How To Calculate Debt To Income Ratio

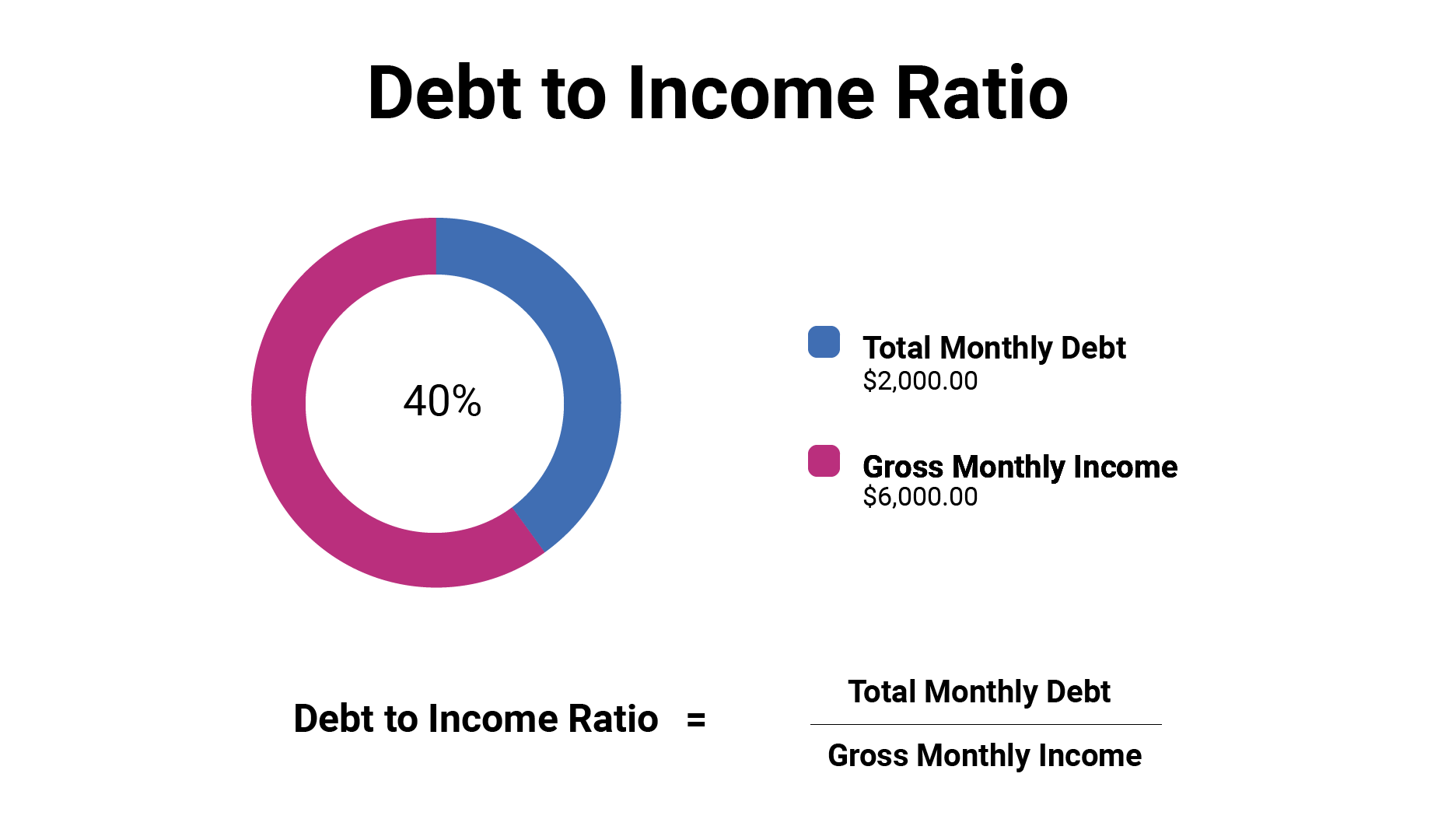

Okay easy enough, but your ratio is likely not as clear-cut as half your income . How do you calculate your exact DTI? Theres math involved, but thankfully its pretty basic .

