How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Total Interest Paid On A $300000 Mortgage

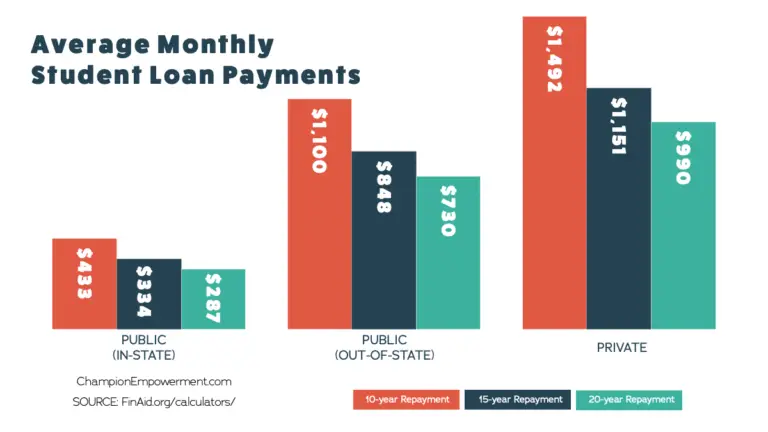

Youll always pay more interest on longer-term loans. So, for example, a 30-year loan would cost more in the long haul than a 15-year one would .

With a 30-year, $300,000 loan at a 3% interest rate, youd pay $155,332.34 in total interest, and on a 15-year loan with the same rate, itd be $72,914.08 a whopping $82,418 less.

Use the below calculator to see how much interest youll pay, as well as what your home will cost you every month.

Enter your loan information to calculate how much you could pay

| $0.00 |

You May Like: Can I Get A Mortgage With A Fair Credit Score

Read Also: Does Rocket Mortgage Service Their Own Loans

What Is Mortgage Life Insurance

Mortgage life insurance is insurance that covers your outstanding mortgage balance.

In other words, your insurer will pay whateverâs left on your mortgage to your mortgage provider if you pass away before your mortgage is paid off.

Mortgage life insurance is sometimes called âmortgage insuranceâ or âmortgage protection insurance.â

Itâs not the same as mortgage default insurance, which is required when you pay less than 20% on a down payment on a home. Itâs administered by the Canada Mortgage and Housing Corporation .

This crystal-clear explainer video will tell you everything you need to know.

First off, mortgage life insurance isnât mandatory in Canada.

Itâs necessary in that mortgage life insurance protects your family from worrying about making mortgage payments in the unlikely event youâre not around to make those payments.

You and your partner may have chosen the best home your could afford.

It may also mean you need both incomes to cover the mortgage payment.

Mortgage protection insurance is a step you can take to make sure your mortgage will always be paid off and that thereâs never any stress around how to cover payments.

25% of Canadian families have mortgage life insurance, according to our recent survey.

That said, term life insurance is a better option for most Canadian families as the money goes to families, not creditors.

Learn more about Laurenâs journey with mortgage life insurance:

Average Monthly Mortgage Payment In The Us

The median monthly mortgage payment in the U.S. is $1,100, based on the most recent American Housing Survey data provided by the U.S. Census Bureau.

The average monthly mortgage payment is not as easy to calculate, as there is no official government source to pull from. However, we can start by looking at data from the 2020 National Association of REALTORS®Profile of Home Buyers and Sellers.

According to this study, the national median home price is $272,500 and the median down payment is 12% of the purchase price. This brings the total loan size to $245,250. Note that this does not take into account any closing costs, HOA fees, homeowners insurance or any outside expenses. A mortgage calculator may help you to further estimate your total housing costs.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

Average Mortgage Size In Australia By State

When it comes to mortgage sizes, all Australian states are not on an even playing field. Victoria and New South Wales boast the largest mortgage sizes, thanks to Sydney and Melbourne, Australias largest cities. Sydney brings the state average up due to its skyrocketing house prices, and Melbourne isnt too far behind. Australias less populated states are more affordable, but prices have also crept up during the 2020-21 boom.

