Tips For Buying A Home

In order to help ensure that you can afford your home and maintain it over time, there are some smart measures you can take. First, save up a cash reserve in excess of your down payment and keep it in reserve in case you lose your job or are unable to earn income. Having several months of mortgage payments in emergency savings lets you keep the house while looking for new work.

You should also look for ways to save on your mortgage payments. While a 15-year mortgage will cost you less over the loan’s life, a 30-year mortgage will feature lower monthly payments, which may make it easier to afford month-to-month. Certain loan programs also offer reduced or zero down payment options such as VA loans for veterans or USDA loans for rural properties.

Finally, don’t buy a bigger house than you can afford. Do you really need that extra room or finished basement? Does it need to be in this particular neighborhood? If you are willing to compromise a bit on things like this, you can often score lower home prices.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

The Annual Salary Rule

The ideal mortgage size should be no more than three times your annual salary, says Reyes.

So if you make $60,000 per year, you should think twice before taking out a mortgage that’s more than $180,000. However, if you have a partner, and your combined income is $120,000, you can comfortably increase your loan amount to $360,000.

That’s not to say you should always opt for the most expensive mortgage you can qualify for. If you settle on something below your max, you’ll have more wiggle room to put money into a savings account or pay for other costs like home renovations.

Also Check: How Much Should You Borrow For A Mortgage

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

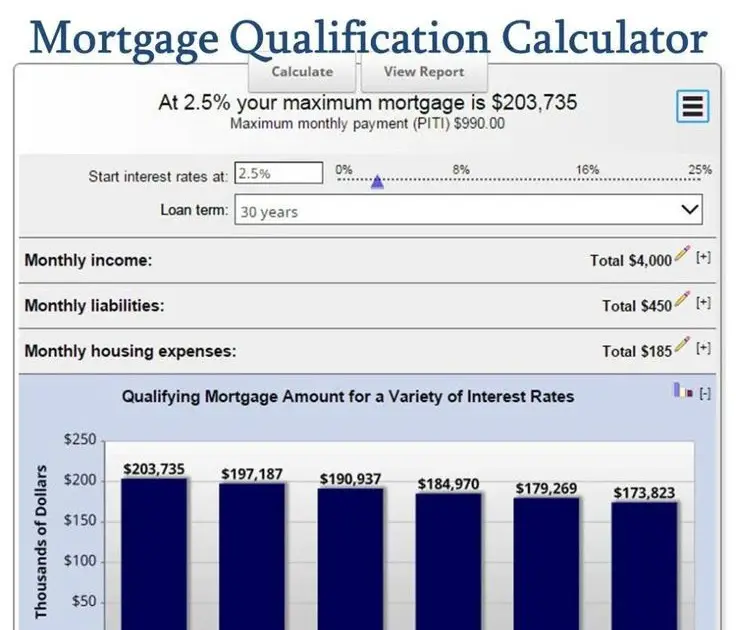

How Much House Can I Afford Home Affordability Calculator

To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment.

Generally, lenders cap the maximum amount of monthly gross income you can use toward the loans principal and interest payment to not more than 28% of your gross monthly income and traditionally limit your total allowable debt-to-income ratio to not more than 36%. This final figure includes the mortgage loans principal and interest payments, plus taxes, insurance and any other debts you are required to repay.

Prequalifying for a mortgage is simple, and is intended to give you a working idea of how much mortgage you can afford. Combine this amount with your down payment, and you’ll answer your question of how much house can I afford? This is not the same as being preapproved for a mortgage loan, which involves borrowers placing an application and providing documentation to a lender, who will formally evaluate your financial situation.

Remember — this is just a guide. Your final amount will vary depending on a number of factors, especially interest rate, which will be based on your credit score. When you’re ready, a lender can give you a more precise figure.

Don’t Miss: Can I Afford Two Mortgages Calculator

Help To Buy Equity Loan

The equity loan scheme finances the purchase of newly built houses. You can borrow a minimum of 5% and a maximum of 20% of the propertys full price. As a requirement, you must make a 5% deposit and obtain a mortgage to shoulder 75% of the loan. The house must also be bought from a builder recognized by the program. As an advantage, interest is not charged during the first 5 years of the equity loan. For more information on this government scheme, visit the Help to Buy equity loan page.

