Increase Your Chances Of Getting A Mortgage

Don’t wait until after you receive a declination letter to learn that there’s a problem with your credit. Before you apply for a mortgage, get a copy of your free credit report and free credit score to see if there are any issues that might keep you from getting approved.

If there are mistakes on your credit report, have them corrected. If your credit score is too low, take steps to improve your score before you apply for a mortgage. Paying down debt, demonstrating good credit habits and reducing your credit utilization can boost your odds of getting a mortgageand of successfully paying it off.

If You Suspect Discrimination

Take action if you think youve been discriminated against.

- Complain to the lender. Sometimes you can persuade the lender to reconsider your application.

- Check with your state Attorney Generals office to see if the creditor violated state laws: Many states have their own equal credit opportunity laws.

- Consider suing the lender in federal district court. If you win, you can recover your actual damages and be awarded punitive damages if the court finds that the lenders conduct was willful. You also may recover reasonable lawyers fees and court costs. Or you might consider finding other people with the same claim, and get together to file a class action suit.

- Report any violations to the appropriate government agency. If your mortgage application is denied, the lender must give you the name and address of the agency to contact.

You can file a complaint regarding a violation of the ECOA with the Consumer Financial Protection Bureau. You can file a complaint regarding a violation of the FHA with the U.S. Department of Housing and Urban Development .

For ECOA violations:

For details about the Fair Housing Act, contact the Office of Fair Housing and Equal Opportunity.

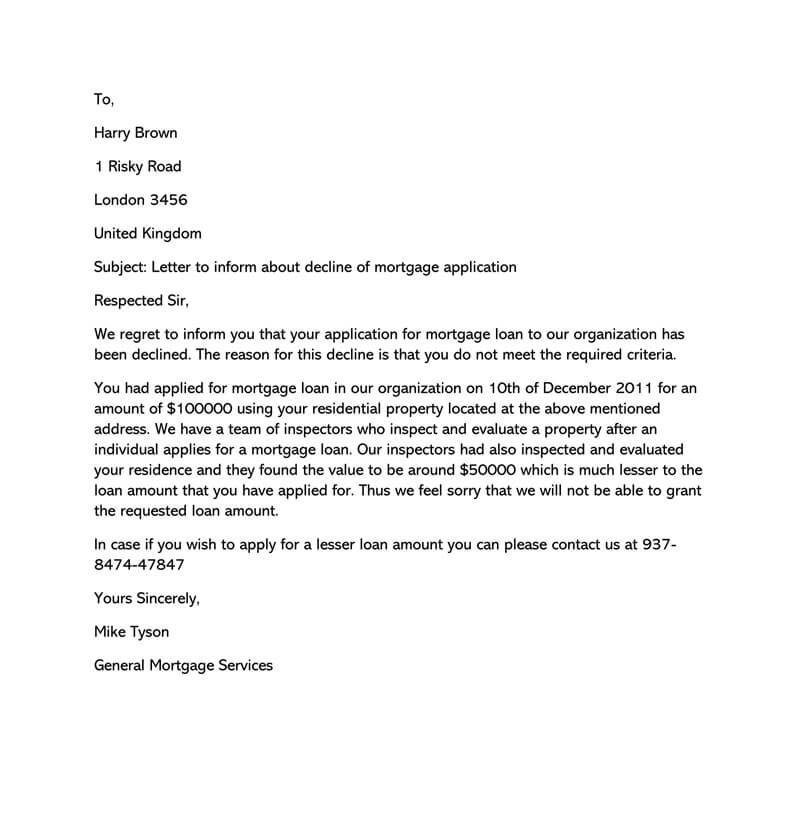

Why Would A Home Loan Be Denied

You cant fix what you dont know, so first find out why your application wasnt approved. Lenders are required to provide a rejection letter explaining the reason behind their decision, and you can always ask the loan officer for more information. Here are a few common reasons loans are denied, and what you can do next in each situation.

Don’t Miss: How To Shave Years Off Your Mortgage

Mortgage Loan Denied For Credit Or Debt To Income Issues

Most of the time, these last second issues are avoidable. At least, they may be known very early in the process. Reasons for last second denials usually result from borrower or lender procrastination. If the documentation is provided early, as it should be, a denial at the last second for credit or debt ratio would be rare.

