Pros And Cons Of An Interest

Before making your decision to proceed with an interest-only mortgage, its important to consider the pros and cons. Knowing the advantages and disadvantages can ensure that the choice suits your personal financial situation best. Lets explore the pros and cons below.

Pros

- Low Monthly Payments Initially.Monthly payments are low during the beginning of the mortgage term.

- Earn Elsewhere. Using the extra cash that isnt being put toward the principal amount of the mortgage, you can hypothetically earn more elsewhere.

Cons

What happens when you miss your mortgage payments? to find out.

How Compound Interest Adds Value

If youve ever paid compounding interest on a loan, you might wonder if its possible to reap the benefits of compound interest instead. Outside of student loans, car payments, mortgages and other borrowed money, compounding interest becomes a formidable tool for growing your wealth, especially over a long period of time. And compared to simple interest, compound interest contributions can generate wealth exponentially and yield far greater returns for the same purchase amount. As an example, certificates of deposit, certain savings accounts and bonds are all investments that are well-regarded as compounding opportunities.

Helping your money grow isnt the only value that compound interest adds. There are several other reasons why compound interest is powerful. Here are a few other reasons why compound interest can be valuable to your investment strategy.

Oriental Bank Of Commerce

Benefits/key highlights:

- The Oriental Bank of Commerce offers two variants under its Mortgage Loan Schemeterm loan and overdraft facility.

- You can borrow this loan to meet your personal or business expenses by submitting immovable property as collateral.

- Several types of borrowers are eligible for this loan:

- Individual and joint borrowers who are income tax assessees for more than two consecutive years.

- Individuals involved in agricultural activities.

- NRIs with a residential Indian as a co-borrower.

- The maximum amount you can borrow through this loan is Rs.10 crore and the repayment can be done before the superannuation of non-pensionable salaried employees, and extends up to 75 years for salaried applicants with pension.

- Companies or firms jointly with directors or partners .

| Bank |

|---|

- There are no documentation charges when you apply for this loan.

- A penal interest rate of 2% will be charged for delayed payments.

Read Also: Mortgage Rates Based On 10 Year Treasury

How To Calculate Compound Interest

When calculating how much youll end up making due to compound interest, theres a formula you can use.

Lets break down this formula by each of its components:

- B: Ending balance

- N: Number of times each year that the interest on an investment or loan compounds

- T: Length of time youll have the investment or loan

Here are a couple of examples to show how this works.

Say you invest $4,000 in a certificate of deposit that pays 2% interest compounded semiannually for 4 years. Your total return would be the following:

In this case, when the CD matures, youd have $4,331.43.

Now, what if youre trying to figure out how much interest you pay on something like a mortgage? You can use this formula to determine how much interest you would pay over the life of the loan by first getting the total amount of money paid over the life of the loan if every payment was made on schedule. Then you can subtract the initial principal balance to get the interest paid.

This is slightly complicated by the fact that the principal has to be reduced every month by your initial mortgage balance, so taking a careful look at how mortgage amortization is calculated will be important.

Can I Change A Fixed

All lenders will allow you to convert a fixed-rate mortgage to a variable-rate mortgage at the time of renewal . Of course, there are very few restrictions at the end of your mortgage term, you can also switch lenders.

Most lenders will allow you to convert your fluctuating rate mortgage to a fixed-rate mortgage before the term is completed so long as you commit to a longer fixed-rate term than the term remaining on your floating rate term. You benefit from locking in the rate and they benefit by locking you into the borrowing relationship for a longer period of time.

You May Like: Reverse Mortgage For Condominiums

What Is An Interest

Join millions of Canadians who have already trusted Loans Canada

Due to the rising price of homes in Canada and the mortgage stress test, it has been challenging for Canadians to secure a mortgage. If youre frustrated by the housing economy youre definitely not alone.

For these reasons, some Canadians are turning to alternative forms of mortgages to successfully purchase a home. One variation of a traditional mortgage is an interest-only mortgage. To learn more about what an interest-only mortgage is, how it differs from traditional mortgages and the pros and cons, continue reading below.

to check out more alternative mortgage financing options.

