What’s The Difference Between Pmi And Mortgage Protection Insurance

Unlike PMI which is solely for the lender’s protection, mortgage protection insurance will continue to cover your mortgage payments after you die. This insurance can help protect your family members facing foreclosure on the property after you have passed on. This insurance is sometimes referred to as mortgage life insurance.

Get A New Home Appraisal

Keep track of your homes value! If it ends up being worth more than it was the year before , this means more equity in your name. Equity is the dollar value of your home that belongs to you basically, its the market value of your home minus your loan balance.

Ask for a new appraisal from your lender if you think your home value has risen enough to boost your equity to more than 20%. As long as you owe less than 80% of the new appraisal, you might be able to write to your mortgage lender and request to end PMI. But its up to you to pay for the new appraisal and follow the proper steps when asking your lender to end PMI early.

Having your home appraised after a few years, along with paying a little extra in mortgage payments every month, could get you to that magical 80/20 threshold much fasterand that equals big savings!

Cost Of Mortgage Loan Insurance

The fee you pay for mortgage loan insurance is called a premium. Mortgage loan insurance premiums range from 0.6% to 4.50% of the amount of your mortgage. Your premium depends on the amount of your down payment. The bigger your down payment, the less you pay in mortgage loan insurance premiums.

Find premiums based on the amount of your mortgage:

You can pay your premium by adding it to your mortgage or with a lump sum up front. If you add your premium to your mortgage, you pay interest on your premium. The interest rate is the same rate as youre paying for your mortgage.

Ontario, Manitoba and Quebec apply provincial sales tax to mortgage loan insurance premiums. Your lender cant add the provincial tax on premiums to your mortgage. You must pay this tax when you get your mortgage.

Recommended Reading: How To Select A Mortgage Lender

How Long Do I Have To Carry Pmi

You must pay BPMI until you have 20% equity in your property. Equity refers to the percentage of your principal balance that youve paid off. For example, lets say you borrow $100,000 to buy a home and you pay off $30,000 of principal. This means you have 30% equity in your home.

Keep in mind that payments that only go toward your principal balance count toward your equity. Paying interest doesnt help you build equity. Contact your lender and request a mortgage statement if you dont know how much equity you have. Many lenders also make this information available to you online.

You can contact your lender and request that they cancel your BPMI once youve built 20% equity in your home. Many lenders will automatically do this once you reach 22% equity.

You may want to make extra payments on your loan if you want to stop paying for PMI as soon as possible. Your money can go directly to reduce your principal balance when you make an extra payment, but you have to tell your lender specifically thats where youd like it credited. Many lenders will automatically apply extra money toward next months payment instead.

You must pay PMI for the duration of your loan if you have LPMI or MIP. The only way to cancel PMI is to refinance your mortgage loans interest rate or loan type.

Are There Any Benefits To Paying Pmi As A Borrower

Although PMI is for the protection of the lender and not the borrower, thats not to say there arent some indirect benefits for the borrower. There are two big ones that well go over here:

- PMI enables a lower down payment: Because PMI offsets some of the risk for lenders in the event that the borrower defaults, it enables down payments as low as 3%. Without PMI, you would need a minimum of a 20% down payment for a conventional loan. PMI allows you to accomplish homeownership faster.

- PMI is tax deductible: Congress has extended the mortgage insurance tax deduction through the 2020 tax year, so if you havent filed your taxes yet, this is still deductible. You report it along with your deductible mortgage interest from the Form 1098 you should have received from your mortgage servicer.

Even if you have the money for a 20% down payment, it may make sense to make a smaller down payment and opt for PMI depending on your financial situation and your other goals. Its not necessarily a good idea to empty your savings.

Also Check: Who Is Rocket Mortgage Owned By

Is There Any Advantage To Paying Pmi

Paying PMI comes with one major benefit: the ability to buy a home without waiting to save up for a 20 percent down payment. Home prices are continuing to climb, hitting an all-time high of more than $329,000 for an existing property as of April 2021, according to the National Association of Realtors. A 20 percent down payment at that price would be more than $65,000, which can seem like an impossible figure for many first-time homebuyers.

