How Will I Find Out If My Mortgage Is Sold

Lenders are legally required to notify you of your loan sale before it happens. You should get a notice in the mail at least 15 days prior to the official transfer.

Your loan may be owned and serviced by the same company, or two different companies. The new servicer of your loan must also send notification within 15 days of the sale.

If theres a new owner of your loan, they must send notification within 30 days of taking over your loan, which will include:

- The new owners name, address, and phone number, and the person authorized to fix loan payment issues and receive legal notices

- The date the owner takes possession and where the transfer is recorded

What To Expect If Your Loan Servicing Transfers

Finding out you have a new loan servicer after your mortgage has been sold is completely normal many lenders sell mortgages.

The transfer notice will provide the information you need to get ahold of your new servicer. From there, you may need to set up a new online account, direct deposit schedule and account profile on a new online servicing system. Be sure to act on this quickly so there are no delays that could cause your home loan payments to go through past the due date.

If there are delays that cause your mortgage payment to be missed, dont panic. Reach out to both providers to explain the issue. For instance, if you were notified on the 29th of a change in service and your next mortgage payment was already scheduled to go through on the 30th with the old provider, you might not be able to set up a new payment in just 24 hours.

Be sure to talk to your original lender to ensure your last payment went through and that you have clear expectations of when you should stop paying them. Then reach out to the new lender with this information, particularly if you missed a payment because you scheduled it with the old provider. If you accidentally make a payment to your old servicer within 60 days of the transfer of servicing, they arent legally allowed to consider it a late payment.

Communication is key during this process, so make sure youre covered and communicating with both providers.

Will My Loan Change

The details of your loan your mortgage rate, terms and other agreements will not change if your home loan is sold by your current lender. Those details are locked into your contract and will remain the same as they did on the day you closed on your home.

What you need to look out for are potential changes in your loan servicer.

When lenders sell your home loan to institutions like Fannie Mae, Freddie Mac or the three main government agencies, they sometimes retain servicing rights. This means theyll still handle all the home loan servicing.

As a customer, this means youll still deal with the same lender you financed your home through. Your service wont be interrupted and you likely wont even notice any differences. Your lender will send you a letter if your home loan changes investors, with all of the specific information regarding this transaction, and will note that your servicing will remain the same.

Not all banks and lenders are able to keep home loan servicing after a loan has been transferred, however. If this is the case, your servicing will transfer to another lender. When your loan is sold, youâll be notified of this change with a transfer notice within 30 days of the loan sale. When you receive this notice, your lender will let you know if your servicing was transferred and will provide details with your new contact information.

Don’t Miss: How To Own A Home Without A Mortgage

Why Your Lender Sold Your Loan

It’s common for lenders to sell home loans to another company, including Freddie Mac, sometimes soon after you’ve closed on your home.

Freddie Mac supports the secondary mortgage market by helping keep money flowing through the mortgage system, regardless of whether economic times are good or bad.

Learn about the role Freddie Mac plays with your mortgage.

Who Actually Owns My Mortgage

Where this process can get confusing is that neither the company that originated your loan, nor the servicer, may actually own your loan. Today, the majority of home loans are guaranteed or issued by Fannie Mae, Freddie Mac or the FHA, government-chartered companies that purchase loans from lenders to free up money so they can then lend to other mortgage borrowers.

Read Also: How Long Is A Mortgage Rate Good For

What Is Fannie Mae

Fannie Mae short for the Federal National Mortgage Association dominates the secondary mortgage market. But what exactly does that mean?

Along with its counterpart, Freddie Mac, Fannie Mae purchases about 66% of Americas mortgages from the lenders that originate them.

This frees up money so those companies can keep on lending and buyers can keep on purchasing homes.

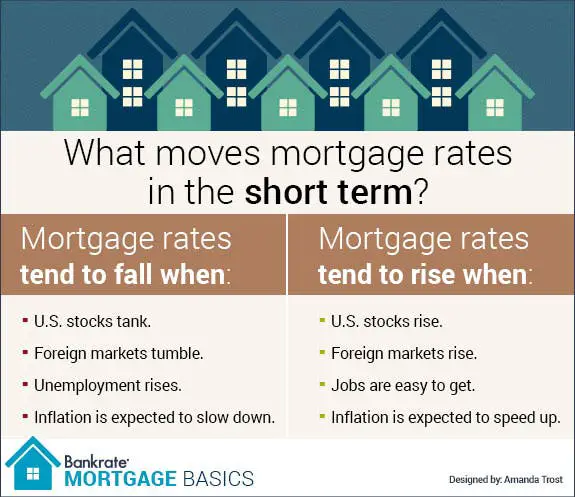

In large part, Fannie Mae and Freddie Mac are also behind the rate you get from your mortgage lender. The two play a big role in keeping U.S. mortgage rates relatively low.

Why Does My Mortgage Keep Getting Sold

A letter arrives in the mail and tells you your mortgage has been sold. It also informs you to send your monthly payments to a new address. Dont panic! This happens all the time, and you shouldnt see many changes.

I would say probably 30% to 50% of the time going to eventually end up mailing their payments somewhere else different from when they first originated it, says Rocke Andrews, president of the National Association of Mortgage Brokers.

So why does your mortgage get soldand why can it happen multiple times? Banks and mortgage servicers constantly check the numbers to find a way to make a buck on your big loan. It all takes place behind the scenes, and you find out the result only when you get that aforementioned letter in the mail.

Recommended Reading: Are 10 Year Mortgages Available

Will My Loan Change After Being Sold

The details of your loan your mortgage rate, terms and other agreements will not change if your home loan is sold by your current lender. Those details are locked into your contract and will remain the same as they did on the day you closed on your home.

What you need to look out for are potential changes in your loan servicer.

When lenders sell your home loan to institutions like Fannie Mae, Freddie Mac or the three main government agencies, they sometimes retain servicing rights. This means theyll still handle all the home loan servicing.

As a customer, this means youll still deal with the same lender you financed your home through. Your service wont be interrupted and you likely wont even notice any differences. Your lender will send you a letter if your home loan changes investors, with all of the specific information regarding this transaction, and will note that your servicing will remain the same.

Not all banks and lenders are able to keep home loan servicing after a loan has been transferred, however. If this is the case, your servicing will transfer to another lender. When your loan is sold, you’ll be notified of this change with a transfer notice within 30 days of the loan sale. When you receive this notice, your lender will let you know if your servicing was transferred and will provide details and contact information for your new servicer.

Your Loan Payments Are Unchanged

Even though your mortgage was sold to Freddie Mac, there is no change to the way you make your mortgage payment.

You must continue to send your payments to the company listed on your mortgage statement.

The selling of your mortgage to Freddie Mac does not change the terms or conditions of your mortgage, and your payment obligations remain the same.

If you have questions about your mortgage or mortgage payment, contact your servicer, which is the company you make your mortgage payments to, using the contact information on your mortgage statement. Do not contact Freddie Mac.

Read Also: How Much Does It Cost To Get A Mortgage

Also Check: What Is Rocket Mortgage Interest Rate

List Of Banks That Dont Sell Their Mortgages

Are you worried about your mortgages being sold? Fortunately, there are banks that dont sell their mortgages, many of which are referred to as “portfolio lenders.

Many of them are small, community-oriented banks and credit unions, which are also more likely to offer lower rates, fewer fees, and better customer service. Some of them include:

- Rosedale Federal Savings & Loan Association. Rosedale Federal is a Maryland-based bank that prides itself on being a hometown lender. It doesnt sell its loans.

- Pentagon Federal Credit Union. The nation’s second-largest credit union, PenFed is known for its low rates and its practice of handling mortgages in-house.

- Member First Mortgage. Member First Mortgage is owned by 11 credit unions and handles its mortgages in-house instead of selling them to larger financial institutions.

The list of banks that dont sell their mortgages varies widely by geographic area. If you’re interested in working with a mortgage lender who won’t sell your mortgage to Fannie Mae, Freddie Mac, Carrington Mortgage Services, or another financial institution, check out the credit unions in your area.

They are more likely to service your mortgage in-house instead of selling it to another organization. Unlike banks, credit unions are non-profit organizations focused on providing better products and services to their members.

Who Owns Your Home Loan

- Theres a lot of confusion with regard to ownership here

- The bank that originally funded your mortgage may have nothing to do with it today

- It could have been sold off years ago to another company

- But if they still own/service it, they may not be keen to offer you a refinance

- In that case, just look elsewhere for a new lender who actually stands to benefit

Some of the confusion regarding whats in it for them might come from the fact that ownership of the loan is unclear.

So even though say Bank of America closed your loan, it could have been sold to Wells Fargo or some other lesser-known loan servicer after the fact.

That would explain Bank of Americas willingness to refinance your mortgage. They can make money on closing costs and make money by selling it off again or by servicing the loan.

If they actually hold onto the mortgage the second time around, they may not want to refinance it again in the future.

But if they sell it again, theres a good chance youll get an offer to refinance down the road. They may even urge to you cash out to make the loan even bigger and more profitable.

If you consider a mortgage broker, who closes loans on behalf of a variety of lenders, they can refinance your mortgage over and over with different banks and always make a profit regardless of where the loan ends up.

Theyll still earn their commission even if your interest rate goes up, down, or sideways.

Don’t Miss: How Does Paying Mortgage Work

Know The Difference Between A Loan Owner & Servicer

Thereâs a difference between the owner of the mortgage and the mortgage servicer. They donât necessarily have to be the same company, said Matt Hackett, operations manager for Equity Now, a direct mortgage lender.

