When Would You Need A Non

1. Financial or credit limitations

Some non-conforming loans, such as FHA loans, VA loans, and USDA loans, offer more relaxed financial requirements. These loans are backed by government entitiesthe Federal Housing Administration , the Department of Veterans Affairs , and the United States Department of Agriculture respectivelyand all have their own qualification guidelines, such as maximum allowable incomes or location limitations.

Here are a few scenarios when a government-backed loan may be beneficial to borrowers:

- You have little to no money for a down payment. The upfront costs of a conforming loan can be prohibitive for some borrowers, ranging from between 3-20% of the mortgage amount. Alternatively, government-backed non-conforming loans offer extremely low or zero down payment requirements.

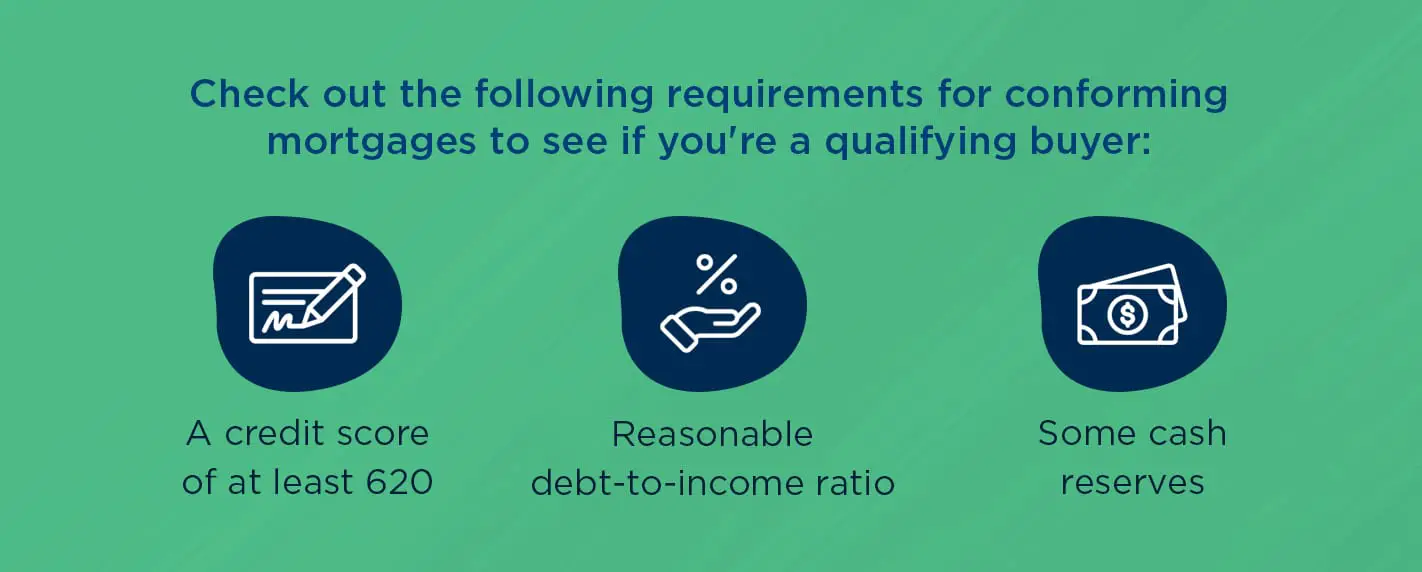

- You have a high DTI ratio. Conforming loans have strict debt-to-income ratio requirements. DTI measures your total income each month versus how much of it goes toward debt payments. While requirements vary by loan type, a buyer with a DTI of more than 50% would typically be ineligible for a conforming loan but would still qualify for some non-conforming loans.

- You have a low credit score. Similar to DTI ratios, lenders have different credit score requirements for different loan types. In most cases, a borrower with a credit score less than 620 would only qualify for a non-conforming loan.

2. High property costs

Heres why you may need a jumbo loan:

What Are Conventional Loans

The term conventional, when applied to mortgage financing, is different from the way we normally use it to mean something that is traditional or ordinary.

In mortgage lending, a conventional loan is privately funded, not government-backed. Very simple. Lenders often find government-backed loans more attractive than conventional loans, because potential losses are covered by a government-administered insurance program. Added safety means government loans often have lower rates than conventional mortgages.

