When To Consider A 30

You can likely claim a sizable tax deduction based on interest payments for your 30-year loan, especially in the early years, when most of your payments go toward interest. And because it’s a fixed-rate loan, youll pay the same amount every month.However, if you dont plan to stay put for several years, or if you want a lower rate, a 15-year fixed-rate mortgage or an adjustable-rate mortgage might be a better option.

Consider Your Other Goals

A 30-year mortgage makes it easier to save for retirement. Youll have more free money in your budget to put toward long-term goals instead of making a hefty mortgage payment every month. However, you might not be better off with a 30-year loan if you spend that extra money on wants and luxuries each month instead,

Do You Pay More Interest On A 15

The average interest rate for a 30-year mortgage was around 0.51% higher than a 15-year mortgage for the past several years.1,2

One percentage point may not seem like much of a differencebut keep in mind, a 30-year mortgage has you paying that difference for twice the amount of time compared to a 15-year mortgage. Thats why the 30-year mortgage ends up being so much more expensive.

Also Check: Who Is Rocket Mortgage Owned By

Vs 30year Mortgage Overview

Most borrowers choose a 30year fixedrate mortgage, which gives them three decades to pay off their home.

You could also opt for a shorter loan term, such as a 15year mortgage. This will pay off your loan debt in half the time and likely save tens of thousands in interest. But your monthly payments will increase substantially.

So which is the best choice for you: a 15 or 30year mortgage? That depends on several factors, including your financial situation, life goals, and what you can afford.

In this article

Investing Vs Paying Off Debt

A fundamental issue at the heart of the 15 vs. 30-year mortgage question is whether the money saved with the smaller payments can earn a better return elsewhere. Mathematically, the return of paying down debt is equal to the after-tax interest rate. This can be compared to the after-tax rate of the return from various investments.

Risk Tolerance

Chris Davin

Historically, stocks have returned about 10% per year and bonds have returned about 5%, although current yields on investment-grade bonds are closer to 4%. For a younger investor with decades to grow a nest egg and some tolerance for taking risk, a portfolio tilted toward stocks is usually recommended by financial planners. It wouldnt make sense for such an investor to earn an 8% return and simultaneously pay down a 3.75% mortgage on an accelerated schedule. After 15 years, the $1,998 per month payment difference invested to earn 8% will exceed the remaining balance on the 30-year mortgage with lots of money left over.

On the other hand, with a conservative portfolio returning closer to 5% with still some risk, it makes a lot more sense to take the guaranteed return of around 2.5-4% by paying off the mortgage faster with a 15-year note, especially if mortgage interest is not tax-deductible.

Don’t Miss: Are Mortgage Discount Points Worth It

There Are Other Ways To Pay Down Your Mortgage Faster

If your goal is to pay down your mortgage faster, you can do that with a 30-year loan by simply making extra payments whenever youre able. If you make enough extra payments over your loan term, you can easily shave off time from your loan, even as much as 15 years.

The catch with this strategy is that youll still pay a somewhat higher interest rate on the 30-year mortgage compared to a 15-year note.

If you do make extra payments, make sure you indicate that these payments are to go toward your loan principal. Your Caliber Loan Consultant can show you how to do that.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How Is Home Mortgage Interest Calculated

Best For Monthly Affordability: 30

A 30-year mortgage may be best if youre seeking stable and affordable monthly payments or wish for more flexibility in saving and spending your money over time. The longer loan term may also be the better option if you plan on purchasing property you couldnt normally afford to repay in just 15 years.

Considerations When Choosing A 15

When youre trying to buy a house, you think choosing which home to purchase will be the hard part. But thats just a small piece of the decision puzzle yet to come. Who will do your inspection? Who will be your mortgage lender? When should you lock your rate? Who will be your home insurance company? The list goes on and on. One of those decisions you must make is whether to choose a 15-year or 30-year mortgage.

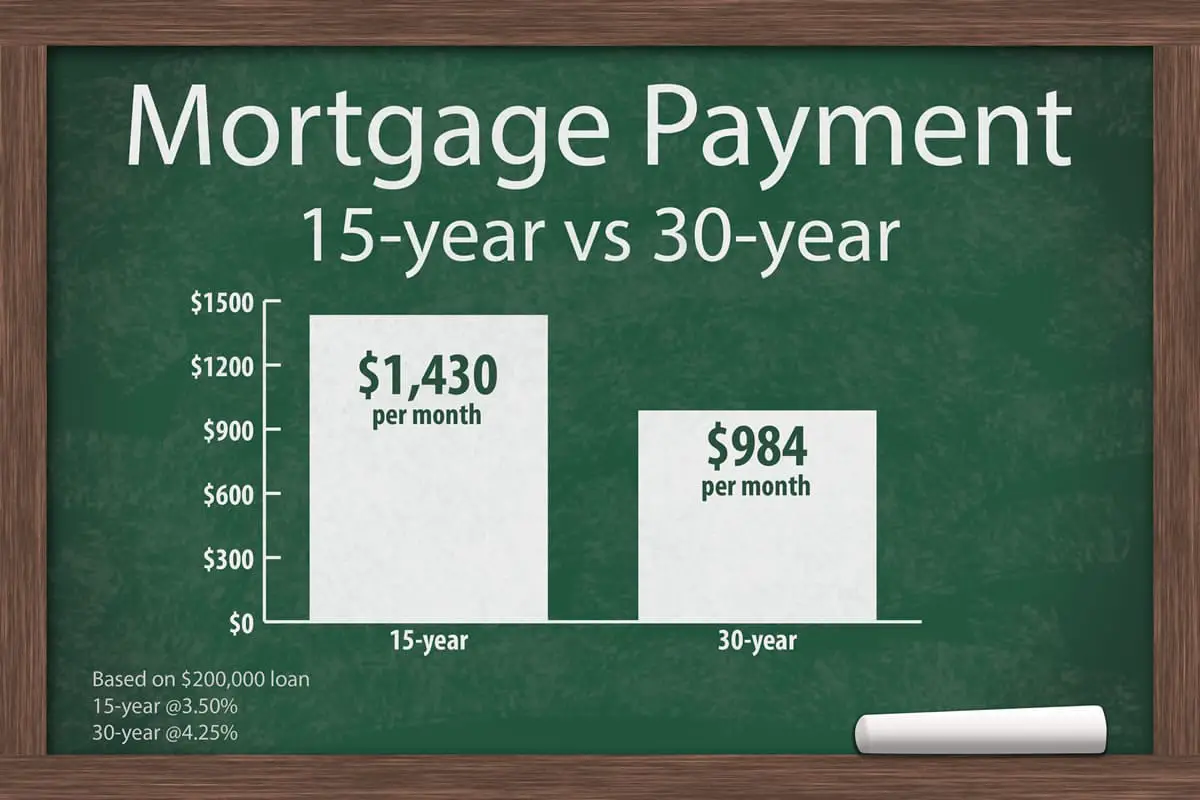

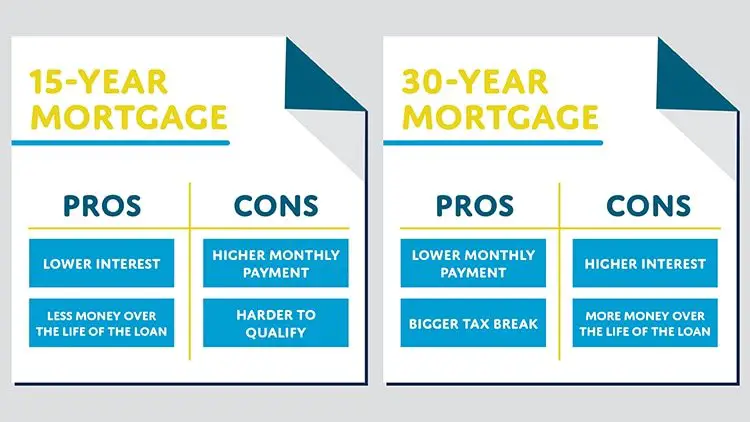

Mortgage Bankers Association reported that 86% of people applying for mortgages in February 2015 chose 30-year loans. But does that mean its the right choice for you?The main differences between a 15-year and 30-year mortgage are fairly simple. The decision, however, may not be. A 15-year mortgage will cost you more in monthly payments. That may make this shorter loan seem like a less affordable option, but youll pay less interest. Therefore, youll pay significantly less over the life of the loan. A 30-year mortgage will have lower monthly payments, but youll pay more in interest, meaning youll pay more for the house over the life of the loan.

In short, a 15-year mortgage means higher monthly payments, but a smaller total payment. A 30-year mortgage means lower monthly payments, but a larger total payment.

Mortgages are not one-size-fits-all, and choosing a 15-year versus 30-year option should be determined based on your unique financial situation. So lets explore the options further.

What should you consider when choosing a 15 vs. 30-year loan?

You May Like: What Do I Need To Become A Mortgage Broker

The Advantages Of A 30

The 30-year mortgage is the most popular option for homeowners in the US for many reasons. But one of its main advantages is that the payments are stretched out over a period thats twice as long as a 15-year mortgage, which means 30-year mortgages have lower monthly payments. Those lower payments make it easier to afford a home, or to buy a larger home and still stay within your budget.

According to Juan Carlos Cruz, founder of Britewater Financial Group in Brooklyn, New York, a 30-year mortgage is ideal when the loan amount is large and amortizing it over 15 years makes the payments too much to handle, or the buyer wants more purchasing power on a greater home that they can pay off over the 30-year mortgage.

With a lower monthly payment, youll have more money to spend on other household expenses, or you can even use the extra cash to turn around and make more money.

If your money can make a 10-year annual average of 8% in the market with a diversified portfolio minus fees of investment advisors and hidden mutual fund fees why would you hurry and pay your 3% mortgage loan? asks Carolyn Mescher, a CPA, and principal at Magnolia 313 Accounting Services in San Luis Obispo, California.

Invest the additional cash youre saving with a 30-year mortgage versus a 15-year term, and the 5% difference between the 8% youre earning and the 3% interest youre paying would then compound over 30 years, explains Mescher.

More flexibility in payback terms

Larger tax deduction

Vs 30 Year Mortgage: Which Is The Best Choice

In this article, I recommend that a 30-year fixed-rate mortgage is best for most people. I realize this may be controversial among the finance blog/FIRE community, but I think I have a solid case to make. I have come up with four criteria that a home-buyer should consider when choosing between a 15 vs 30-year mortgage, and readers of this blog will disproportionally meet them, but some wont. In any case, this post is targeted at the typical high-income professional working a normal-length career, not a FIRE hobbyist saving 60% of her gross income and wanting to retire by 45.

The key advantage of a 30-year mortgage is the lower monthly payments. For example, consider the purchase of a $1M house with 20% down and an $800,000 mortgage. For a 30 year mortgage with a 4.0% interest rate, the monthly principal and interest payment would be $3,819. The main reason to consider a 15-year note over a 30 year is that the interest rate is typically lower. At todays rates, the difference is about 0.25%. For a 15 year mortgage at 3.75%, where the monthly P& I would be $5,817 it means a difference of $1,998. For most people, the advantage of a lower payment outweighs the lower interest rate.

Recommended Reading: What To Expect When Applying For A Mortgage Loan

Less Money Going To Savings

The higher payment requires higher cash reservesas much as one years worth of income in liquid savings. Also, the higher monthly payment means a borrower may forgo the opportunity to build up savings or save for goals such as college tuition for a child or retirement.

Both college savings and retirement accounts are tax-deferred, while 401k retirement accounts have an employer contribution. Besides, a savvy and disciplined investor would lose the opportunity to invest the difference between the 15-year and 30-year payments in higher-yielding securities.

-

A 15-year mortgage costs less in total interest versus a 30-year

-

A 15-year usually has a more favorable interest rate

-

A 15-year is a forced savings since the extra money paid is invested in the home instead of spent

-

15-year loans have higher monthly payments

-

Less affordability with 15-year mortgages

-

Less money going to savings or retirement

-

Financial hardship might result if the borrower can’t pay the higher 15-year loan amount

What Happens If You Make One Extra Mortgage Payment A Year

The primary benefit of making one extra mortgage payment a year is that you could pay off your loan balance several years sooner. The amount of time you could knock off your loan term depends on several factors, including your loan amount and the length of your loan term. Of course, the more extra payments you can make, the sooner you might pay off your loan.

Recommended Reading: How To Recruit Mortgage Loan Officers

Why A 30 Year Mortgage Might Be Better For You

Only you can decide if its worth it, but heres what you may be getting:

More Financial Flexibility

- Saving for Emergencies: You should have an emergency fund with at least three months worth of household expenses in case you lose your job or get injured or sick. Saving on your house payment could help you create this fund.

- Saving for Retirement: If a 30-year mortgage loosens up more money in your monthly budget, you could direct those funds into an IRA for retirement. This will also give you some tax breaks, either now or later, during retirement.

- Investing: Whether its in a CD, with a robo-advisor, or through a brokerage house, spending less each month on your house payment could free you up for investing elsewhere. Yes, your home is a big investment, but it doesnt have to be your only investment.

You Can Afford A Better Home

The expense of a 30-year mortgage may be worthwhile if its opening the door to a better house in a better neighborhood whose value will increase more rapidly.

Some financial advisors say you should always get a 15-year loan even if it means buying a less expensive home. While its hard to argue with the logic of hard numbers, real-life cant always be distilled down to simple numbers.

If a 30-year mortgage allows you to buy a home you couldnt otherwise afford, your homes higher value and its appreciation could cut into the extra financing charges.

Its Easier to Qualify

Dont Forget About Retirement

Hows your retirement fund? Check on this and see if youre currently contributing enough. Instead of refinancing to a 15-year mortgage, you may be better off putting more money toward a 401 plan or an IRA account.

You also want to make sure youre maximizing your tax benefits in these and other types of programs, like health savings accounts and 529 college savings accounts. Compared to these plans, paying down a low-rate, potentially tax-deductible debt like a mortgage is a low financial priority.

You May Like: How Much Usda Mortgage Can I Qualify For

How To Save Money On A 30

When you close on your mortgage, your lender will be required to show you a Truth in Lending report.

This report will show you how much youll pay for your home based on the interest and payment schedule your mortgage requires.

If you were borrowing $250,000 for 30 years at 4 percent interest, for example, your Truth in Lending report would show $429,674 as the full price.

This is a frightening moment for many homebuyers. Are we getting ripped off? Can we really afford this? Should we have shopped around some more?

Most of us go right ahead and sign the loan papers, move into the home, and make payment after payment, steadily chipping away at that huge number as the years go by.

The Main Downsides Of A 30

The most obvious disadvantage of a 30-year mortgage is that itll take twice as long for you to own your home outright, which means a longer duration until you have financial freedom from your housing payment.

But Nicole Rueth, producing branch manager at Fairway Mortgage in Denver, also points out that the lower monthly payment of a 30-year mortgage comes at an additional cost, with 30-year mortgages carrying higher interest rates. Combined with the longer term, that results in paying much more in total interest over the life of your mortgage.

According to a recent Bankrate mortgage survey, average interest rates on a 30-year fixed-rate mortgage are currently 3.05%, which is near a record low. But in the same survey, the average rate on 15-year mortgages was just 2.45%.

That means youre paying 0.6% more for a 30-year mortgage, which may not sound like a lot. But on a $200,000 home with a 20% down payment, youll pay a total of $31,358 in interest over the entire length of a 15-year mortgage at 2.45%, while the same home with a 30-year mortgage at 3.05% ends up costing a much higher $84,399 in total interest.

Don’t Miss: How Much Is Mortgage On 1 Million

Why Should I Get A 15

If you can afford the larger monthly payment that comes with a 15-year fixed mortgage, it can help you pay off your home, freeing up funds for retirement. You will spend less in interest over the life of the loan compared to a 30-year mortgage, and usually, a 15-year fixed mortgage means a better interest rate.

How Soon Can You Repay Your Loan

A 15-year mortgage helps you pay down your loan balance quickly. Youll make a bigger dent in your debt with each monthly payment you make than you would over 30 years. Youll owe less money at any given point in time, which offers several benefits.

You’ll build equity more quickly, which you can use for your next home purchase or for other needs. Its also easier to refinance when you have a lower loan-to-value ratio. And youre less likely to find yourself “underwater,” owing more on your home than its fair market value, if you find that you have to sell your property for some reason.

Don’t Miss: What Is A Mortgage Inspection

Should You Choose A 15

Theres a good reason that 30-year mortgages are typically the more popular choice for homeowners they come with lower monthly payments and can provide more purchasing power. While 15-year mortgages do have some advantages, especially when it comes to paying less overall interest, the higher monthly payments may be difficult for most borrowers to swallow.

However, if you do end up with a 30-year mortgage, its a good idea to try to make extra payments on your loan each year if you can. You can either plan out a faster overall payment plan or just make an extra payment whenever you have the money. Either way, those extra payments will help you save on interest, pay off your mortgage quicker and potentially give you the best of both worlds.

Reason No 1 To Avoid A 30

The main reason to avoid a 30-year mortgage is because it’s costly. You’ll typically pay more than twice as much in interest over the life of the loan with a 30-year loan as with a 15-year one. That, of course, is because the loan is lasting a long time.

Many people favor longer loans because their monthly payments are lower. That is indeed a factor worth considering. Check out the examples below to appreciate the difference in monthly payments with the two kinds of loans . Note that I assigned a lower interest rate for the 15-year mortgage because they typically feature lower rates.

|

Home Price |

|---|

Recommended Reading: How Does The Interest Work On A Mortgage