Calculating Points On Arm Loans

While a point typically lowers the rate on FRMs by 0.25% it typically lowers the rate on ARMs by 0.375%, however the rate discount on ARMs is only applied to the introductory period of the loan.

ARM loans eventually shift from charging the initial teaser rate to a referenced indexed rate at some margin above it. When that shift happens, points are no longer applied for the duration of the loan.

When using the above calculator for ARM loans, keep in mind that if the break even point on your points purchase exceeds the initial duration of the fixed-period of the loan then you will lose money buying points.

| Loan Type |

|---|

| 120 months, or whenever you think you would likely refinance |

When Are Mortgage Points Worth It

If you are buying a home and have some extra cash to add to your down payment, you can consider buying down the rate. This would lower your payments going forward. This is a particularly good strategy if the seller is willing to pay some closing costs. Often, the process counts points under the seller-paid costs. And if you pay them yourself, mortgage points usually end up tax deductible.

In many refinance cases, closing costs are rolled into the new loan. If you have enough home equity to absorb higher costs, you can pay mortgage points. Then you can finance them into the loan and lower your monthly payment without paying out of pocket.

In addition, if you plan to keep your home for a while, it would be smart to pay points to lower your rate. Paying $2,000 may seem like a steep charge to lower your rate and payment by a small amount. But, if you save $20 on your monthly payment, you will recoup the cost in a little more than eight years.

The lower the rate you can secure upfront, the less likely you are to want to refinance in the future. Even if you pay no points, every time you refinance, you will incur charges. In a low-rate environment, paying points to get the absolute best rate makes sense. You will never want to refinance that loan again.

But when rates are higher, it would actually be better not to buy down the rate. If rates drop in the future, you may have a chance to refinance before you would have fully taken advantage of the points you paid originally.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Also Check: Does Mortgage Modification Affect Credit Score

What Type Of Mortgage Do You Need

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

Benefits Of A 20% Down Payment

A large down payment helps you afford more house with the same monthly income.

Say a buyer wants to spend $1,000 per month for principal, interest, and mortgage insurance . Making a 20% down payment instead of a 3% down payment raises their home buying budget by over $100,000 all while maintaining the same monthly payment.

Heres how much house the homebuyer in this example can purchase at a 4% mortgage rate. The home price varies with the amount the buyer puts down.

| Down Payment | |

| $1,000 / $0 | $261,500 |

Even though a large down payment can help you afford more, by no means should home buyers use their last dollar to stretch their down payment level.

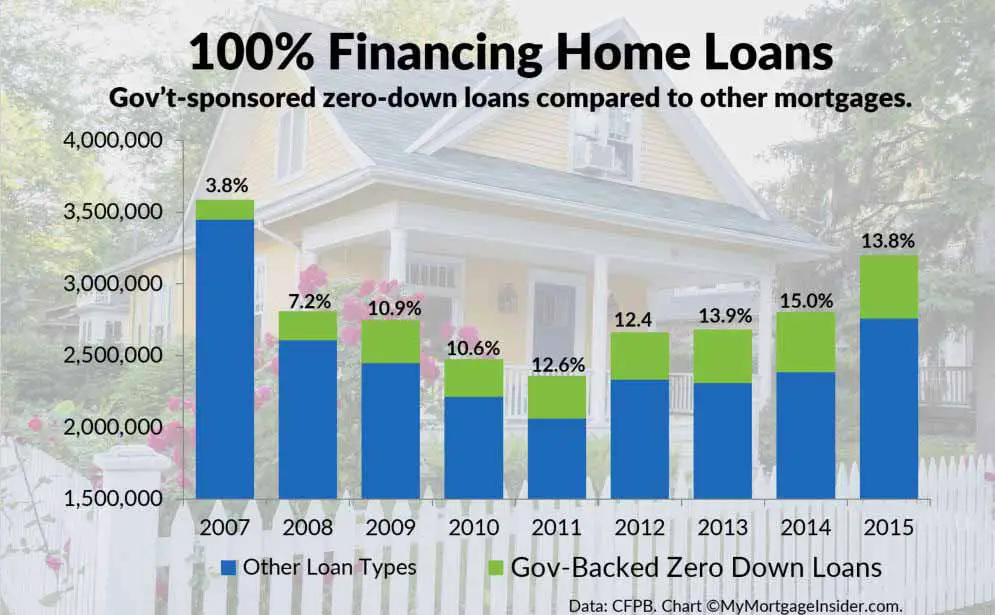

And, as the charts below show, you dont save a ton of money each month by putting a lot down.

