Mortgage Insurance Premiums For Fha Loans

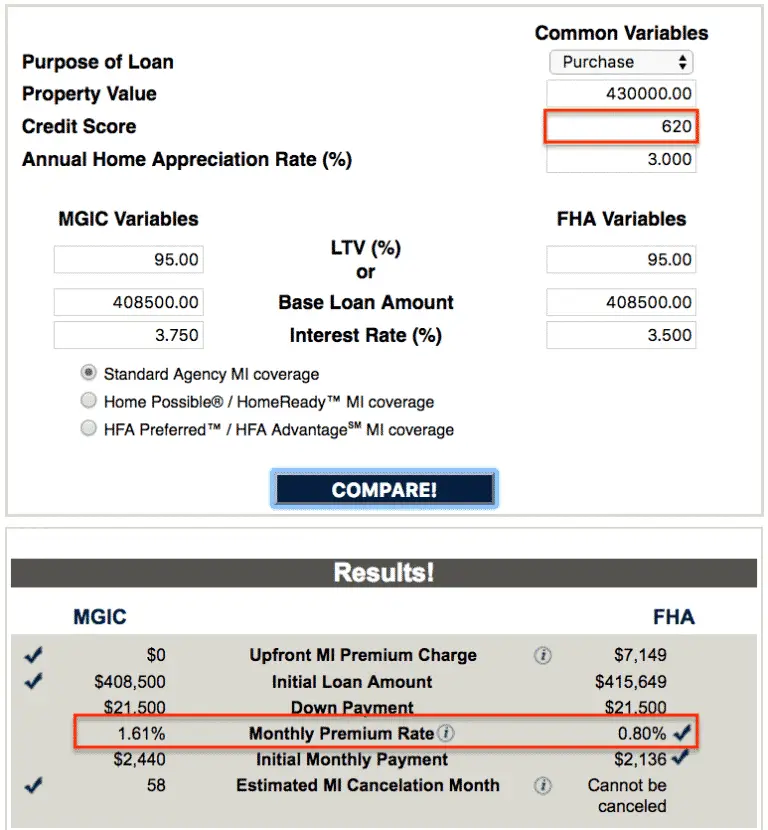

One important difference between the mortgage insurance requirements for FHA and conventional loans is the upfront mortgage insurance premium. Every person who buys a house with an FHA loan has to pay an upfront fee which is currently 1.75% of the purchase price of the house. That means if you buy a house that costs $250,000, you have to pay an upfront premium of $4,375. Conventional loans do not have upfront mortgage insurance premiums.

Another important difference between MIP and PMI are the monthly insurance premiums. Every person who buys a house with an FHA loan must also pay monthly insurance premiums . The cost of MIP depends on the term of your mortgage, the amount of your base loan amount, and your loan-to-value ratio . While the cost of the annual premium can vary from borrower to borrower, the annual cost of MIP generally runs between 0.45% and 1.05% of the loan amount.

The same is true when you refinance an FHA loan. You will need to pay upfront and annual mortgage insurance premiums when you refinance using an FHA loan.

Is Mortgage Insurance Included In Your Mortgage

Mortgage insurance isnt included in your mortgage loan. It is an insurance policy and separate from your mortgage. Typically, there are two ways you may pay for your mortgage insurance: in a lump sum upfront, or over time with monthly payments. That said, its not uncommon to have the monthly cost of your PMI premium rolled in with your monthly mortgage payment. This way you can make one monthly payment to cover both your mortgage loan and your mortgage insurance.

If you want to know whether a lender requires mortgage insurance, how you pay it, and how much it will cost, check the loan estimate1 you get from a lender for details and ask questions. You can also do your own research by visiting an online resource such as the Consumer Financial Protection Bureau. Youll want to look for information that explains the closing disclosures on your loan estimate to better understand what PMI may be required, and whether youd pay premiums monthly, upfront or both.

The good news is, if you do need mortgage insurance, you may be able to cancel PMI after you make enough payments on your loan to reach more than 20 percent equity in your home. Check with your lender to find out when and how you can get out of PMI2 when you no longer are required to have PMI.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: How Do I Get My Mortgage Fico Score

When Can I Stop Paying Pmi

PMI is typically no longer required once you have at least 20% equity in your home whether from paying down the principal or an increase in your homes value.

However, some lenders may have further requirements you must meet before satisfying your PMI obligations. These might include making a set number of mortgage payments, getting a new appraisal or owing less than 80% of your loan principal.

Though this process may differ slightly by lender, you can usually request PMI cancellation in writing once you have reached the 80% loan-to-value threshold. You must meet specific requirements as laid out by the Consumer Financial Protection Bureau, including:

- A record of good payment history

- Current loan status

- The equity must not be subject to a subordinate loan.

- Proof of value, if requested .

Borrowers with Fannie Mae or Freddie Mac mortgage have a different threshold for removing PMI if the mortgage is between 2 and 5 years old. For these borrowers, the equity must be at least 25% before PMI can be terminated.