Fixed Interest Rate Loans

With a fixed rate home loan the interest rate you pay is fixed for a period of six months to five years. At the end of the term, you can choose to re-fix again for a new term or move to a floating rate.

Advantages:

- You know exactly how much each repayment will be over the term.

- Lenders often compete with fixed rate specials.

- You can lock in lower rates if market interest rates are rising.

Disadvantages:

- Fixed rates often have limits on how much you can raise repayments or make extra payments without paying charges.

- If you take a long term, there is a risk floating rates may drop below your fixed rate.

- If you choose to sell your property and/or break a fixed loan you may be charged a break fee.

Capped rates are a variation where the interest rate cant rise above a certain point, but will drop if floating rates drop below the capped rate.

Also Check: Reverse Mortgage Manufactured Home

Factors Influencing Your Mortgage Interest Rate

When you are applying for a mortgage, the interest rate you are offered will be based on a number of factors. To understand the current interest rate for mortgages, it is important to understand what these factors are. The first factor is the current market rates. The rate that the lender offers you will be based on the current rates in the market. If they are high, the lender will offer you a higher interest rate, and if the rates are low, the lender will offer you a lower interest rate. Another factor is the term of the mortgage. The term of the mortgage is the length of time that you will be paying off the mortgage. The longer the term of the mortgage, the lower the interest rate will be. Youll be able to find the average annual percentage rates on 30-year, 15-year, and 5/1 ARM mortgages online so that you can compare different rates for different loan terms. The amount of the mortgage loan also affects your rates. This is the amount of money that you are borrowing.

How Much Can I Borrow For A Mortgage

How much you can borrow for a mortgage varies by person, and depends on your financial situation: your credit, your income, and the amount of cash you have available for a down payment. The general rule of thumb for a conforming mortgage is a 20% down payment. On a $400,000 home, that would mean you need $80,000 up front.

