Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Formula To Get The Apr

- Divide the interest by the number of interest rates per year. In the example 10% / 12 =

- Add one to the number calculated inStep 1. In the example 1+ =

- Increase the calculated number byStep 2 high how many times in a year money is earned.

- Subtract one from the number calculated inStep 3 to determine the annual interest.

Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

Also Check: Can You Get A Mortgage On Disability

How To Calculate Mortgage Interest Paid

Mortgage payments constitute a large financial obligation for many people. In addition to the principal of a mortgage, homeowners must also pay a lender interest over the course of the loan. This interest adds up to a significant amount due to the size of the loan and the length of the loan period. You can calculate mortgage interest paid over the course of a loan to see how much money you will pay to the lender in interest.

1

Find your monthly mortgage payment in your loan papers. Look in the amortization schedule that the lender provides you to find this amount, if you do not know it.

2

Multiply your monthly payment by the number of payments you will make over the entire course of the mortgage. For example, if your monthly payment is $825.00 and you will make 180 payments over the course of a 15-year loan, multiply 825 by 180 to get 148,500.

3

Subtract the principal from this figure to calculate the interest paid to the lender. If your principal is $110,000, subtract 110,000 from 148,500 to get $38,500 in interest.

References

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

You May Like: What Is Tip In Mortgage

How To Calculate Total Interest Paid On A Mortgage

Any company, which lends mortgage loans to people, knows and keeps a track of the amount of total interest that a customer would pay on a certain mortgage deal. The same however cannot be said about the customers. People most often leave these calculations to the company and thus become prone to potential frauds.

Three mostly commonly used methods to calculate total interest paid on a mortgage are add-on, discount and simple interest methods. Here is how to calculate total interest paid on a mortgage using each of these methods.

Understand the terminologies, Interest and Principal. Interest is simply a fixed or variable amount of fee that a customer has to pay on a loan. The percentage of interest that a borrower has to pay depends directly on the total amount of loan. Principal is the total amount of loan granted to a buyer by a lender.

Early Loan Payoffs Benefits Simple

In a traditional mortgage, a payment made on the first, or the tenth, or fifteenth of the month is the same. Since the calculation is on a monthly basis, no more interest accrues in that time which would not have customarily accumulated. However, in a simple-interest mortgage interest increases every day, so a borrower who pays even one day late will have accrued even more interest.

A borrower who pays early or on time every month will end up paying the amount before the interest accrues.

When a borrower pays more than what is due on any scheduled payment, those extra funds are credited to the loan’s principal paying extra on the traditional mortgage can reduce the principal amount consistently. A consistent payment will shorten the amount of time it takes to pay off the loan and reduce the total amount of interest paid over the life of the loan.

There is no benefit to making extra payments on a simple-interest mortgage. However, there is a risk for borrowers who do not intend to pay off the note early. Since interest compounds daily, the principal, or the amount due, continues to increase on a daily basis.

You May Like: Does Chase Allow Mortgage Recast

How To Calculate Apr On Credit Card

How do credit card companies determine their APR? This is how the annual credit card percentage is calculated. Interest on credit card balances is charged monthly. However, because the months vary in length, most card issuers use a daily periodic rate , which is the annual percentage divided by 365. The daily rate is multiplied by your daily balance count and the number of days in the month.

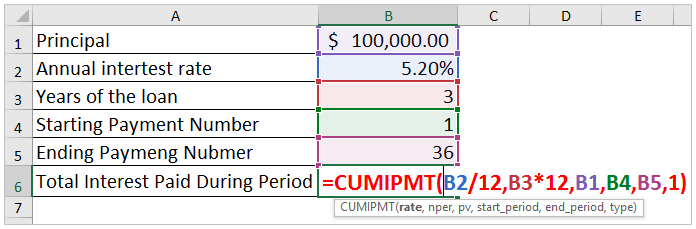

Use Excel To Find The Payment And Total Interest On A Loan

This lesson combines what you learned about calculating the payment on a loan using the PMT function with calculating the total amount of the loan in order to calculate the interest on a loan. As you watch this video, follow along in Excel. You can use Excel for your practice problems and the quizzes, so it will be helpful for you to practice.

