Economic Factors That Help Determine Mortgage Rates

Ultimately, several factors, including the rate of inflation, the price of U.S. treasuries and the Federal Reserve, affect mortgage rates. That’s because all these things and more affect how much investors are willing to pay to invest in the mortgage-backed securities we discussed on the previous page.

Let’s start with inflation, which is the phenomenon where the prices of common goods and services rise across the board. Consistent and moderate inflation is actually a sign of a healthy economy, and should ideally result in a proportional rise in wages for workers as well. For lenders, inflation poses an inherent problem — it means that the money people borrow now will be worth less when they come to pay it back. If economists predict a rise in inflation, investors will insist on higher mortgage rates to make up for this loss.

Because investors have many choices of where to invest their money, competition among other investments also determines mortgage rates. Like with bonds and other financial instruments, investors often compare MBSs against U.S. treasuries. You might assume a 30-year fixed mortgage would compare to a 30-year treasury. But in reality, borrowers in 30-year fixed mortgages are likely to refinance or move after only 10 years. So investors compare such mortgage investments to 10-year treasuries.

We’ve just skimmed the surface of a complex system of factors that affect mortgage rates. For more on similar financial topics, explore the links on the next page.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

Should You Lock A Mortgage Rate Today

What do you do when everything is so unpredictable? Lock or float your mortgage rate?

Well, as Dirty Harry might have put it, Do you feel lucky? Mortgage rates may well fall next week if Russia invades Ukraine, though probably relatively briefly. But if that standoff deescalates, theyre more likely to rise.

Your decision really is down to your appetite for risk. Just be aware that your chances of success and the stakes you might be playing with are very hard to estimate.

Those of us who are more cautious may prefer to lock as soon as possible. And I count myself among those.

So my personal rate lock recommendations remain:

- LOCK if closing in 7 days

- LOCK if closing in 15 days

- LOCK if closing in 30 days

- LOCK if closing in 45 days

- LOCK if closing in 60days

However, with so much uncertainty at the moment, your instincts could easily turn out to be as good as mine or better. So let your gut and your personal tolerance for risk help guide you.

Also Check: Reverse Mortgage Mobile Home

How Do I Compare Current Mortgage Rates

When comparing current mortgage interest rates, start by comparing rates for the same type of loan. Compare 15-year loans to other 15-year loans, and fixed-rate mortgages to other fixed-rate mortgages.

Don’t just read about rates online — apply for prequalification at multiple lenders. When you apply for prequalification, lenders look at factors unique to you, such as your credit score and down payment, when determining your mortgage rate. This can help you more accurately compare different lenders.

Shopping around for the best mortgage lenders is best done in a short time frame. The three major encourage borrowers to shop around within a period of 45 days, depending on the bureau. You can apply with any number of lenders within this time frame. No matter how many applications you submit, these credit bureaus will only count one credit inquiry against your credit score.

Each lender you apply with provides a loan estimate. This document outlines a loan’s terms and fees. It includes the interest rate, closing costs, and other fees such as private mortgage insurance . Be sure to compare all of these fees and costs to get a picture of which offers you the best overall deal.

How You Can Get Ready To Purchase A Home

Saving for a down payment on a home and improving your credit score are both long-term personal finance goals, but you can still take steps to get started today.

First, consider using a , like Experian or IdentityForce. Many of these services are offered for free by multiple financial institutions, and can help you understand the factors that affect your credit score. And if you see something that may be incorrect or negatively affecting your score, you can take a proactive approach to fix those issues.

In addition, you may want to sign up for a high-yield savings account to put away money for a down payment. While interest rates on these accounts remain low, every dollar you can earn in interest will bring you closer to your goal of buying a home. It isn’t advisable to keep your money in a checking account as there is basically no interest accruing, and investing the money is likely too risky as you don’t want market volatility to affect the ability to buy a house. However, some robo-advisors, like Wealthfront, will create a lower-risk portfolio for you based on when you want to buy a home.

