Upcoming Eligible Usda Map Changes

USDA had slated changes to its eligibility maps for October 1, 2015. However, according to a source inside USDA, map changes had been postponed.

According to the source, eligibility maps are now reviewed every three to five years. The last review happened in 2014.

USDA runs on a fiscal year of October 1 through September 30. This is why most big changes to the program happen in October. For this reason, watch for a geographical boundary change on October 1, 2020.

Changes are more likely in 2020 and 2021. The reason: The 2020 census. USDA bases its maps on these US-wide population counts that happen every 10 years. Since the USDA has not made major changes to maps since the year 2000, its becoming more and more likely that big updates will happen soon.

What Are The Eligibility Requirements For A Usda Loan

The USDA loan program, like any other mortgage, has certain eligibility requirements you must meet. If you tick the following boxes, then you should be eligible for a USDA loan, if youre buying the right kind of property:

- Youre a U.S. citizen or a permanent resident with a Green Card

- Ability to prove creditworthiness

- The home would be your primary residence

- You meet income requirements

- Youre in good standing with all federal programs

- You can provide history or proof of on-time payments for bills such as rent or car loans

- The property is located in an eligible area

Who Qualifies For A Usda Loan

To get a USDA loan, the home you want to buy or repair must be in an eligible area. Homes usually need to be located in an area where the population is below 20,000, though in some cases homes in areas with a population as high as 35,000 are eligible.

There are other requirements that vary depending on the type of loan youre applying for.

- Section 502 direct loans Applicants need to have income no higher than the USDAs low-income limit for the county where theyre buying or building a home. They also have to be able to show that they can pay back the loan. They must plan to use the property as their primary residence, and they cant already have other housing lined up or have the option to take out a reasonably good loan from a different source.

- USDA-guaranteed loans Applicants need to have household income that isnt more than 115% of the median income. They have to show that they can repay a loan, but its OK if they have alternative proof of credit history in place of conventional credit reports and scores. They need to plan to use the property as their primary residence, and they must be unable to get a no-PMI conventional loan.

- USDA housing repair loans Applicants need to own the home and be living in it. Their income has to be less than 50% of the median income for their county, and they must not be able to find a loan they can afford from another source.

Read Also: Reverse Mortgage For Condominiums

Rural Repair And Rehabilitation Loan

Purpose: The Very Low-Income Housing Repair program provides loans and grants to very low-income homeowners to repair, improve, or modernize their dwellings or to remove health and safety hazards.

Eligibility: To obtain a loan, homeowner-occupants must be unable to obtain affordable credit elsewhere and must have very low incomes, defined as below 50 percent of the area median income. They must need to make repairs and improvements to make the dwelling more safe and sanitary or to remove health and safety hazards. Grants are only available to homeowners who are 62 years old or older and cannot repay a Section 504 loan.

Do I Qualify For A Guaranteed Usda Loan

To qualify for a guaranteed USDA loan, you must meet the following requirements:

- Be a U.S. Citizen, U.S. non-citizen national or qualified alien

- Have income at or below the set low income in the area you intend to live in

- Agree to set the dwelling as a primary residence

- Have the legal capacity to incur the loan obligation

- Have not been suspended or debarred from participation in federal programs

- Demonstrate the willingness to meet credit obligations in a timely manner

- Purchase a property that meets all program criteria

A credit score of 640 or above usually helps eligible borrowers secure the best rates for a guaranteed USDA loan with zero down payment. Such a score also rewards you with a streamlined or automated application process.

You can still qualify for a USDA loan if your credit score falls below the margin or if you have no credit history at all. However, the interest rates may not be as favorable. In addition, applicants with no traditional credit history may still qualify for these loans. However, theyd need to support a reliable financial standing through evidence like timely utility or tuition payments.

In addition, USDA-backed lenders generally prefer to work with borrowers who demonstrate that none of their accounts have been transferred to collection agencies in the last 12 months. If youve experienced this issue or any bankruptcy, youll need to provide relevant documentation.