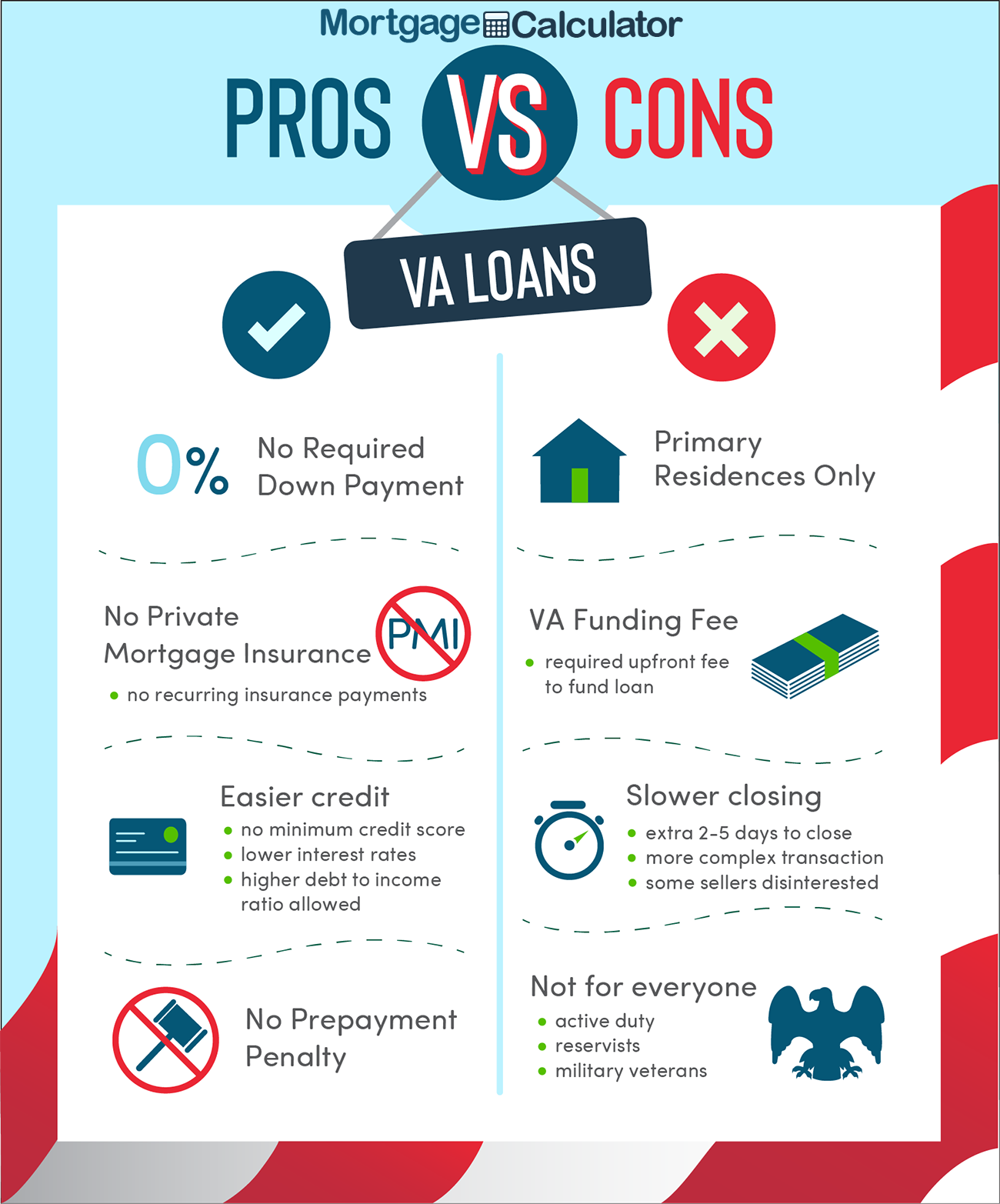

Note that this calculation may be different if you qualify for a different type of mortgage like an FHA or VA loan, which require smaller down payments, or if you’re looking for a “jumbo loan” over $548,250 in most parts of the US in 2021 .

You don’t have to go with the first bank to offer you a mortgage. Like anything else, different servicers offer different fees, closing costs, and products, so you’ll want to get a few estimates before deciding where to get your mortgage.

Read Also: Rocket Mortgage Payment Options

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

Mortgage By Conditional Sale

Mortgage by conditional sale is one where the mortgagor ostensibly sells the mortgaged property on the condition that

- On default of payment of the mortgage money on a certain date, the sale shall become absolute, or

- On such payment being made, the sale shall become void, or

- On such payment being made, the buyer shall transfer the property to the seller.

Also Check: Rocket Mortgage Launchpad

Who Should Consider An Interest

Interest-only mortgages have a unique structure that is only favourable in some circumstances. Below is a list of scenarios where an interest-only mortgage is desirable.

- Youre purchasing and selling the property in a short period of time.

- Able to afford a large payment increase in the future in exchange for a lower payment now.

- You do not earn a flat salary and have a variable salary instead.

- Able to earn more with your money elsewhere in the short term.

- Youre a first time home buyer who is not accustomed to making mortgage payments and other homeownership costs.

Extra Payments Compound Principal

- If you make extra mortgage payments

- Your principal payment can compound

- In the sense that a lower outstanding balance

- Will lower each subsequent interest payment

However, if you paid an extra $100 each month on top of your required mortgage payment, the principal portion would start compounding.

In month one, youd pay $1,532.25, with $1,000 going toward interest and $532.25 going toward the principal balance.

This wouldnt provide any extra benefit in the first month because youd simply be paying $100 extra to get $100 more off your principal balance.

However, in month two the total interest due would be calculated based on an outstanding balance that is $100 lower. And because payments dont change on a mortgage, even more money would go toward the principal balance.

The second payment would be $998.23 in interest and $534.02 in principal.