Finally, consider establishing a budget for yourself. It isn’t an exciting task, but it’s a foundational part of your financial journey to purchasing a home. By building a budget which factors in how much you can save each month for a home, you can begin projecting when you’ll have enough funds for a down payment.

Don’t Miss: Does Chase Allow Mortgage Recast

How To Estimate Your Mortgage Rate

The best way to estimate your mortgage rate is to get pre-approval from multiple online mortgage lenders, but you can estimate your payments.

Online loan calculators are a great tool to consult when youre preparing to take out a loan of any kind. With mortgage calculators specifically, you can input the following pieces of information to estimate your payment:

- ZIP code

- Property tax and home insurance

Most calculators auto-generate the current average interest rate and provide median homeowners insurance and property tax information for their area.

Other Factors Affecting Mortgage Pricing

Aside from movements in the economy, there are several other factors outside of a lenders control that influence their ability to price their mortgage loans.

The heart of the challenge facing a lender is managing the difference between the price investors will pay to buy a specific mortgage on the secondary market and adjusting for the many variables that affect margin management within a lending company. The lender must take into account not just the investors price, but also the costs of origination, competitive positioning, capacity constraints, profit margin, and the borrowers price.

Below, we will briefly touch upon the most influential of these variables.

Also Check: 10 Year Treasury Yield Mortgage Rates

Are Mortgage Rates And Refinance Rates Different

Yes. Starting December 1st, 2020, Fannie Mae and Freddie Mac implemented an extra 0.5 percent adverse market fee on mortgage refinances. Still, your final rate will depend on the lender along with other components, such as your debt-to-income ratio, credit score, and your loan balance if it is a mortgage refinance.

How Do Those Factors Translate Into Mortgage Rate

The lower the DTI, the lower the risk for the investor and lower the mortgage rate hell ask you to pay.

Same applies for LTV. If your loan amount is small compared to the value of the home, the lenders risk is lowered and youll get a better rate.

Higher FICO scores lead to the same outcome. You have demonstrated a good history of paying back your debt. The lender will see you as less risk and offer you a lower rate.

Remember, a lower DTI, a lower LTV and a higher FICO score will get you the lowest rate. That is what you have to aim for.

You May Like: Who Is Rocket Mortgage Owned By

How Mortgage Payments Are Calculated

With most mortgages, you pay back a portion of the amount you borrowed plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much youll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because youll be paying interest for a longer period.

Mortgage Rates By State

Real Estate Economist and Associate Dean in Florida Atlantic University’s College of Business

With mortgage rates near historic lows, what can homebuyers do right now to ensure theyre getting the best deal when purchasing a home?

Individuals should begin their mortgage search before they begin their home search. This will put them at the price point they can best afford and allow them to potentially prioritize their offer with sellers over other buyers, since they will be ready to close quickly.

What causes mortgage rates to rise or fall?

