Using The Mortgage Payment Formula

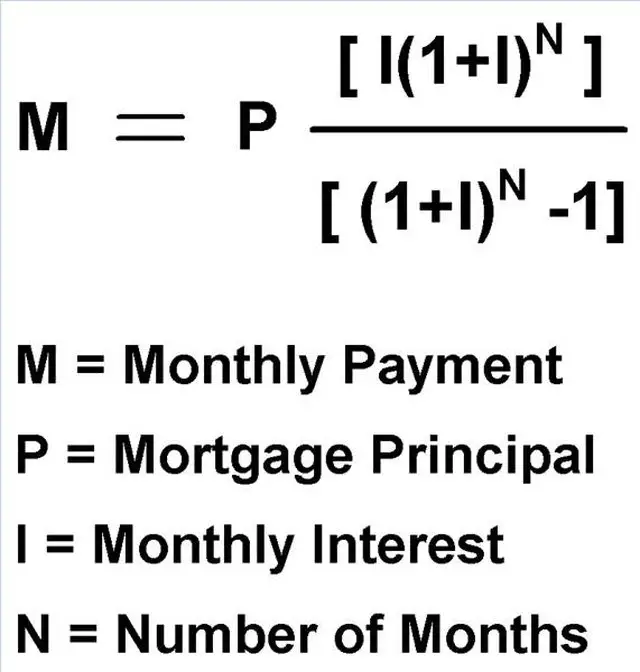

Now that you have those three numbers in handyour mortgage principal, your monthly interest rate and your number of payment periodscomplete the formula below. For simplicity, weve attributed a symbol for each of the three inputs used in the formula.

Monthly payment = P x ^N ) / ^N 1)

P = Mortgage principalI = Monthly interest rateN = Number of payment periods

Simply swap out the variables with your own inputs and complete the calculation. Note, youll want to follow the same sequence of calculations as we do in order to get the correct result.

Keeping with the example used above, lets say you have enough saved for a 20% down payment on a $600,000 home, amortized over 25 years at a rate of 2.69%. In this case, your inputs are:

I = 0.00224N = 300

Now lets complete the equation by replacing the variables in the formula with the inputs:

Monthly payment = P x ^N ) / ^N 1)Monthly payment = 480,000 x ^300) / ^300 1)Monthly payment = 480,000 x / Monthly payment = 480,000 x / Monthly payment = 480,000 x 0.00438 / 0.95667Monthly payment = 2,102.4 / 0.95667Monthly payment = 2,197.62

The answer represents the dollar amount of your monthly mortgage payments: $2,197.62

What’s The Formula For Calculating Mortgage Payments

For the maths-inclined among us, the mortgage payment formula isnt that complicated. Just remember, this doesnt account for variable rates, which can change.

Youll need these numbers to get started:

- r = Annual interest rate /12

- P = Principal of the loan

- n = Number of payments in total: if you make one mortgage payment every month for 25 years, thats 25*12 = 300

Heres the formula:

If we wanted to figure out the payment for an average mortgage, it might look like this:

- r = 0.033/12 = 0.00275

- N = 25*12 = 300

If you cant tell from the points above, this is a £350,000 mortgage at 3.3% APRC and a 25-year term.

Lets plug those numbers into the formula:

And we’ll simplify:

And thats it! It may not be as easy as a calculator, but it’s quite possible to do yourself.

If you enjoyed this article, dont forget to subscribe for updates here. Thanks for reading!

How Long To Pay Off Mortgage With Extra Payments Calculator

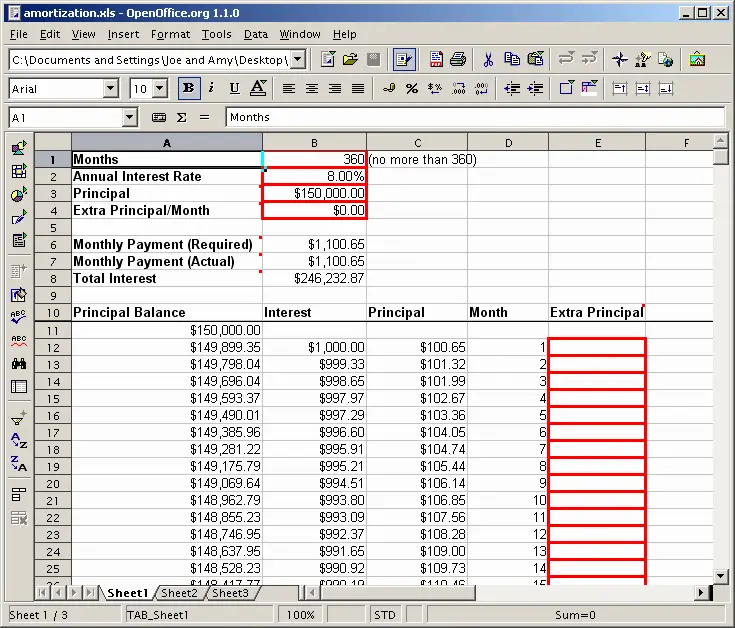

Ultimately, significant principal reduction cuts years off your mortgage term. Extra payments count even after 5 or 7 years into the loan term. If the first few years have passed, its still better to keep making extra payments. Another technique is to make mortgage payments every two weeks. This is called a biweekly payment plan.