Total interest = Total amount of loan Original principal amount

Practice Problems

You May Like: How Much A Month Is A 500k Mortgage

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

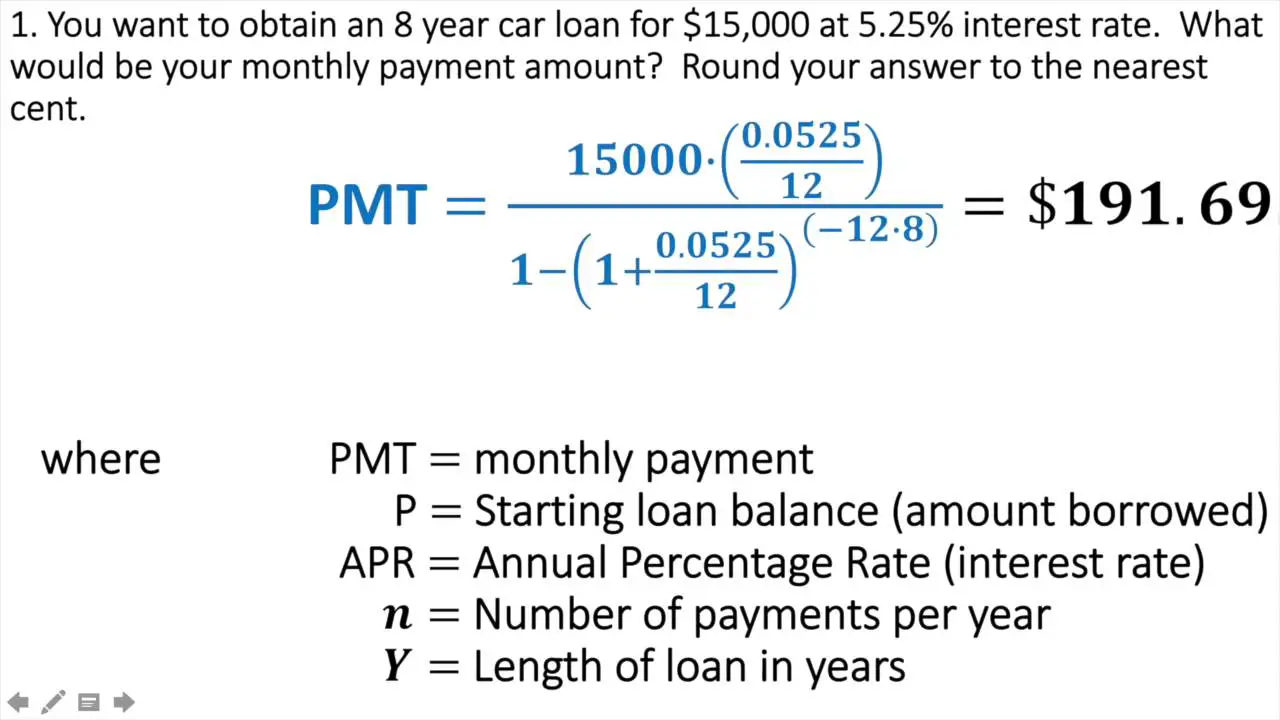

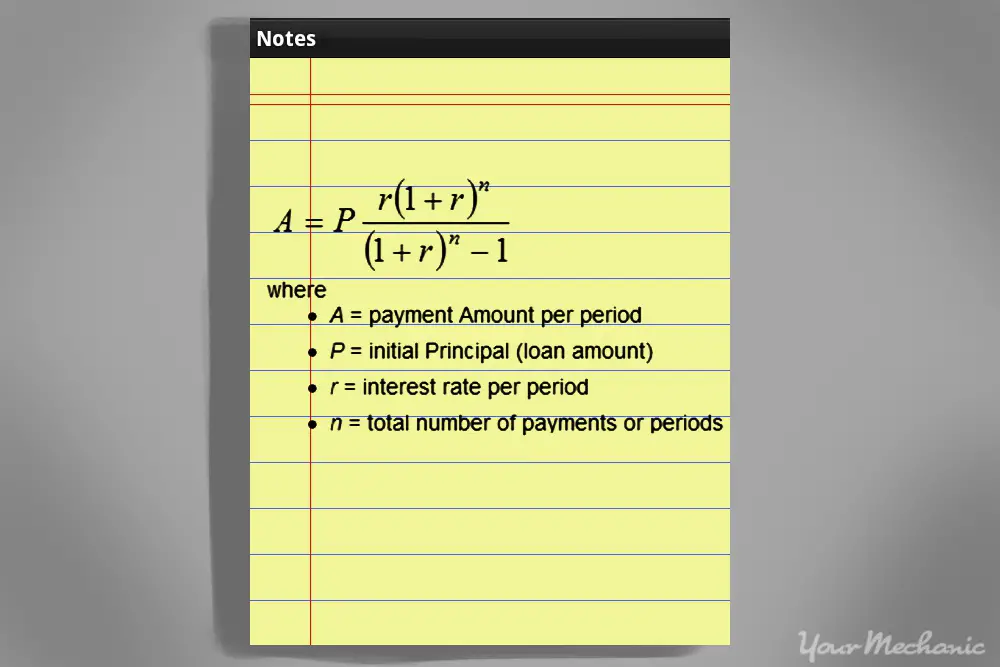

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

Don’t Miss: How To Build A Mortgage Business

Why Is The Total Interest Higher Than That Of A Standard Mortgage

The total interest paid is higher on interest-only mortgages because during the first phase of the loan, you’re not reducing the loan principle . And if you’re not paying down the principle, you’re still paying interest on the full amount of the loan each month. So 4% of $250,000 is the same in the first year of the term as it is in the fifth, unless you make prepayments.

Mortgage Interest Compounding In Canada

Mortgage interest in Canada is compounded semi-annually. This means that while you might be making monthly mortgage payments, your mortgage interest will only be compounded twice a year. Semi-annual compounding saves you money compared to monthly compounding. Thats because interest will be charged on top of your interest less often, giving interest less room to grow.

To see how this works, lets first look at credit cards. Not all credit cards in Canada charge compound interest, but for those that do, they usually are compounded monthly. The unpaid interest is added to the credit card balance, which will then be charged interest if it continues to be unpaid. For example, you purchased an item for $1,000 and charged it to your credit card which has an interest rate of 20%. You decide not to pay it off and make no payments. To simplify, assume that there is no minimum required payment.

