What Is The Average Monthly Mortgage Payment

The mean or average monthly mortgage payment for U.S. homeowners is $1,487, according to the latest American Housing Survey from the U.S. Census Bureau.

The Census also reports that the median monthly mortgage payment for U.S. homeowners is $1,200. Thats up slightly from the last study when the median monthly payment was $1,100.

Calculate Monthly Interest Amount

Current Annual Mortgage Interest Amount / 12 Months = Monthly Mortgage Interest Amount

This formula calculates the total interest on your mortgage per month.

From the previous example we have an annual interest amount of $6,375.

$6,375 / 12 months = $531.25 per month

Here you would pay $531.25 in interest per month.

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

You May Like: How Much Mortgage Will I Qualify For

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

Can You Afford A 100000 Mortgage

Is the big question, can your finances cover the cost of a £1,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering yes then its worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £1,000.00

Do you need to calculate how much deposit you will need for a £1,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UKs leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesnt charge you fees, so you get the best mortgage deals without the hassle.

You May Like: What To Look Out For With Mortgage Lenders

Read Also: Can You Refinance A Mortgage With Less Than 20 Equity

So Should I Buy A Home

The answer to that question depends on your financial status and your goals. Just because a lender is willing to give you money for a home doesnât necessarily mean that you have to jump into homeownership. Itâs a big responsibility that ties up a large amount of money for years.

Itâs important to remember that the mortgage lender is only telling you that you can buy a house, not that you should. Only you can decide whether you should make that purchase.

How The Deposit Affects How Much A 150000 Mortgage Costs A Month

The deposit you can put down for a £150,000 mortgage directly affects the loan to value ratio and the terms and interest rate of the mortgage.

The LTV ratio refers to the amount the lender is willing to offer you relative to the total value of the property. It reflects the proportion of the mortgaged property and the proportion youve paid off upfront with your deposit.

A higher deposit means a lower LTV, which translates to better mortgage rates and terms. Lenders will see you as a lower risk if you have a high deposit, and they can provide you with better deals with a lower monthly repayment.

A low deposit translates to a high LTV ratio, and lenders can insist on stricter terms translating to higher interest rates or fees. The best deals you can get for a £150,000 mortgage will require a higher deposit and a low LTV ratio. The higher the amount you can put down, the lower the interest rate, monthly repayments and overall loan amount youll have to repay.

Also Check: What Is A Payment On A 200k Mortgage

How Much Savings Should I Have Before Buying A House

This depends on how much you intend to put up as a down payment. If you pay less than 20% of the sales price, you will have to pay PMI as part of your monthly repayments. You will also need to pay for mortgage closing costs. Its a good idea to have at least $3,000 to $10,000 saved up to cover these costs or unexpected expenses along the way.

Realize That Other Expenses May Come Up

Even if your mortgage doesn’t stretch your budget, an unexpected job loss or other event could cause you to struggle to make your mortgage payments. The more affordable a home is in the first place, the better chance youll have of recovering.

Building up an emergency fund is easier if you limit your mortgage payment to 25 percent of your take-home pay. The more cash you have on hand, and the lower your monthly obligations, the better chance youll have of staying afloat if difficult times strike.

Recommended Reading: How To Get Into Mortgage Processing

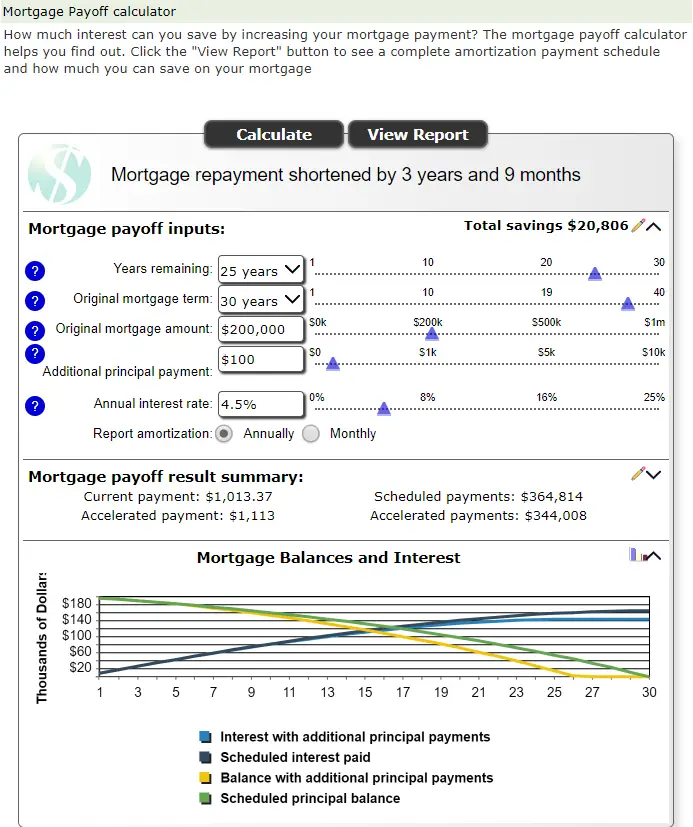

Get A Better Interest Rate

The interest rate a lender offers you affects your monthly mortgage payment amount. If you nab a lower rate, youll make a lower monthly payment. Your chances of getting a better interest rate might increase in a few different scenarios:

Average Interest Rates Are Low

Average mortgage interest rates vary substantially from year to year, and have at times varied by as much as 2% within a mere six-month period.

