Determining The Best Mortgage

Once you have a good idea of what your mortgage payments look like, try using the best Canadian mortgage rates to see how much you can save. Also explore our Mortgage Guides to learn more about mortgage payments and everything else you need to know when it comes to choosing the ultimate mortgage.

*Mortgage payment calculator disclaimer:

The mortgage payment calculator is intended to help you compare different mortgage options and understand your expected payment schedule. However, the mortgage payment calculation should not be used in isolation to influence your mortgage decision-making. Be sure to consult with a mortgage broker or lender about the various mortgage financing and payment options you can take advantage of. We’ll be happy to connect you with a licensed mortgage advisor. The best bet is to first start with analyzing different mortgages, which youcan do on RATESDOTCAhere.

How Do You Lower Your Interest Expense

These are the most common ways to lower your interest costs. Some of these methods are similar to above and some are the exact opposite:

- Lower the purchase price

- Make a larger down payment

- Find a lower interest rate

- Reduce the amortization

- Choose accelerated payments

- Make lump-sum prepayments

Things that save you interest generally lower your amortization, resulting in you paying off your mortgage sooner.

What Kinds Of Mortgages Are There

There are many kinds of mortgages available and a lot of jargon that comes with them. Here are six:

- Conventional loans are the most popular. Consumers with generally above 680 face fewer fees and less restrictive terms to qualify. These sorts of loans aren’t covered by the federal government. You’ll need at least 3% down. Lenders also require a monthly private mortgage insurance premium if your down payment is lower than 20%. They can be conforming or non-conforming .

- Conforming loans. These loans, such as a typical 30-year fixed rate mortgage, adhere to standards set by Government Sponsored Entities called Fannie Mae and Freddie Mac. In 2022, the baseline conforming loan limit is $647,000 but varies by state and county. Fannie Mae and Freddie Mac don’t directly lend to borrowers. Rather, they buy mortgages from lenders, including banks. They were set up in the decades following the Great Depression to spur home ownership and help build wealth. So lenders follow their guidelinesfor conforming loans. You can explore your loan qualifications easily by answering a few short questions.

Recommended Reading: How Much Income To Qualify For 200 000 Mortgage

How Lenders Decide How Much You Can Afford To Borrow

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

How Banks & Mortgage Lenders Determine Their Mortgage Rates

Mortgage rates in Canada are determined by a range of factors.

On one hand, external economic forces have considerable effect, on the other, the profile of the mortgage applicant is significant.

External factors include:

| 7.7% | 7.5% |

*All rates presented in this table are the most typical of those offered by the six major Canadian chartered banks in the beginning of each year.

Recommended Reading: Who Has The Best Mortgage Loan Rates

Don’t Forget Taxes Insurance And Other Costs

If you’re buying a home, you’ll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time. Your lender will itemize any additional costs as part of your mortgage agreement and recalculate them periodically.

Total Interest Paid On A $300000 Mortgage

Youll always pay more interest on longer-term loans. So, for example, a 30-year loan would cost more in the long haul than a 15-year one would .

With a 30-year, $300,000 loan at a 3% interest rate, youd pay $155,332.34 in total interest, and on a 15-year loan with the same rate, itd be $72,914.08 a whopping $82,418 less.

Use the below calculator to see how much interest youll pay, as well as what your home will cost you every month.

