Mbs And The Financial Crisis

Mortgage-backed securities played a central role in the financial crisis that began in 2007 and went on to wipe out trillions of dollars in wealth, bring down Lehman Brothers, and roil the world financial markets.

In retrospect, it seems inevitable that the rapid increase in home prices and the growing demand for MBS would encourage banks to lower their lending standards and drive consumers to jump into the market at any cost.

Definition And Examples Of Mortgage

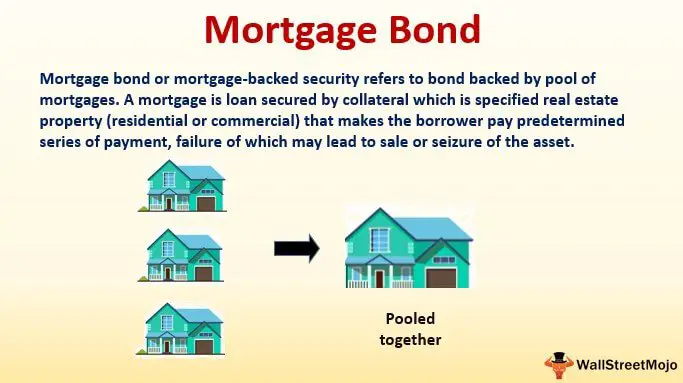

Mortgage-backed securities are a specific type of asset-backed security. In other words, they’re a kind of bond that’s backed by real estate like a residential home. The investor is essentially buying a mortgage so they can collect monthly payments in place of the original lender.

Typical buyers of these securities include institutional, corporate, and individual investors. However, if the homeowner defaults, the investor who paid for the mortgage-backed security won’t get paid, which means they could lose money.

- Acronym: MBS

A security is an investment made with the expectation of making a profit through someone else’s efforts. In the case of mortgage-backed securities, the investor attempts to profit through the efforts of a mortgage lender.

How Does Mortgage Bond Works

When a person purchases a home and finances it by keeping it as a mortgage, the lender gets the ownership of that mortgage until the loan is fully paid. The lender includes banks and mortgage companies that give a loan on such real estate assets. Banks then club these mortgages and sell them to an investment bank or any government entity at a discount. This way, banks get money instantly that they originally would get over the term of a loan, and they also manage to shift the risk of any default from themselves to investment banksInvestment BanksInvestment banking is a specialized banking stream that facilitates the business entities, government and other organizations in generating capital through debts and equity, reorganization, mergers and acquisition, etc.read more.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

Recommended Reading: Are There Zero Down Mortgages

Terms To Know Before Investing

Before investing in mortgage-backed securities, you should have a clear understanding of the terms of the issue.

Type of security

Identify the collateral behind the mortgage bonds, whether purchasing a pass-through or a more complex CMO.

Issuer guarantee

Verify the existence of any guarantee or other credit enhancements and the credit quality of the guarantor.

Quality of security

Understand what types of mortgage loans are held in a pool.

Average life vs. stated maturity

Align average life, which may be shorter or longer than estimated, and the final stated maturity should match an investors investment horizon.

YTAL vs. YTM

Compare a yield-to-average-life to a yield-to-maturity of another comparable investment. A YTAL takes into account the return of principal over time, whereas a YTM is the yield based ona bonds stated maturity date.

More information is available online from the Securities Industry and Financial Markets Association at investinginbonds.com.

Mortgage-backed securities and collateralized mortgage obligations

While the mortgage-backed securities market is vast, the information you will find here focuses on investments securitized with residential mortgages and covers only the most common types of mortgage securities – those issued by one of the government-sponsored enterprises , also commonly referred to as GSEs. Private label mortgage-backed securities and other types of asset-backed securities are not part of this discussion.

Securitization

The Following Terms Will Help You Further Understand A Bonds Psa Analysis:

The Average Life of a mortgage bond is the average time that each principal dollar in the pool is expected to be outstanding, based on an estimated PSA. If the actual prepayment speed is faster or slower than estimated, the average life will be shorter orlonger. It is a general practice to quote average life rather than the stated maturity date when evaluating mortgage-backed securities.