Recommended Reading: How Much Is Mortgage On 1 Million

Usda Mortgage Eligible Geographic Areas

The property must be located in a USDA-eligible area. Borrowers can search USDAs maps to browse certain areas or pinpoint a specific address. If you are unsure if a property is eligible, check with a USDA loan officer here

Think your area is not eligible? Well, about 97% of United States land mass is USDA-eligible, representing 109 million people. Many properties in suburban areas may be eligible for USDA financing. Its worth checking, even if you think your area is too developed to be considered rural. The USDA eligibility maps are still based on population statistics from the census in the year 2000. This is a unique opportunity to finance a suburban home with this zero-down mortgage program before the USDA updates their maps.

Usda Home Loan Income Limits

Guaranteed loans are available to moderate income earners, which the USDA defines as those earning up to 115% of the areas median income. For instance, a family of four buying a property in Calaveras County, California can earn up to $92,450 per year.

The income limits are generous. Typically, moderate earners find they are well within limits for the program.

Its also important to keep in mind that USDA takes into consideration all the income of the household. For instance, if a family with a 17-year-old child who has a job will have to disclose the childs income for USDA eligibility purposes. The childs income does not need to be on the loan application or used for qualification. But the lender will look at all household income when determining eligibility.

Recommended Reading: Mortgage Recast Calculator Chase

Mortgage Insurance On Usda Loan

insuranceCreation.com USDA Home Loans Zero-Down Eligibility & Qualification. USDA loans offer 100% funding, low rates and affordability. The USDA guarantees loans of a local lender and permits borrowers to have mortgage interest rates at low rates.

Direct loan for low-income applicants are given by the USDA with interest rates as low as 1%. The grants allow home improvement projects to occur at a cost of up to $30,000. These grants can pay for repairs and upgrades to homes for amounts to be paid for upgrade or repairs.

Geographic Eligibility For A Usda Mortgage

You can check your area on the USDA Eligibility Map to see if it qualifies for a USDA Mortgage. Some states are completely eligible, like Wyoming. Note that, at least 97% of the U.S land mass is eligible for the loan, about 109 million people. Some suburban areas qualify since the maps havent been updated for a while but you need to apply for the loan before the boundaries change.

Most people looking to buy homes in the suburban areas assume that their homes are not eligible. When you do a proper search, you will find eligible locations within 30 minutes of your workplace. For a town to be eligible it must meet the following.

- Have a population of less than 20,000 people

- Located in a rural place with rural characteristics

- Have lack of available credit

Some of the new rules classify an area to be rural if the population is below 35,000 but the newest census will determine the rules. Currently, cities with a huge population are still eligible for the Rural Housing loan. Note that USDA loans offer a lot of value in the home buying market today.

They were created for people who make a modest income. As such, the underwriting standards are very lenient. If you have always wanted to own a home, you can do so with the USDA loan program. Check your eligibility today and get your dream house without a down payment.