Enter your loan information to calculate how much you could pay

| $0.00 |

Recommended Reading: How Accurate Are Mortgage Calculators

Summary Of Current Mortgage Rates

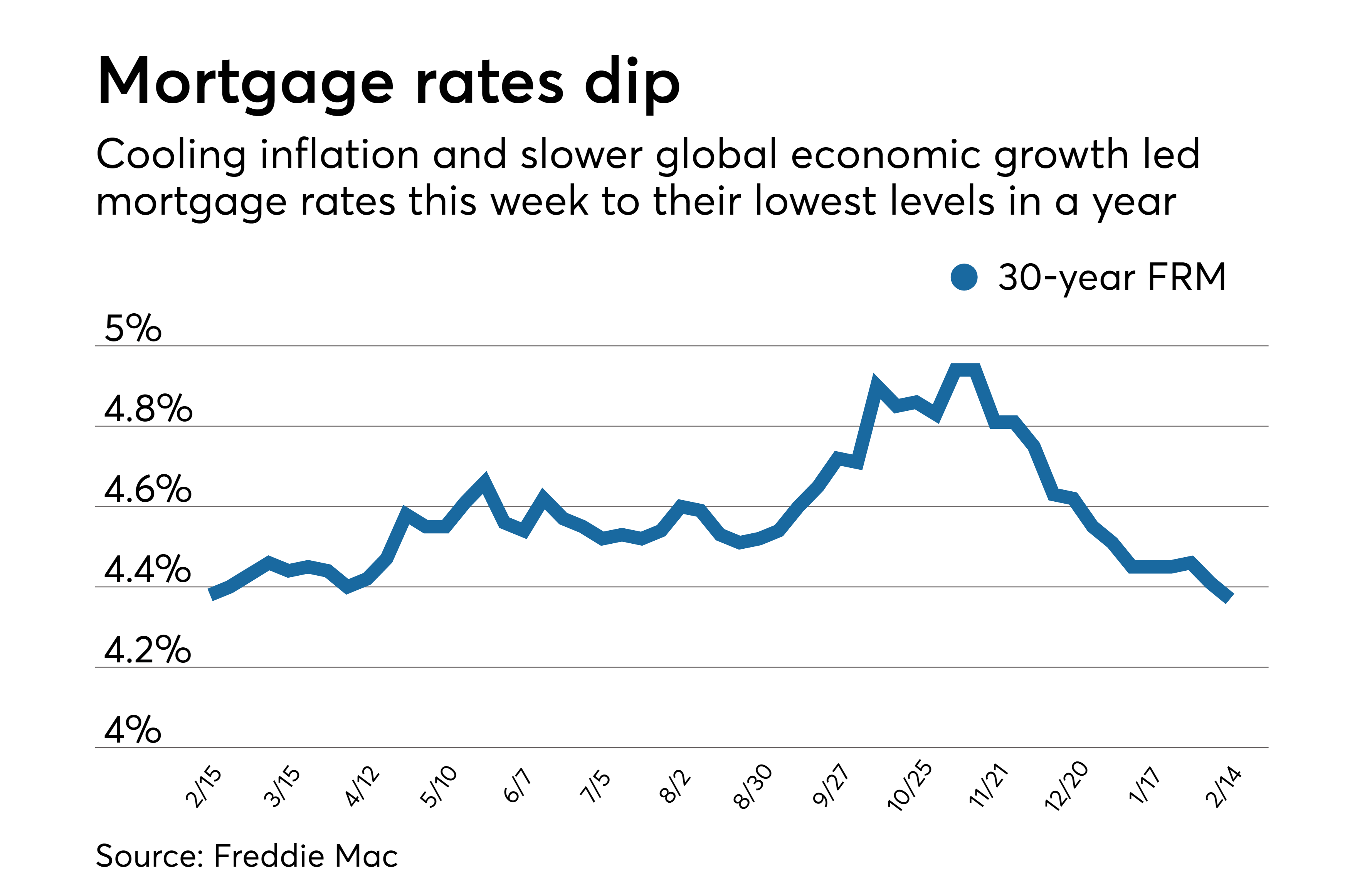

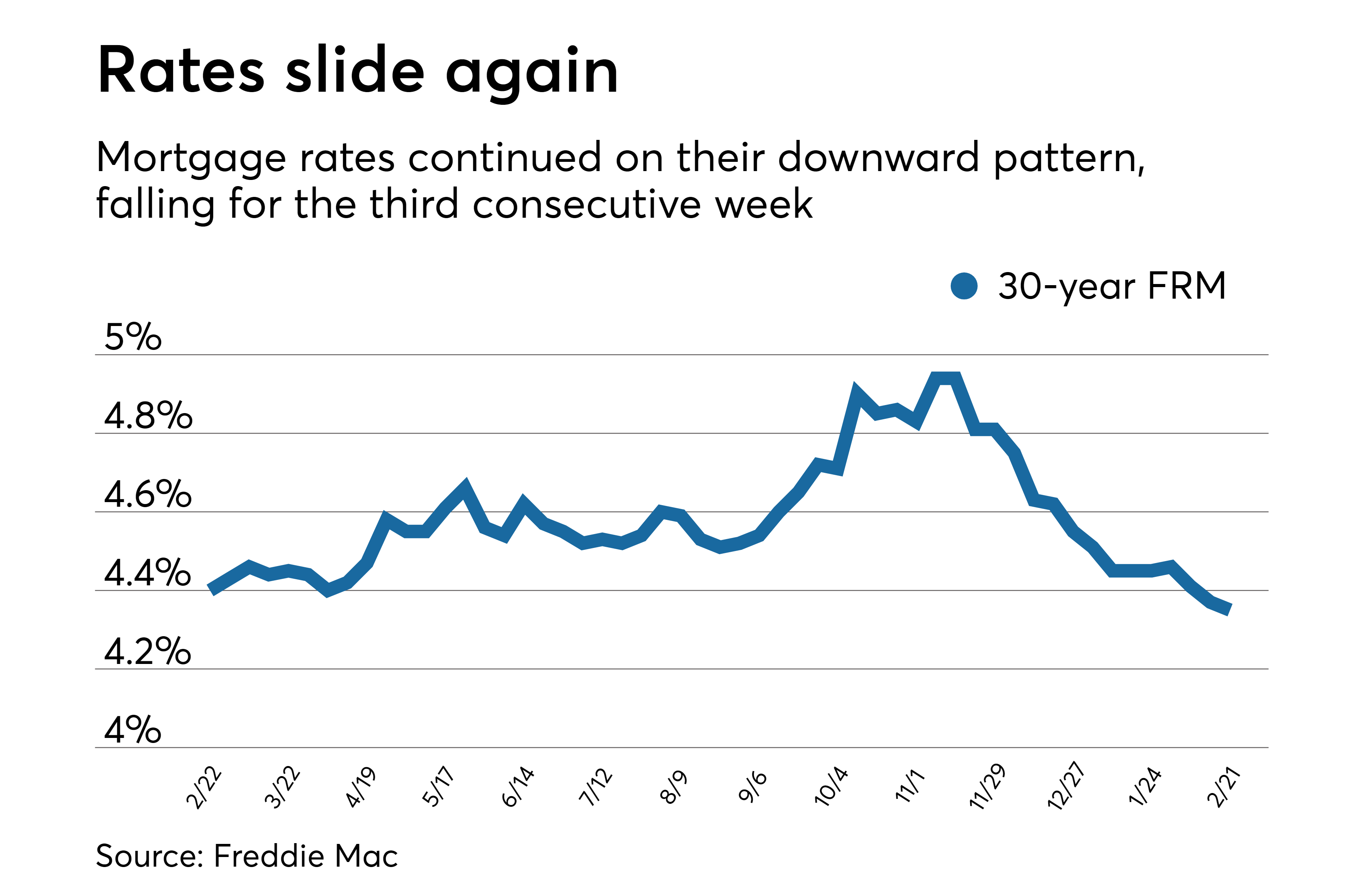

Average mortgage rates are lower this week

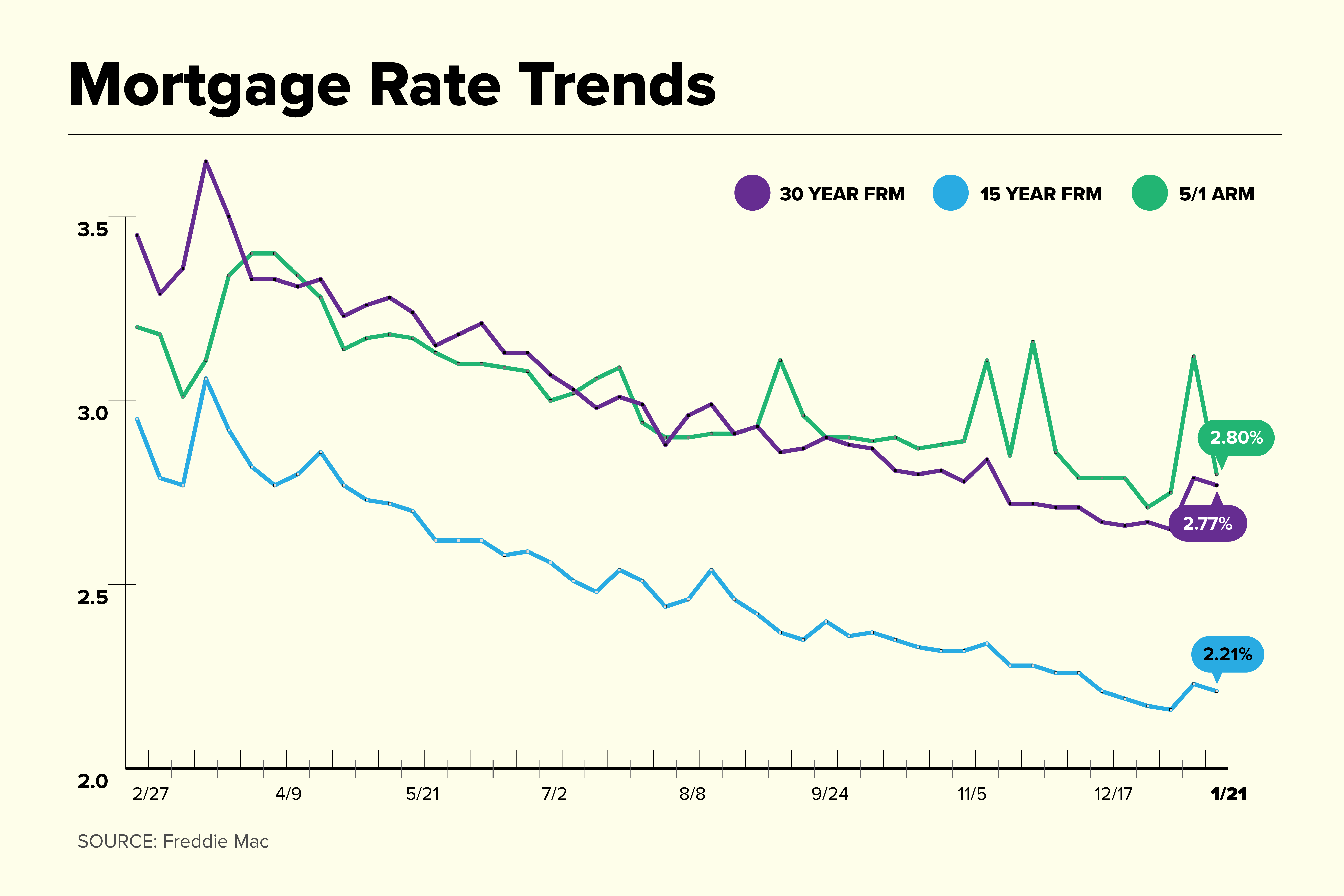

- The current rate for a 30-year fixed-rate mortgage is 4.99% with 0.8 points paid, down 0.31 percentage points from a week ago. The 30-year rate averaged 2.77% this week last year.

- The current rate for a 15-year fixed-rate mortgage is 4.26% with 0.6 points paid, a decrease of 0.32% percentage points week-over-week. A year ago, the 15-year rate averaged 2.10%.

- The current rate on a 5/1 adjustable-rate mortgage is 4.25% with 0.3 points paid, 0.04 percentage points higher/lower compared to last week. The average rate on a 5/1 ARM was 2.4% a year ago.

- Categories

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Also Check: What To Look For Mortgage Loan

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Don’t Miss: Can I Add Someone To My Mortgage Without Refinancing

How Much Interest Can Cost

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

Are The Lowest Mortgage Rates Usually Online

For the last few years, the best rates in Canada have usually been found online. Thats because internet-based lenders have been more competitive and often accept smaller profit margins. Even big banks are now joining the bandwagon with special pricing for online mortgage shoppers. RATESDOTCA tracks dozens of lenders and aggregates the best deals all in one place.