The owner is the financial institution that loaned you the money. The servicer is the company that issues the monthly mortgage statements and handles day-to-day loan management.

âA consumer has a right to know when their mortgage is sold and when their servicing is sold, and they get a new servicer,â said Hackett.

Why Was My Mortgage Loan Sold

Dont take it personally to your lender, your loan is nothing more than another financial asset . And in the case of a mortgage loan, youre paying back the money you borrowed relatively slowly, usually over 15 or 30 years. By selling loans, lenders can quickly free up funds to lend to other potential buyers. Lenders often bundle loans together and sell them to investors. These investing companies then sell them as bonds. In the big picture, this practice helps keeps rates competitive and boosts the economy.

Recommended Reading: Which Way Are Mortgage Rates Trending

When A Mortgage Company Sells Your Loan

Lenders and investors buy and sell mortgages all the time, usually without any problems. So how do you prevent mishaps if this occurs?

If you get a notice from a new servicer without notification from your current servicer, dont send any money. Contact your current servicer. Thats how you avoid fraud.

Why Mortgage Companies Sell Your Loan

You closed on a new mortgage four months ago and all of a sudden you get a letter in the mail saying your loan was sold to a different company. What gives?

This happens quite a bit in the mortgage world and is more common than people think. The good news is there is nothing to worry about. The terms of your loan will not change. Just who you send the check to.

And the reason why your loan was sold really comes down to one thing. Money.

Read Also: What Is The Average Mortgage Payment In Michigan

Who Is Buying And Selling These Mortgages

These mortgage loans are sold on the secondary market, which mainly consists of two organizations, Fannie Mae and Freddie Mac. The secondary market is the place where mortgages are bought and sold by various investors. Secondary market investors include Fannie Mae, Freddie, various pension funds, insurance companies, securities dealers, and other financial institutions. All of the loans sold to Fannie Mae and Freddie Mac must meet certain guidelines for credit worthiness and repayment likelihoods.

The secondary mortgage market exists as a source of money for banks to lend out to home buyers in every state. This is done in two ways:

- Pay cash for mortgages that purchased from lenders and hold those mortgages in Fannie Maeâs investment portfolio. The lenders, in turn can use that money to make more mortgages for more home buyers.

- Second the secondary market issues what are known as Mortgage-Backed Securities in exchange for pools of mortgages from lenders. These MBS provide the lenders with a more liquid asset to hold or sell. MBS are highly liquid investments and are traded on Wall Street through securities dealers.

Why Do Mortgages Get Sold And How Does That Impact The Borrower

If you’ve had a mortgage, you may have been notified by your mortgage lender that it was transferring the servicing rights to your loan to another company. Why do mortgages get sold?

Mortgage companies are required to inform you of any transfers of your loan between mortgage servicers. It’s fairly common, and doesnt impact the terms of your loan. All that changes for you is that, after determining when youll start sending your payments to the new servicer, you’ll send your monthly payments to a new address.

Also Check: What Is Qualifying Income For A Mortgage

Should I Refinance My Mortgage

If you prefer not to do business with the institution to which your first mortgage has been sold, or if you’re concerned it may use predatory lending tactics on you, you have an option: refinancing with another bank or lender.

Refinancing is a process that allows you to renegotiate the terms of your mortgage. This can involve changing your monthly payment, increasing or decreasing the timescale of your mortgage , transitioning from an adjustable-rate to a fixed-rate loan, or even getting rid of your mortgage insurance.

All of this can save you money in either the short or long term.

In order to identify the right move for you, determine what your priorities are. For instance, is paying off your mortgage as quickly as possible a priority? If so, refinancing to a 15-year mortgage may be right for you.

Once you identify your main reason for refinancing, you can begin to look for the best rates, apply for refinancing with your preferred lenders, lock in a lender, and close the deal.

Although the decision to refinance is personal, there are some factors to consider. Homeowners with adjustable-rate mortgages and high-interest rates are often encouraged to refinance.

Additionally, many finance experts recommend switching from a 30-year to 15-year mortgage. If you can comfortably make the higher payments, youll be able to pay off your mortgage faster.

What Is A Second Mortgage

A second mortgage is a home equity loan that allows you to borrow money based on the equity you have in your home, without having to refinance your current mortgage. Equity is the difference between the appraised value of your home and the amount you owe on your first mortgage.

A second mortgage is not the mortgage on a second property. The term second means that the loan does not have priority on your home in case you default on your mortgage payments. If you were to default, your first mortgage has priority and that loan would be paid off before any funds go towards the second mortgage. A third mortgage would be subordinate to the first and second mortgages.

A home equity line of credit , is a type of a second mortgage that is a revolving line of credit, available to you as you need it, as opposed to a lump sum loan. Its still secured against your home.

Because second and third mortgages are a higher risk to lenders, the interest rates are higher than first mortgages.

Don’t Miss: Can You Get A Second Mortgage On A Va Loan