How Mortgage Rates Have Changed

Todays mortgage rates are largely up compared to the same time last week.

-

30-year fixed mortgage rates: 3.250%, up from 3.000% last week, +0.250

-

20-year fixed mortgage rates: 2.875%, up from 2.750% last week, +0.125

-

15-year fixed mortgage rates: 2.375%, up from 2.250% last week, +0.125

-

10-year fixed mortgage rates: 2.250%, the same as last week

Rates last updated on Oct. 22, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What You Should Know

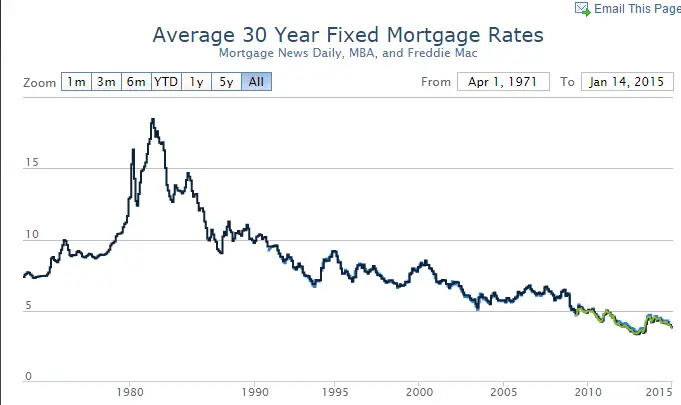

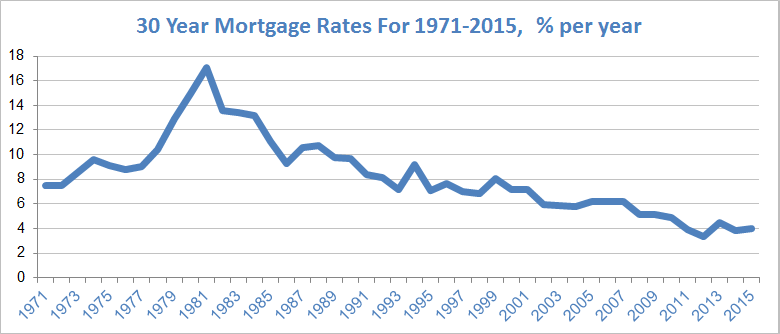

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades

- 5-year fixed mortgages are the most popular in Canada

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youll need to pay formortgage default insurance

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties

Read Also: What Credit Agency Do Mortgage Lenders Use

Bankrate Average Annual 30

| Year | Average 30-Year Fixed Annual Rate |

|---|---|

| 2008 |

- First time home buyers grants and programs: get financial assistance to lower your down payment and closing costs

Zach Wichter is a mortgage reporter at Bankrate. He previously worked on the Business desk at The New York Times where he won a Loeb Award for breaking news, and covered aviation for The Points Guy.

Reviewed by: Greg McBride, chief financial analyst for Bankrate

Greg McBride, CFA, is Senior Vice President, Chief Financial Analyst, for Bankrate.com. He leads a team responsible for researching financial products, providing analysis, and advice on personal finance to a vast consumer audience.

| Loan Type |

|---|

How We Chose The Best 30

In order to assess 30-year mortgage rates, we first needed to create a credit profile. This profile included a credit score ranging from 700 to 760 with a property loan-to-value ratio of 80%. With this profile, we averaged the lowest rates offered by more than 200 of the nations top lenders. As such, these rates are representative of what real consumers will see when shopping for a mortgage.

Keep in mind that mortgage rates may change daily and this data is intended to be for informational purposes only. A persons personal credit and income profile will be the deciding factors in what loan rates and terms they are able to get. Loan rates do not include amounts for taxes or insurance premiums and individual lender terms will apply.

Don’t Miss: Can You Get A Mortgage While In Chapter 13

How Do I Get The Best Mortgage Rate

Shopping around is the key to landing the best mortgage rate. Look for a rate thats equal to or below the average rate for your loan term and product. Compare rates from at least three, and ideally four or more, lenders. This lets you make certain youre getting competitive offers. Check with a variety of types of lenders large banks, credit unions, online lenders, regional banks, direct lenders and mortgage brokers. Bankrate offers a mortgage rates comparison tool to help you find the right rate from a variety of trusted lenders.

Interest rates and terms can vary significantly among lenders depending on how much they want your business and how busy they are processing loans. Many lenders staffed up during the refinancing boom of 2020 and in 2021 are lowering their profit margins to keep enough new mortgages in the pipeline. As online and non-bank lenders take an ever-greater share of the mortgage market, expect to see the deals get even better no matter where interest rates go.

Keep in mind that mortgage rates change daily, even hourly. Rates move with market conditions and can vary by loan type and term. To ensure youre getting accurate rate quotes, be sure to compare similar loan estimates based on the same term and product.

How To Navigate Your Finances In Uncertain Times

The economic outlook has brightened considerably in recent months, but the U.S. economy remains on shaky footing. Heres what you can do to prepare your finances for the next crisis:

- Make a plan. Get your financial life in shape. Determine how much youll spend, how much youll save and how youll tackle high-interest debt. If you plan to buy a home in the future, factor a down payment into your savings plan. Now can be a good time to shore up those funds while you wait for housing inventory to open up or decide where you want to live. Having a bigger down payment can help you get more favorable loan terms and afford more house for your money.

- Build a rainy-day fund. Youll sleep better once youve amassed an emergency fund equal to about six months worth of your expenses. Stash the cash in a liquid and accessible vehicle, such as a high-yield savings account. Shop around for the best rate, and for an account that fits your needs.