The same applies to mortgages, but instead of monthly compounding, the compounding period for mortgages in Canada is semi-annually. Instead of adding unpaid interest to your balance every month like a credit card, a mortgage lender is limited to adding unpaid interest to your mortgage balance twice a year. In other words, this affects your actual interest rate based on the interest being charged.

Also Check: Can You Take A Cosigner Off A Mortgage

What Factors Affect How Much Interest You’ll Pay On A Mortgage

While you may see headlines about how interest rates have climbed or fallen, the rate you read about in a news story isn’t necessarily the one you’ll receive on your mortgage. As with other types of loans, the rate you receive can depend on your creditworthiness and the loan’s specifics.

With mortgages, the following can affect your interest rate:

How Is Apr Calculated Loan

The annual interest rate on the loan is calculated by multiplying the amount borrowed plus the commission by the interest rate, and you get a number that is slightly higher than the interest rate because it includes all the costs associated with the loans. There are two types of APR: floating and fixed.

Don’t Miss: What Is The Mortgage On 800k

How Much Interest Do You Pay On A Mortgage

The overall interest you’ll pay on your mortgage depends on the interest rate you receive, whether it’s a variable or fixed rate and how long it’ll take you to repay the loan. While you may refinance or move before the end of the loan’s term, you can find your loan’s monthly interest payment breakdown by reviewing your loan’s amortization table.