You May Like: How Much Can You Get On A Reverse Mortgage

Can You Put Less Than 10 Percent Down On A House

The short answer is yes, it is possible to buy a home with less than 10% down payment. In fact, the median down payment in 2017 was 5% for home equity loans, according to the Urban Institute. Some loan programs only require a 3% investment.

Can I buy a house with just 5% down?

Conventional loans can be made with advances of 3% to 5%, depending on the borrowers ownership and qualifications. If your credit score is on the lower end of the spectrum, you can still get an FHA mortgage for your primary residence at just 3.5% reduction.

Don’t Miss: Can You Get Mortgage With 550 Credit Score

How To Avoid Pmi

Mortgage insurance covers your lender, not you. That makes it an expense you’ll want to avoid, if possible. Below are a few ways you can avoid PMI, if you’re able:

- Put 20% or more down: If you have a conventional loan, you won’t have to pay PMI with a down payment of at least one-fifth of the home’s purchase price.

- Take a second mortgage: Often referred to as “piggybacking,” you can cap your first mortgage at 80% of your home’s value and use a second mortgage to finance the rest. Lenders usually require a down payment of at least 10% for this option.

- Choose a government-insured loan: If you’re eligible for a VA loan, backed by the U.S. Department of Veteran Affairs, mortgage insurance isn’t required. Same goes for USDA loans. Keep in mind, FHA loans require mortgage insurance.

- Cancel mortgage insurance when possible: Stay up to do date with your home’s market value and monitor your mortgage balance. Once the balance of your loan falls below 80% of your home’s value or purchase price, consider refinancing or contact your lender about eliminating PMI.

Related articles

Types Of Private Mortgage Insurance

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

If you are making a down payment of less than 20% on a home, it’s essential to understand your options for private mortgage insurance . Some people simply cannot afford a down payment in the amount of 20%. Others may elect to put down a smaller down payment in favor of having more cash on hand for repairs, remodeling, furnishings, and emergencies.

Private Mortgage Insurance

Don’t Miss: Are Low Mortgage Rates Good

Conventional Mortgages Prior To July 29 1999

For a conventional mortgage that was effective prior to July 29, 1999, and has not been refinanced, Texas Insurance Code, §§3502.201 – 3502.203 requires:

A lender that requires a borrower to purchase mortgage guaranty insurance shall provide annually to the borrower a copy of the following written notice printed in at least 10-point bold-face type: “NOTICE OF RIGHT TO CANCEL PRIVATE MORTGAGE INSURANCE: If you currently pay private mortgage insurance premiums, you may have the right to cancel the insurance and cease paying premiums. This would permit you to make a lower total monthly mortgage payment and to possibly receive a refund of any unearned premiums on the policy. In most cases, you have the right to cancel private mortgage insurance if the principal balance of your loan is 80 percent or less of the current fair market appraised value of your home. If you want to learn whether you are eligible to cancel this insurance, please contact us at or the Texas Department of Insurance help line at .”

How Does Pmi Work

PMI exists to protect your lender in case you default on the loan. Because lenders have to make an educated guess about whether youll be able to repay a loan, they arent willing to take a risk on a borrower who cant put down at least 20% at least not without the safety net of PMI. If youre unable to make payments and the loan goes into default, PMI will cover what you arent able to pay.

Youre required to get PMI on a conventional loan when youre buying a house with less than a 20% down payment, or youre refinancing and you have less than 20% equity in the home. Homebuyers with a traditional 80/20 mortgage, which is a loan for 80% of the purchase price and a 20% down payment, can avoid PMI.

Things You Should Know

Dont confuse PMI with homeowners insurance and mortgage protection insurance, which protect the interests of the homeowner. Homeowners insurance policies typically kick in to cover damage to the home due to unforeseeable events like fires, natural disasters or theft. With mortgage protection insurance, the insurance company will help repay the mortgage when the policyholder becomes disabled or dies.

There are slightly different rules for government-backed loan programs.

FHA loans: If youre buying or refinancing with a loan backed by the Federal Housing Administration , youll likely pay an upfront mortgage insurance premium and an annual mortgage insurance premium that typically cant be canceled unless you put down at least 10% at closing.

Don’t Miss: Does Pre Approval For Mortgage Affect Credit

Homebuyers Can Avoid Paying Pmi If Their Down Payment Is Large Enough

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

When you apply for a mortgage, the lender will typically require a down payment equal to 20% of the home’s purchase price. If a borrower can’t afford that amount, a lender will likely look at the loan as a riskier investment and require that the homebuyer take out PMI, also known as private mortgage insurance, as part of getting a mortgage.

PMI protects the lender in the event that you default on your primary mortgage and the home goes into foreclosure.

Is It Smart To Pay Off Pmi

Early mortgage repayment may be wise for some. Eliminating PMI will reduce your monthly payments, ensuring an immediate return on investment. Homeowners can then use the extra savings back into the mortgage capital, ultimately paying off the mortgage even faster.