When credit or debt to income ratios arise, there are potential solutions. Some lenders and programs allow buyers to qualify at higher debt ratios. Conventional loans allow up to 50%, FHA and VA possibly over 55% and USDA potentially up to 46%. The solution may be as simple as using a lender which allows the higher ratios.

Common last second credit issues result from expiring credit reports. Once the new credit report is pulled, the scores may be lower for many reasons. One includes borrowers paying off old collectionswhich may dramatically lower credit scores. Sometimes buyers go under contract in hopes that a credit score will increase enough during the process to qualify. Regretfully, the seller often does not know this is happening. Thus, it is a form of misrepresentation by the buyer, and the chances of closing issues are high when rolling the dice like this.

Top Reasons Underwriters Deny Mortgage Loans

Rejection hurts. And its even more upsetting when it gets in the way of buying your dream home.

Once you get your offer accepted, it may feel like theres nothing thatll stop you. But pump the brakes, just a bit. Theres one last hurdle youll need to go through. Its called the underwriting process, and its used to determine whether your loan application and your chances of buying the home you want will be accepted or rejected.

You may be wondering how often an underwriter denies a loan. According to mortgage data firm HSH.com, about 8% of mortgage applications are denied, though denial rates vary by location.

To avoid falling into that percentage of hopeful buyers, its important to understand how underwriting works, the top reasons why mortgage loans are denied in underwriting and some tips for preventing loan denial.

Don’t Miss: Do Multiple Mortgage Applications Hurt Credit

Reasons For Last Minute Mortgage Denial

There are many reasons for last-minute mortgage denial.

- The mortgage application process starts with the borrower applying for a mortgage loan by completing the mortgage loan application and signing it as well as disclosures

Documents required for mortgage underwriters:

- two years tax returns

- W-2s, recent paycheck stubs

- 60 days bank statements and other documents that pertain for the mortgage loan underwriter to underwrite and process the mortgage loan application

The mortgage loan underwriter then issues a conditional mortgage loan approval if the borrower meets all underwriting guidelines.

A conditional mortgage approval does not guarantee a clear to close.

Clearing Conditions For Clear To Close

Once the mortgage underwriter issues a pre-approval, the borrower will shop for a home. While borrowers are shopping for a home, the pre-approval letter will contain mortgage conditions.

The key word here is conditions:

- Underwriter issues clear to close after clearing all conditions

- Borrowers who cannot clear or meet conditions from conditional approval can get denied

- Or the borrower has been late on their rent payments in the past 12 months

- Other issues are the higher debt to income ratios due to higher homeowners insurance, or homeowners association fees, or high unreimbursed expenses

For borrowers counting on overtime income or part-time income or bonus income, a mortgage denial can happen if through the verification of employment the employer states the overtime, part-time, or bonus income is not likely to continue.

Recommended Reading: Are Home Mortgage Rates Going Down

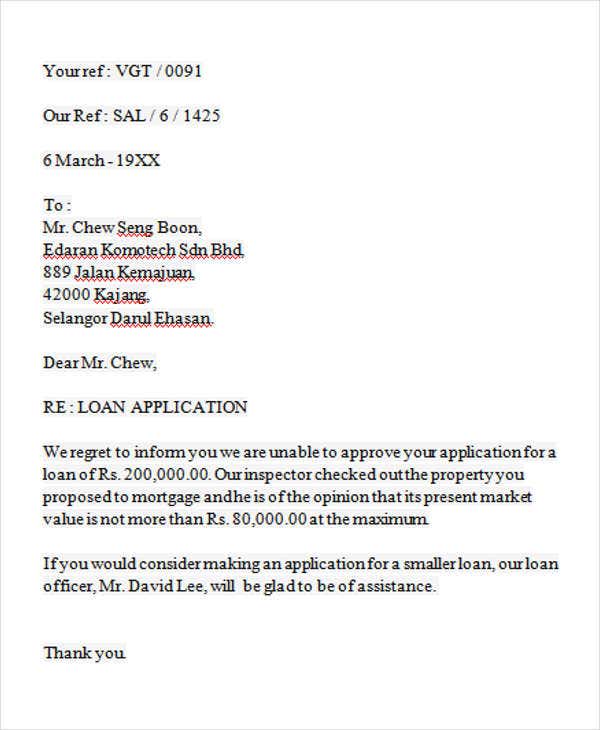

Example Of Credit Denial

Here’s a hypothetical example to show credit denials work. Let’s say Julia has a history of missed payments on her and her account was suspended by the issuer because of various personal and monetary problems. That negative behavior was reported to all three .