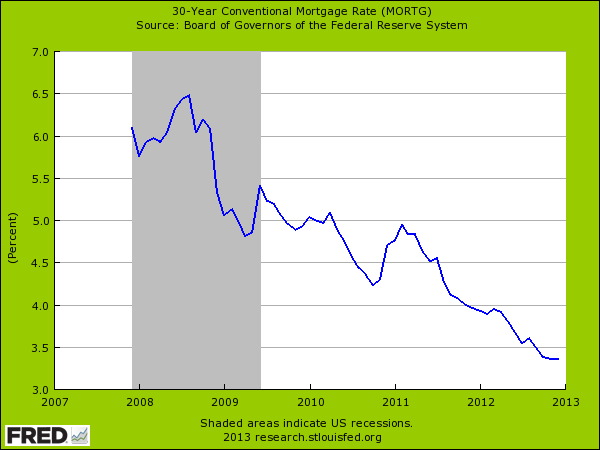

- Consider refinancing debt. Mortgage rates have risen slightly from record lows, but millions of homeowners still could shave hundreds of dollars from monthly payments by refinancing. If youre carrying high-cost credit card debt, check if a balance transfer card is right for you.

Read Also: Does Rocket Mortgage Affect Your Credit Score

Why Save Up For A Large Down Payment If The Mortgage Rate Is Higher

In most cases, a high-ratio insured mortgage will have a mortgage rate that is lower than a low-ratio mortgage with a down payment greater than 20%. Why bother saving up for a large down payment if you can make a small down payment and get an even lower mortgage rate? The answer lies in the cost of the mortgage default insurance, which isnt free.

CMHC insurance premiumscan add thousands of dollars to the cost of your mortgage. The cost of this mortgage default insurance will either need to be paid upfront or it will be added to your mortgage principal balance. Adding the cost of the mortgage insurance to your principal means that you will be paying interest on the insurance over time, adding on to the cost of your mortgage. The CMHC insurance premium will depend on the size of your down payment.

What Are The Mortgage Rate Trends For 2021

The expectation for mortgage rates in 2021 is that they will grow as the economy recovers. However, our economic recovery is unlikely to follow a straight line, so there will be ups and downs along the way.

To start the year, the average 30-year mortgage rate climbed to 3.18% by the end of March. That was followed by a month-long retreat for rates all the way back down to under 3%, before mortgage rates returned to 3% in late May. So even though the long-term overall trend will be rising rates, there will be ups and downs from month to month. But overall, rates are expected to remain historically favorably for months to come.

Recommended Reading: What Is The Mortgage Payment On 240k

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

Don’t Miss: What Percent Down Payment To Avoid Mortgage Insurance

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youâre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, hereâs what youâll need:

- The home price

How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thats because with bi-weekly payments, youll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2% mortgage rate.

Read Also: How To Determine Ltv Mortgage

Current Mortgage Rates: 15

- The 15-year rate is 2.62%.

- That’s a one-day increase of 0.049 percentage points.

- That’s a one-month increase of 0.127 percentage points.

The shorter payback time of a 15-year fixed-rate mortgage means the loan will be paid off faster. It also means the monthly payments will be higher compared to a similarly sized 30-year mortgage, which makes this loan less attractive to some borrowers. However, if you can afford the higher payments, you can save money over time as the interest rate will be lower compared to a longer-term loan.

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenâor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisorâs mortgage rate tables to get the latest information.

The lower the rate, the less youâll pay on a mortgage. Todayâs rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youâre offered might be higher than what lenders advertise or what you see on rate tables.

If youâre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Also Check: How Much Are Monthly Payments On A 200 000 Mortgage

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem more risky. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV. Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare not only interest rates, but also the fees and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders around the same time makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans, instead they work with a number of lenders to find you the best deal. But their services arent free, they work on commission paid by either the lender, or the borrower.

Why Your Mortgage Rate May Be Higher Than Current Mortgage Rates

Not all applicants will receive the very best rates when taking out a mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location, and the loan size will affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their realtors. Yet this means that they may miss out on a lower rate elsewhere.

Last year, Freddie Mac reported that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Don’t Miss: How Much Is The Mortgage On A $300 000 House

When Should I Lock My Mortgage Rate

Right now mortgage rates are historically low, so its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, you can ask your lender if it offers the option to change your rate if it drops, this is also called a float down. With this option, youll need to pay attention to the fine print. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

How Do You Find Personalized 30

We’re showing today’s average mortgage rates, but you can find personalized rates based on your down payment amount, credit score, and debt-to-income ratio.

You can Google “mortgage rate calculator” to enter your information and get an idea of what rate you’d pay.

Some online lenders, such as Ally and Better.com, provide personalized rates with their own digital calculators.

If you’re a little further along in the homebuying process, then you can speak with multiple lenders to receive personalized rates to compare and contrast rates before choosing a lender.

Recommended Reading: Which Is Better 30 Or 15 Year Mortgage

How Much Can I Save By Comparing Mortgage Interest Rates In Canada

Because of the significant amount of money being borrowed under a mortgage, even the slightest difference in the mortgage interest rate may result in you saving money over the course of a mortgage term, and even more over an entire amortization period. While the mortgage rate is a very important consideration, you should also be sure to evaluate the terms and conditions of each type of mortgage to make sure you choose the right one for you.

Are Mortgage Rates Impacting Home Sales

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Make sure we land in your inbox, not your spam folder.

Recommended Reading: Do Mortgage Lenders Work On Saturdays