Making a $75,000 down payment on a $300,000 home, you only save $500 per month compared to a zero-down loan.

Recommended Reading: Are Current Mortgage Rates Good

Save Up A Solid Down Payment

Your down payment directly impacts your loan-to-value ratio, so its very important when youre seeking the best rate. -Michele Skipper

Another great way to get a better rate is to increase your down payment. Though sometimes you can get away with a lower down payment, typically, you want to save at least 20% of the cost of your home as a down payment.

The bigger your down payment, the less your lender has to loan you and the smaller the risk you pose. And if youre a lower risk borrower, youll probably get lower interest rates as a result.

Pro tip:

Mortgage Rates Are On The Rise Should You Pay ‘points’ To Get A Better Deal

Inflation is bubbling up and with prices rising, so are mortgage rates. They’re now at their highest level in six months, with 30-year fixed-rate mortgages averaging 3.05%, according to mortgage giant Freddie Mac.

But you can still bag a mortgage in the mid-2s maybe even lower by using what are called discount points. They’re optional fees you can pay your lender to cut down your mortgage rate, whether you’re buying a home or refinancing an existing home loan.

And there’s the catch.

“You have to be willing to pay for it,” says Nicole Rueth, producing branch manager of Fairway Independent Mortgage Corp. in Englewood, Colorado. “But how much are you willing to pay and when does it stop making sense?”

Points wont benefit every mortgage shopper. So before you buy down your interest rate, be sure you understand how points operate and whether theyre worthwhile.

Recommended Reading: What Is Rocket Mortgage Interest Rate

Buying Down The Rate When It Makes Sense

In the two examples above the best mortgage rate depends on how long you will keep the loan. If you are keeping the loan for less than five years than you probably want to make sure you make back the cost to buy down the rate in two to three years.

If your plan is to keep the loan for longer than that then make sure you recoup the cost to buy down the rate in five years or less. Anything longer than five years is risky. Life changes so you dont want to risk paying fees and not seeing the benefit of paying that fee.

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Read Also: How To Know How Much Mortgage I Can Afford

