Monthly Payments On A $300000 Mortgage

At a 3% fixed interest rate, your monthly mortgage payment on a 25-year mortgage might total approximately $1,422.63 a month, while a 10-year mortgage might cost approximately $2,896.82 a month.

Note that your monthly mortgage payments may differ slightly depending on the type of interest rate , your mortgage term, payment frequency, taxes and possible other fees.

-

See your monthly payments by interest rate.

Interest $1,667.50

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Your Total Interest On A $300000 Mortgage

On a 25-year mortgage with a 3% fixed interest rate, youll pay approximately $126,790.18 in interest over the life of your mortgage. Thats almost half of what you borrowed originally.

If you instead opt for a 10-year mortgage, youll pay approximately $47,618.68in interest over the life of your mortgage less than half of the interest youd pay on a 25-year mortgage.

-

See how much you’d pay in total interest based on the interest rate.

Interest

You May Like: What Does Gmfs Mortgage Stand For

Is The Deduction Worth Claiming

Schedule A covers many other deductible itemized expenses as well, including real estate property taxes, medical expenses, and charitable contributions. Sometimes all these add up to more than the standard deduction for your filing status, making it worth the time and effort to itemize your deductions, but sometimes they don’t.

It may be smart to skip the home mortgage interest deduction and claim the standard deduction if the total of all your itemized deductions doesn’t exceed the amount of the standard deduction you’re entitled to. Standard deduction rates are as follows:

- Single taxpayers and married taxpayers who file separate returns:$12,550 for tax year 2021, $12,950 for tax year 2022

- : $25,100 for tax year 2021, $25,900 for tax year 2022

- Heads of household: $18,800 for tax year 2021, $19,400 for 2022

It may be wise to complete Schedule A and compare the total of your itemized deductions with your standard deduction to find out which method is best for you before filing your return.

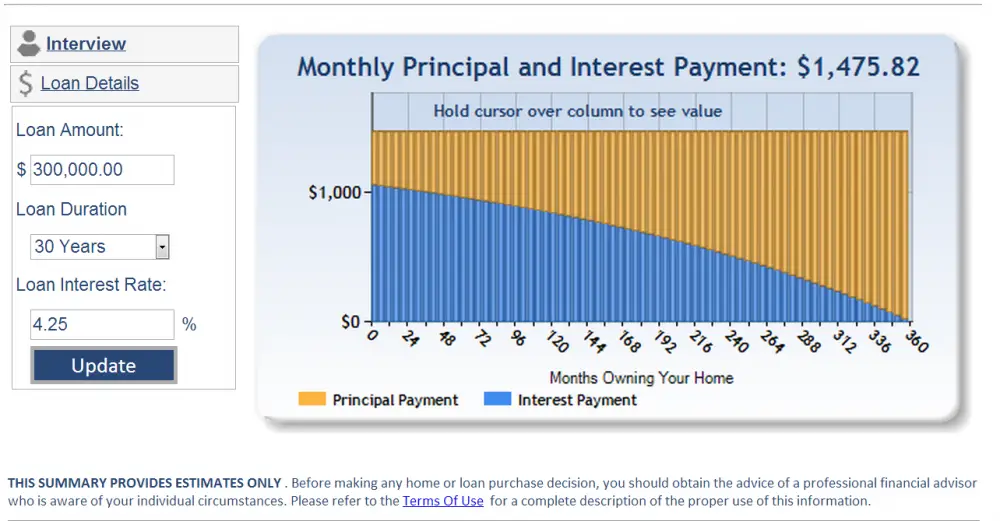

How To Use Credit Karmas Loan Amortization Calculator

When youre deciding how much to borrow or comparing loans, its helpful to get an estimate of your monthly payment and the total amount youll pay in principal versus interest. You can use our loan amortization calculator to explore how different loan terms affect your payments and the amount youll owe in interest. You can also see an amortization schedule, which shows how the share of your monthly payment going toward interest changes over time.

Keep in mind that this calculator provides an estimate only, based on your inputs. It doesnt consider other variables, such as mortgage closing costs or loan fees, that could add to your loan amount and increase your monthly payment. It also doesnt consider the variable rates that come with adjustable-rate mortgages.

