Monthly Payments On A $500000 Mortgage

At a 3% fixed interest rate, your monthly mortgage payment on a 25-year mortgage might total $2,366.23 a month, while a 15-year might cost approximately $3,448.44 a month.

Note that your monthly mortgage payments may differ slightly depending on the type of interest rate , your mortgage term, payment frequency, taxes and possible other fees.

-

See your monthly payments by interest rate.

Interest

About our promoted products

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Homeowners spend about 1.91% of their household income on home insurance, based on average premiums and median household income.

- Homeowners insurance costs are rising, having increased about 42% since 2009, according to the Insurance Information Institute.

- Erie provides the cheapest average annual homeowners insurance rates on our list, at $897 for $250,000 in dwelling coverage.

- Oklahoma is the most expensive state for average annual homeowners insurance rates on our list, while Hawaii is the cheapest.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

You May Like: How Big A Mortgage Can I Get With My Salary

How Much Do I Need To Put Down

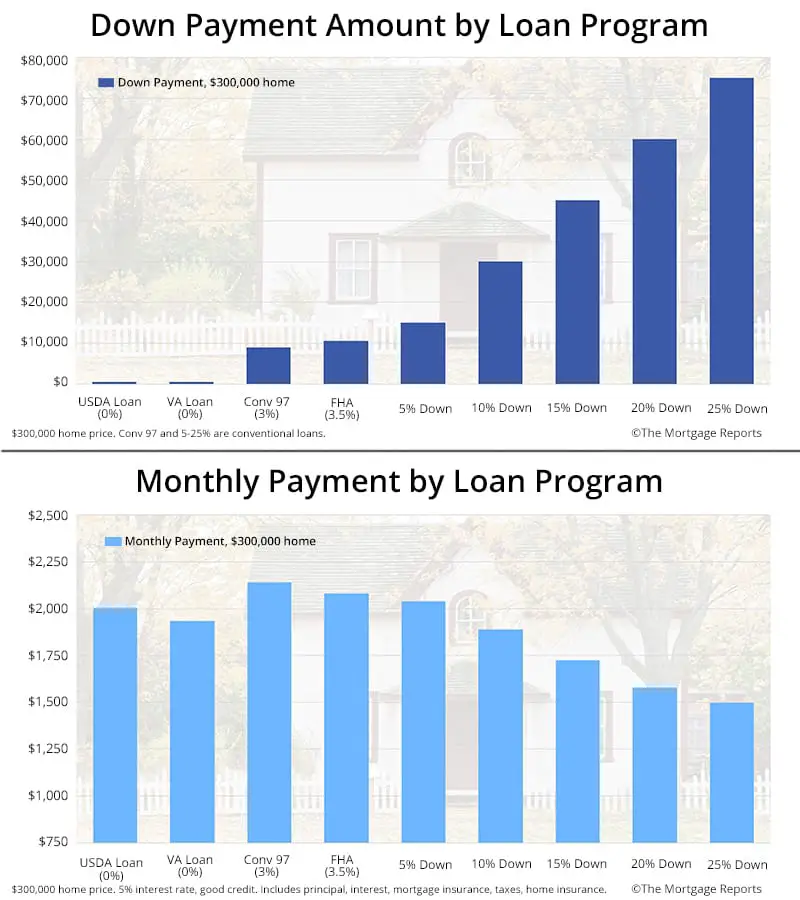

A down payment of 20% or more will get you the best interest rates and the most loan options. But you dont have to put 20% down to buy a house. There are a variety of low-down-payment options available for home buyers. You may be able to buy a home with as little as 3% down, although there are some loan programs that require no money down.

What Mortgage Lenders Look For In Borrowers

To be eligible for a home loan, you must meet certain standards that indicate you are a capable borrower. As previously mentioned, these aspects include your income and assets, debt-to-income ratio, and credit score. By evaluating these key financial areas, it shows how much risk you might impose on a lender. The level of risk determines how much money they are willing to offer, as well as how much interest rate they should charge. Overall, you must prove that you are a worthy investment to qualify for a mortgage.