The image below shows the difference in interest rate between government loans and conforming home loans. Rates for government-guaranteed loans are lower, but they can be more expensive when you factor in their insurance costs and fees.

Current Limits For Conforming Loans

The 2021 baseline limit for conforming loans is $548,250, which increased from $510,400 the year prior. The boost of 7.42 percent mirrors an increase by the same percentage in average U.S. home prices between 2019 and 2020.

That limit, however, is not the same everywhere in the U.S. In certain high-cost areas, the limit grows by as much as 150 percent, to $822,375.

The high-cost areas are typically around major metros with hot real estate markets. This map provided by the federal government shows exactly where each loan limit applies.

Read Also: What Does The Bank Need For A Mortgage

Is A Non Conforming Loan Bad

Nonconforming mortgages are not bad loans in the sense that they are risky or overly complex. Financial institutions dislike them because they do not conform to GSE guidelines and, as a result, are harder to sell. For this reason, banks will usually command a higher interest rate on a nonconforming loan.

Conforming Home Loans: Definition & Basic Requirements

By Brandon Cornett | © 2021, all rights reserved | Copyright policy

Reader question: “What is a conforming home loan, and how is it different from other types of mortgages? Is it the same as a conventional loan? Which ones are easier to qualify for, for a first-time home buyer like myself? I’m hopelessly confused by all of the lingo.”

You’ve come to the right place. De-confusing home buyers is what we do! And if it’s any consolation, you’re certainly not alone. Many first-time buyers are confused by the conventional and conforming loan terminology.

Let’s start by addressing your first and primary question: What is a conforming loan?

Don’t Miss: How Much Are Monthly Payments On A 200 000 Mortgage

What Is A 15 Year Conforming Mortgage

Before you start shopping for that chic new apartment, it’s worth figuring out what your financing options are. Mortgages come in all shapes and sizes, and the two biggest factors impacting your decisions will be the type of mortgage and the length of the mortgage term. A 15-year conforming mortgage is one that meets the requirements of Fannie Mae and Freddie Mac, where your monthly obligations are calculated over a 15-year repayment schedule.

Tips

-

If you take out a mortgage with a 15-year term, the bank will calculate your monthly payments on the basis that you’ll pay off the loan over 180 months. The “conforming” part means that your loan meets the lending guidelines of Fannie Mae and Freddie Mac, which are established by the federal government.

What Does It Mean To Conform

A conforming loan is one that meets certain pre-established criteria used by Freddie Mac and Fannie Mae. The most important of these criteria is the size or amount of the loan.

When a borrower uses a mortgage that falls within the loan limits for his or her county, it is referred to as a conforming loan. It can therefore be sold to Fannie Mae or Freddie Mac via the secondary mortgage market.

When a conventional home loan exceeds the conforming limits for the county where the home is being purchased, it is referred to as a jumbo loan. This means it does not meet the conforming standards used by Fannie and Freddie, and therefore cannot be sold to either of those entities.

Because of the larger amount being borrowed, jumbo loans are typically more strict in terms of borrower eligibility criteria. Generally speaking, borrowers need better credit and a larger down payment in order to qualify for a jumbo mortgage product.

So, from a size perspective, a conventional loan can either be conforming or jumbo. If it falls within the parameters used by Freddie Mac and Fannie Mae , it is considered to be a conventional conforming loan.

On the other hand, if it exceeds the size limits or other parameters used by Freddie and Fannie, it is referred to as a jumbo loan.

Read Also: What Is The Current Rate For A 30 Year Mortgage

What Is A Non Conforming Mortgage Loan

3.9/5nonconforming mortgagemortgageloanMortgageLoan Mortgage

Correspondingly, what is the difference between conforming and non conforming mortgage loans?

Conforming loans are mortgages that conform to financing limits set by the Federal Housing Finance Agency and meet underwriting guidelines set by Fannie Mae and Freddie Mac, whereas nonconforming loans do not. Conforming and nonconforming loans are both types of conventional loans.

Secondly, is a conforming loan the same as conventional? Short answer: A conventional home loan is one that is not insured or guaranteed by the government. A conforming loan is one that adheres to the size limits used by Freddie Mac and Fannie Mae, the two U.S. corporations that purchase mortgage loans. So no, an FHA loan is not the same as conventional.