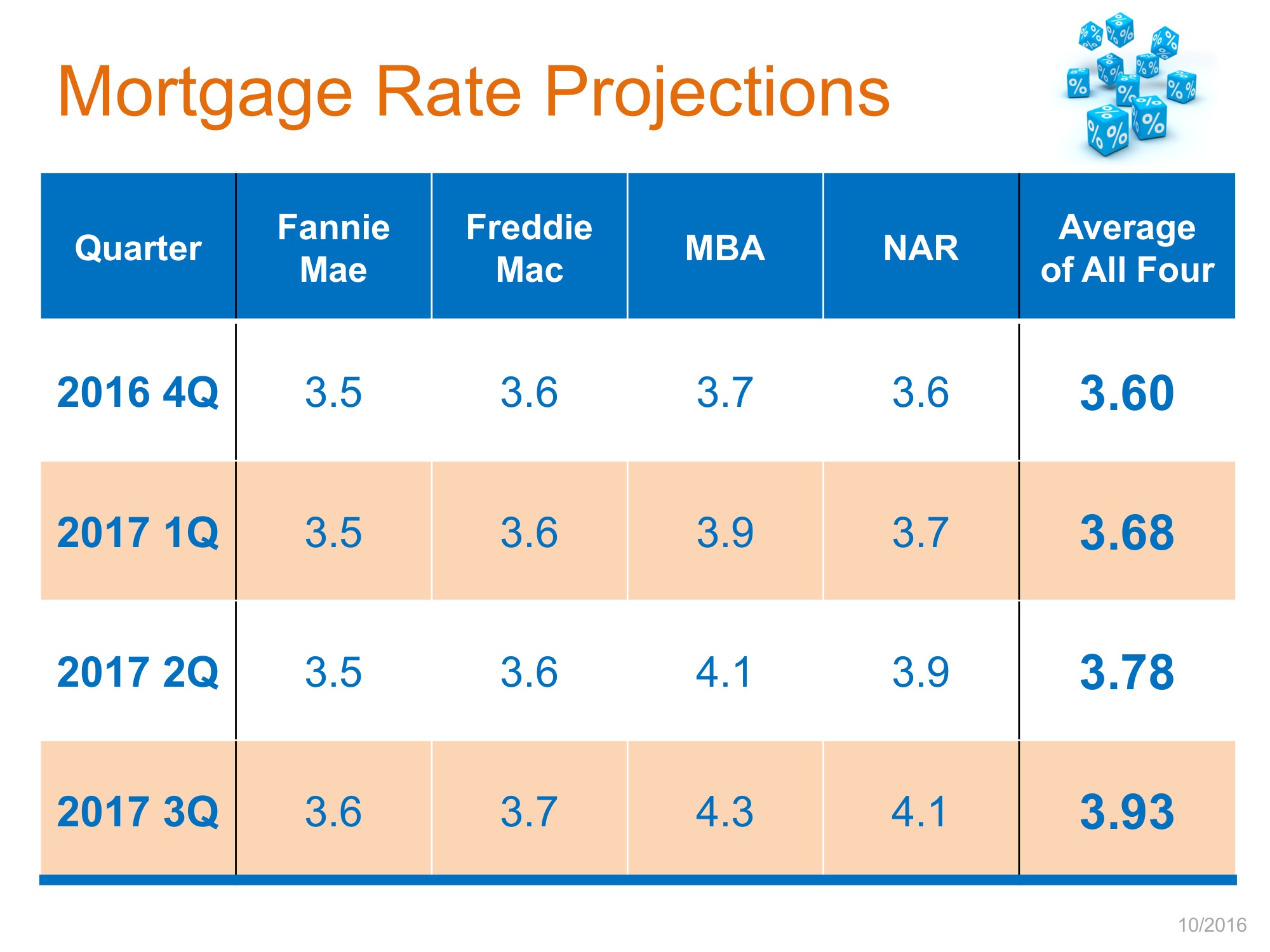

Will Mortgage Rates Go Down In September

It seems like mortgage rates will stay in their current low range throughout September, at least until the end of the month.

Concerns around the Delta variant are still keeping rates low. And recent reports show our economic recovery slowing down.

The August jobs report released September 3 showed only 235,000 new jobs created in August. That was far below the forecast of 750,000 new jobs.

The rising number of Covid-19 cases tied to the Delta variant could result in slower job growth for two reasons, reported Wall Street Journal.

Businesses, particularly in services sectors requiring in-person contact, could hold off on hiring amid heightened pandemic uncertainty. Jobless individuals who are fearful of Covid-19 health risks might also be slower to return to the labor market until the virus abates.

Remember that the weaker the economy is, the longer interest rates will stay low.

Experts arent expecting mortgage rates to rise substantially until the Fed makes a firm announcement about when it will start tapering its bond-buying program. And, as Fed Chair Powell has said, they wont make that announcement until they see further progress toward maximum employment. This report throws a wrench in that progress.

Will we learn more about tapering plans when the FOMC meets at the end of September? And will mortgage interest rates rise as a result?

Thats yet to be seen but it seems less likely now than it did a week ago.

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Read Also: Can You Get A Second Mortgage With Bad Credit

When To Consider A Down Payment Of Less Than 20%

There are some cases when it doesnt make sense to save a 20% down payment for your home. For example, if interest rates are currently very low and expected to rise soon, it might be sensible to make your home purchase sooner rather than later. That said, predicting interest rates isnt an exact science, and jumping into the market before youre ready brings its own set of risks.

Another time where it might make sense to purchase a home without a 20% down payment is if home prices are rapidly rising in your area. This phenomenon is becoming increasingly common in Canadas housing market, with hot markets in Toronto and Vancouver posting double-digit gains. Smaller markets arent immune to housing pressure either, with far-flung cities like Halifax, Nova Scotia seeing significant price growth as well.