To get started, youll need to enter the following information about your loan:

Also Check: Chase Recast Calculator

Calculating Arms Refinances And Other Mortgage Types

The equations that we’ve provided in this guide are intended to help prospective borrowers understand the mechanics behind their mortgage expenses. These calculations become more complicated if you’re trying to account for ARMs or refinances, which call for the use of more specialized calculators or spreadsheet programs. You can better understand how these loan structures work by referring to one of our guides about mortgage loans below:

What Is Mortgage Interest

Interest is charged by lenders in exchange for allowing you to borrow money. For borrowers, mortgage interest is charged based on your mortgage principal balance. The mortgage interest charged is included in your regular mortgage payments. This means that with every mortgage payment, you will be paying both your mortgage principal and your mortgage interest.

Your regular mortgage payment amount is set by your lender so that youll be able to pay off your mortgage on time based on your selected amortization period. This is why your mortgage payment amount can change when yourenew your mortgageorrefinance your mortgage. This can change your mortgage rate, which will impact the amount of mortgage interest due. If you now have a higher mortgage rate, your mortgage payment will be higher to account for the higher interest charges. If youre borrowing a larger amount of money, your mortgage payment may also be higher due to interest being charged on a larger principal balance.

However, mortgage interest isnt the only cost that youll need to pay. Your mortgage might have other costs and fees, such as set-up fees or appraisal fees, that are necessary to get your mortgage. Since youll need to pay these extra costs in order to borrow money, they can increase the actual cost of your mortgage. Thats why it can be a better idea to compare lenders based on theirannual percentage rate . A mortgages APR reflects the true cost of borrowing for your mortgage.

Don’t Miss: Monthly Mortgage On 1 Million

How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

You May Like: Can You Get A Reverse Mortgage On A Condo

Tips For Buying An Affordable Home

- Set aside funds for home maintenance and emergencies. Unexpected expenses are par for the course for homeowners, so youll want to make sure you can cover them without taking on debt. Whether its a broken appliance or a pipe that springs a leak, home repairs always seem to happen at inconvenient times and wind up costing more than youd expect. State Farm recommends setting aside 1 percent to 4 percent of your homes value for emergency repairs each year.

- Plan for income changes. If you or your partner or co-borrower wants to switch up the employment situation after moving, youll want to make sure to factor that into your budget. You dont want to wind up taking out a mortgage that you can no longer afford.

- Shop around to save on homeowners insurance. Comparing mortgage offers isnt the only way to save. Youll also want to solicit quotes from multiple insurers to make sure youre getting the best deal.

- Stay within your means. A lender might be willing to offer you a larger mortgage than youre comfortable with or able to pay. Dont buy a house just because the bank tells you you can afford it only commit to monthly payments that actually fit into your overall budget.

| Loan Type |

|---|

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Read Also: Rocket Mortgage Payment Options

Calculating The Numbers Yourself

If you don’t want to use a premade calculator, you can do the math yourself with a pocket calculator, a calculator app or a spreadsheet program.

First, you’ll want to compute yourmonthly interest rate. This is found by dividing your annual interest rate by 12, since there are 12 monthly payments in a year. For example, if your annual interest rate is 6 percent, your monthly interest rate is 6 / 12 = 0.5 percent. Once you have that rate, determine how much principal is currently owed on your mortgage. You should be able to see that on your most recent mortgage statement or through an online banking site or app.

Then, multiply the principal amount by the monthly interest rate to get the monthly interest amount. If the principal is $200,000 and the monthly interest rate is 0.5 percent, for example, the monthly interest amount is $200,000 * = $200,000 * = $1,000.

Your monthly mortgage payment minus the interest portion is the amount of principal you are paying down in that particular month.

How Much I’ll Pay In Loan Interest

If you borrow $20,000 at 5.00% for 5 years, your monthly payment will be $377.42. Your total interest will be $2,645.48 over the term of the loan.

Note: In most cases, your monthly loan payments won’t change over time. With , the proportion of interest paid vs. principal repaid changes each month. As the loan continues to amortize, the amount of monthly interest paid will decrease .

You May Like: Chase Recast

How To Use Our Loan Interest Calculator

Say that you’re going to borrow $20,000 at a 5% interest rate. You expect to repay it over 5 years. Enter:

- “$20,000” as the Loan Amount

- “5” as the Term, and

- “5” as the Annual Interest Rate.

Use this total loan interest calculator to see how much interest you can expect to pay your lender over the lifetime of your loan.

Can You Pay Mortgage Default Insurance On A Million Dollar Home

Mortgage default insurance protects the bank in the event the homeowner defaults. Any home with a down payment of less than 20% is considered a high-ratio mortgage. All mortgages that fall into this category require mortgage default insurance. There are three companies in Canada that can offer this insurance, The Canada Mortgage and Housing Corporation , Genworth Financial, and Canada Guaranty

Million-dollar homes differ significantly because mortgage default insurance is not available. Any consumer in Canada looking to purchase a house that is worth one million or more must provide at least a 20% down payment.