Recommended Reading: How Long Do You Have To Pay For Mortgage Insurance

Why Is It So Complicated

It would be easy to figure out a mortgage payment if the numbers didnt change over time. Unfortunately for us, they doquite a bit. Banks need to make money off the money they lend, so they charge interest on a loan. Mortgage interest is basically the fee the bank charges you to borrow money.

Theres an old story that Albert Einstein called compound interest the most powerful force in the universe. While were not sure if its worthy of that much praise, it is quite powerful. The word compound makes things more difficult for us. If you borrow £10,000 for 10 years at 2% simple interest, youll pay £200 in interest each year: that’s quite simple. However, if you borrow with compound interest, we have to calculate the interest every time you make a payment.

Mortgages in the UK use compound interest, so the math goes like this:

Whats The Difference Between Interest Rate And Apr

The interest rate is the amount that the lender actually charges you as a percent of your loan amount. By contrast, the annual percentage rate is a way of expressing the total cost of borrowing. Therefore, APR incorporates expenses such as loan origination fees and mortgage insurance. Some loans offer a relatively low interest rate but have a higher APR because of other fees.

Read Also: What Are The Payments On A 150 000 Mortgage

Use A Mortgage Calculator

As a practical matter, youre much better off using a mortgage calculator to calculate your mortgage payment because its very hard to even input that formula properly in a regular calculator. Using a mortgage calculator takes the guesswork out of the formula for you and can help you calculate your mortgage payments much faster. There are several types of mortgage calculators, so its important to understand the purpose of each one so that you can be sure youre using the right one for your needs.

Save money with a lower interest rate.

Lock in your rate today before they rise.

How To Choose The Right Mortgage Lender

Choosing the right lender takes a fair amount of research and requires a thorough review of your situation before you even start your search. For example, if you are a first-time buyer, some lenders might be better than others for your situation. Other factors that can help determine the right lender for your situation might include:

- Do you have a high credit score, or are there issues here?

- Are you looking for a 30-year mortgage or perhaps one with a 15-year term?

- Are you a veteran?

The key factors to consider when starting your search include:

- Your credit score

- The amount of your down payment

- The loan term you are seeking

- Extra fees and closing costs associated with the mortgage

- The interest rate

The types of lenders you might consider include:

In some cases, it might make sense to work with a mortgage broker who can help you look across the mortgage lender spectrum and can often help you obtain a suitable deal. Some online mortgage sites offer access to several different lenders, much like a traditional mortgage broker.

Read Also: What Determines Your Mortgage Interest Rate

Costs Of Property Tax

Property taxes are collected by the lender and then paid into a specific account, usually known as an escrow or impound account, at the end of each year and are often included in a monthly mortgage payment. On behalf of the homeowners, the taxes are paid to the government at the end of the year.

The amount you owe in property taxes is determined by local tax rates and the homes value. Therefore, the lenders estimate of how much a homeowner will have to pay may be greater or less than the actual amount owed, resulting in a credit or a bill at tax time.

The Number Of Payment Periods

The total number of mortgage payments it will take to pay off the mortgage in its entirety, based on the amortization period. Again here, lenders use annual terms to describe the length of time you will carry your mortgage loan . In Canada, lenders typically offer amortization periods of five to 25 years. This isnt the same as your mortgage term, which is the duration of your mortgage contract. You will usually complete several mortgage terms before paying off your mortgage in full.

Before completing the next step using the mortgage payment formula, make sure you have converted your amortization period into a total number of payment periods. To do that, multiply the number of years in your amortization by 12. For example, a 25-year mortgage will leave you with 300 payment periods before you have paid off your mortgage.

Payment periods = number of years x 12 monthsPayment periods = 25 x 12Payment periods = 300

Also Check: How To Get Approved For A Second Home Mortgage

What About Variable Rates

Weve been talking about fixed rates so far, where the interest rate doesnt change. In a variable rate mortgage, your interest rate can change, often at the whim of the bank. Usually, this variable rate is determined by the Bank of Englands bank rate, plus two or three percent. On a standard variable rate, the lender has total control over your interest rate.

If you thought compound interest was tricky, variable rates are positively devilish. Most banks just quote a cost for comparison: this is an educated guess of what your average interest rate will be if you stay on that mortgage. These educated guesses are about as good as we can do: if you do figure out how to predict interest rates accurately, call us.

This is important because most mortgages have a fixed rate for a short period: 2-5 years, typically. The day your mortgage leaves this introductory rate, youll be paying a variable rate, and your payments can change every month!

What Is An Amortization Schedule

An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your principal vs. interest. The maximum amortization in Canada is 25 years on down payments less than 20%. The maximum amortization period for all mortgages is 35 years.