In this case, the average price of your ideal home in your perfect neighbourhood might be rising so quickly that if you wait to save a 20% down payment, youll be priced out. In this case, you might only achieve your dream of homeownership if you jump into the market before its too late. The drawback of this strategy is that a smaller down payment results in higher costs and leaves you more vulnerable to a housing market correction, which can occur, especially in hot housing markets. You also havce to take the risk that home prices wont continue to rise.

Give Your Credit Score A Boost

Credit score and loan-to-value ratio are probably the two most important factors in getting the best rate. -Michele Skipper, Senior Loan Officer and a Credible mortgage expert

Improving your is one of the best things you can do to improve your interest rate. It also can increase your chances of getting a loan in the first place.

Even just a small boost in your credit score can make a big difference, too. Take a look at the recent rate data from FICO. If you had a score of 659 and were able to bump it up to 680, you could shave more than 0.60% off your interest rate.

Here are some quick and easy ways to improve your credit score:

- Pull your credit report and alert the credit bureau of any errors.

- Become an authorized user on another persons account.

- Ask for a credit line increase .

- If you dont have much credit at all, consider a secured card or .

Find Out: How to Improve Your Credit Score in 5 Steps

You May Like: Can I Get A 30 Year Mortgage

When You Take Out A Mortgage Your Lender Offers You An Interest Rate Based On Several Factors Including Market Rates And Your Credit Profile

Lenders also offer you the opportunity to pay for a lower your mortgage rate by buying mortgage points, sometimes called discount points.

Points are priced as a percentage of your mortgage cost. Each point you buy reduces your interest rate by a certain amount that will vary by lender. Buying points makes financial sense when you stay in your home long enough, because you can save more on interest over time than you paid for the point.

Keep reading to learn how mortgage points work so that you can decide if buying points makes sense for you.

What Are Mortgage Points And How Do They Work

1-min read

A mortgage point equals 1 percent of your total loan amount for example, on a $100,000 loan, one point would be $1,000.

Mortgage points are essentially a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments .

In some cases, a lender will offer you the option to pay points along with your closing costs. In exchange for each point you pay at closing, your mortgage APR will be reduced and your monthly payments will shrink accordingly.

Typically, you would buy points to lower your interest rate on a fixed-rate mortgage. Buying points for adjustable rate mortgages only provides a discount on the initial fixed period of the loan and isn’t generally done.

Also Check: What Is A Teaser Rate Mortgage

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

For many borrowers, however, paying for discount points on top of the other costs of buying a home is too big of a financial stretch, and buying points might not always the best strategy for lowering interest costs.

It may make financial sense to apply these funds to a larger down payment, says Boies.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Overall, borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Recommended Reading: Would I Be Eligible For A Mortgage

Current Local Mortgage Rates

Compare your potential loan rates for loans with various points options.

The following table shows current local 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down

Take The First Step And Get Prequalified

Results of the mortgage affordability estimate/prequalification are guidelines the estimate isn’t an application for credit and results don’t guarantee loan approval or denial.

All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

Home lending products offered by JPMorgan Chase Bank, N.A.

Also Check: Can You Get A Mortgage With Less Than 20 Down

Why Are Down Payments So High

For lenders, undeveloped land loans are riskier especially when the property isn’t immediately being used for housing, because the resale opportunities are much lower and there is a future risk of land-use zoning changes.

In other articles of mine, you will see a reoccurring theme relating to the lender’s mindset – if the owner fails to pay the mortgage, and lender has to foreclose, how fast will the property sell and will the lender get their money back? How fast a property will sell depends on the land properties and location, its zoning, market conditions at the time. Depending on these increased risk factors, down payments and interest rates may be higher for land loans than for housing mortgages.

- As a general rule, the more expensive the lot, the bigger your required down payment will be.

- As a general rule, the further away the property is from urban locations, the bigger your down payment.

- Zoning is expected to be residential, country residential, or agricultural upon exception for rural properties.

- An appraisal is often required, and no value is given to existing structures – indeed the presence of structures could be a non-starter for some lenders.

- Existing services make properties more desirable to finance for lenders.