by paying them back at the full, not discounted, rate.

Treasury notes, also known as T-notes, are issued with maturities of two, three, five, seven and 10 years. They pay interest every six months and return their face value at maturity.

Treasury bonds, also known as T-bonds, are the longest-term government securities, issued for 20 and 30 years. They pay interest every six months and return their face value at maturity.

Don’t Miss: Is Closing Cost Part Of Mortgage

What The Federal Reserve Does

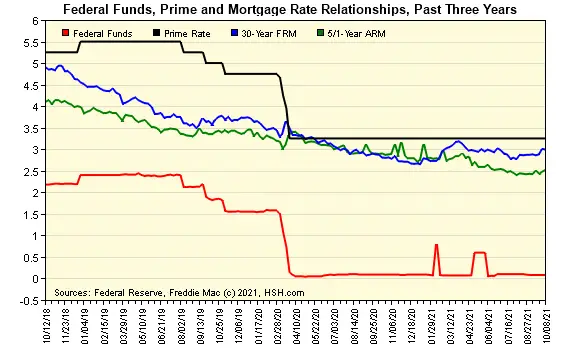

The Federal Reserve sets borrowing costs for shorter-term loans in the U.S. by moving its federal funds rate. The Fed kept this rate set near zero. The rate governs how much banks pay each other in interest to borrow funds from their reserves kept at the Fed on an overnight basis. Mortgages, on the other hand, track the 10-year Treasury rate.

Changes to the federal funds rate might or might not move the rate on the 10-year Treasury, which are bonds issued by the government that mature in a decade. Though a Fed rate cut doesnt directly push down yields on the 10-year, it can lead to the same outcome. Investors worried about the economy after a rate cut might flock to the 10-year Treasury, considered a safe-haven asset, pushing down yields.

The Fed also influences mortgage rates through monetary policy, such as when it buys or sells debt securities in the marketplace. Early in the pandemic there was severe disruption in the Treasury market, making the cost of borrowing money more expensive than the Fed wanted it to be. In response, the Federal Reserve announced it would buy billions of dollars in Treasuries and mortgage-backed securities, or MBS. The move was to support the flow of credit, which helped push mortgage rates to record lows.

Should You Rush To Buy Or Refinance A Mortgage

Mortgage rates are much higher today than they were a month ago. But they’re much lower today than they were a year ago.

At several points last year, rates sat at record lows, and while that’s no longer the case right now, today’s rates are still quite competitive. That goes for mortgages as well as refinance rates. As such, if you’re looking to buy a home or refinance an existing mortgage, don’t get spooked by recent jumps — you can still do quite well for yourself in today’s mortgage rate environment.

That said, we don’t know if mortgage rates will continue to climb over the course of the year or at what pace. Last year, there were many predictions that mortgage rates would largely hold steady throughout 2021, but that was before meaningful progress was made on the coronavirus vaccine front and before a massive stimulus bill was signed into law and made official. These developments, though extremely positive in their own right, could drive mortgage rates upward in the coming months. So if homeownership or refinancing is on your radar, it could pay to get moving sooner rather than later.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Will Current Mortgage Rates Last

Mortgage rates have been in a holding pattern for a little over a month. The rise of the Delta variant of the COVID-19 virus has put a damper on the economic recovery and counteracted some of the positive developments that could have pushed rates higher the last few weeks.

This pattern may soon change, however, as COVID infections seem to be plateauing. On the economic front, retail sales, which had been expected to decline, saw a nearly 1% increase in August, which is good news for the economy. On the other hand, Inflation, meanwhile, was a little lower than expected last month.

Why does this matter?

The Federal Reserve has based decisions around tapering its accommodative monetary policy on the strength of the labor market and the economic recovery. The Fed’s position has been that inflation, which is currently over 5% and above the central bank’s target rate of 2%, is temporary. If inflation continues to slow down and other economic indicators, such as employment and retail sales, continue to improve, it could push the Fed to a more aggressive stance on its policy. For now, all eyes will be on the Fed’s upcoming September meeting.

