Mortgage Rates By Credit Score

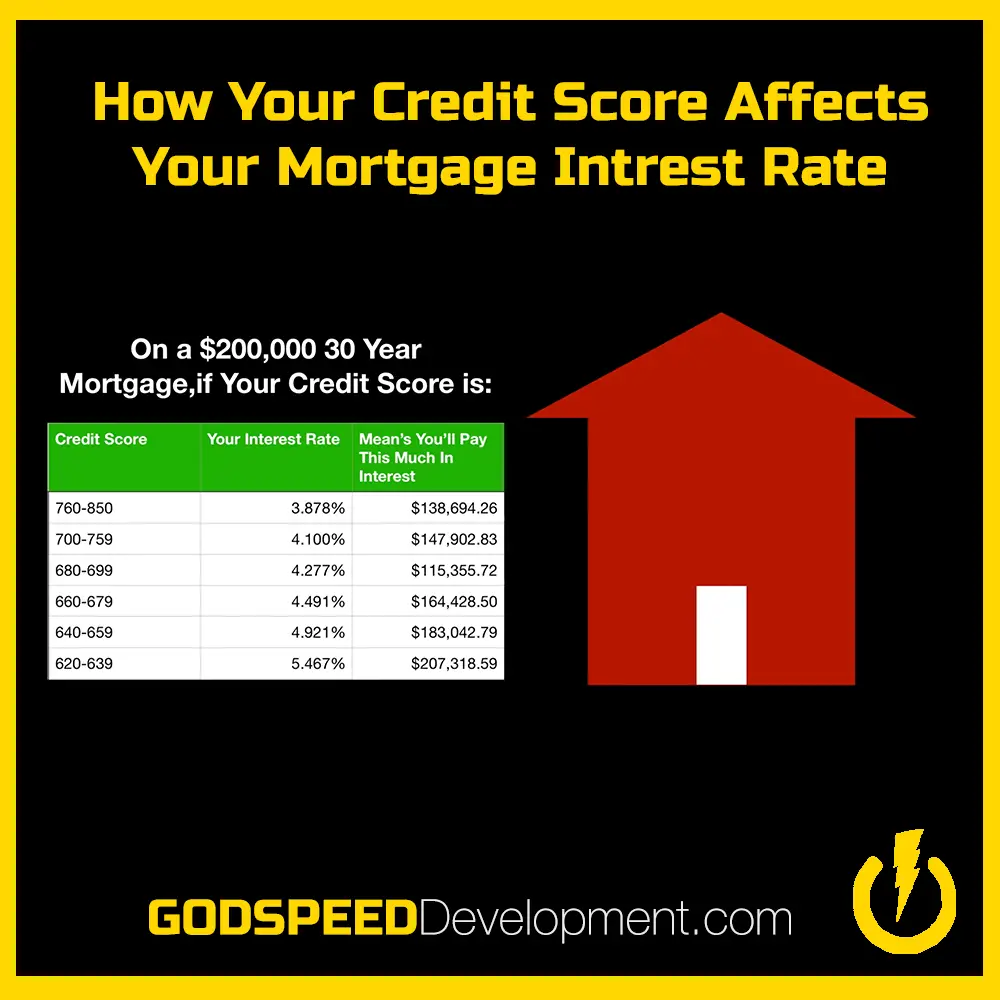

FICO, the biggest credit scoring company in America, has a handy online calculator that shows just how much mortgage rates vary by credit score.

As an example, heres how average annual percentage rates stacked up by credit score in early February 2022. Keep in mind that rates change constantly and will likely be different by the time you read this. These numbers are meant only as a sample to show you how much rates can vary.

| FICO Score |

| $2,239 | $382,876 |

*Payment examples and APRs sourced from myFICO.com on February 1, 2022. Payments based on a loan amount of $423,100 and a 30-year, fixed-rate mortgage loan. Your own interest rate and monthly payment will be different.

If you compare the highest and lowest credit score tiers, the borrower with better credit saves about $390 per month and $140,000 in total interest over the life of their mortgage loan.

Of course, most people fall somewhere in between those two extremes. But the point is, your credit can have a big impact on both your interest rate and the amount of interest youre paying to your mortgage lender.