Take a look at the average new lending amounts across Australia:

Average Length Of A Mortgage

As mortgages are the biggest loan youre likely to get, theyre often the longest, too.

Mortgages normally take 25, 30 or 35 years to pay back. Historically, the most popular length people opt for is 25 years, but in recent years the 30- and even 35-year mortgages are becoming more popular.

The reason longer mortgages are attractive is because they lower your monthly mortgage repayments. This makes is easier for people to afford a mortgage, helping people to get on the property ladder. Remember though, a longer mortgage means you end up paying substantially more over the lifetime of the mortgage.

Mortgage pay-off times actually vary a bit. This is for a few reasons.

Often people will remortgage every few years. This means you go back to a mortgage lender and thrash out a new mortgage deal, taking into consideration how much of your homes value youve paid off. Sometimes its possible to knock a couple of years off the total time youre paying your mortgage, as you could get a better deal.

Most people though will take the chance to lower their monthly repayments instead of shortening their mortgage term.

Some people also overpay each month on their mortgage. This means that the overall mortgage is lower, which makes the interest charged against it lower. All this means the mortgage itself can be paid off earlier.

Be careful though. Some mortgages charge fees for overpayments, or have a limit of how much can be paid. Go over the limit and you could get charged a fee.

Recommended Reading: Rocket Mortgage Requirements

Hows That Average Calculated

The first thing to keep in mind is that the U.S. Census Bureau reports the median monthly mortgage, which technically isnt the same as the average monthly mortgage payment .

To find the median, you order the numbers you have from least to greatest and take the number in the middle:

$1,450, $1,500, $1,600, $1,700, $4,600

Now, if you average these numbers, you get $2,170. Is that a fair representation? Definitely notnearly every number in that line is below $2,025 by a lot.

But if you look at the median, which is $1,600, you can see its more accurate, isnt it?

Oh yeah, it is. Thats why we take the medianso homeowners with multimillion-dollar mansions or cheaper-than-cheap houses cant skew the final average.

With that in mind, lets take a quick look at the Census Bureaus data.

How About Property Taxes

You cant escape taxesperiod. From the moment you buy a house, until, well, forever, your local government makes you pay property taxes. How do they calculate these taxes? Theyll send a property assessor to find out how much your house is worth, then theyll use that number to figure out how much you owe them.

Read Also: Recast Mortgage Chase

What Are Hoa Fees

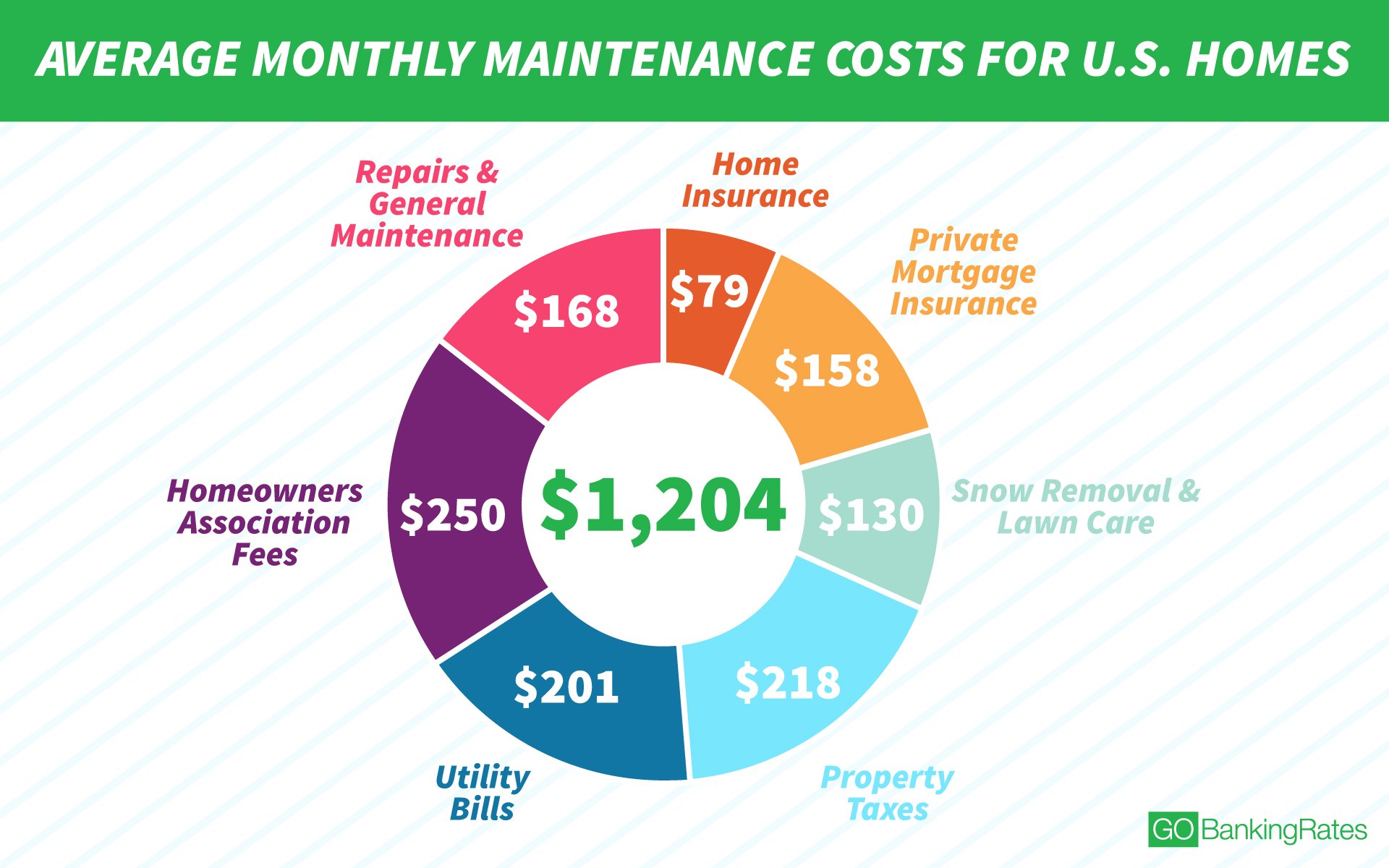

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

What Mortgage Amount Could I Qualify For

A lender will weigh up multiple factors when deciding your approval amount. For example, they will consider your income, partners income, dependents, living expenses, and more. Applying for pre-approval can be a good way to determine how much you are eligible for whilst making you a more attractive buyer.

Don’t Miss: Rocket Mortgage Conventional Loan

The Average Debt For Those 55

Between the ages of 55 and 64, many Americans start to think about retirement. But among heads of household who have debt and are in this age bracket, average debt levels stand at $131,900. They might have assets in excess of this debt, but they might have negative net worth. In short, for some in this age group, lingering debt can be a reason to postpone retirement.

Breakdown Of The Average Mortgage Payment

In 2015, the average American homeowner spent about $1,800 on paying down the principal on their loans and nearly $8,000 on mortgage interest and related charges, a combined monthly average of about $820. The bulk of each payment is split between paying interest and paying principal. As time goes by, the portion of money going towards interest decreases while the amount put towards reducing principal increasesa process called amortization.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Average Mortgage Interest Rates As Of May 2021

| Rate Type | |

|---|---|

| 2 year fixed rate, 95% LTV | 3.85% |

| 2 year fixed rate, 75% LTV | 1.46% |

| 3 year fixed rate, 75% LTV | 1.72% |

| 5 year fixed rate, 75% LTV | 1.74% |

| 10 year fixed rate, 75% LTV | 2.58% |

| BSA.org.uk |

Please note that mortgage rates vary greatly from one lender to another, as well as there being different deals available with the same lender for different circumstances e.g. Loan to Value amount, applicants credit history, etc.