Computing Daily Interest Of Your Mortgage

To compute daily interest for a loan payoff, take the principal balance times the interest rate, and divide by 12 months, which will give you the monthly interest. Then divide the monthly interest by 30 days, which will equal the daily interest.

Suppose, for example, that your uncle gives you $100,000 for a New Year’s Eve present, and you decide to pay off your mortgage on January 5. You know that you will owe $99,800.40 as of January 1, but you will also owe five days of interest. How much is that?

- $99,800.40 x 6% = $5,988.02. Divide by 12 months = $499. Divide by 30 days = $16.63 x 5 days = $83.17 interest due for five days.

- You would send the lender $99,800.40 plus $83.17 interest for a total payment of $99,883.57.

You May Like: Can I Get A Mortgage With A Fair Credit Score

How Do You Calculate A Loan Payment

The first step to calculating your monthly payment actually involves no math at all – it’s identifying your loan type, which will determine your loan payment schedule. Are you taking out an interest-only loan or an amortized loan? Once you know, you’ll then be able to figure out the types of loan payment calculations you’ll need to make.

With interest-only loan options, you only pay interest for the first few years, and nothing on the principal balance – the loan itself. While this does mean a smaller monthly payment, eventually you’ll be required to pay off the full loan in a lump sum or with a higher monthly payment. Most people choose these types of loan options for their mortgage to buy a more expensive property, have more cash flexibility, and to keep overall costs low if finances are tight.

The other kind of loan is an amortized loan. These loan options include both the interest and principal balance over a set length of time . In other words, an amortized loan term requires the borrower to make scheduled, periodic payments that are applied to both the principal and the interest. Any extra payments made on this loan will go toward the principal balance. Good examples of an amortized loan are an auto loan, a personal loan, a student loan, and a traditional fixed-rate mortgage.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Don’t Miss: What Is A Teaser Rate Mortgage

How Does The Cash Rate Affect Commercial Interest Rates

The cash rate reflects the market interest rate on funds banks lend and borrow from each other overnight. It is set by the Reserve Bank of Australia , which meets on the first Tuesday of every month to discuss any potential moves.

But what does this have to do with commercial interest rates? Simply put, the cash rate serves as a benchmark rate for savings accounts and variable rate home loans. When the RBA raises or lowers the cash rate, banks and lenders tend to modify their own home loan and deposit interest rates soon after.

Can I Lower My Monthly Payment

There are a few ways to lower your monthly payment. Our mortgage payment calculator can help you understand if one of them will work for you:

- Increase the term of the loan. The longer you take to pay off the loan, the smaller each monthly mortgage payment will be. The downside is that youll pay more interest over the life of the loan.

- Get to the point where you can cancel your mortgage insurance. Many lenders require you to carry mortgage insurance if you put less than 20% down. This is another charge that gets added to your monthly mortgage payment. You can usually cancel mortgage insurance when your remaining balance is less than 80% of your homes value. However, FHA loans can require mortgage insurance for the life of a loan.

- Look for a lower interest rate.You can think about refinancing or shop around for other loan offers to make sure youre getting the lowest interest rate possible.

Don’t Miss: What Credit Agency Do Mortgage Lenders Use

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

Calculate Your Monthly Payment By Hand

You can calculate your monthly mortgage payment, not including taxes and insurance, using the following equation:

M = P /

P = principal loan amount

i = monthly interest rate

n = number of months required to repay the loan

Once you calculate M , you can add in the monthly property tax and homeowners insurance premium, if you have them. These are fixed costs that aren’t determined by how much you borrow from the bank, so they can easily be added to the monthly cost.

Read Also: How Much Is The Mortgage On A $300 000 House

What Is Apr And Why Is It Important

The annual percentage or annual percentage is your interest rate, which is shown as an annual rate. The annual interest on the loan may include costs that can be charged to you, for example: B. start-up costs. The annual interest rate is important because it can give you a good idea of how much you need to pay to get a loan.