Additional Reading

You May Like: Chase Mortgage Recast Fee

How To Calculate Repayments On A Mortgage

To calculate how much interest you’ll pay on a mortgage each month, you can use the monthly interest rate. Generally, you’ll find this by dividing your annual interest rate by 12. Then, multiply this by the amount of principal outstanding on the loan. Note that this means you’ll pay less interest later in the life of the mortgage, but keep in mind that this won’t always hold true for adjustable rate mortgages.

TL DR

Divide you annual mortgage interest rate by 12 to get your monthly rate. Multiply this number by the total amount outstanding on the loan to get how much interest you owe for the month.

Do All Mortgages Qualify For This Tax Deduction

The home mortgage interest tax deduction comes with several qualifying rules.

This includes interest you paid on loans to buy a home, home equity lines of credit , and even construction loans. But the TCJA placed a significant restriction on home equity debt beginning with the 2018 tax year. You can’t claim the deduction for this type of loan unless you can prove that it was taken out to “buy, build, or substantially improve” the property that secures the loan. You cant claim the tax deduction if you refinance to pay for a college education or wedding, either.

The tax deduction is also limited to interest you paid on your main home or a second home. Interest paid on third or fourth homes isn’t deductible. The home can be a single-family dwelling, condo, mobile home, cooperative, or even a boatpretty much any property that has “sleeping, cooking, and toilet facilities,” according to the IRS.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

I Want To Pay Off My Debt Quicker What Are My Options

Typically, there are three options to choose from although not all lenders will offer them so it depends on the terms of your loan. You can opt to increase your monthly payments, switch your debt to a new provider offering a lower interest rate, or pay off some or all of the debt with a lump sum. More information and advice regarding these options can be found in our Knowledge Base.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

What Is An Interest Rate Example

Interest is the cost of borrowing money, and an interest rate tells you how quickly those borrowing costs will accumulate over time. For example, if someone gives you a one-year loan with a 10% interest rate, you’d owe them $110 back after 12 months. Interest rates obviously work against you as a borrower.

Do You Need To Make The Mortgage Interest Deduction Worth It

iQuanti: As tax season rolls around yet again, you may be thinking about ways to lower your taxable income and keep as much money as you can in your pocket. Tax deductions lower your overall taxable income and could end up moving you into a lower tax bracket. The most common deduction for homeowners is mortgage interest.

But how much do you need to pay your lender in a year to make the mortgage interest deduction worth it?

What are Tax Deductions?

There are two types of ways to take a tax deduction: standard and itemized. The standard deduction amount for the tax year 2021 is $12,550 for single filers, $25,100 for joint filers, and $18,800 for the head of household. The standard deduction simplifies the filing process as one lump sum is removed from taxable income.

Itemizing deductions involves tracking individual expenses throughout the year and totaling up eligible expenses to form the same lump sum, just with a bit more work. If you decide to itemize, you should anticipate the amount of your itemized deductions will be greater than the standard deduction amount for your filing status.

Common tax deductions if you itemize include:

Medical and dental expenses )

Student loan interest

Breaking Down the Mortgage Interest Deduction

So, lets talk about when taking the deduction is worth it.

As a single filer, youd need to have paid mortgage interest greater than the standard deduction of $12,550.

How to Claim the Mortgage Interest Deduction

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

Determining How Much Interest You Paid On Your Mortgage

You should receive Form 1098, the Mortgage Interest Statement, from your mortgage lender after the close of the tax year, typically in January. This form reports the total interest you paid during the previous year if it exceeds $600.

You don’t have to attach the form to your tax return, because the financial institution must also send a copy of Form 1098 to the IRS, so the IRS already has a copy.

Make sure the mortgage interest deduction you claim on Schedule A matches the amount thats reported on Form 1098. The amount you can deduct might be less than the total amount that appears on the form, based on certain limitations.

Keep Form 1098 with a copy of your filed tax return for at least three years. Keeping copies of your filed returns will help in preparing future tax returns.

The Cost Of A $300000 Mortgage Including Repayments Total Interest And Amortization So That You Can Borrow With Confidence

- 5 year fixed rate from 2.64%

- Prepay up to 25% annually

- All provinces & territories

If youre ready to apply for a mortgage, you might wonder how the amortization period and interest rate you choose has an impact on the total cost of your mortgage. Heres a breakdown of what your monthly payments might be, in interest and over the life of a $300,000 mortgage.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home