Simply divide all your monthly debt payments by your gross income, and then multiply that number by 100. This will give you your DTI percentage.

In some cases, what constitutes income and debts is clear-cut. In other cases, not so much. Generally, lenders follow these guidelines for what to include for each.

Debt includes:

-

Minimum required credit card payments

Income includes:

-

Income from additional jobs or side hustles

-

Revenue from rental property or other investments

-

Regular income from annuities, trust funds, and retirement accounts

-

Any child support or alimony payments you receive

Lets look at a real-world example:

Auto loan: $350 per monthStudent loans: $220 per monthCredit cards: $130 minimum monthly paymentExpected housing costs: $1,800 per month= $2,500 monthly debt obligation

Monthly salary: 5,000 Monthly side-gig income: $1,500

x 100 = 38% DTI

The above scenario is for illustrative purposes only.

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

You May Like: Can You Get Extra Money On Your Mortgage For Furniture

How To Calculate Your Debt

To calculate your debt-to-income ratio, add up your recurring monthly debt obligations, such as your minimum credit card payments, student loan payments, car payments, housing payments , child support, alimony and personal loan payments. Divide this number by your monthly pre-tax income. When a lender calculates your debt-to-income ratio, it will look at your present debt and your future debt that includes your potential mortgage debt burden.

The debt-to-income ratio gives lenders an idea of how youre managing your debt. It also allows them to predict whether youll be able to pay your mortgage bills. Typically, no single monthly debt should be greater than 28% of your monthly income. And when all of your debt payments are combined, they should not be greater than 36%. However, as we stated earlier, you could get a mortgage with a higher debt-to-income ratio .

Its important to note that debt-to-income ratios dont include your living expenses. So things like car insurance payments, entertainment expenses and the cost of groceries are not included in the ratio. If your living expenses combined with new mortgage payments exceed your take-home pay, youll need to cut or trim the living costs that arent fixed, e.g., restaurants and vacations.

Having A Good Dti Isnt Too Hard

Your debt-to-income ratio is one of the most important factors in qualifying for a mortgage.

DTI determines whether youre eligible for the type of mortgage you want. It also determines how much house you can afford. So naturally you want your DTI to look good to a lender.

Luckily, thats not too hard. Todays mortgage programs are flexible, and a wide range of debt-to-income ratios fall in or near the good category. So theres a good chance you can get approved as long as your debts are manageable.

In this article

Recommended Reading: What Are Mr Cooper Mortgage Rates

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Read Also: When Will My Chapter 7 Bankruptcy Be Discharged

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

Recommended Reading: What Are Basis Points In Mortgage

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt ratio means.