How Can I Get Assistance Buying A Home

There are quite a few opportunities to get financial assistance with buying a home. If its your first time or if you havent owned a home in the last three years start by exploring the first-time homebuyer loans and programs that cater to your state or city. There are also grant programs, many of which are tailored to help low- and moderate-income borrowers with money that does not have to be paid back. Additionally, you might be able to get assistance based on your line of work. For example, teachers and emergency service workers, like police officers and firefighters, can qualify for the Good Neighbor Next Door program, which lets qualifying individuals buy HUD-approved properties for 50 percent off their purchase price.

Don’t Miss: Can You Use A Mortgage To Build A House

What Salary Do You Need To Buy A $400000 House

Now lets take what weve learned and put it into an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment. Or if you already own a home, make sure you have enough equity to pay off your current mortgage and cover your down payment when you sell it.

With a 15-year mortgage at a 5% interest rate, your monthly payment would be around $2,500 . To cover that payment, youd need to earn a monthly take-home pay of at least $10,000 .

So, to buy a $400,000 home, your annual take-home salary would have to be more than $120,000 . But youd actually need more than that after adding in the cost of property taxes and home insurance.

If that doesnt sound like you, dont worry. You have a few options. You could save a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

Should I Wait To Buy A New Home

If you dont qualify for the rates youd like, have enough income to buy the type of house you want or have enough saved up for a large down payment, you face a tough decision: You can go ahead and buy a home now, or wait until you can more easily afford the home youd prefer.

There are pros and cons to each option. If you wait, you may be able to get a better interest rate later, which could save you thousands of dollars in the long run. And buying a home means assuming the risk that the propertys value could fall, or that it might need expensive repairs sometime down the line. If you postpone a home purchase, you can put off those risks until youre in a better financial position.

On the other hand, if you wait to buy a home, you wont start building equity. Because building equity can grow your net worth and give you better borrowing options, you may be better off if you begin that process sooner rather than later.

If you cant afford to buy a home with a conventional loan, you might benefit from one of these government loan programs designed to make home ownership more accessible.

Read Also: What Does A Mortgage Application Look Like

Assessing Your Mortgage Eligibility

After the 2008 UK financial crisis, lenders began employing strict measures before approving mortgages. By 2014, the Financial Conduct Authority required lenders to perform thorough affordability assessments before granting loans. The evaluation considers your personal and living expenses, as well as the level of monthly payments you can afford. It includes a stress test which simulates how consistently you can pay your mortgage under drastic financial changes. To determine the loan amount, lenders specifically consider your credit score and history, debt-to-income ratio , size of the deposit, and the price of the property you are buying.

Expect lenders to scrutinise your employment records, how long youve held your current job, and your present address. They also check the length and history of your bank accounts, together with other debt obligations you must fulfil. To do this, they review your also known as your credit report, which is used to determine your credit score. This gives insight into your ability to make mortgage payments. Ultimately, your records must prove youre a reliable debtor who always pays on time.

Mortgage Affordability Assessment Factors

To prepare for your mortgage application, be sure to gather the following documents:

If you are self-employed, expect lenders to ask for additional documentation. They require proof of income, such as a statement from your accountant covering 2 to 3 years of your accounts.

| Income |

|---|

| £211,600 | £306,600 |

What Other Costs Could Be Added To A Mortgage Payment

While the principal and interest will make up the bulk of your monthly mortgage payment, other costs can increase the overall payment amount.

- Private mortgage insurance : If your down payment is less than 20% of the home purchase price, your conventional mortgage lender may require you to buy private mortgage insurance a type of insurance policy that helps secure the lender if a homeowner stops making their monthly house payments. While you can typically have it removed once you reach 20% equity, it will still drive up your mortgage payments at first.

- Property taxes: It is common to have your property tax bundled with your monthly mortgage payment. Those payments typically go into an escrow account and are automatically released when the bill is due. Even if your property tax isn’t bundled, it is still a new cost to account for on a monthly basis.

Recommended Reading: How Long Does Refinancing A Mortgage Take

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Also Check: Rocket Mortgage Launchpad

Oh Perfect That Was Easy Off To Go Take Out A Mortgage Now Bye

Woah, slow down! Were just getting started here. Remember? We said this was supposed to be painful, laborious and even depressing. Lets continue:

There are two things that you need to consider when figuring out the answer to how much mortgage can I afford. First, theres how much debt you are willing to take on and the second is how much debt a lender is willing to extend to you. The former is definitely important but the latter is what were going to discuss here.