Instead of waiting while saving, paying PMI allows you to stop renting sooner. Homeownership is generally an effective long-term wealth building tool, so owning your own property as soon as possible allows you to start building equity sooner, and your net worth will expand as home prices rise. If home prices in your area rise at a percentage thats higher than what youre paying for PMI, then your monthly premiums are helping you get a positive ROI on your home purchase.

What Is The Minimum Down Payment Required For A Mortgage

Your minimum down payment depends on the purchase price of your property.

- If your purchase price is under $500,000, your minimum down payment is 5% of the purchase price.

- If your purchase price is $500,000 to $999,999, your minimum down payment is 5% of the first $500,000, plus 10% of the remaining portion.

- If your purchase price is $1,000,000 or more, your minimum down payment is 20% of the purchase price.

| Purchase Price | Minimum Down Payment |

|---|---|

| Under $500,000 | |

| 5% of the first $500,000, then 10% of remainder | |

| $1 million and up | 20% |

Read Also: Does Pre Approval For Mortgage Affect Credit

Next Steps: Dont Drain Your Bank Accounts To Escape Pmi

While paying PMI each month or as a lump sum each year is no financial joyride, homeowners should be careful not to make their finances worse by hustling to get rid of PMI.

Most financial experts agree that having some liquidity, in case of emergencies, is a smart financial move. So before you tap your savings or retirement funds to reach that 20 percent equity mark, be sure to speak with a financial adviser to make sure youre on the right track.

There seems to be a philosophical aversion to PMI on the part of many buyers that is misplaced, McBride says. As long as youre not taking an FHA loan, youre not married to the PMI. You can drop it once you achieve a 20 percent equity cushion, which may only be a few years away depending on home price appreciation. But do not feel the need to use every last nickel of cash to make a down payment that avoids PMI, only to leave yourself with little in the way of financial flexibility afterwards.

With additional reporting by Jeanne Lee

What If I Cant Afford The Down Payment

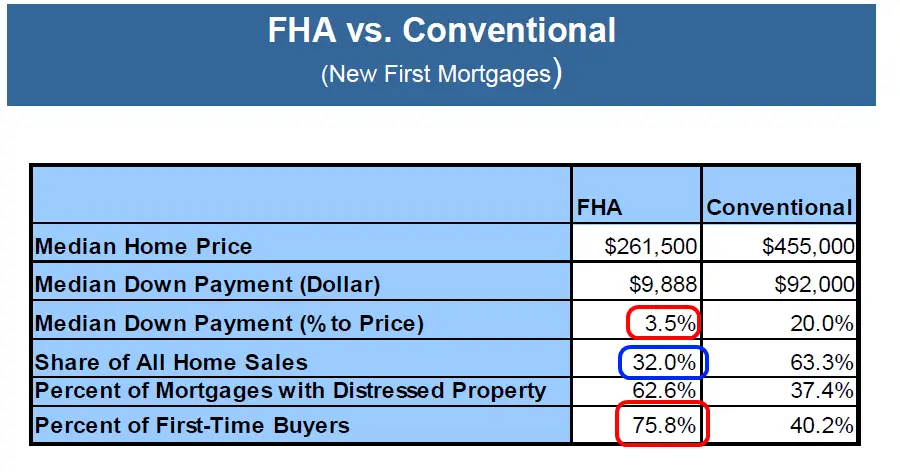

Not everyone qualifies for a zero-down mortgage. Most borrowers need at least 3% down for a conventional mortgage or 3.5% down for an FHA loan.

But what if you cant quite afford the minimum down payment? Three percent down on a $300,000 home is still $9,000 a considerable amount of money.

Luckily there are programs that can help.

For example, every state has multiple down payment assistance programs . These programs often funded by state and local governments and nonprofits offer money to make homeownership more accessible for lower-income or disadvantaged home buyers.