Also Check: What Is Rocket Mortgage Interest Rate

Required Income For 500k Mortgage Under The Stress Test

Lets determine the Gross Debt Service for a $500,000 condo using the mortgage stress test rate of 5.19% over 25 year amortization. Your household expenses break down like this:

- Property tax $255/month ÷ 12)

- Heating $60/month

- Mortgage payments $2,927/monthTOTAL: $3,442

With your monthly household expenses amounting to $3,442 this means the required minimum income for a 500K mortgage under the Stress Test is $130,000 per year. This could also be two salaries of $65,000 per year.

$130,000 ÷ 12 = $10,833$10,833 x 0.32 = $3,447

Expenses $3,442 < $3,447 GDS

Dont forget about any debts, keeping in mind they should not exceed 40% of your monthly household income.

So while the above is how the bank will approach determining what you can afford, below is closer to the income one actually needs to afford a 500K mortgage.

Find Out What Your Monthly Payment And Total Interest Could Look Like On A $500000 Mortgage

Approved for a mortgage of $500,000? You might wonder how much your monthly repayments will cost you on a half a million dollar mortgage and whether you can afford them with your income. Heres a breakdown of what you might face monthly, in interest and over the life of a $500,000 mortgage.

Recommended Reading: How To Get A 15 Year Fixed Mortgage

How Much Difference Does 25% Make In A Monthly Mortgage Payment

Related Articles

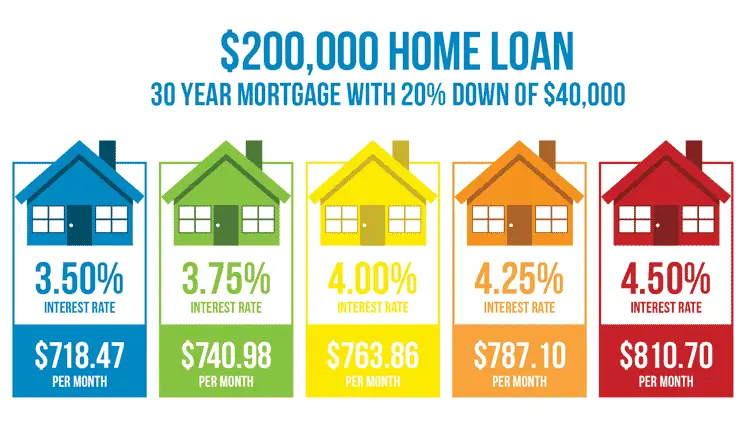

The interest rate is the amount of money the bank charges you for borrowing the money to pay for your home. The principal of the loan plus the interest rate determines your monthly mortgage payment. With a fixed-interest loan, your total amount is divided by the length of the loan, and then again by 12 monthly payments. Even a .25 percent difference in your interest rate can add to your monthly payment depending on your loan amount. That number increases even more over the life of the loan.

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

You May Like: How To Lower My Mortgage

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

You May Like: Which Credit Reporting Agency Do Mortgage Lenders Use

The Homebuyers Guide To Qualifying For A Mortgage

Buying a house is one of the largest purchases people make in a lifetime. Its an expensive proposition, with most consumers relying on loans to acquire their own home. And since mortgage payments typically take decades to pay down, it requires financial commitment and a level of stability. With this in mind, mortgage lenders assess your financial disposition and creditworthiness to make sure you can afford to make regular payments.

The following guide will walk you through the basic qualifying process to secure a mortgage. Well also rundown the primary financial requirements you must satisfy before you can buy a home. This includes factors such as your credit score, income, and debt-to-income ratio, to name a few. Finally, using our calculator above, well provide an example of how you can estimate your required annual income in order to purchase a home with a specific amount.

Understanding the Mortgage Qualifying Process

Can I Lower My Coverage To Decrease My Premium

Lowering your coverage limits or removing optional endorsements will likely decrease your premium, but it may not be the smartest financial decision. Higher coverage limits provide more financial protection against disasters, so lower limits could leave you with more out-of-pocket expenses if something happens. Removing endorsements that you do not need may be a good way to trim your costs, but be sure to review your situation with your agent so that you dont remove coverage that you should keep.

You May Like: Can Non Permanent Resident Get Mortgage

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

How Much A Month Is A 300 000 Mortgage

Monthlymortgagemonthly mortgagemortgagemonthmonth

Based on their mortgage calculator it seems reasonable to look at houses up to about $300,000. Their calculator estimates the monthly payments to be about $1500 a month for this price. We will be making about $50,000 a year plus about $20,000ish for a down payment.