“The fact that interest rates havenât moved much in recent weeks indicates that investors are still waiting for more certainty,” said Matthew Speakman, senior economist at Zillow. “All told, thereâs a good chance that mortgage rates will move notably in the coming weeks, but the juryâs still out on which direction theyâll head.â

Mortgage Rates Explained: A Complete Guide To Get You Up To Speed Fast

- A lot of factors go into determining your mortgage rate

- Things like credit score are huge

- As are down payment, property type, and transaction type

- Along with any points youre paying to obtain said rate

- The state of the economy will also come into play

- This means there are some things you can control, and others you cannot

If you do a web search for mortgage rates youll likely see a list of interest rates from a variety of different banks and lenders.

Unfortunately, this wont tell you much without actually knowing why the rates are what they are and if theyre actually available to YOU.

Its really just a bunch of numbers on a page. Shouldnt you know how lenders come up with them before you start shopping for a home loan and buying real estate?

Simply put, the more you know, the better youll be able to negotiate! Or call out the nonsense

Many homeowners tend to just go along with whatever their bank or mortgage broker puts in front of them, often without researching mortgage lender rates or inquiring about how it all works.

Whether youre interested in rates or not, its wise to get a better understanding of how mortgage rates move and why.

One of the most important aspects to successfully obtaining a mortgage is securing a low interest rate. After all, the lower the rate, the lower the mortgage payment each month.

And if your loan term lasts for 360 months, youre going to want a lower payment. If you dont believe me, plug some rates into a mortgage calculator.

Don’t Miss: How Do You Calculate Self Employed Income For A Mortgage

Mortgage Rates Continue To Move Sideways

Like most of us, mortgage rates seem to be languishing as summer winds down.

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average edged up to 2.87 percent with an average 0.6 point. It was 2.86 percent a week ago and 2.91 percent a year ago. The 30-year fixed average has remained below 3 percent the past two months.

Freddie Mac, the federally chartered mortgage investor, aggregates rates from around 80 lenders across the country to come up with weekly national averages. It uses rates for high-quality borrowers with strong credit scores and large down payments. Because of the criteria, these rates are not available to every borrower.

The survey is based on home purchase mortgages. Rates for refinances may be different. As of Aug. 1, borrowers refinancing their mortgages will no longer have to pay the adverse market refinance fee. The fee, which was imposed on mortgages sold to Fannie Mae and Freddie Mac, added about $1,500 to a $300,000 loan. The surcharge was intended to offset covid-related losses.

The 15-year fixed-rate average moved slightly higher to 2.17 percent with an average 0.6 point. It was 2.16 percent a week ago and 2.46 percent a year ago. The five-year adjustable rate average slipped to 2.42 percent with an average 0.2 point. It was 2.43 percent a week ago and 2.91 percent a year ago.

More Real Estate:

Why Bonds Are Low Risk

There are three reasons bonds are low-risk:

Still, different types of bonds carry different risk levels. Bond investors are looking for predictable outcomes, but some are willing to take on a higher risk to get a better return. Investors constantly compare the risk of bonds versus the reward offered by interest rates. The highest-risk bonds, like junk bonds and emerging market bonds, also have the highest return. Bonds with medium risk and return include most corporate bonds. The safest bonds include most municipal bonds and U.S. government Treasury notes.

All these bonds compete with mortgages for investors. But Treasurys have the biggest impact on mortgage interest rates. If Treasury rates are too low, other bonds look like better investments. If Treasury rates rise, other bonds must also increase their rates to attract investors.

Also Check: Can You Refinance Mortgage Without A Job

Long Rates Tend To Follow Short Rates

Technically, the Treasury yield curve can change in various ways: It can move up or down , become flatter or steeper , or become more or less humped in the middle .

The following chart compares the 10-year Treasury note yield to the two-year Treasury note yield from 1977 to 2016. The spread between the two rates, the 10-year minus the two-year, is a simple measure of steepness:

We can make two observations here. First, the two rates move up and down somewhat together . Therefore, parallel shifts are common. Second, although long rates directionally follow short rates, they tend to lag in magnitude.

More specifically, when short rates rise, the spread between 10-year and two-year yields tends to narrow and when short rates fall, the spread widens . In particular, the increase in rates from 1977 to 1981 was accompanied by a flattening and inversion of the curve the drop in rates from 1990 to 1993 created a steeper curve in the spread, and the marked drop in rates from 2000 to the end of 2003 produced an equally steep curve by historical standards.