Meanwhile, those making the standard monthly payment with no extra amount paid would pay $998.56 in interest and $433.69 in principal.

Thats more than a $100 difference, $100.33 to be exact. And over time, this gap will widen. In month 60, the principal payment would be $121.70 higher on the loan where youre paying an extra $100 per month.

So the benefit of paying extra increases more and more over the life of the loan and eventually allows the mortgage to be repaid early.

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

What Types Of Mortgages Are There

The best mortgage for you will depend on your circumstances, future plans and whether youre choosing to live in, or rent out, the property.

A mortgage is a long-term agreement. Its important to take time to think about what you want, and how much youll be able to afford. Keep in mind, your home may be repossessed if youre unable to meet your payments.

Here’s a quick guide to some of the different types of mortgages, so you can find one that suits you.

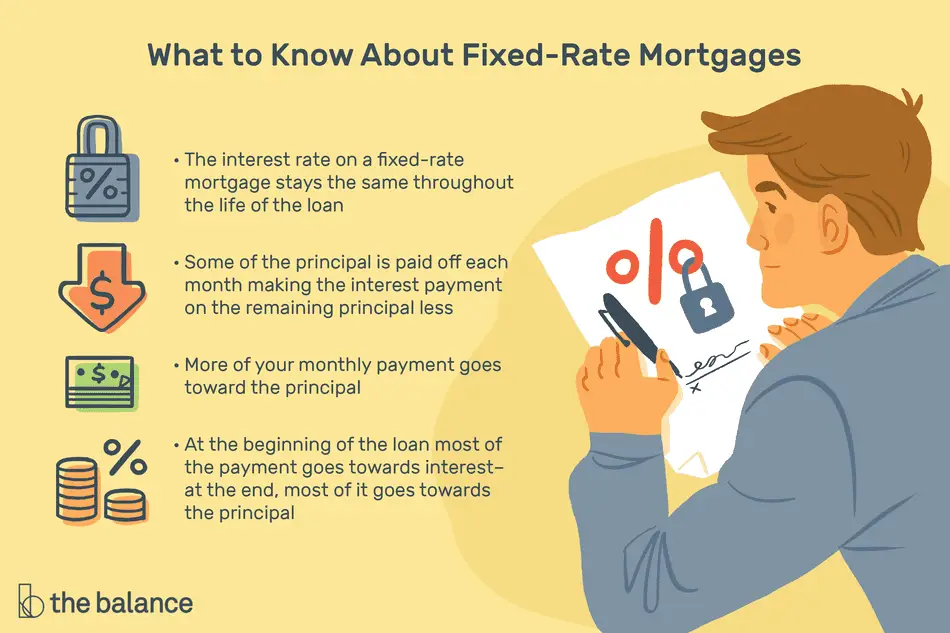

When Should You Use A Fixed

Fixed-rate loans are typically the better choice when you plan to stay in the home for many years. If you expect the current home to be your forever home, or you expect to be there for at least 10 years, a fixed-rate mortgage is usually the best option. It will provide rate and payment protection regardless of whats happening with interest rates. And should rates drop after you take your loan, you can always refinance to get the benefit of a lower rate.

A fixed-rate mortgage is also strongly advised if you want to minimize homeownership risk. An inherent disadvantage of ARMs is that rates can rise, perhaps enough to threaten your ability to remain in the home. If this is a concern you have, choose a fixed-rate mortgage.

Along the same line, fixed-rate mortgages are generally a better choice for first-time homebuyers. They provide greater predictability and eliminate a potential interest rate shock that comes with ARMs.

However, given that interest rates are currently at historic lows, it makes abundant sense to lock in a fixed rate now. Though its always possible interest rates will go even lower in the future, its hardly guaranteed. And whenever anything is at a historic low, the likelihood of further declines is much less likely to happen.

You May Like: Can You Do A Reverse Mortgage On A Condo

Leave Rates The Unchanged

This is often the case inflation is within the 1 to 3% target which generally coincides with a satisfactory level of economic growth.