Recommended Reading: Chase Recast Calculator

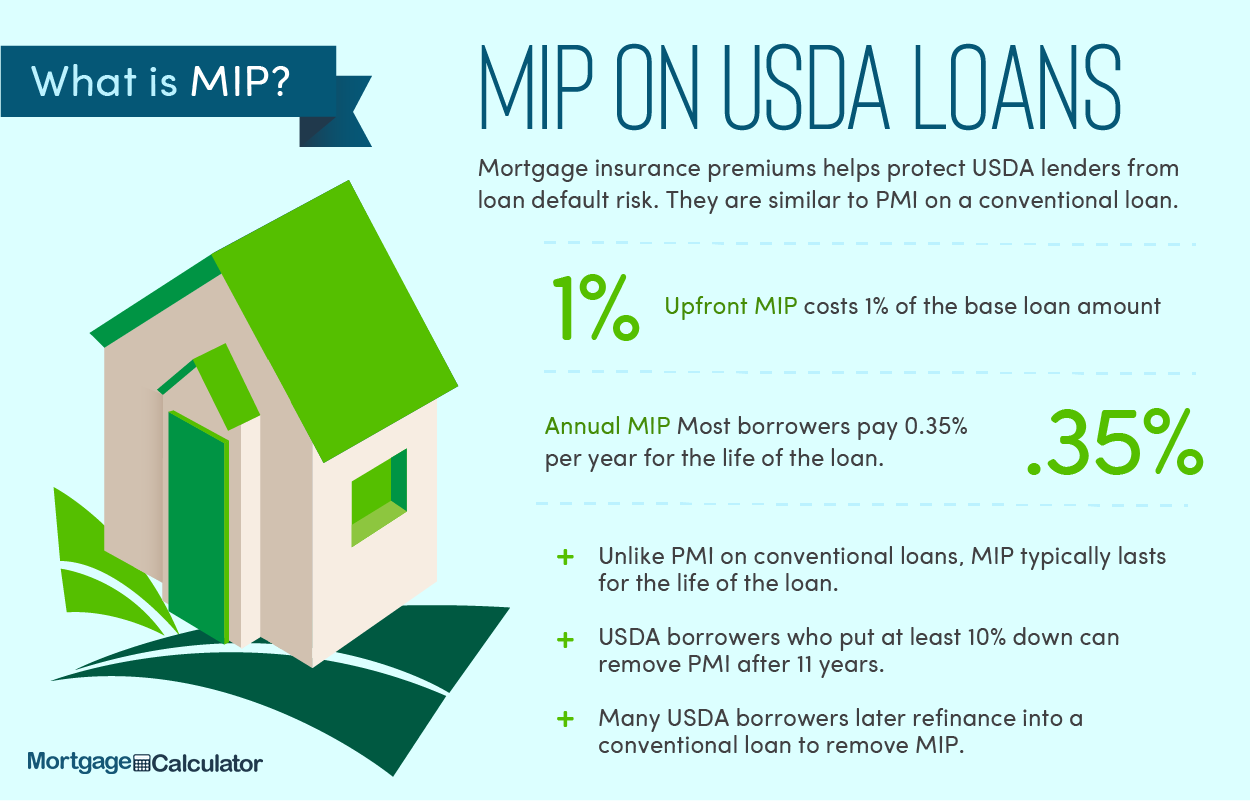

Is Mortgage Insurance Required With A Usda Loan

April 5, 2017 By JMcHood

Mortgage insurance has a bad reputation. Who wants to pay more on their mortgage payment than they already do? Probably not many people do. But, in some cases, this insurance helps. It is not a way to punish you. It is a way to help you secure financing. In the case of the USDA loan, it helps fund the United States Department of Agriculture. This way they can provide you with the opportunity to have a USDA loan. Here we look at the different types of insurance and what you may owe.

Who Can Get A Usda Mortgage

Candidates for a USDA loan should meet a number of standards.

You need to fall throughout the programs revenue limits, sometimes 115% of the median revenue in your area or much less. The direct loan program requires a significantly decrease revenue threshold than the assured loan program does. As with all federal packages, revenue thresholds range by group, family measurement and family composition.

A great first step earlier than making use of is to enter your private data to see should you qualify for a USDA loans revenue limits.

You need to not use the loan for a industrial objective. The borrower has to personally occupy the house.

You have to be a U.S. citizen, nationwide or certified alien and have to be legally capable of tackle debt.

You need to buy the house in a qualifying rural space. This program doesnt apply to cities, and the federal authorities runs no related program to subsidize city dwelling possession. Youll be able to search the USDAs map to search out qualifying areas.

You need to exhibit the power to pay this mortgage. Whereas the standards for a USDA loan is significantly lighter than with a financial institution, the company nonetheless requires sure monetary metrics. The mortgage funds should sometimes be 30% or much less of your demonstrated revenue, and you mayt spend greater than 40% of your revenue on different debt funds. You need to additionally not have had an account not too long ago enter collections.

Don’t Miss: Chase Recast Mortgage

The Usdas Eligibility Requirements:

- Must be a US citizen

- Must make monthly payments

- Must have a dependable income

- Requires an acceptable credit history

USDA loans are also only eligible in rural areas. In general Metropolitan areas are excluded from USDA programs. If you think your home may apply talk to a lender today and get the assistance you need.

Usda Direct Mortgage Particular Necessities

Along with the above, the direct loan program provides the next necessities.

You need to not at the moment have first rate, protected and sanitary housing.

You need to have been unable to discover a loan from different sources on phrases that you possibly can moderately meet.

You need to purchase a house thats 2,000 sq. toes or much less with a market worth no higher than the realms loan restrict and no in-ground swimming pool.

Also Check: Reverse Mortgage On Condo

What Type Of Property Is Eligible For A Usda Loan

Homes purchased with USDA loans must be located in eligible rural areas. The USDA defines these areas as open country or any town, village, city, or place, including the immediate adjacent densely settled area, which is not part of or associated with an urban area.