How Does The 10

Here’s the big number you should be tracking.

For mortgage borrowers, looking at the 10-year Treasury rates is more important than most realize. Since mortgage rates often closely align with the 10-year Treasury bond yields, keeping an eye on this rate can help borrowers assess when to take out a mortgage or if it is the right time to refinance.

But there is a lot of mystery surrounding 10-year Treasury rates. Below is a primer on Treasury bonds, what you need to know, and why it is important to pay attention to these rates. For homeowners thinking of refinancing, now is a great time to visit Credible to view loan options across multiple lenders with fewer forms to fill out.

What Is The 10

The 10-year Treasury yield is the current rate Treasury notes would pay investors if they bought them today.

Changes in the 10-year Treasury yield tell us a great deal about the economic landscape and global market sentiment, professional investors analyze patterns in 10-year Treasury yields and make predictions about how yields will move over time. Declines in the 10-year Treasury yield generally indicate caution about global economic conditions while gains signal global economic confidence.

At the end of April 2021, the 10-year Treasury note was yielding around 1.65%but back in April 2000, the 10-year yield was 6.23%. Thats a pretty significant decline, and If you look at the chart below, youll see that 10-year Treasury yields have fallen dramatically since 1990.

Lets take a closer look at the 10-year Treasury yield in 2016. On July 5, 2016, the 10-year Treasury yield had fallen to a record low of 1.37% shortly after the conclusion of a referendum in which the citizens of the United Kingdom voted to leave the European Union. This political earthquake rattled markets around the world, which is why the 10-year yield declined.

Meanwhile, when Donald Trump was elected president of the United States in November 2016, the 10-year yield gained considerably, reaching 2.60% by mid December.

Government Bonds And Mortgage Rates What’s The Connection

Many people don’t realize the strong correlation between fixed mortgage rates and Bank of Canada bond yields.

Both rates can change daily, but each carries different risks â at relatively opposite ends of the spectrum. Fixed mortgages are considered ‘riskier’ assets for banks, while government bonds are thought of as ‘safer,’ or even risk-free. Why?

Government bonds are 100% guaranteed to be repaid, but mortgages are not. Mortgages carry more risk of default or early repayment, which could potentially disturb the expected return on investment. Mortgage rates, therefore, are priced higher by banks to compensate for that added risk.

Many factors can affect fixed mortgage rates. But the single biggest factor is Government of Canada bond yields. Banks actually use the 5-year bond yield market to determine their fixed mortgage rates, using the forecasted earnings from bond investments to cover the costs and possible losses incurred through their mortgage market.

Related: How are mortgage rates set?

What Are Todays Mortgage Rates

Mortgage rates change all day, every day. And, the only play to get access to live, accurate rate quotes is via a mortgage lender.

Get todays live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

Popular Articles

Resources

Impact Of Changes In Demand For T

The demand for 10-year Treasury Notes directly affects the interest rates of other debt instruments. As the yield on 10-year T-notes rises during periods of low demand, there will be an increase in interest rates on longer-term debt. Long-term debt that is not backed by the US Treasury must pay a higher rate of interest to compensate investors for the higher risk of default.

How Much Higher Are Mortgage Rates Priced Over Bond Rates

As the 5-year bond yield rises, lenders get squeezed by the rise in funding costs. At some point, they can no longer absorb the increase and will pass it on to the borrower by raising their fixed mortgage rates .

In a normal market, the average ‘spread’ or markup of fixed mortgage rates above secured government bonds is roughly 100 to 200 basis points, or 1% to 2%. That markup â the spread relationship â will widen and contract in response to a range of market conditions, such as the risk of rising inflation, investor appetites, product supply, and competition from other investment opportunities, like corporate bonds or equity markets.

During times of financial uncertainty, this spread can widen. For example, during 2020, as the Canadian markets were tossed around by the COVID-19 pandemic, some mortgages rates were briefly raised even though bond yields fell.

It’s not automatic that banks will raise fixed mortgage rates as soon as bond yields increase. But with economic conditions trying to sketch out a recovery, and housing markets trying to cool off, if bond yields increase, fixed rates may well follow.