If youre able to boost your score before applying for a home loan, it could lead to serious savings over the next few decades.

Can You Get A Mortgage With Credit Card Debt

Credit card debt wonât affect your ability to get a mortgage by itself. It depends on how big the debt is, how capable you are of paying it back and how well you have kept up repayments. A small amount of debt that you make regular payments on could be fine if you earn enough to cover both credit card and mortgage payments. On the other hand, if you have defaulted on credit card payments or have run up debt on several cards, lenders might decide you are too much of a risk.

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

Also Check: How To Figure Debt To Income Ratio For Mortgage

How Consumers Can Secure A Low Interest Rate

Your first step in shopping for a new home should be starting the pre-qualification process, which means contacting lenders to see if they’ll approve you for a loan, and lenders checking your credit score to see if you qualify for it.

Before you begin applying for a mortgage, check your credit score to get a sense of the kinds of interest rates you’ll qualify for. If your credit score is less than perfect, it’s also a good way to find out what could be dragging it down, whether it’s credit card or student debt, late payments or any other factors. Note that every single point you manage to increase on your credit score can make a significant difference in how much interest you’ll have to pay on your mortgage, potentially saving you thousands in the long run.

For instance, if you take the example above and buy a $300,000 home with a 10% down-payment and you have a 5.27% interest rate on your loan, your total interest paid over 30 years would be $267,946.70. With a slightly higher interest rate of 5.5%, you would pay $281,890.91 over 30 years, reflecting a difference of nearly $14,000.

Getting a good interest rate and terms on your mortgage not only has to do with your credit score, but also with your lender. Select ranked the best mortgage lenders and found that Rocket Mortgage, Chase Bank, Ally Bank, PNC Bank, SoFi were among the top, based on the types of loans offered, customer support and minimum down payment amount, among other factors.

How Mortgage Rates Can Vary By Credit Score

Let’s see how a 100-point difference in credit scores affects one womans mortgage payment.

For example, suppose a borrower looking to buy a home worth $300,000 has a 20% down payment and applies for a 30-year fixed-rate loan of $240,000. She has a 780 FICO credit score, which gets her a 4% rate. Thats around $1,164 a month, not including taxes, insurance or homeowners association fees.

If this borrowers score dropped by about 100 points to between 680-699, her rate might increase to about 4.5%. At that interest rate, her monthly payment would increase to $1,216, an extra $62 a month, or $744 per year.

The effect of the difference in the rates may not seem significant at first, but added up over years, it could be a lot. In this example, a 100-point-drop has the borrower paying an additional $25,300 over 30 years.

At the same time, its important not to go crazy gaming your mortgage rate. If your score is already good, you should consider taking the rate you qualify for.

Industry professionals advise against taking too long to fine-tune an already-good credit score as rates could go up in the meantime and offset any benefit of a slightly higher score.

» MORE: Use our tool to see how mortgage rates differ by credit score

Read Also: How Much Could We Get Approved For A Mortgage

Helocs Vs Home Equity Loans

HELOCs are a type of credit product called revolving credit, which refers to the way they allow borrowers to draw some money, pay it back and then draw more, as needed. That process can be repeated over the term of the line of credit, which is often 10 years.

In exchange for that flexibility, however, borrowers give up the certainty of a fixed interest rate. HELOC rates track the interest rates influenced by the Federal Reserve, which has recently started a multiyear rate-rising process.

That may make HELOCs less attractive than other products, such as home equity loans, which have fixed interest rates. In exchange for the certainty of the interest rate, home equity loans borrowers take out a set amount of money all at once and pay it back in regular installments.

How Are Mortgage Rates Determined

In general, mortgage rates are determined by economic factors. These include the Federal Reserve benchmark interest rates and the job market. Mortgage rates aren’t directly tied to Fed rates, but they tend to trend in the same direction. If the job market is poor and fewer people are working, rates will drop to attract buyers.

Lenders then look at factors like credit score and history, income, and total debts to determine what mortgage rate to offer specific borrowers.