Though your amortization may be 25 years, your term will be much shorter. With the most common term in Canada being 5 years, your amortization will be up for renewal before your mortgage is paid off, which is why our amortization schedule shows you the balance of your mortgage at the end of your term.

Recommended Reading: Who Should I Get Mortgage Pre Approval From

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Whats The Necessary Credit Score To Get A Mortgage

In addition to making sure you can afford your mortgage payments, lenders also look at your credit score when deciding both whether to lend to you and the amount of interest to charge you for borrowing.

When lenders look at your credit score, most have a minimum score requirement before you can even get approved for a mortgage loan. This minimum credit score is lower with government-backed loans, including FHA loans, VA loans, and USDA loans than it is for conventional mortgage loans.

For a loan backed by the FHA, you usually need a credit score of 580, although its possible to get a loan with a score as low as 500 under certain circumstances if you make a larger down payment. VA lenders typically require a score between 580 to 620, depending on the lender, while USDA loans typically wont be available to you if your score is less than 640.

Conventional loans, on the other hand, generally require a minimum credit score of 620but you will pay much higher rates and could be stuck with a subprime mortgage if your score is low. To get the most competitive rates on a mortgage, a score of 740 or higher is preferred.

Also Check: What Type Of Mortgage Do I Have

What It Means For Consumers

Calculating your monthly payments can help you figure out whether you can afford to use a loan or credit card to finance a purchase. It helps to take the time to consider how the loan payments and interest add to your monthly bills. Once you calculate your payments, add them to your monthly expenses and see whether it reduces your ability to pay necessary and living expenses.

If you need the loan to finance a necessary item, prioritize your debts to try and pay the ones that cost you the most as early as possible. As long as theres no prepayment penalty, you can save money by paying extra each month or making large lump-sum payments.

It helps to talk to your lender before you begin making extra or lump-sum payments. Different lenders might increase or decrease your monthly payments if you change your payment amount. Knowing in advance can save you some headaches down the road.

Take Homeowners Insurance Into Consideration

Even if you think you can avoid it, homeowners insurance should be taken into consideration. Most people have to pay for this item, and the lender will automatically add the cost to the payment you make each month.

There are many different types of insurance in the world. For homeowners, there are eight options to choose from for your place. Its critical to consult a professional to determine which will help you the most in case of a disaster.

Varying price points depend on the type of insurance you get, and a high deductible means you owe a lower monthly premium than other choices.

Recommended Reading: How To Calculate Mortgage Debt Ratio

How To Lower Monthly Mortgage Payments

Maybe you have your dream home but cant afford the mortgage payments. There are a few ways to lower the monthly payments for your mortgage.

Here are some of the best ways to lower your monthly payments:

-

Pick a cheaper home: A less expensive house means lower payments. You might be able to find your dream home in a different location or in a different style.

-

Invest in a better down payment: The higher the down payment, the lower the monthly cost. Aim for at least 20% to ensure you get better rates for the other mortgage fees.

-

Look for a lower interest rate: Interest builds over time, so the lower the rate, the better. However, some need you to pay upfront.

-

Look out for PMI: Pay at least 20% on your down payment to steer clear of PMI. The more you pay, the safer you can be on that front.

-

Pick a longer loan: The longer the loan, the lower each monthly payment. It might mean paying more in the long run.

These can all help lower the monthly payment and make your mortgage more afordable.

If you cant afford the loan, it doesnt make sense to buy out of your price range. You may lose your home.

Use Our Calculator To Estimate Your Monthly Payment

Most people need a mortgage to finance a home purchase. Use our mortgage calculator to estimate your monthly house payment, including principal and interest, property taxes, and insurance. Try out different inputs for the home price, down payment, loan terms, and interest rate to see how your monthly payment would change.

Mortgage Calculator Results Explained

Read Also: How Does Rocket Mortgage Work

Recommended Reading: How Do You Calculate Self Employed Income For A Mortgage

How To Calculate Monthly Mortgage Payment Formula

Want to know how to calculate the mortgage payment?

First of all, you have to understand the functions of the spreadsheet program, such as Microsoft Excel, Apple Numbers and the Google Spreadsheets also. These functions can help you out combining the interest rate, payment tenure and the principal that is to be paid at the time of paying EMIs.

Secondly, you have to make using the PMT functions. This program will direct you to make proper entries into each part by showing the functions like PMT . The rate represents the monthly interest rate, which is calculated based upon the yearly rate and then divided by 12. If your annual rate is 10%, then your monthly rate will be .00001%. However, nper means the number of years/periods the repayment is going to be continued and PV stands for the present value of the loan amount. After gathering all this information, you have to put all the values and you can easily calculate the mortgage payment value.

Do you need more ways to calculate your mortgage payments?

Dont worry, you can easily calculate the mortgage payments by using the equation. First of all, you have to understand the equation for the monthly instalments which is represented by M.

M=P * / N-1

Facing complexity in calculating the mortgage value? We are here to guide you.

Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into because it might be cheaper than the closing costs on a refinance.

Recommended Reading: How Do I Qualify For A Mortgage With Bad Credit

Don’t Miss: How Much Interest Will I Pay Mortgage Calculator