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

Recommended Reading: Can You Consolidate Your Debt Into Your Mortgage

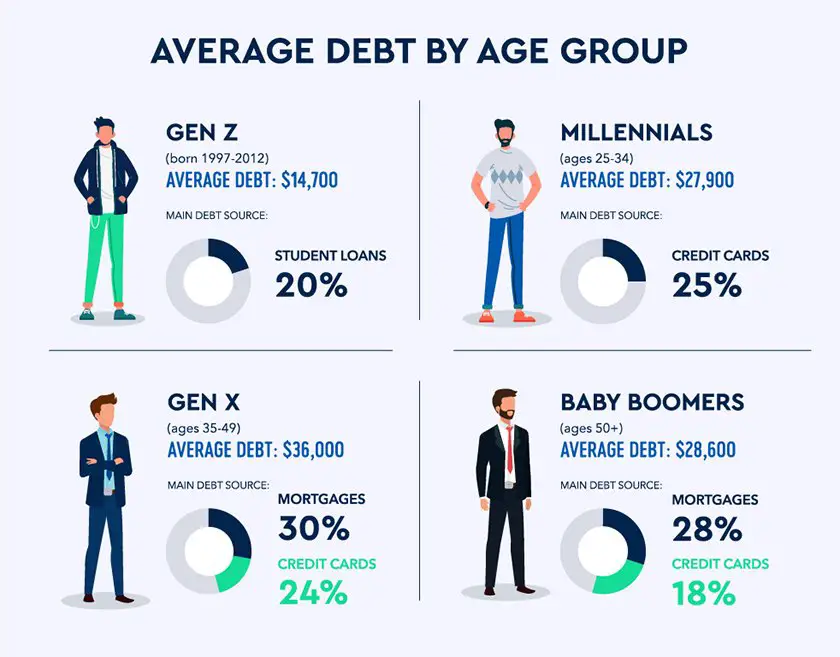

How Much Debt Does The Average 50 Year Old Have

50 years or older = $96,984 Baby boomers have an average debt of $96,984, according to Experian. Mortgages, credit card bills, and auto loans are the three main debt sources for those in this age group. Although this is less than the average debt of those 3549, it could still spell trouble for two primary reasons.

Divide That Total By Your Gross Monthly Income

Once you have an idea of what your monthly debt total is, divide it by your gross monthly income to determine your DTI ratio. Your gross monthly income is the amount of money you make each month before taxes. You can usually find your gross income on your paystubs or you can calculate it.

If you are a salaried employee, you can divide your yearly salary by 12 to find your gross monthly income. If you are paid hourly, multiply your hourly rate by the number of hours you work in a week and then multiply that number by 52 to get your yearly income, which you can divide by 12 to get your monthly gross income.

Once you know your monthly gross income, you should be able to use it to find your DTI. If you make $4,000 a month as your gross income and your total debts amount to $1,200, the formula to calculate your DTI would look like this:

= 0.3, or 30%

Also Check: Can You Refinance A Mortgage More Than Once

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

Recommended Reading: How Does The Interest Work On A Mortgage

What Is A Debt

Your debt-to-income ratio tells you how affordable your debt repayment is. It can help you decide if you have too much debt or if you can manage your debt payments comfortably.

To calculate your debt-to-income ratio, add up all your monthly debt payments, and divide this by your monthly gross income. To express your ratio in percentage form, multiply it by 100.

As a formula: DTI = monthly debt payments ÷ monthly gross income x 100

Lets use the 2018 average Canadian total income of $4,000 a month as an example. Lets also say that your overall total monthly debt commitment is $1,800.

Doing the math, that would be $1,800 divided by $4,000, with the result being 0.45. Now, multiply that 0.45 by 100 . The final answer, which is 45%, is your debt-to-income ratio.

To calculate the share of your income consumed by debt repayment, try our easy-to-use debt-to-income ratio calculator.

What If My Debt

What happens if my debt-to-income ratio is too high? Borrowers with a higher DTI will have difficulty getting approved for a home loan. Lenders want to know that you can afford your monthly mortgage payments, and having too much debt can be a sign that you might miss a payment or default on the loan.

Recommended Reading: What Is Needed To Refinance A Mortgage

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyoure applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If youre new to building credit

- If youve had financial problems in the past like a bankruptcy or foreclosure

- If youre taking out ajumbo loan

Dont Miss: How Long Does Chapter 7 Bankruptcy Affect Your Credit Score

Fannie Mae 97 Ltv Conventional Loans For First

For borrowers who had ownership of a home in the past three years, Fannie Mae and Freddie Mac require a 5% down payment on a home purchase. HUD requires a minimum 580 credit score to qualify for a 3.5% down payment home purchase FHA loan. Homebuyers can qualify for FHA loans with credit scores down to 500 FICO. However, if you have under 580 credit scores and are down to a 500 FICO, HUD requires a 10% down payment. VA loans and USDA loans do not require any down payment on a home purchase. The down payment on a home purchase can be gifted.

You May Like: What Is Your Credit Score After You File Bankruptcy

Recommended Reading: What Is The Rate For A 15 Year Mortgage

What If Your Debt

Some lenders are more flexible than others. Some lenders refinance if you have a higher debt-to-income ratio when you agree to use your lump sum from a cash-out refinance to pay down debts. The lender will require proof that youve paid down the debts.