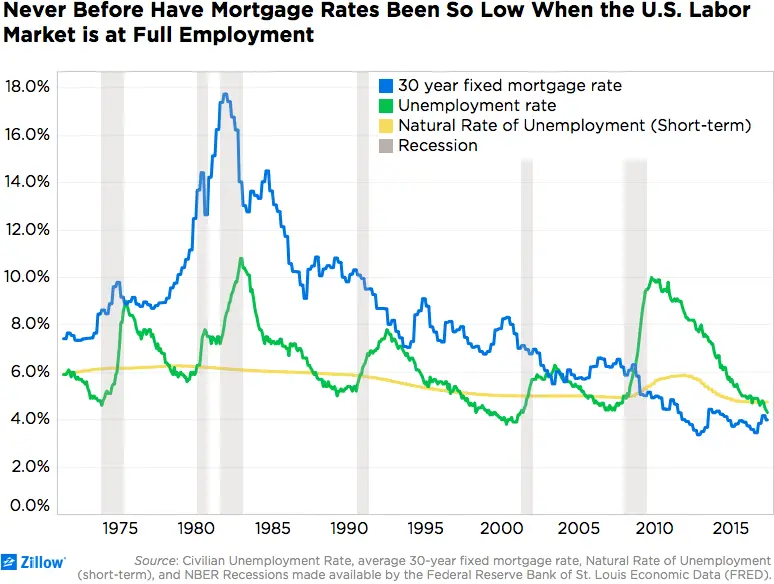

Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates. Currently, the Federal Reserve is actively buying 10-year Treasury notes, which increases the demand for these securities and drives their price up and yields down. So, our near record low mortgage rates are directly tied to the Federal Reserve Board’s response to COVID-19 in efforts to keep financial markets open. When it begins to taper significantly, mortgage rates will rise.

Should current homeowners consider refinancing with rates that are this low?

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

How Consumers Can Secure A Low Interest Rate

While economic factors are out of the control of consumers, Westreich believes home buyers can help still improve their shot at getting a lower interest rate, as mortgage rates “are determined for the most part on two factors: credit score and equity/down payment.”

He strongly advocates to save up as much as possible for a down payment while simultaneously working to improve your . He told Select that consumers should “pay down all revolving debt to 30% of the credit limit and try not to open or close any accounts.” Essentially you need to keep your and avoid opening or closing any new credit cards or loans before you apply for a mortgage.

Tara Falcone, CFP and founder of the goals-first investing app Reason, reiterates Westreich’s mantra adding that consumers should think and prepare carefully before buying.

“It’s important to focus on the total purchase price rather than the monthly payment,” she said. It may be tempting to buy a home you qualify for, but even if you lock in a low interest rate, being ‘house poor’ isn’t a recommended strategy.

And just like any other financial decision, Falcone recommends consumers take the time to shop around to get the best interest rate.

“Get referrals for mortgage lenders from people you know and trust in your area,” said Falcone. “Speak to everyone from banks to online mortgage lenders, and make sure to do your own rate research ahead of time.”

What Causes Canadian Mortgage Rates To Move Up And Down

Now we know how Canadian mortgage rates are determined, but what factors influence whetherthey move up or down? Essentially, when the economy is good mortgage rates go up, and whenthe economy is bad interest rates fall. If we delve a little deeper we can see exactly why thishappens.

As mentioned before, variable mortgage rates are affected when the key interest rate is changed.The Bank of Canada increases the key interest rate as the economy starts to grow. A growingeconomy is a good thing, but if it grows too rapidly that can lead to rising prices for good andservices. This is known as inflation. By increasing the key interest rate the Bank of Canada isable to to slow the growth of the economy down to prevent this from happening.

Conversely, the key interest rate is decreased when the economy is in a downturn. By loweringinterest rates it encourages businesses and consumers to borrow, which in turn spurs economicgrowth.

Fixed mortgage rates move up and down depending on bond yields. When the economy is goodpeople are more inclined to invest in stocks. Because of this, bond yields are increased to makethem more attractive to investors. When bond yields increase so do fixed mortgage rates.When the economy is struggling investors tend move their money to safer investments, such asgovernment bonds. Because during these times there is more demand for bonds, yields aredecreased. This causes fixed mortgage rates to fall as well.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