Getting a fixed-rate mortgage at a time when interest rates are low can keep your monthly payments low.

Read more:Mortgage Rates Briefly Explained

Your Credit Score Increases

One surefire way to score a better interest rate is to improve your credit score. If you havent applied for a mortgage yet and your score has room for improvement, it might be worthwhile to wait six months or so for your credit score to climb up before you go for the mortgage.

If you already have a mortgage and your credit score has improved significantly since you originally took out the loan, you might be able to refinance for a better rate.

Read more:How Much Does a 1% Difference in Your Mortgage Rate Matter?

You Shop Around

There are oodles of options out there for mortgage lenders. Signing with your historical bank might give you the comfort and trust of familiarity, but it wont necessarily give you the lowest rate you can find.

Always compare your banks offer with competing banks, credit unions, and reputable online lenders.

Heres How Much The Same Mortgage Costs Now Compared To Last Year

Fewer people are shopping for homes, a sign that homebuyers are getting priced out of the market due to surging mortgage rates, which spiked to an average of 5% this week for 30-year fixed-rate mortgages.

The fixed-rate mortgage rate jumped 0.28% in the last week alone, reaching a high not seen since February 2011, according to government-mortgage company Freddie Mac. A year ago, the 30-year rate averaged 3.04%, which is nearly 2% lower than the rate now.

That 2% difference can add hundreds of dollars to the monthly cost of financing a home, making it unaffordable for some potential buyers.

For a home worth $408,100 the median home price in the U.S. with a 20% down payment, 30-year fixed mortgage and a 5% interest rate, monthly mortgage costs would come to $1,752.62, according to CNBC calculations.

But for the same home purchased last year, when interest rates were 3.04%, monthly mortgage payments would only come to $1,383.51, according to CNBC calculations. Thatâs nearly $400 less per month, and more than $4,400 less per year.

Recommended Reading: Which Company Has The Lowest Mortgage Rates

Don’t Miss: What Type Of Interest Is A Mortgage

The Major Part Of Your Mortgage Payment Is The Principal And The Interest The Principal Is The Amount You Borrowed While The Interest Is The Sum You Pay The Lender For Borrowing It Your Lender Also Might Collect An Extra Amount Every Month To Put Into Escrow Money That The Lender Then Typically Pays Directly To The Local Property Tax Collector And To Your Insurance Carrier

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, you’ll have an additional policy, and if you’re in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the home’s purchase price, you’ll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, it’s important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

You May Like: What Is Mortgage Interest Deduction

Our Recommended Percentage Of Income For Mortgage

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the ideal amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

You May Like: How To Sue A Mortgage Lender

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in total interest over time, it can free up monthly cash to keep your DTI low.

Average Monthly Mortgage Payment In The Us

The median monthly mortgage payment in the U.S. is $1,100, based on the most recent American Housing Survey data provided by the U.S. Census Bureau.

The average monthly mortgage payment is not as easy to calculate, as there is no official government source to pull from. However, we can start by looking at data from the 2020 National Association of REALTORS®Profile of Home Buyers and Sellers.

According to this study, the national median home price is $272,500 and the median down payment is 12% of the purchase price. This brings the total loan size to $245,250. Note that this does not take into account any closing costs, HOA fees, homeowners insurance or any outside expenses. A mortgage calculator may help you to further estimate your total housing costs.

You May Like: When To Choose A Mortgage Lender

Monthly Costs For A 150000 Mortgage For A Buy

Youll find slightly different rules for a buy-to-let mortgage. You may have to provide a higher deposit and meet strict income requirements set by lenders to qualify.

Some lenders will only accept a 25% deposit and above, and others may consider rental income forecasts and require that the projected rent covers 125% to 130% of the monthly repayments.

Many buy-to-let mortgages are offered on an interest-only basis, translating to lower monthly repayments for a £150,000 mortgage. It provides more flexibility and tax efficiency for landlords, and they can quickly sell the property at the end of the term and clear the loan balance.

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

-

Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

-

Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

-

Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

-

Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

-

Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

Also Check: How To Get 0 Down Mortgage

Why Start With The Monthly Payment

Loan officers often offer to start by looking at the maximum mortgage amount you could qualify for, based primarily on your credit score and debt-to-income ratio. While it can feel pretty cool to see a big number, maxing out what a lender will offer could leave you house poor. That would mean too much of your income would go toward housing, leaving you scraping to pay your other bills, let alone save for retirement, travel or have fun.

Before you start talking to lenders, you should have a strong sense of your current financial situation. That includes money coming in, money going out and money goals. For example, if you want to start a family or plan to increase your contributions to your 401, include that extra spending even if it’s not part of your current budget. If you’re considering a career change or going back to school down the line, think about how that would affect your household income. Use those numbers to figure out what mortgage payment amount would be comfortable for you.

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Don’t Miss: Why Reverse Mortgage Is A Bad Idea