Can I pay off my PMI early?

While you are paying for PMI, protection protects the lender, not you, from the risk of you defaulting on your mortgage. You can get rid of PMI in advance by asking your mortgage servicer in writing to leave the PMI when your mortgage balance reaches 80% of the value of the home at the time you buy it.

Recommended Reading: What Are Points Paid On A Mortgage Loan

Can You Put Down Less Than 5% On A House

FHA Loan: With an FHA loan, you will need a down payment of at least 3.5%. To be able to establish the FHA minimum payment of 3.5%, you will need a credit score of 580 or higher. If your credit score is between 500 and 579, you will need to put in at least 10%.

Can you put less than 5% down?

Another way to buy a home with less than 5% down payment applies to veterans and certain homebuyers in rural areas qualified buyers dont need to spend any money. USDA loans are available to buyers in certain rural areas whose income is below the limitations based on their location of residence.

What is the smallest percentage you can put down on a house?

The minimum is usually determined by the individual lender, but it can be 20%, 25%, 30% or more. FHA loans, backed by the Federal Housing Administration, are available for a minimum amount of 3.5% if the borrower has a credit score of at least 580.

Alternatives To Piggyback Loans

But you still have options for avoiding PMI. One is to borrow from other sources, such as relatives, in order to reach a 20 percent down payment. Unless they’re quite wealthy, you’ll have to pay them back, but you may be able to get better terms from them than you would from a private lender.

Another possibility is to have the lender pay the mortgage insurance. In a so-called “no-PMI loan,” the lender actually pays the PMI in return for charging a higher interest rate on the mortgage itself. This sometimes, but not always, can be cheaper than paying the PMI yourself.

If you and your spouse earn more than $100,000 a year, having the lender pay the PMI can be beneficial because the higher interest rates that result are tax-deductable. Actually, this is true for everyone, but starting in 2007, PMI became tax-deductable as well, but only for loans closed from that date forward and for households earning less than $100,000, so the tax-advantage for that group has vanished. The deduction is gradually phased out up to $110,000 annual income.

Also Check: Which Score Do Mortgage Lenders Use

When Does Lpmi Go Away

Lender-paid mortgage insurance is required no matter how much equity you have built up in your home. That means youll have to pay your private mortgage insurance for the duration of your loan. The only way to cancel PMI is to refinance your mortgage. If you refinance your current loans interest rate or refinance into a different loan type, you may be able to cancel your mortgage insurance.

Other Requirements To Cancel Pmi

Requirements for discharging PMI depend on the type of loan.

For example, for Fannie Mae-owned loans, if youve had it between two and five years and its your primary or second home, you could get PMI removed if the home value has appreciated enough to move the current LTV ratio to 75%

Also, if you have a loan for an investment property through Freddie Mac and your home value increased enough to request PMI removal, you would need to have a current LTV rate of 65% and have made mortgage payments for at least two years. You also shouldnt have any 30-day late payments for the last year or 60-day late payments for the last two years.

Fannie and Freddies regulations also change if youve had the loan for less than two years but have made significant improvements on the home that has increased its value.

You May Like: Can I Qualify For A Mortgage With A New Job

How Much Is Pmi Insurance

Although it can vary, a good general guideline is that PMI costs 0.5 1% of the loan amount annually.

There are several ways to pay PMI. The options available to you depend on your lender. Most commonly, PMI is paid as a monthly premium thats added to your mortgage payment to go along with property taxes, homeowners insurance and homeowners association dues.

Other options include an upfront premium paid at closing and a combination of upfront and monthly premiums. When you receive a Loan Estimate from your lender, your PMI information will be included.

Options To Get Rid Of Pmi

For homeowners with a conventional loan, the rules about who must have private mortgage insurance and for how long come from the Homeowners Protection Act, also known as the PMI Cancellation Act. There are four methods you can use to terminate your PMI, according to these guidelines:

Read Also: What Are Normal Mortgage Rates

How Will You Pay For Mortgage Insurance

If you have a mortgage, you will generally pay your monthly mortgage payments. Mortgage lenders pay the premiums for you and incorporate the cost into your mortgage payments. The money will typically go into an escrow account before its distributed to the insurance company.

Conversely, mortgage insurance payments can come in a variety of forms:

- Conventional loans: When the mortgage isnt guaranteed or insured by the federal government, a lender will typically require you to pay private mortgage insurance. PMI can be baked into your premium or paid in one lump sum at closing. You can ask your lender to cancel your PMI when youve reached a loan-to-value ratio of 80%.

- FHA loan: If your mortgage is insured by the Federal Housing Administration, youll pay two forms of mortgage insurance: an upfront premium and a monthly payment . FHA loans are suited for borrowers who want to make low down payments or have lower credit scores. The mortgage insurance covers the risks associated with this type of loan.

Recommended Reading: How Does A 5 1 Arm Mortgage Work