Yield-to-Average Life is a standard measure of return used to compare MBS to other fixed income alternatives with similar characteristics. However, average life is only an estimate and largelydepends on the accuracy of prepayment speed assumptions.

Due to the uncertainty of payments on principal and interest, MBS generally offer long-term competitive returns

Do not invest in MBS if you will need access to funds by a specific date, as the assumptions of homeowners prepayments may or may not be met.

1st principal is the expected first principal payment based on the PSA

Last principal is the expected final principal payment based on the PSA

1 month actual is the actual PSA for the prior month

3 month, 6 month, 12 month, lifetime avg is the historical average PSA.

You May Like: Can You Get A Second Mortgage With Bad Credit

Disadvantages Of Mortgage Bonds

Although considered safer than other bonds, mortgage bonds also offer some disadvantages.

- The safety feature with these bonds means lower investment returns.

- If the pool of mortgages includes subprime mortgages, it carries a notorious reputation as well as a higher risk of default.

- These bonds often come with floating interest rates that can change the investment returns in the long term.

Mortgage Bonds: Defined And Explained

When you close on a home, your mortgage takes on a life of its own. After closing, your mortgagor is likely to immediately sell your mortgage in a group of other mortgages known as a mortgage bond. These bonds are then sold for investment in the secondary mortgage market. This happens because lenders need to liquidate the mortgages they hold so that they can offer future mortgages. Therefore, the mortgages that are sold are sold as mortgage bonds, a type of mortgage-backed security , and are secured by residential property.

Also Check: How To Determine What You Qualify For A Mortgage

How Do Bond Loans Work

Low- and middle-income families who want to buy homes may be able to get a bond loan. State and local authorities issue bond loans to subsidize the cost of becoming a homeowner for those who meet certain income requirements, either by lowering interest rates or offering cash assistance. Curious about how bond loans work? Weve got you covered. We can also help you find a financial advisor to work with if you want to improve your finances to secure a conventional mortgage with favorable terms and rates.

Find out now: How much house can I afford?

How Do Bond Ratings Work

All bonds carry the risk of default. If a corporate or government bond issuer declares bankruptcy, that means they will likely default on their bond obligations, making it difficult for investors to get their principal back.

Bond credit ratings help you understand the default risk involved with your bond investments. They also suggest the likelihood that the issuer will be able to reliably pay investors the bonds coupon rate.

Much like credit bureaus assign you a credit score based on your financial history, the credit rating agencies assess the financial health of bond issuers. Standard and Poors, Fitch Ratings and Moodys are the top three credit rating agencies, which assign ratings to individual bonds to indicate and the bank backing the bond issue.

| Moodys |

|---|

Also Check: How Can You Have Two Mortgages

How Does Mortgage Bond Work

In general, a bank holds a large number of mortgage loans on their books and some of them they dont want to maintain until their maturity. In such a scenario, the bank can sell the mortgage loans to an investment bank or other similar institution, which could be a private, governmental or quasi-governmental entity, and get the liquidity to make other loans.

The investment bank then creates a pool of mortgages and groups them into securities with mortgages that exhibit similar characteristics, say same interest rates, maturity periods, etc. The investment bank can now sell the securities to interested investors in the open market. Once the securities are sold, the investment bank can then use the funds from the sale to purchase more mortgage loans and create more mortgage bonds.

The investors who purchase these bonds get their payments which comprise of the interest as well as principal payments for the underlying mortgages. In case the bond defaults, then the investors have the right to foreclose on the underlying collateral or asset.

How To Buy Mortgage Bond

The interested investors can buy mortgage bonds through banks or authorized brokers at approximately the same fee as any other traditional bond, which would be in the range of 0.5% to 3% depending on the bond size and various other factors. In the US, the mortgage bonds are primarily issued by three agencies Government National Mortgage Association , Federal National Mortgage Association and Federal Home Loan Mortgage Association .

Recommended Reading: How Do Commercial Mortgages Work

Government Bonds And Mortgage Rates What’s The Connection

Many people don’t realize the strong correlation between fixed mortgage rates and Bank of Canada bond yields.

Both rates can change daily, but each carries different risks â at relatively opposite ends of the spectrum. Fixed mortgages are considered ‘riskier’ assets for banks, while government bonds are thought of as ‘safer,’ or even risk-free. Why?

Government bonds are 100% guaranteed to be repaid, but mortgages are not. Mortgages carry more risk of default or early repayment, which could potentially disturb the expected return on investment. Mortgage rates, therefore, are priced higher by banks to compensate for that added risk.

Many factors can affect fixed mortgage rates. But the single biggest factor is Government of Canada bond yields. Banks actually use the 5-year bond yield market to determine their fixed mortgage rates, using the forecasted earnings from bond investments to cover the costs and possible losses incurred through their mortgage market.

Related: How are mortgage rates set?

As A Adjective Bond Is

Derived terms

Read Also: How Much Is A Mortgage On A 650k House

Cost Of Mortgage Bonds

Mortgage bonds range in bond amount, anywhere from $5,000 – $500,000. You don’t need to pay the entire bond amount to get bonded, though.

First, find out your state’s bond amount.

The range in premium is largely dependent on your personal and business credit history.

The best way to see what you’d pay for a mortgage bond is to get a free quote.

At Surety Solutions, our Bond Cost Calculator lets you view quotes for your bond so you can shop around before you buy.

How Do Bond Rates Affect Mortgages

yieldsratesmortgagesmortgageratesBond prices affect mortgageratesbondsmortgages

In this manner, what is the relationship between mortgage rates and the bond market?

Bond prices have an inverse relationship with mortgage interest rates. As bond prices go up, mortgage interest rates go down and vice versa. This is because mortgage lenders tie their interest rates closely to Treasury bond rates. When bond interest rates are high, the bond is less valuable on the secondary .

Likewise, do mortgage rates follow 10 year treasury? There is a strong correlation between mortgage interest rates and Treasury yields, according to a plot of 30-year conventional mortgages and 10–year Treasury yields using Federal Reserve Economic Data. Mortgage interest rates are higher than Treasury yields because mortgages are riskier than Treasury bonds.

People also ask, how do Fed rates affect mortgage rates?

The Fed doesn’t actually set mortgage rates. Instead, it determines the federal funds rate, which generally impacts short-term and variable interest rates. Those higher costs may be passed on to consumers in the form of higher interest rates on lines of credit, auto loans and to some extent mortgages.

How do interest rates affect bonds?

You May Like: Is It A Good Idea To Pay Off Your Mortgage

Advantages And Disadvantages Of Mortgage Bonds

A disadvantage of mortgage bonds is that their yields tend to be lower than corporate bond yields because the securitization of mortgages makes such bonds safer investments. An advantage would that if a homeowner defaults on a mortgage, the bondholders have a claim on the value of the homeowner’s property. The property can be liquidated with the proceeds used to compensate bondholders. Another advantage of mortgage bonds is that they are a safer investment than stocks, for example.

In contrast, investors in corporate bonds have little to no recourse if the corporation is unable to pay. As a result, when corporations issue bonds, they must offer higher yields to entice investors to shoulder the risk of unsecured debt.

Examples Of More Common Types Of Cmo Classes

Sequential Class is the most basic CMO structure. Each class receives regular monthly interest payments. Principal is paid to only one class at a time until it is fully paid off. Once the first class is retired, the principal is then redirected to the next class until it is paid off, and so on. The classes are paid off based on their corresponding average maturities, which may be 2-3 years, 5-7 years, 10-12 years, etc. This type of structure may help reduce prepayment variability.

Planned Amortization Class offers a fixed principal payment schedule. This is done by redirecting cash flow irregularities caused by faster-than-expected principal repayments away from the PAC class and toward another class referred to as a support class.

In other words, two or more classes are active at the same time. When repayment of principal is less than scheduled, principal is paid to the PAC class while principal to the support class is suspended. With a PAC class, the yield, average life, principal window and principal return lockout periods estimated at the time the deal is structured are more likely to remain stable over the life of the security.

Read Also: What Is The Mortgage Rate For Bank Of America

Mortgage Bonds And Mortgage

Lenders of mortgage bonds and loans, such as banks, do not usually retain the ownership of mortgages. Instead, they securitize the mortgages into financial products that can be sold in the secondary market. Such a type of financial product is known as a mortgage-backed security Mortgage-Backed Security A Mortgage-backed Security is a debt security that is collateralized by a mortgage or a collection of mortgages. An MBS is an asset-backed security that is traded on the secondary market, and that enables investors to profit from the mortgage business.

A special purpose vehicle the originator of the MBS gathers mortgages from a bank into a pool and sells small packages of the mortgages to investors. The originator gathers interest payments from the mortgage borrowers and then distributes the payments to the MBS investors. Hence, the default risk is transferred to the MBS investors.

Legal Talk What You Should Know About Mortgage Bonds In South Africa

To inform home owners and prospective home owners about the registration procedures of mortgage bonds.

INTRODUCTION

A creditor who advances money to a debtor usually requires the debtor to provide some form of security for the repayment of the debt. Two main forms of security can be distinguished, namely:

- Personal security: An individual can bind himself / herself personally as surety for the repayment of anothers debt in the event of non-payment by the debtor himself. Should the debtor not pay, the surety will be called upon to pay on behalf of the debtor.

- Real security: A borrower can offer his immovable property to a lender as security for the repayment of a debt. The Mortgagee will cause a mortgage bond to be registered over the immovable property as security for the fulfillment of the Mortgagors obligations.

WHO IS THE MORTGAGOR AND WHO IS THE MORTGAGEE?

- The Mortgagor is the individual, company, close corporation, partnership or trust who has borrowed money to finance the purchase of an immovable property and mortgages his/her property as security for repayment of the loan.

- The Mortgagee is the Bank, Financial Institution, employer or individual who lends the money to the Mortgagor and in whose favour the mortgage bond is registered.

WHAT IS A MORTGAGE BOND?

WHAT PROPERTY IS CAPAPABLE OF BEING MORTGAGED?

WHAT ARE THE RIGHTS AND OBLIGATIONS OF THE MORTGAGOR?

WHAT DOES THE MORTGAGE BOND COVER?

WHAT HAPPENS IN THE EVENT OF THE MORTGAGORS INSOLVENCY?

Recommended Reading: How Do You Get A Mortgage To Build A House

How Mortgage Broker Bonds Benefit You

Your bond protects your clients. If you break the law or any other rules while operating as a mortgage brokerage, your clients can file claims on your bond. However, your bond benefits you as well, as the surety bond alternatives have several disadvantages. Read our guide to lean more about and how they work.

How Does A Mortgage Bond Work

A mortgage bond is a bond in which holders have a claim on the real estate assets put up as its collateral. A lender might sell a collection of mortgage bonds to an investor, who then collects the interest payments on each mortgage until it’s paid off. If the mortgage owner defaults, the bondholder gets her house.

Consequently, what is a mortgage bond?

A mortgage bond is secured by a mortgage or pool of mortgages that are typically backed by real estate holdings and real property, such as equipment. In the event of default, mortgage bondholders could sell off the underlying property to compensate for the default and secure payment of dividends.

how do mortgage backed bonds work? Mortgage–backed securities are simply shares of a home loan sold to investors. They work like this: A bank lends a borrower the money to buy a house and collects monthly payments on the loan. It’s also an excellent and safe way to make money when the housing market is booming.

Thereof, is a mortgage considered a bond?

A mortgage bond is a bond backed by a pool of mortgages on a real estate asset such as a house. More generally, bonds which are secured by the pledge of specific assets are called mortgage bonds. Mortgage bonds can pay interest in either monthly, quarterly or semiannual periods.

How much is a mortgage bond?

You May Like Also

Read Also: Are Rocket Mortgage Rates Competitive