The simplest way to negotiate with a debt-to-income ratio thats higher than your lender prefers is to lower the ratio. Lenders are more concerned with how much debt you pay each month than how much total debt you owe. You can also extend the loan term for smaller loans, negotiate lower monthly minimum payments, or pay off smaller debts like credit cards and personal loans to bring your ratio to a more reasonable level. With the exception of paying things off, these actions reduce your monthly debt even though you still owe the same amount of money.

Debt-to-income ratios serve as a protection for consumers just as much as they do for mortgage lenders. Carefully weigh the advantages and disadvantages of altering your debt-to-income ratio to qualify for a refinance. Even with a lower ratio, the refinance may be unaffordable. Extending other loan terms to qualify for refinancing can result in large long-term interest payments.

Qualifying Rate For Debt

- Pay attention to the qualifying rate used by the lender

- Which could differ from the note rate on the loan

- If you apply for an adjustable-rate mortgage

- You might be required to qualify at a higher interest rate to account for future rate adjustments

One important thing to keep in mind is the qualifying rate banks and mortgage lenders use to come up with your debt-to-income ratio.

Many borrowers may think that their start rate or minimum payment is their qualifying rate, but most banks and lenders will always qualify the borrower at a higher interest rate to ensure the borrower can handle a larger amount of debt in the future assuming payments rise.

For example, a borrower may be in an adjustable-rate mortgage with a monthly payment of only $1,000, but their fully-indexed payment could quite a bit higher, say $1,500, after the fixed period ends.

For a bank or lender to effectively gauge the borrowers ability to handle debt, especially once the minimum payment is no longer available for the borrower, the lender must qualify the borrower at the higher of the two payments.

This gives the lender security and prevents under-qualified borrowers from getting their hands on mortgages they cant really afford.

Borrowers should also note that most debt cannot be paid off to qualify. If you have debt on credit cards or other revolving accounts and plan to pay them off with your new loan, the monthly payments will likely still be factored into your DTI.

Don’t Miss: How Much Of Your Income Should Go To Your Mortgage

Lets Look At A Basic Example Of The Debt

- Annual gross income : $120,000

- Monthly gross income: $10,000

- 35% debt-to-income ratio

In this example, your debt-to-income ratio would be 35% . Pretty simple, right?

Well, before you think youre done calculating your DTI, you should know that the debt-to-income ratio goes into greater detail and comes up with two separate percentages.

One for all of your monthly liabilities divided by your gross monthly income , and one for just your proposed monthly housing expense divided by income .

What Income To Include

Once youve added up all your debt payments, you need to divide them by your monthly gross income . This is the total amount of money you make every month before taxes.

Your gross income is different from your take-home pay or net income, which have taxes deducted. Gross income also still includes the amount that youd pay towards any employment insurance, Canada Pension Plan , and any benefit deductions by your employer.

Include all income sources, including employment income, pension income, government benefits, student grants, support payments received, etc.

Self-employed contractors should include gross income less business operating costs but before any personal taxes.

If your income is variable, take your annual income and divide by twelve. Estimate on the low side, excluding any bonuses or commissions you may not earn.

Also Check: What Is The Monthly Payment On A 50000 Mortgage

What Is An Ideal Debt

Quick Answer

In this article:

Lenders have different definitions of the ideal debt-to-income ratio the portion of your gross monthly income used to pay debtsbut all agree that a lower DTI is better, and a DTI that’s too high can tank a loan application.

Lenders use DTI to measure your ability to take on additional debt and still keep up with all your paymentsespecially those on the loan they’re considering offering you. Knowing your DTI ratio and what it means to lenders can help you understand what types of loans you are most likely to qualify for.

Add Fixed Monthly Debts

The first step in calculating the debt-to-income ratio is adding up all your existing monthly debt obligations. These expenses may include:

- Student loan payment

- Existing rent or house payment

- Monthly alimony or child support payments

- Wage garnishments or installment payments on back taxes.

Take how much you pay each month for each of these items and add them all together. This is how much you pay each month in debt.

Don’t Miss: Can You Mortgage A Boat