Furthermore, what does non conforming mortgage mean?

A non–conforming mortgage is a term in the United States for a residential mortgage that does not conform to the loan purchasing guidelines set by the Federal National Mortgage Association /Federal Home Loan Mortgage Corporation .

What does conforming mean in a mortgage?

A conforming loan is a mortgage that is equal to or less than the dollar amount established by the limit set by the Federal Housing Finance Agency and meets the funding criteria of Freddie Mac and Fannie Mae.

What Is A Nonconforming Mortgage

A nonconforming mortgage is a mortgage that does not meet the guidelines of government-sponsored enterprises such as Fannie Mae and Freddie Mac and, therefore, cannot be sold to them. GSE guidelines consist of a maximum loan amount, suitable properties, down payment requirements, and credit requirements, among other factors.

A nonconforming mortgage may be contrasted with a conforming mortgage.

Don’t Miss: Can You Take A Cosigner Off A Mortgage

How Does This Affect My Homebuying Process

Most buyers, especially for their first home, count on a low down payment and favorable interest rates to make the purchase affordable. Those perks are easier to access with a conforming loan.

So before you begin your home search in earnest, make sure you check on the loan limits for your area . This will serve as a benchmark for which homes you can purchase with less than 20% down payment and relatively easier requirements.

Be aware of how the limits change from county to county, because you might end up in jumbo loan territory without realizing it. For example, the loan limit in Monmouth County, New Jersey, is $822,375. But cross the border into Mercer County, and the limit drops back down to $548,250,

If youre anywhere near that edge and you think you might go over, you need to see if you qualify for jumbo, said Beeston.

If you do end up needing a non-conforming loan, thats okay. Youll just need to make sure youve got the cash to afford the higher down payment and reserve requirements.

What Are Conforming Loan Limits

Fannie Mae and Freddie Mac have conforming loan limits. This means you cant borrow more than the limit for that year unless youre buying in a high-cost area with higher limits. Any borrower that needs more than the conforming loan limits will need a nonconforming loan, such as a jumbo loan.

Great news! Rates are still low in 2021.

Missed your chance for historically low mortgage rates in 2020? Act now!

Read Also: How Mortgage Pre Approval Works

Check Your Credit Report

As much in advance as possible several months if doable check your credit reports at AnnualCreditReport.com. Due to the coronavirus crisis, credit reports are now available at no charge on a weekly basis from Experian, Equifax and TransUnion through April 2021. Check your reports carefully for things such as out-of-date items and factual errors. Dispute any errors you spot, because even minor issues can result in a lower credit score.

The Appeal Of Conforming Loans

As a borrower, once youve met the requirements for a conforming loan, getting approved can be easier because the bank can sell the loan. Plus, Fannie and Freddie guidelines ensure that lenders follow certain rules for issuing you a loan. Although you still need to be careful about making sure you understand loan terms, you may have a little more peace of mind than you would if you got a nonconforming loan.

Recommended Reading: What Should My Mortgage Be

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Not The Same As ‘conventional’

First-time home buyers often confuse the terms “conventional” and “conforming,” and sometimes use them interchangeably. But they are two different things entirely.

A conventional mortgage is one that is not insured or guaranteed by the federal government. This distinguishes it from government-backed programs and products, such as the FHA and VA loan programs. So a conventional, or non-government-backed, loan can be either conforming or non-conforming depending on whether or not it adheres to Fannie Mae and Freddie Mac guidelines.

A jumbo loan, for example, can be conventional but non-conforming due to its size.

Also Check: How To Get A Mortgage License In Florida

What Are The Benefits Of A Conforming Loan

How Do Conforming Loan Limits Work

The conforming loan limit is set by The Housing and Economic Recovery Act and designated by the county. The FHFA bases each years restrictions on their House Price Index report. Most counties will be assigned the national baseline limit, which reflects the change in the average U.S. home price.

Because the FHFA uses the House Price Index to determine the following years loan limits, the annual loan increases in loan limits are automatic. Each time home prices rise, the FHFA reacts by increasing mortgage limits. This helps the mortgage industry naturally fluctuate with the housing industry.