What Are The Average Mortgage Rates Today

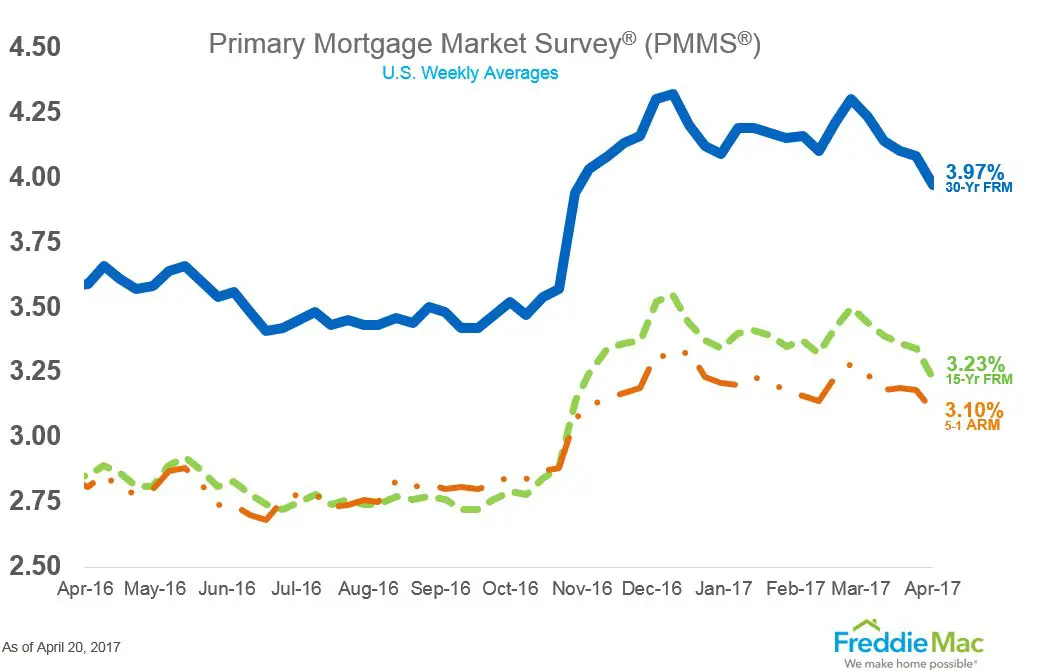

Mortgage rates regularly fluctuate, so the average rate today may not be relevant next week, next month, or next year. The best way to get a sense of the current mortgage rate environment is to check the mortgage data maintained by the Federal Reserve Bank of St. Louis. These charts offer daily and weekly snapshots of various mortgage averages, including the average 15-year and 30-year fixed mortgage rates, as well as details on origination fees and discount points.

The Factors That You Can Control

Now that the factors that are out of the borrowers hands have been made clear, its worthwhile to explore the factors that you can control and discuss how they can get you a better, fairer rate in the long run.

Your Credit Score

More than anything else, a good credit score will help to secure a good mortgage interest rate. Lenders will be able to take one look at your credit score and instantly know all they need to know about you as a borrower, and this will directly influence the kind of rate you end up with. If you have a low enough score, you might not even get a chance to borrow in the first place.

Your Loan-to-Value Ratio

Just as important as a good credit score is a low loan-to-value ratio. This number tells the lender how much money the home is worth and compares it to how much money the borrower needs to pay it off. For example, if you pay off 10% of the home with your down payment, then your loan-to-value ratio would be 90%. The more you pay off, the lower that ratio will be, and the better interest rate youll end up with.

Other Key Factors

Beyond credit score and loan-to-value ratio, there are some smaller factors that rest in your hands: things like the kind of property youre buying, the level of risk associated with that property, and whether or not its going to be used as an investment for the home buyer or as a place theyll actually be living in.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

One More Thing To Consider: The Trade

As you shop for a mortgage, youll see that lenders also offer different interest rates on loans with different points.

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs.

- Points, also known as discount points, lower your interest rate in exchange for an upfront fee. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

- Lender credits might lower your closing costs in exchange for a higher interest rate. You pay a higher interest rate and the lender gives you money to offset your closing costs. When you receive lender credits, you pay less upfront, but you pay more over time with the higher interest rate. Keep in mind that some lenders may also offer lender credits that are unconnected to the interest rate you payfor example, a temporary offer, or to compensate for a problem.

There are three main choices you can make about points and lender credits:

Learn more about evaluating these options to see if points or credits are the right choice based on your goals and financial situation.