Therefore, the mortgage interest rates are very attractive for mortgage applicants right now, although there are other factors that are not as attractive, such as the requirement to provide a deposit in order to get a mortgage loan and higher house values.

The current market shows that Halifax are offering an initial rate as low as 1.23% . At the other end of the rates scale are the bad credit mortgages, with Kensington providing an initial rate of 5.59% . So there really is a huge gulf in the interest rates that are available, depending on the applicants circumstances and the details of the loan.

What Do These Look Like Altogether

Lets say you buy a gorgeous $200,000 house on a 20% down payment . In this scenario, youd have to borrow $160,000. On a 15-year mortgage with a fixed interest rate of 4%, youd pay around $1,184 a monththats principal and interest.

But wait. Theres still tax and insurance. So lets say one of our ELP insurance agents hooked you up with a sweet deal and got you homeowners insurance for $75 a month. Then lets say your local government charges you $1,400 a year for property taxes or $117 per month. Add all these numbers together, and you have your monthly mortgage.

Recommended Reading: Recasting Mortgage Chase

Need An Estimate On Your Home Loan

Looking for a mortgage rate quote for a potential home loan on a home purchase in Washington? Sammamish Mortgage can help. We have been offering many mortgage programs since 1992 and can give you a specific rate quote based on the type of loan you need. We can also estimate how much your monthly payments will be, as well as your closing costs. Please contact us with any financing questions you have, or to receive a rate quote.

Mortgage Payments By State

While some states have relatively low home values, homes in states like California, Hawaii, and New Jersey have much higher home costs, meaning people pay more for their mortgage each month. Additionally, mortgage interest rates vary by state.

Data from the 2018 American Community Survey shows that homeowners paid a median amount of $1,556 per month. This figure includes a mortgage payment, as well as insurance costs, property taxes, utilities, and HOA fees where necessary.

Here’s how all 50 US states stack up:

| State |

| $1,428 |

Recommended Reading: Mortgage Recast Calculator Chase

In Summary: Term Life Insurance Offers Better More Flexible Protection Than Mortgage Insurance

If you have a mortgage and a young family, having some sort of coverage for your mortgage only makes sense.

Itâs easy to see from the tables above that term life insurance is usually cheaper than mortgage life insurance. And sometimes, it’s cheaper by a lot.

In short, if you’re looking for broad coverage that’s flexible and affordable, pass on mortgage life insurance and buy a term life insurance policy instead.

That said, mortgage life insurance could be a good option for your family if you have an existing medical condition. In that case, standard life insurance may be unaffordable or unavailable to you.

Ready to see how affordable term life insurance can be? Get your quote today.

Weâre not only affordable: PolicyMe is backed by Canadian insurance giants, with coverage options from $100,000 to $5M.

Questions? Talk to one of our Toronto-based, licensed advisors via chat, email or phone. No strings attached.

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

You May Like: Rocket Mortgage Vs Bank

Average House Payment By Balance Owed

Average house payments vary by balance owed, and even the monthly payments for the same amount can differ. The mortgage term and the interest rate are the most decisive factor. Lets analyze the average mortgage payment on 100k under different terms.

While the table focuses on 100k mortgages, the same variations apply to the average mortgage payment on 500k. The takeaway, in any case, is that the average payment can vary remarkably. For instance, the difference between a 15-year mortgage with an interest of 3% and one with a 5.50% rate is $126.5 a month.

Whats Included In A Mortgage Payment

While your mortgage is a single payment, it doesnt include just the balance of your loan. In fact, there are four main factors that go into your payment: the principal, interest, property taxes and homeowners insurance . You can calculate your expected mortgage payment based on this information. Note that if youre paying private mortgage insurance , this will be included in the payment as well, and potentially HOA fees if your home is in a homeowners association.

Also Check: Will Mortgage Pre Approval Hurt Credit Score

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.