Some areas that satisfy requirements for higher maximum conforming loan limits will be assigned higher limits. This is typically true in notably expensive metropolises where the local median home value exceeds the baseline conforming loan limit by at least 115%. These areas often include cities such as San Francisco, New York City and Washington, D.C. The ceiling on the limits in these areas is 150% of the baseline loan limit.

If your home exceeds the conforming loan limit, you have a couple of options. You can pay a higher down payment to ensure youre not borrowing more than the conforming loan limit. Additionally, you may be eligible for a Federal Housing Administration loan. With an FHA loan, you can take out a conforming loan and then take out an FHA loan to cover the difference in home value.

Don’t Miss: Which Credit Reporting Agency Do Mortgage Lenders Use

What Is A Conforming Fixed Loan

A fixed-rate mortgage comes with an interest rate that wont change for the life of your home loan. A conventional mortgage is a loan that conforms to established guidelines for the size of the loan and your financial situation. Terms of these conventional loans typically range from 10 to 30 years.

Advantages Of Conforming Loans

For consumers, conforming loans are advantageous due to their low interest rates. For first-time homebuyers taking out Federal Housing Administration loans, for example, the down payment can be as low as 3.5%.

However, the buyer who makes a low down payment may be required to purchase mortgage insurance, the cost of which varies according to their loans terms. For example, for 30-year loans of $625,000 or less, with an LTV ratio of 95% or more, the cost is about 0.85% of the loan amount per year.

Lenders also prefer to work with conforming loans, as they can be packaged easily into investment bundles and sold in the secondary mortgage market. This process frees up a financial institutions capacity to issue more loans, which is how it makes its money.

Read Also: Is 680 Credit Score Good Enough For Mortgage

So The Term Conforming Is Used Mainly For Describing The Size Of The Loan So Conventional Loans Represent A Mortgage Loan Program

That is accurate.

Conventional Loans are your standard non-government mortgages. In fact in todays mortgage lending world, there is really only two loan programs available to consumers buying or refinancing a house, Conventional or Government. Put another way, you cannot have a Conventional FHA Mortgage since FHA falls under the government hub and Government Programs always Insured, or Guaranteed by an entity.

You can have a Conforming FHA mortgage, but if youre seeking an FHA mortgage, its likely already in the Conforming Loan Limits for your given area.

Unique separator between Conventional Loans and Government Loans

Conventional Loans- are the most sought-after types of mortgage financing available, by the same token, qualifying for Conventional Financing is more strict than Government Financing. Unlike Government Mortgages conventional loans are not guaranteed by or insured by a government agency such as the Federal Housing Administration or Department of Veterans Affairs or US Department of Agriculture. Conventional loans are backed directly by Fannie Mae and Freddie Mac who have specific underwriting criteria lenders are required to abide by in the origination of the loan thus making them the cream ream of the crop.

Now, being armed with the subtle differences in the mortgage program arena, you can make better comparisons on loan amounts, loan programs and mortgage rates with each comparison quote you receive.

Closing Costs On Jumbo Loans

Simply put, jumbo mortgages have higher closing costs than normal mortgages. Theres a lot more to assess and those extra qualification steps take time.

As well as higher closing costs, you may also need to pay for a second home appraisal. Lenders do this to offset some of their risk. Make sure youve considered all the closing costs, as well as the down payment and cash reserves youll need to have on hand before applying for a jumbo mortgage.

Read Also: Can There Be A Cosigner On A Mortgage

Jumbo Vs Conforming Loan: What’s The Difference

From big and small to high-interest and low-interest, mortgages come in all shapes and sizes. The two most common types are jumbo, or non-conforming, and conforming. To understand the difference between the two, let’s touch on federal loan limits.

The Federal Housing Finance Agency sets conforming loan limits annually. Loan limits determine whether mortgages are eligible for purchase by Fannie Mae and Freddie Mac. Mortgages that fall within these limits are considered conforming. Mortgages that fall outside these limits are considered non-conforming.

The government uses two businesses Fannie Mae and Freddie Mac to purchase conforming mortgages. That makes regular mortgages less risky for lenders to issue. But what happens when you need a house that costs more than the limit?

Some lenders will let you take out a jumbo mortgage. These are non-conforming mortgages used to finance mortgages over the FHFA loan limit. These mortgages are typically kept by the lender and are not guaranteed or insured, which makes them riskier. Every jumbo lender will have its own standards for making these loans.