Sometimes when most indicators would lead the BoC to raise rates, the uncertainty created by an event creates uncertainty and leads the BoC to take a wait-and-see approach.

Types Of Mortgage Loans Faq

What are the 4 types of home loans?

The four main types of home loans are conventional loans, FHA loans, VA loans, and USDA loans. Conventional loans are not backed by the federal government, but most need to meet lending guidelines set by Fannie Mae and Freddie Mac. FHA, VA, and USDA loans are all backed by the federal government but offered by private lenders. Most major lenders offer all four mortgage programs, though USDA loans can be a little harder to come by.

What is the most common type of home loan?

The most common type of home loan is a conventional mortgage, which is any mortgage not backed by the federal government. This is what most people think of as a standard mortgage. Conventional loans are flexible down payments can range from 3 to 20 percent or more, and you only need a 620 credit score to qualify with most lenders. These loans make up about 80 percent of the mortgage market, according to the ICE Mortgage Technology Origination Report.

What type of home mortgage is best?

The best type of home loan depends on your situation. If you have great credit and a 20 percent down payment, conventional loans usually offer the best value. If you need extra help qualifying due to lower credit scores or income, an FHA loan might be better. And if youre a qualifying veteran or military member, a VA loan is almost always the best bet. Your loan officer can help you compare loan options and find the right loan for your needs.

Are there mortgages with no down payment?

Don’t Miss: Recast Mortgage Chase

Flexibility In Payment Schedule

The terms of an interest-only mortgage allow for principal payments during the interest-only years. Its just not mandated.

This implies that if you get a windfall gain, you can pay off some principal and reduce future principal payments. To confirm that this is/would be allowed, ensure you check the terms of the agreement to confirm and look out for any restrictions orearly payment penalties.

What Is A Good Mortgage Interest Rate

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board, and it’s expected they’ll stay low throughout 2021.

You May Like: Monthly Mortgage On 1 Million

Conforming Vs Nonconforming Arms

Beyond the loan term, you will encounter conforming loans and nonconforming loans as you explore your ARM options.

Conforming loans are mortgages that meet specific guidelines that allow them to be sold to Fannie Mae and Freddie Mac. Lenders can sell mortgages that they originate to these government-sponsored entities for repackaging on the secondary mortgage market if they conform to their rules.

If a loan doesnt meet these specific guidelines, then it will fall into the nonconforming category. But beware of the potential pitfalls before jumping into a nonconforming loan! Although there are good reasons why borrowers may need a nonconforming mortgage, and most originators of these loans are reputable, many are not. If youre considering a nonconforming ARM, read the fine print about rate resets very carefully and make sure you understand how they work.

One corollary to this is that FHA and VA ARMs are considered nonconforming according to the rules of Fannie Mae and Freddie Mac, but they have the full backing of the U.S. government. With the might of the federal governments backing, you might be more comfortable choosing one of these loans if theyre available to you.

What Youll Pay Each Month

Monthly payments depend on your interest rate and whether the interest rate adjusts during the repayment period or is locked at a fixed percentage of the balance. Its important to remember that during the no-interest period of the loan, your equity balance wont change, which means you will never pay less each much unless your interest rate adjusts lower.

Heres an example of how it works: You buy a $350,000 home and make a $150,000 down payment. You take a 30-year mortgage interest only loan that carries a 7% interest rate during the first 10 years. During the interest only period, the monthly payment will be $1,166.67, unless your interest rate adjusts. After that, you begin paying both interest and principal and the loan amortizes mortgage for the next 20 years.

A key difference between a conventional fixed and interest-only loans: Payments on a conventional loan is the same every month, but the amount of interest you pay, gradually falls and the principal portion increases as the loan is paid down. An interest-only loan payment is based on both the interest rate and the balance, so it can be variable. If the interest rate adjusts, or you make extra principal payments, the monthly payment can change. And, of course, when the interest-only period ends, the minimum monthly payment will jump.

About The Author

Read Also: Does Rocket Mortgage Service Their Own Loans