So we are trying to determine how much your lender thinks you can afford. After all, theyre the one taking the risk by loaning you the money. Theyre going to be very concerned about your job, how much money you make in a year, how much money you can put down up front, your credit score and more.

Your lender is going to take all your information and come up with two figures to guide them: your back-end ratio and your front-end ratio.

Read Also: When Does Mortgage Insurance End

Standard Variable Rate Mortgage

Each lender sets their own standard variable rate on a mortgage. This is the default interest rate they charge if you do not remortgage after a particular type of mortgage ends. This includes fixed-rate mortgages, tracker mortgages, and discount rate mortgages. SVRs typically have higher interest rates than other types of mortgages.

A variable interest rate rises or decreases based on the UK economy and fluctuations in the Bank of England base rate. If rates increase, you must be ready for higher monthly payments. However, the extra money you pay will go toward the interest instead of the capital . In effect, you wont be paying your mortgage more quickly. So be sure to remortgage if you do not want to take an SVR. Note that lenders may also adjust their interest rate any time, especially if the BoE announces a possible increase in the near future.

Ok So Theyve Got My Information And Done Some Math Now What

From there, the lender will determine what length of loan and interest rate they feel comfortable giving you. To figure this out, theyll take a look at your credit score, which ranges from 300 to 850 . As youd expect, the higher your credit score, the lower the interest rate youll generally get, though the amount of your down payment also gets factored in.

Its difficult to say what constitutes an ideal credit score for taking out a mortgage , but a number between 700 and 740 seems to be a good range. In general 620 is considered the lowest acceptable score that will get you the green light.

If your credit score isnt where you want it, it might be useful to try to boost your number a bit before applying for a mortgage. The difference between a 3-percent and 5-percent rate might not sound huge, but all that interest adds up over the 15 or 30 years of the loan to some pretty significant money.

Don’t Miss: What Is A Mortgage Modification Agreement

Percentage Of Income Toward Monthly Payment

While the 28% rule is a good starting guideline, there are other factors to think about. Lenders are legally obligated to learn about your assets, expenses and credit history before offering you a mortgage. How reliable your income is can also matter. If much of your earnings come from a source that varies from month to month, like commissions, a lender might not be willing to lend as much to you as it would to someone who earns a consistent salary.

Consider what you can comfortably afford to spend on a monthly basis without affecting other financial goals, such as saving for an emergency fund or investing toward retirement.

Bank Of England Limitations

In the wake of the 2008 – 2009 financial crisis the Bank of England implemented mortgage affordability testing rules which aimed to stop banks from offering risky loans where the borrower would be unable to repay the reversion rate on the loan if the rate increased by 3%.

In June of 2022 the Bank of England pressed ahead with plans to scrap this mortgage affordability test, though borrowers who are stretched should consider what happens to their finances if rates rise.

Also Check: What Would My Mortgage Rate Be

How Does The Amount Of My Down Payment Impact How Much House I Can Afford

The down payment is an essential component of affordability. For example, if we include down payment on that $70,000 annual salary, your home budget shrinks to $275,000 with a down payment of 10 percent . By making a larger down payment, you would reduce the loan-to-value ratio, which makes a difference in how your lender looks at you in terms of risk.

Bankrates mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And dont forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, youll need to pay for private mortgage insurance, or PMI.

% Down Is Great But Not A Requirement

Thereâs a general perception that you have to put 20% down to get a mortgage. Thatâs just not true. There are many mortgage options with low or no down payment requirements.

Depending on the type of loan you choose and the amount of your down payment, you may be required to pay private mortgage insurance . PMI protects the lender against any loss if you fail to pay your mortgage. In some instances, mortgage insurance is required for the life of the loan. Other times, itâs only required until the loan is paid down to a certain percentage of the original amount. Mortgage insurance is known for its bad rap, but itâs not always the enemy. The benefit to you is that it allows you put less than 20% down.

Consider your options. Gifts or loans from relatives and programs like an 80/10/10 âcombinationâ loan can help you avoid PMI. 80/10/10 loans consist of a first mortgage and a second mortgage that total 90% of the purchase price, and a 10% down payment. These loans allow you to put just 10% down while helping you avoid the mortgage insurance payments typically associated with conventional loans with down payments of less than 20%. Our down payment calculator can help you to understand the costs and benefits of different down payment amounts so you can decide what makes the most sense for you.

Read Also: How Much Loan Can I Afford Mortgage