One may also ask, how much deposit do I need for a 300 000 House UK? The amount of deposit you’ll need in order to get a mortgage is worked out as a percentage of the value of the property. Typically, you’ll need to save between 5-20 per cent. For example, if your home is £300,000 you’ll need a minimum of £15,000.

Similarly one may ask, how much is a 400k mortgage per month?

Mortgage Loan of $400,000 for 30 years at 3.25%

| Month |

|---|

| 668.25 |

Can I afford a 300k mortgage?

The oldest rule of thumb says you can typically afford a home priced two to three times your gross income. So, if you earn $100,000, you can typically afford a home between $200,000 and $300,000. But that’s not the best method because it doesn’t take into account your monthly expenses and debts.

Read Also: What Is The Rate For A 15 Year Mortgage

The Income Needed To Qualify For A $400k Mortgage

Unfortunately, theres no magic bullet for determining the exact income needed for a $400K mortgage. However, we can generate an estimate based on some basic calculations.

Most mortgage lenders follow the 43% rule, which stipulates that all of the bills you pay each month including your mortgage, taxes, insurance premiums, credit card payments, and utilities should total less than 43% of your total annual income.

Essentially, banks wont consider borrowers with a debt-to-income ratio or DTI above 43%.

In order to calculate how much you can afford to pay each month, youll need to know:

Although these considerations can vary widely, we can make a broad-scale estimate to roughly determine the income needed to qualify for a $400K mortgage.

For example, if you make a $55,600 downpayment on a $400K house and qualify for a 4.25% 30-year mortgage, your minimum monthly income should be $8,178 .

According to this calculation, a prospective homebuyer looking to purchase a $400K house should make roughly $100,000 a year. Again, this number may vary with other considerations such as budget limitations, other loan obligations, and the details of your mortgage. However, it should hopefully serve as a working estimate.

What Are The Monthly Repayments On A 500000 Mortgage

If youre looking to take out a pretty sizeable £500k home mortgage, youre probably wondering how much the repayments are going to set you back.

Jump to our calculator journey to establish the costs and which of the best deals youll qualify for.

Every day, we receive enquiries from customers asking us questions like How much is a mortgage on a £500,000 house? or How do I get approved for a £500k mortgage?

This article covers what factors are considered for a loan of this size, and how much £500k mortgage repayments are likely to cost you each month.

The following topics are covered below…

Don’t Miss: Does Navy Federal Sell Their Mortgages

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

How Much Mortgage Can I Afford

The first step to starting your home buying journey is to get a mortgage pre-approval. This is where your mortgage lender will look at where you stand financially to help give you an idea of how much mortgage you can afford and at what interest rate.

What they do is look at your income, your monthly expenses, what debt you may have, how much you have available for your down payment, as well as any other registered and non-registered savings you may have. They use this to calculate your debt-to-income ratios which helps them determine what you can afford.

However, your mortgage pre-approval will generally tell you the maximum mortgage you can afford but it doesnt guarantee that youll get that amount. Well elaborate on qualifying for a mortgage later on.

Also Check: How To Mortgage Property In Monopoly

Fha Loan Limits In 2021

The Federal Housing Administration regulates the maximum amount of mortgage loans that can be awarded to potential homebuyers. These loans are based on the median price of homes in specific counties and cities, with maximum loan amounts set at 115% of area median house prices.

In 2021, these loan limits will reach a maximum value of $822,375 in high-cost areas. This increase is due to the rise in home values over the past year.

While the value of $822,375 represents the national loan ceiling or the highest loan amount that an applicant can receive, the loan floor or minimum possible loan has also increased to $356,362.

This means that, depending on what your salary is and where youre looking to buy a home, you may easily qualify for a $400K or even $500K mortgage.

Because the FHA loan limits are based on the median home value in a given county or city, a jumbo loan may be well within your reach.

For more information, check out this resource about FHA Loan Limits By State to identify the FHA loan limits in your county. The information will help you make a more informed decision about choosing a home location and qualifying for a jumbo loan.

How Much Income Is Needed For A 250k Mortgage

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Also Check: When You Sign A Mortgage You Are