DPA funds can come in the form of a grant or loan, and the loans are often forgiven if you live in the home for a certain period of time.

To find out whether youre eligible for assistance, ask your Realtor or lender to help you find and apply for programs in your area.

You May Like: What Is A Mortgage Modification Agreement

How Much Is Pmi

PMI, like other types of insurance, is based on insurance rates that can change daily. PMI typically costs 0.5 1% of your loan amount per year.

Lets take a second and put those numbers in perspective. If you buy a $300,000 home, you would be paying anywhere between $1,500 $3,000 per year in mortgage insurance. This cost is broken into monthly installments to make it more affordable. In this example, youre looking at paying $125 $250 per month.

Your lender will also consider a few other factors when determining how much PMI youll have to pay as part of your regular mortgage payment. Lets review some of them.

Can You Avoid Or Eliminate Cmhc Premiums

Mortgage insurance is automatically worked into your mortgage when you put less than 20% down towards the purchase price. There is a way to avoid paying this type of mortgage, by putting a minimum of 20% as a down payment. Its also possible to avoid CMHC insurance if you refinance your mortgage and leave at least 20% in the home.

You may be able to save money by requesting a shorter amortization period. Generally speaking, the longer the amortization period, the higher the risk for the lender. As such, the insurance premium will likely be higher. Basically, higher risk equals higher fees.

Whats the difference between a mortgage term and a mortgage amortization? .

CMHC insurance premiums can also be reduced or even eliminated if you move to another house thanks to a portability option. This helps to reduce or get rid of the premium on a new insured mortgage to buy another house. That said, its important to check with your lender to find out the exact terms and conditions of mortgage portability for a particular mortgage package.

To learn more about portable mortgages, read this.

Also Check: Can A Locked Mortgage Rate Be Changed

Ways To Not Pay Mortgage Insurance

Just because you shouldnt fear mortgage insurance, doesnt mean that you should be happy about paying it either. There are several ways to get out of mortgage insurance with less than 20% down payment.

1. Excellent Credit Programs

Some lenders have relationships with mortgage insurance underwriters that allow them to offer very high credit score borrowers lender paid mortgage insurance, without increasing interest rates. This is a common practice, and a good way to convert non tax deductible mortgage insurance into tax deductible mortgage interest.

Normally, the mortgage insurance cost is rolled into your interest rate, resulting in a slightly higher rate over the long term of your loan. For borrowers with a 760 credit score or better, these programs offer reduced interest rates, so that by the time you calculate in the cost of the mortgage insurance, the interest rate is the same, or lower than a borrower with a score of below 760.

These programs will go all the way up to 97% loan to value for qualified borrowers in low to moderate income price ranges. This price range is generally limited to the conforming loan limit in your County.

2. Piggyback Mortgage

3. Buy Out Private Mortgage Insurance

The money to pay for this buyout can come from a seller credit and/or a lender credit, it does not have to come out of your pocket.

Us Department Of Veterans Affairs Home Loans

A benefit of employment in the U.S. armed services is eligibility for a VA loan. VA loans do not require a down payment or monthly mortgage insurance.

Key Takeaways

VA Loan Insurer

The VA pays most of the cost for insuring VA loans. The VA limits the amount it will insure based on the location of the home.

VA Loan Insurance Cost

Most VA borrowers pay an upfront funding fee. The fee ranges from 1.25 percent to 3.3 percent of the loan amount, depending on the borrowers category of military service, down payment percentage and whether the loan is the borrowers first VA loan. The fee can be paid in cash or financed.

Don’t Miss: Can You Apply For A Mortgage Before Finding A House

How Does Pmi Work

PMI insurance is a lot like any insurance policy where you make payments every month for coverage. But remember, it only protects lendersnot homeowners. Heres how it works:

- Getting PMI: Once PMI is required, your mortgage lender will arrange it through their own insurance providers. This will probably happen after your offer on a house is accepted and while your mortgage is being processed.

- Paying PMI: Youll be told early on in the mortgage process how many PMI payments youll have to make and for how long, and youll pay them every month on top of your mortgage principal, interest and any other fees.

- Canceling PMI: Youll stop paying PMI on the date that your lender has calculated that your principal balance on your mortgage reaches 78% of the original appraised value of your home.1 After this, the PMI stops, and your monthly mortgage payment will go down.

PMI in no way covers your ability to pay your mortgageits protecting your lender, because theyre the ones lending you more than 80% of the sale price.

How To Avoid Pmi

Borrowers with low down payments often ask: how can I avoid PMI?

The easiest way to avoid PMI is by making a down payment of 20 percent or more. If you do this, you wont have mortgage insurance on any loan.

Another way to avoid PMI is to use a second mortgage. The first mortgage must be capped at 80 percent of the homes value to avoid PMI, and a second mortgage will usually allow for another 10percent financing on top of this, for a total of 90 percent financing.

If you do this, you will have a second mortgage payment, which can sometimes make the total cost of your financing the same as if you used Lender Paid or Borrower Paid PMI. So ask your lender to present comparisons of all three options.

Also note that if youre putting down less than 10 percent, the second mortgage option is usually not available, because lenders typically cap total allowable financing at 90 percent if youre using a second mortgage.

Don’t Miss: What Is Loss Mitigation Mortgage

What Is Private Mortgage Insurance

Buyers who have a significant stake in the equity of the home are, in many lenders’ eyes, more likely to make their mortgage payments on time. However, demanding a 20 percent down payment is an onerous obligation for a lot of buyers, especially those seeking a first home. In many areas, such regulations make it harder to ensure a healthy real estate market. As a result, lenders have adjusted their requirements to make some accommodations to buyers who cannot put 20 percent down. Borrowers who make a lower down payment are usually required to pay for private mortgage insurance, which provides the lender with an extra layer of protection in case the mortgage defaults.

Why Is 20% Ideal For A Down Payment

The minimum down payment required for a conventional loan is 3%. And the minimum down payment for an FHA loan is 3.5%. Some special loan programs even allow for 0% down payments. But still, a 20% down payment is considered ideal when purchasing a home. You may have heard this referred to as the 20% rule.

For many home shoppers, saving up for a 20% down payment is not easy, but it can have significant financial benefits. For starters, it will help you avoid paying private mortgage insurance and lower your monthly mortgage payments. The infographic below looks at all the benefits of a 20% down payment for a mortgage:

Embed This Image On Your Site :< div style=”clear:both”> < a href=”http://www.zillow.com/mortgage-learning/20-percent-down-payment/”> < img src=”http://cdn1.blog-media.zillowstatic.com/1/Blog_20Percent_Infograph_Zillow_05-27_a_02-546f85.png” border=”0″ /> < /a> < /div> < div> Courtesy of: < a href=”http://www.zillow.com/mortgage-rates”> Zillow< /a> < /div>

Current Mortgage Rates

Recommended Reading: Are Online Mortgage Calculators Accurate

Option : Pay Down Your Mortgage For Automatic Or Final Termination Of Pmi

Under the HPA, the mortgage lender or servicer is required to drop your PMI when one of two things happens:

The provider must automatically terminate PMI when your mortgage balance reaches 78 percent of the original purchase price, provided you are in good standing and havent missed any scheduled mortgage payments.

The lender or servicer also must stop the PMI at the halfway point of your amortization schedule. For example, if you have a 30-year loan, the midpoint would be after 15 years. The lender must cancel the PMI then depending on whether youve been current on your payments even if your mortgage balance hasnt yet reached 78 percent of the homes original value. This is known as final termination.

Who this affects: Removing PMI in this way works for folks with conventional mortgages who have paid according to their original payment schedules and have reached the milestones of 78 percent equity or the halfway point in time. To be eligible, you must be up to date on your payments.