You May Like: How To Find Out If You Can Get A Mortgage

Checking Your Credit Score

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, it’s worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

It’s a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

What Is A Good Credit Score

Honestly, what determines a good credit score for a mortgage varies. It really depends on your loan program and financial history. Lenders look at things such as your debt-to-income ratio, W2s, current debts, etc. to calculate your interest rate.

Take a look at some typical FICO score minimums by loan type. Just know that the chart were providing is a reference point. Contact an American Financing mortgage consultant to compare loan programs for your specific situation.

Also Check: Do Mortgage Lenders Work On Saturdays

How Does Your Credit History Affect Getting A Mortgage

Lenders use your credit report to get information on how reliable you have been at paying back debts in the past. When you apply for a mortgage you will have to supply payslips, P60s and bank statements to show how much you earn and what your monthly budget might look like. This shows lenders your current financial situation, but to predict how you might behave in the future they will also look at your credit report.

Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly youâve borrowed in the past. Special introductory rates or other attractive mortgage offers might only be available to people whose credit history meets certain criteria.

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

Read Also: Can You Refinance Mortgage Without A Job

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

Mortgage Fico Scores Are Used As The Primary Credit Score For Home Buying

When reviewing your application for a mortgage, lenders use your FICO score, a credit scoring model used specifically for mortgages. A FICO score is a single number thats calculated using a proprietary formula and data compiled by the three major credit reporting bureaus .

FICO credit scores can range from 300-850. According to Experian, most consumers have credit scores that fall between 600 and 750.

Recommended Reading: How Much Would A Mortgage Be On 130 000

How To Build Your Credit Score

Here are some of the best ways to build your credit score:

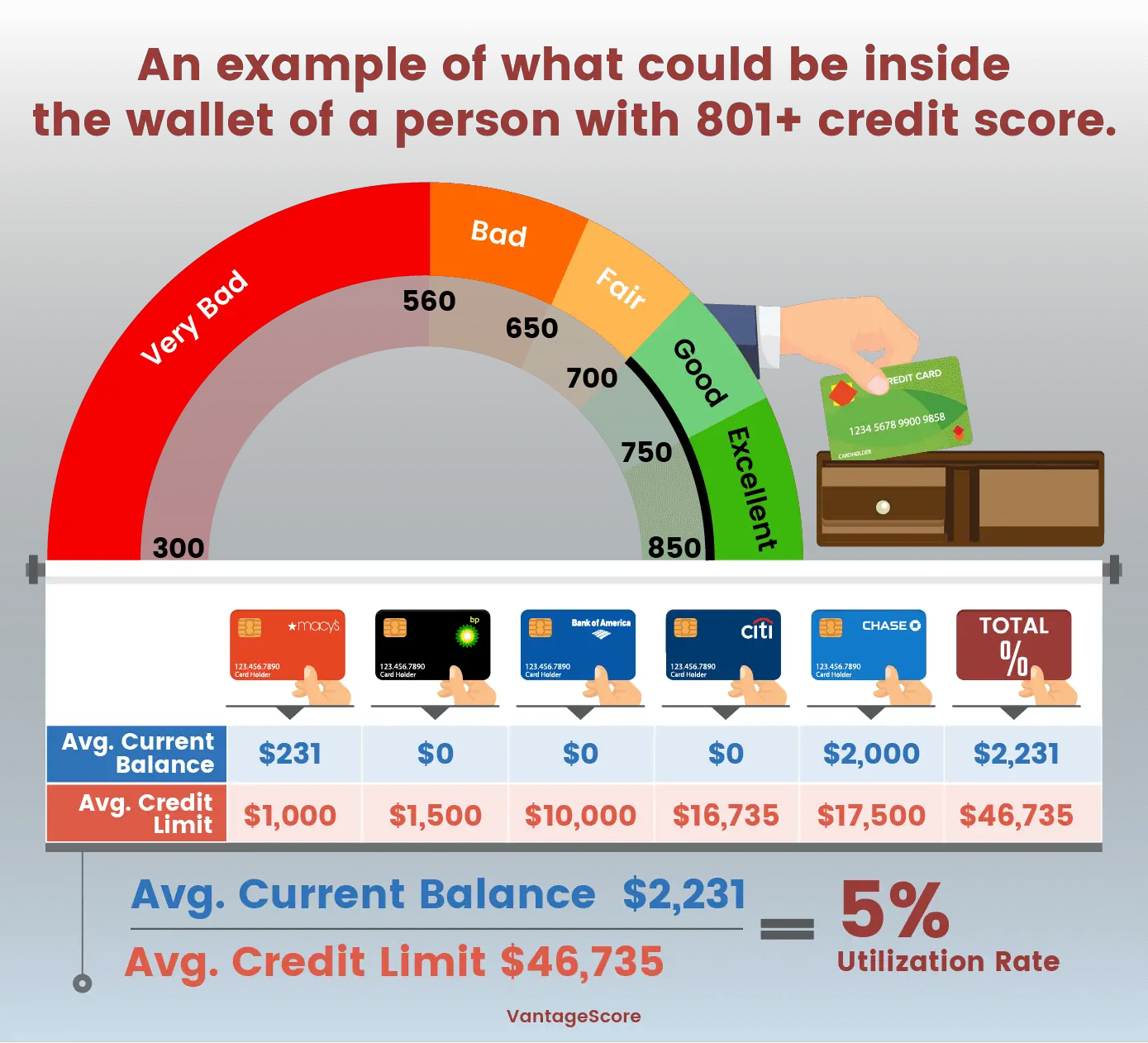

Make payments, including rent, credit cards, and car loans, on timeKeep your spending to no more than 30% of your limit on credit cardsPay down high-balance credit cards and consider balance transfers to free up credit.Check for any errors on your credit report and work toward fixing them.Shop for mortgage rates within a 30-day period. Too many spread-out inquiries can lower your score.Work with a credit counselor or a lender to build your credit.

The best way to build your credit score is to look at your balance-to-limit ratio, Keller says. For example, if you had a credit card with a $10,000 limit, and I pull your credit and youve got $8,000 charged on that and your credit score is a 726, if I can get you to pay down that credit card to 30% or less down to $3,000 your credit score would jump substantially.

Article Source:

*The views, articles, postings and other information listed on this website are personal and do not necessarily represent the opinion or the position of Big Valley Mortgage.

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

|

5.57% |

Read Also: How Long Is A Normal Mortgage

Boosting Your Credit Score

If you have bad credit but are a first-time home buyer, start maximizing your score before you begin house hunting. Check your credit score so you know where you stand, review your credit history to make sure itâs accurate and remember to consistently pay your bills on time. You can check your credit score for free with our tool if youâre a current U.S. Bank customer.

When lenders see multiple applications for credit reported in a short period of time, it can discourage them from giving you a loan. So hereâs a short list of things to try to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards.

- Avoid closing credit cards .

- Avoid applying for new loans.

- Avoid co-signing on any new loans.

Looking for more ways to improve your credit score? Here are some .

You donât have to have a top credit score to get a mortgage, but it will help you compete for the house you want by potentially giving you more financing options. So, take steps to try to boost your credit, avoid applying for credit products at the same time youâre house hunting and talk over your options with a mortgage loan officer who can help.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Read Also: What Can My Mortgage Be

Does A Mortgage Hurt Your Credit

Taking out a mortgage is a huge milestone for youand your credit. For starters, building and maintaining the credit necessary to secure a mortgage is a big win. Responsibly managing a mortgage demonstrates your ability to pay loans on time, handle different credit types and maintain a large, long-term account, all of which can contribute to positive gains for your credit score over time.

Along the way, though, there are times when a mortgage could possibly hurt your credit, either causing a minor bump or more serious turbulence if you encounter difficulties in paying your loan. Here are a few of the ups and downs you and your credit might encounter when you get a mortgage.

How Hard Credit Pulls Affect Your Credit Scores

Hard inquiries show other lenders that youre looking to borrow money. These inquiries usually show up on your reports when a financial institution checks your credit as part of a lending decision like when you apply for a mortgage, auto loan or credit card. According to credit-scoring company FICO, a single hard inquiry may lower your FICO score by up to five points and remain on your credit reports for up to two years.

Also Check: Who Can Get A Va Mortgage Loan