The population requirements differ depending on the characteristics of the property, but the maximum population limit for any USDA loan is 20,000. Even if youre buying in a town that has a lower population than that, you wont qualify for a USDA mortgage if the area is within a metropolitan statistical area . It also must be in an area with a serious lack of mortgage credit for lower and moderate-income families, according to the USDA website.

The easiest way to find out if a home is in a USDA-eligible area is to check the USDA website here.

Like A Bank Only Better

Personal Loan Guidance

Buying a home can be a bit overwhelming. But dont worry. Well be with you every step of the way to guide you through the USDA Loan process, from preapproval all the way to closing. Youll have your personal mortgage experts cell phone number, so you can get all your questions answered very quickly.

Better Rates. Fewer Fees.

Because were a credit union, we return profits to members in the form of reduced fees, higher savings rates and lower loan rates.

Trusted Advice. Fresh Approach.

We pride ourselves in being a trusted source for financial education. We come to your workplace to answer questions and can provide you with a dedicated Mortgage Loan Originator3 to guide you through the entire loan process.

Respected Locally. Accessed Globally.

Headquartered in Indianapolis since 1930, we rank among the top 3% of credit unions nationally4. We serve members in all 50 states and 50+ countries. Youll have access to 5,000+ shared branches nationwide and 78,000+ surcharge-free ATMs globally.

High Tech. Human Touch.

Our technology makes banking with Elements easy. From quick digital applications to online and mobile banking, well be by your side wherever you go. Were here for you with member service available 24/7 and live chat during the workday.

You May Like: Does Rocket Mortgage Sell Their Loans

Fha Loans Vs Usda Loans

Find out the differences between an FHA and USDA loan

FHA and USDA loans are both designed to make buying or refinancing a home more affordable. Because they are backed by the federal government, these loans feature competitive interest rates, flexible credit requirements, and lower down payments compared to most conventional loans.

There are differences between FHA and USDA loans. One important difference is that while you can use an FHA loan to buy a home in every county in the United States, you can use a USDA loan to buy a home only in rural and certain suburban communities. Read on to learn more about them!

Fha Mortgage Insurance Premium

FHA loans feature minimum down payments as low as 3.5% and have easier credit qualifications than with conventional loans. Most FHA home loans require an upfront mortgage insurance premium and an annual premium, regardless of the down payment amount. The upfront premium is 1.75% of the loan amount, and the annual premium ranges from 0.45% to 1.05% of the average outstanding balance of the loan for that year.

You pay the annual mortgage insurance premium, or MIP, in monthly installments for the life of the FHA loan if you put down less than 10%. If you put down over 10%, you pay MIP for 11 years.

» MORE: Is an FHA loan right for you?

Don’t Miss: Rocket Mortgage Loan Types

Do I Qualify For A Usda Direct Loan

To qualify for a direct USDA loan, your adjusted income must fall at or below what the USDA considers low income in the area you want to live in. You must also meet the following requirements as set by the USDA:

- Be a U.S. citizen, permanent resident or qualified alien

- Not be suspended or debarred from participation in federal programs

- Be without decent, safe and sanitary housing

- Be unable to secure loans from other sources on terms you can reasonably meet

- Agree to live in the property for primary residence

- Have the legal capacity to incur a loan obligation

USDA direct loans cant fund homes with market values that rank above the areas loan limit as defined by the USDA. In addition, these mortgages tend to back homes measured at 2,000 square feet or less.

Weigh The Pros And Cons

Besides the benefits, consider the disadvantages of choosing a USDA loan. Since you can only finance a house in a USDA rural area, this option may not suite you. If you work in the city, living too far out may not be a practical choice. Commuting to work daily takes a lot time, money, and energy that you might not have.

Next, income limits may keep you from qualifying for this type of mortgage. If your household earns more than 115% of the median income in your area, you wont be approved. You should also think of the annual guarantee fee, which is an extra cost you must budget into your mortgage payments.

USDA loans only apply to single family homes. It should also be a primary home, which means you cannot finance an investment property if youre planning to rent out a house. These loans also follow minimum property standards to ensure the home is livable and safe. If you intend to purchase a house that requires a lot of renovation, a strict appraiser might not readily approve your home.

Before you choose a USDA loan, check if any of these factors might not align with your priorities and needs.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit