Mortgage Interest Rate Vs Annual Percentage Rate

| Mortgage Interest Rate | |

| Is a percentage of the amount of money you borrowed | Is based on your interest rate, points, broker fees, and other costs. |

| Can be found under “Loan Terms” on your loan estimate | Can be found under “Comparisons” on your loan estimate |

| Is typically lower than your annual percentage rate because it’s just one component of your APR | Is usually higher than your mortgage interest rate |

Your annual percentage rate is a more complete picture of how much it costs you to borrow.

Interest And Other Loan Charges

Interest is only one component of the cost of a mortgage to the borrower. They also pay two kinds of upfront fees, one stated in dollars that cover the costs of specific services such as title insurance, and one stated as a percent of the loan amount which is called points. And borrowers with small down payments also must pay a mortgage insurance premium which is paid over time as a component of the monthly mortgage payment.

Continue To Monitor Your Credit After You Buy A Home

Making a good impression when applying for a mortgage loan is crucial, but it’s important to remain vigilant with your credit score after you get into your home. Experian’s free credit monitoring tool can provide you with a lot of the information you need to stay on top of your credit and continue to improve it.

The service provides free access to your Experian credit report and FICO® Score powered by Experian data. You’ll also get real-time updates when new inquiries, accounts and personal information are added to your credit report.

With these features, you’ll be in a good position to track your progress, spot issues as they arise and address them before they do significant damage to your credit score.

Don’t Miss: What Lender Has The Lowest Mortgage Rates

What Is A Mortgage Rate And How Do They Work

Your mortgage rate is what youll pay to borrow money from your lender. But there are several ways you can influence your rate and get a better deal.

Edited byChris JenningsUpdated October 12, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If you want the best deal on your home purchase, then comparing loan offers is critical. But loan estimates are filled with many facts, figures, and calculations which can be complicated particularly if youre a first-time homebuyer.

Dont let all those numbers overwhelm you, though. As long as you understand the mortgage rate youre getting, then you have a good foundation on which to compare your loan offers.

Heres what you should know about mortgage rates:

Types Of Reverse Mortgages

As you consider whether a reverse mortgage is right for you, also consider which of the three types of reverse mortgage might best suit your needs.

Single-purpose reverse mortgages are the least expensive option. Theyre offered by some state and local government agencies, as well as non-profit organizations, but theyre not available everywhere. These loans may be used for only one purpose, which the lender specifies. For example, the lender might say the loan may be used only to pay for home repairs, improvements, or property taxes. Most homeowners with low or moderate income can qualify for these loans.

Proprietary reverse mortgages are private loans that are backed by the companies that develop them. If you own a higher-valued home, you may get a bigger loan advance from a proprietary reverse mortgage. So if your home has a higher appraised value and you have a small mortgage, you might qualify for more funds.

Home Equity Conversion Mortgages are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Development . HECM loans can be used for any purpose.

HECMs and proprietary reverse mortgages may be more expensive than traditional home loans, and the upfront costs can be high. Thats important to consider, especially if you plan to stay in your home for just a short time or borrow a small amount. How much you can borrow with a HECM or proprietary reverse mortgage depends on several factors:

Also Check: How To Market Yourself As A Mortgage Loan Officer

How Do Mortgages Work In Canada

30 May, 2018 / by

Before you execute your plans to buy a new home, you must take the time to ask and learn the answer to this question: How do mortgages work?

Not all aspiring homeowners in Canada have the extra money to pay up front the full purchase price of their dream home. And so, to be able to afford the cost of buying a new property, they take out loans, or more particularly, mortgages.

This entails borrowing money from banks and other financial institutions and slowly paying off the amount loaned with interest. This sounds simple enough, but there are many considerations to think about before a potential homebuyer should apply for a mortgage.

There different types of mortgages and each has key features which may or may not suit you. Moreover, although mortgages are common across the globe, the rules which govern them have key differences in every country.

To help you navigate this aspect of the real estate world, here is a guide to understanding how mortgages work in Canada.

What Is A No Cash Out Refinance

Category: Loans 1. No Cash-Out Refinance: A Guide | Rocket Mortgage Dec 3, 2020 A no cash-out refinance is when you refinance an existing mortgage for equal to or less than the current mortgage value, plus any additional A no cash-out refinance mortgage can help customers consolidate higher-rate seconds

You May Like: Can I Get A Mortgage With A Fair Credit Score

What Is An Apr

An annual percentage rate represents the cost of borrowing over the life of the loan expressed as an annual rate. People commonly reference interest rates and APRs when comparing mortgage loans. APRs are typically higher than the interest rate because they include fees associated with getting the loan, like points, origination fees and other charges, as well as interest.

There are two types of mortgage interest rates: Fixed and adjustable. A fixed rate stays the same throughout your loan. A adjustable or variable rate changes with an index such as the prime rate which is based on the Federal Funds Rate outlined by the Federal Reserve Board . This means that if you get a loan with an adjustable rate, your interest rate could change depending on changes in the index The APR for a variable rate loan estimates how the rate could change over time, but actual changes could be very different.

Are Points Right For You

To find out whether points could work for you, determine whether you have the cash available to buy points up front, in addition to your down payment, closing costs and reserves. Also, consider how long you plan to own the home.

Buying points to lower your rate may make sense if you select a fixed-rate mortgage and you plan on owning the home after youve reached the break-even period.

Under certain circumstances, buying mortgage points when you purchase a home can save you significant money over the course of your loan. But its important to understand how they work and how long it takes for the additional upfront cost to be worthwhile.

You May Like: Is 720 A Good Credit Score For Mortgage

Understanding The Different Lender Tier Options

With the newly imposed mortgage regulations taking a toll on Canadian mortgage borrowers, many have started looking towards alternative lenders. Following regulatory changes, mortgage brokers claim as much as a 20% uptick in rejection rates. This has created an opportunity for mortgage investment corporations, private lending options and credit unions to fill the gap that the primary lenders have left wide open.

It is unfortunate that some would be qualified borrowers prior to the regulatory measures have been shunned by the institutional banks. However, the stress test with alternative lenders is more lax and does not come with all the newly imposed stringent qualification procedures looking to cool the housing market.

Institutional lenders including the likes of CIBC, RBC, BMO, TD and Scotiabank are oftentimes referred to as A lenders. These are lenders that offer the lowest interest rates but with the most strings and qualification criteria attached including the newly imposed mortgage stress test.

Lending institutions that fall directly below these A lenders are known as B lenders. The barrier of entry for acquiring a mortgage through this channel is slightly lower. Meaning, the qualification procedure is not as stringent. If you have a lacking credit history for example, this is where a B lender would have some flexibility to accommodate your case.

Disadvantages Of A Mortgage

- Your risk losing your home. Because your house is collateral for the mortgage, the lender has the right to take your home if you stop making payments. If the lender takes your home in a foreclosure, youll also lose any money already paid up to that point.

- Your homes value could drop. Any property you purchase can lose value over time. If the real estate market drops and your home loses value, you could end up with a mortgage balance greater than the value of your house. This is called being underwater, and it can put you in a situation where you have to pay down the loan balance to sell your home since the loan balance is higher than your home is worth.

Recommended Reading: Can You Refinance Mortgage With Poor Credit

Advantages And Disadvantages Of Interest Only

advantages

They are considerably cheaper each month when compared to a repayment mortgage. As there is no fixed repayment structure you could make adhoc repayments during the term to gradually reduce the debt when money becomes available. Most landlords choose to have interest only buy to let mortgages as their income yield is greater.

disadvantages

The main disadvantage is that over the whole mortgage term you will pay more interest than a repayment mortgage. You also need to be quite disciplined to keep up with any investment savings that are needed to accrue for repayment and the end of the term.

How Does Interest On Payday Loans Work

You may have heard about payday loans and their unreasonably high interest rates. But how can these loans have rates that are so high?

A payday loan is a small, short-term loan used when money is needed immediately. Borrowers are expected to repay the loan when they receive their next paycheck. To encourage quick repayments, lenders will often use extremely high interest rates as service fees.

For example, apayday loan might be as low as $100 with repayment due in 2 weeks. If this loan carries a $15 fee, then the APR will be around 400%.

Unlike credit cards and mortgages, this fee is not repaid over the course of a year. Although $15 may not seem like much, it is a high interest rate compared to the $100 you initially borrowed.

How does $115 result in an approximate 400% APR rate?

$15 is 15% of the $100 borrowed. The APR is the annual percentage rate, so 15% must be multiplied by the number of days in a year:

.15 = 54.75

Divide the answer by the length of the loan .

54.75/14=3.910.

Move the decimal point to the right two places to get your APR. So a $15 charge for a 2-week loan of $100 means the APR is 391%.

Also Check: What Does It Mean Refinance Mortgage

How A Mortgage Works

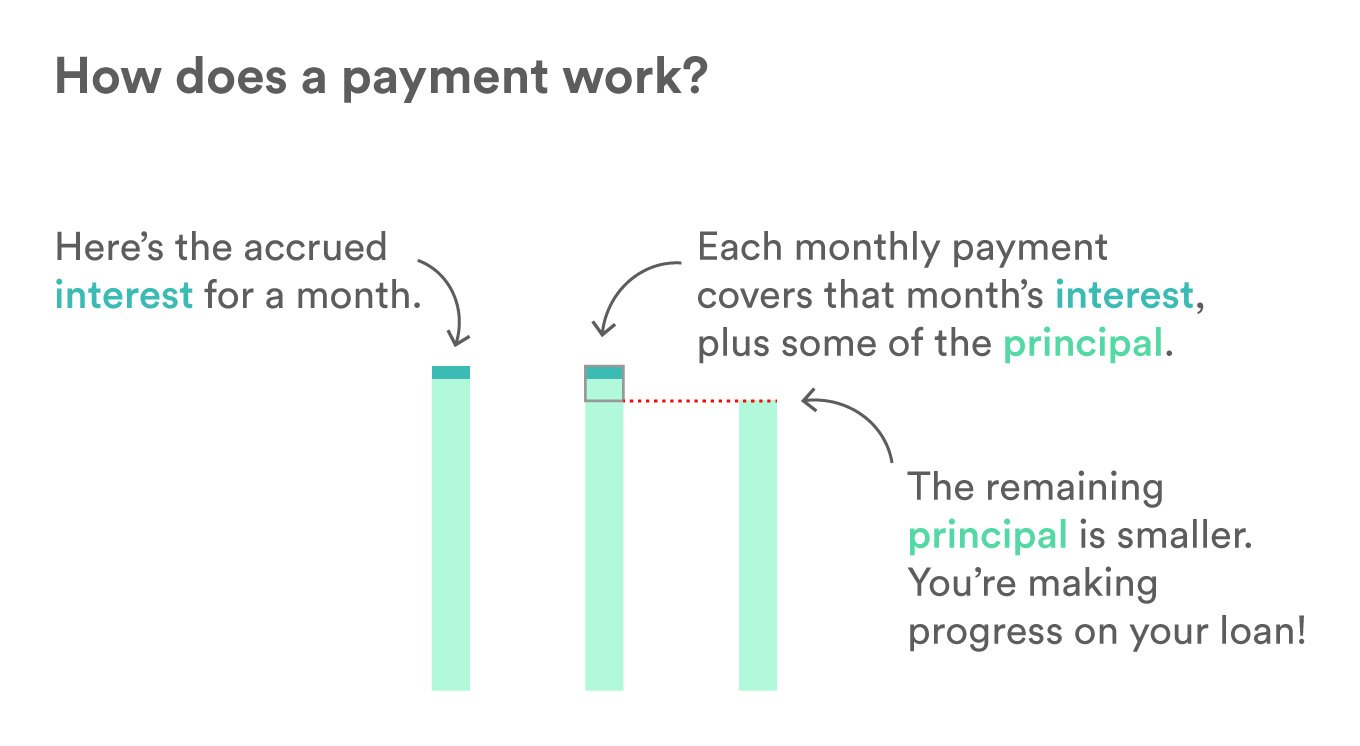

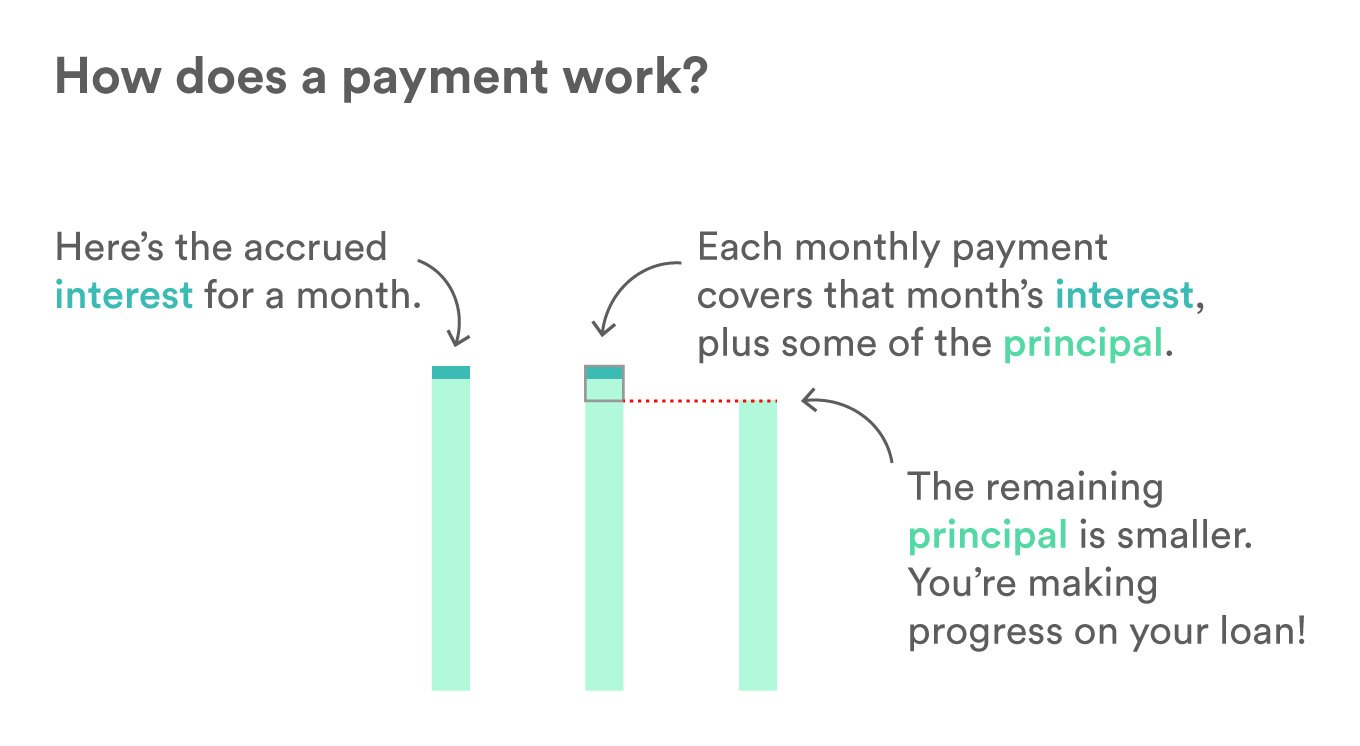

Every month you make a mortgage payment, it gets split into at least four different buckets that make up principal, interest, taxes and insurance or PITI for short. Here is how each bucket works:

In the early years of your mortgage, interest makes up a greater part of your overall payment, but as time goes on, you start paying more principal than interest until the loan is paid off.

Your lender will provide an amortization schedule . This schedule will show you how your loan balance drops over time, as well as how much principal youre paying versus interest.

THINGS YOU SHOULD KNOW

Mortgage lenders require an escrow account to collect your property taxes and homeowners insurance each month if you make less than a 20% down payment on your mortgage. Your lender uses the funds in an escrow account to pay your property tax bills and homeowners insurance premiums.

How Mortgages And Aprs Work

Once you begin your homebuying journey, it helps to understand how mortgages and annual percentage rates work. A mortgage APR reflects the total cost of borrowing and includes costs, like mortgage loan interest, mortgage points and other lender fees. The mortgage loan APR will usually be higher than the interest rate because it includes costs and fees, as well as interest. Knowing how to differentiate between mortgage interest rates and APRs can help you select the best loan for your needs.

Also Check: How Much Money Should You Spend On Mortgage

How Does Your Credit Score Affect Mortgage Interest Rates

Your credit score is an important indicator of how you’ve managed your debts in the past, so it’s a crucial factor in determining whether you qualify for a mortgage and what your interest rate will be.

Most mortgage lenders will have a minimum credit score requirement, which can vary by lender and the type of loan you’re applying for. Just because you have a high credit score, though, doesn’t mean you’re eligible for a low rate. Lenders will also review your credit report, debt-to-income ratio and several other pieces of information to calculate your rate.

Because your credit score is such an important factor in the mortgage process, it’s crucial to take steps to get your credit ready for a mortgage. Ways to do that include:

- Check your credit score to see where you stand and your credit report to determine if you need to address specific areas of your credit history.

- Pay down credit card balances and other debts.

- Avoid applying for credit in the months leading up to applying for a mortgage.

- Make it a priority to pay your bills on time every month.

- Dispute inaccurate information on your credit reports, if applicable.

Getting your credit ready for a mortgage can take time, but again, even a small reduction in your interest rate could save you thousands of dollars.

Are Nonconforming Loans Predatory

The short answer is no. There are many types of nonconforming loans: VA, FHA and jumbo mortgages to name a few. Many borrowers only qualify for an FHA or jumbo mortgage, so these arent inherently predatory when offered by a reputable lender.

The reason nonconforming loans sometimes get major side-eye is because they dont come with loan limits, while conforming loans do. Back in 2008 before the housing crash, lenders were underwriting loans of all sizes to borrowers who couldnt afford them. Post-2008, the Consumer Financial Protect Bureau now has rules in place to help protect consumers from irresponsible mortgage lending practices and to ensure homeowners dont borrow more than they can reasonably afford to repay in a lifetime.

Recommended Reading: Who Is Rocket Mortgage Owned By

How Does Mortgage Interest Work

Mortgage interest rates are a crucial determinant of whether a renter takes the leap into homeownership. Lenders will typically finance up to 80% of the buying price. It is important to understand how mortgage interest works and what goes into your monthly mortgage payments before you sign up.

Key Things To Know About Mortgage Points

The terms around buying points can vary greatly from lender to lender. Here are some important things to consider:

- The interest rate reduction you receive for buying points is not set and depends on the lender and the marketplace.

- Buying points may give you a tax benefit. Contact a tax professional to see whether doing so might affect your tax situation.

- Points for adjustable-rate mortgages typically provide a discount on the loans interest rate only during the initial fixed-rate period. Run the numbers to ensure that your break-even point occurs well before the fixed-rate period expires. For Bank of America customers, however, if rates go up during the adjustable period, your rate will be lower based on the points you initially purchased.

- If you need to decide between making a 20 percent down payment and buying points, make sure you run the numbers. If you make a lower down payment, you may be required to carry private mortgage insurance . Check to see if this additional cost would cancel out the benefit youd get from buying points and lowering your interest rate. The Affordable Loan Solution® mortgage from Bank of America can help eligible low- and moderate-income borrowers secure a home loan with a down payment as low as 3 percent and no PMI required.1

Read Also: What Information Do You Need To Prequalify For A Mortgage