When she applies for another card at a department store near home, the lender rejects her because of her previous record. The company responsible for the department store’s credit cards sends Julia a letter explaining the reasons that her credit application is rejected.

How Long Does It Take For A Mortgage Servicer To Respond To A Letter

How much time the servicer gets to respond to your notice of error depends on the type of error that you claim the servicer committed: If you claim that the servicer didnt provide an accurate payoff statement after you asked for one, it must respond no later than seven business days after receiving your letter.

You May Like: How Do Rocket Mortgage Rates Compare

What To Do When Youve Taken All Those Actions And The Home Loan Still Isnt Approved

The mortgage process is complicated. A home loan could be denied with one lender and approved with another. Sometimes a loan may be approved, but the loan terms dont work for you. When youve made an offer on a home and the clock is ticking, now is the time to explore all your options.

Actions you can take:

Denial Due To Lender Error

Lastly, a loan can be declined because the lender made a mistake. This is the best kind of turn-down because its something you can get fixed and get your approval back. Lenders make mistakes too and sometimes it takes an explanation of your situation before a lender makes a final decision.

For example, say that the lender declined your loan because you listed part time income that couldnt be verified. The loan officer saw the income listed on your application but didnt document it. By providing your income tax returns showing two years of consistent part time work along with documentation from the employer, you can use that in come, helping you to qualify.

The best way to avoid getting a declination notice is to ask as many questions as you can think of before you apply. If youre not exactly sure if youll qualify, speak with an experienced loan officer beforehand. If you cant qualify today, get your road map to an approval before applying for a mortgage, avoiding a declination letter altogether.

Tim Lucas

Editor

You May Like: What Is A 5 1 Arm Mortgage

S On How To Avoid Mortgage Denial: Key Aspects In Preparing For A Mortgage

Key aspects to prepare for mortgage approval:

Payment history:

- Payment history is one of the most important qualifications when attempting to get a home loan

- Late payments are not only killing your credit score, but they may also kill your mortgage qualifications

- It is important to pay your bills on time if you were trying to buy a home

- Some loan products will allow a late payment sprinkled in here and there

- But the general rule of thumb is you need to have at least 12 months of on-time payments

- Depending on your overall credit score and credit profile, you may be able to get around an occasional late payment

- Please remember the old collections and/or charge-offs may not be a factor with Gustan Cho Associates

With many other lenders, this could be a hard stop and is one of the most common lender overlays!

Responding To An Adverse Action

The reason for adverse action may relate to low creditworthiness, inability to provide documents in a timely manner, mis-match between needs of the applicant and the product offered by the lender, or other reasons. You should understand the reason for adverse action and have a plan of action to address it. Read more about the steps you can take to address loan denial here.

Also Check: What Is The Average Time To Pay Off A Mortgage

You Have Unusual Bank Account Activity

As mentioned above, buying a home comes with many costs you need to pay for on top of the mortgage, including closing costs, insurance premiums, taxes and homeowners association fees. In many cases, your lender will want to see that you have enough money in the bank to cover these expenses for up to 6 months. However, large deposits especially from unknown sources can raise some red flags. These could indicate that you took out a loan to pay for a down payment, which will add to your DTI.

If you receive a large amount of money as a gift, you can provide a gift letter from the donor explaining that the money was a gift and does not need to be paid back.

There Are Problems With The Property

The results of an inspection can also make or break your chances of getting a loan. For example, if youre getting an FHA loan, the home must meet certain guidelines to qualify for the loan. If the property fails, your FHA loan will be denied. If an appraisal inspection uncovers a major issue, like a bad foundation, the loan may be denied as the home would be seen as a bad investment.

To help prevent this from happening, make sure you walk through the home in person and read the housing disclosures carefully. Make sure you get an inspection on the home early to avoid wasted time.

Read Also: Can You Get A Mortgage With A Fair Credit Score

Top Reasons Borrowers Are Denied For Mortgage Loans

The best way to avoid the heartbreak from losing out on a home is to make sure you have everything in line before you apply. Knowing what lenders look for and why applications are commonly denied can help eliminate a lot of frustration. There are many reasons why applications arent approved, and some of them come with an easy fix. Things that may have happened include:

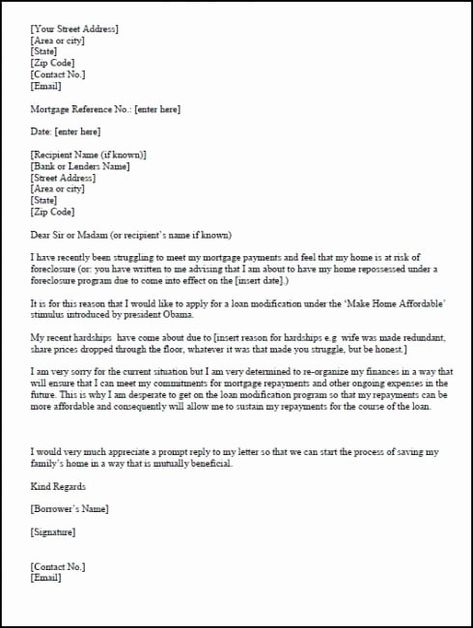

What Are Your Options To Appeal A Mortgage Loan Modification Denial

1. Provide Proof to the Lender

After a modification denial, you are required to prove two things to your lender:

- You were experiencing a financial hardship that kept you from submitting your mortgage payments

- You have overcome your financial hurdles and are able to support the payments

The purpose of proving your income to the lender is to show where you went through financial difficulties and how you recovered. Your lender may either approve or deny your appeal. Lenders typically review a borrowers financial situation by relying on a snapshot in time. You are usually denied when you fail to demonstrate that you were having financial hardships and that you have recovered from them.

2. Understand the Reason For Your Denial

Lenders are legally required to state their reasons for denying your request for a loan modification in a denial letter. Before you go to appeal a loan modification denial, you need to understand the denial letter. A Short Sale Lawyer will help you digest the reasons for your denial.

3. Mediations

In some cases, you may qualify for mediation. The difficulty with appeals is that you are not in a position to know what your lender is thinking. Mediation allows you determine what your lender is thinking by asking them questions about the reason they turned down your loan modification appeal. When you know your lenders mind-set, you are best placed to respond accordingly.

Some of the common reasons for a denial include:

4. Identify an Appeal Strategy

Recommended Reading: What Is The Lowest Fixed Rate Mortgage

Why Did I Get Home Loan Denial

Mortgage Borrowers who got a home loan denial should find out the reason or reasons why the mortgage lender denied the mortgage loan.

- Was it because of their overlays?

- Or was it because the mortgage applicant did something wrong like missed a credit card payment, quit their job, bought a car, or maxed out credit cards during the mortgage process

- Did borrowers have credit disputes on credit report?

- Retracting credit disputes can drop borrowers credit scores significantly

- There is a fix for everything and we can help borrowers get a mortgage loan approval

Getting us the reason for the home loan denial by the borrowers previous lender will help save us time to find a solution to get borrowers approved the second time around.

What To Do After Your Application Is Denied

All is not lost if your application is denied. It just means you’re going to have to wait a little longer. The good news is there are plenty of things you can do to increase your odds of being approved the next time you apply.

Don’t Miss: How Much Income For Mortgage Calculator

Applications Submitted Through A Third Party

1. Third parties. The notification of adverse action may be given by one of the creditors to whom an application was submitted, or by a noncreditor third party. If one notification is provided on behalf of multiple creditors, the notice must contain the name and address of each creditor. The notice must either disclose the applicant’s right to a statement of specific reasons within 30 days, or give the primary reasons each creditor relied upon in taking the adverse action – clearly indicating which reasons relate to which creditor.

2. Third party notice – enforcement agency. If a single adverse action notice is being provided to an applicant on behalf of several creditors and they are under the jurisdiction of different Federal enforcement agencies, the notice need not name each agency disclosure of any one of them will suffice.

3. Third-party notice – liability. When a notice is to be provided through a third party, a creditor is not liable for an act or omission of the third party that constitutes a violation of the regulation if the creditor accurately and in a timely manner provided the third party with the information necessary for the notification and maintains reasonable procedures adapted to prevent such violations.

- Previous section – Interp-8Comment for 1002.8 – Special Purpose Credit Programs

Evaluating Your Financial Status

The underwriting process is an unavoidable part of getting a mortgage loan so you can purchase a home. After filling out the mortgage application, the underwriter will check your financial situation and assess if you can manage its payment or not. They will review your bank account statement, W-2 forms, pay stubs, tax returns, monthly debts, and other sources of income you may have.

Read Also: Can You Refinance Your Mortgage