Also Check: Is A Home Loan A Mortgage

What Is The Breakeven Point

To calculate the breakeven point at which this borrower will recover what was spent on prepaid interest, divide the cost of the mortgage points by the amount the reduced rate saves each month:

$4,000 / $56 = 71 months

This shows that the borrower would have to stay in the home 71 months, or almost six years, to recover the cost of the discount points.

The added cost of mortgage points to lower your interest rate makes sense if you plan to keep the home for a long period of time, says Jackie Boies, a senior director of Partner Relations for Money Management International, a nonprofit debt counseling organization based in Sugar Land, Texas. If not, the likelihood of recouping this cost is slim.

You can use Bankrates mortgage points calculator and amortization calculator to figure out whether buying mortgage points will save you money.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Also Check: Can You Write Off Mortgage Interest

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

What Factors Affect Monthly Mortgage Payments

Many factors make up your monthly mortgage payment. They include general economic conditions , your credit rating, length of your loan, income, down payment, savings and other accounts, debts, and the kind of loan you seek.

Lenders will ask you to fill out a uniform loan application in addition to financial documentation including proof of income, tax and W-2 records, bank and investment statements, and other assets.

Recommended Reading: How Much It Costs To Refinance A Mortgage

Meet The Mortgage Payment Calculator

This mortgage payment calculator will estimate exactly that. You can set everything from your amortization and payment frequency to extra payments. The calculator then determines your monthly mortgage payment and provides an amortization schedule showing how fast it will take to whittle down your principal.

How Do I Get The Best Mortgage Rate

To get the best mortgage interest rate for your situation, its best to shop around with multiple lenders.

According to research from the Consumer Financial Protection Bureau , almost half of consumers do not compare quotes when shopping for a home loan, which means losing out on substantial savings.

Interest rates help determine your monthly mortgage payment as well as the total amount of interest youll pay over the life of the loan. While it may not seem like much, even a half of a percentage point increase can amount to a significant amount of money.

Comparing quotes from three to four lenders ensures that youre getting the most competitive mortgage rate for you. And, if lenders know youre shopping around, they may even be more willing to waive certain fees or offer better terms for some buyers. Either way, you reap the benefits.

Also Check: What Is The Usual Mortgage Interest Rate

How To Calculate Your Mortgage Payments

The calculus behind mortgage payments is complicated, but Bankrate’s Mortgage Calculator makes this math problem quick and easy.

First, next to the space labeled “Home price,” enter the price or the current value of your home .

In the “Down payment” section, type in the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. You can enter either a dollar amount or the percentage of the purchase price you’re putting down.

Next, you’ll see Length of loan. Choose the term usually 30 years, but maybe 20, 15 or 10 and our calculator adjusts the repayment schedule.

Finally, in the “Interest rate” box, enter the rate you expect to pay. Our calculator defaults to the current average rate, but you can adjust the percentage. Your rate will vary depending on whether youre buying or refinancing.

As you enter these figures, a new amount for principal and interest will appear to the right. Bankrate’s calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts or even ignore them as you’re shopping for a loan those costs might be rolled into your escrow payment, but they don’t affect your principal and interest as you explore your options.

What Does A Potential Rate Hike Mean For Your Mortgage

A potential rate hike will affect you in different ways depending on if you’re a first-time homebuyer or if you already own.

For first-time homebuyers, any increase in interest rates will reduce how much home you can afford. That’s because your carrying costs will increase.

For example, let’s say you need a $500,000 mortgage and the interest rate is 3%. Your monthly payment would be $2,366 on a 25-year amortization. However, if the interest rate were 5%, your monthly payment would be $2,908. That would mean you would have to pay an additional $542 each month. Suppose rates went up to 6% or 7%, you’d be looking at monthly payments of $3,199 and $3,502, respectively.

Anyone renewing their mortgage in a rising interest rate environment might be shocked at what their new monthly payments could look like.

Current homeowners that have a variable rate mortgage could also be affected. At Scotiabank, you can either have a variable rate that will increase as BoC rates rise or you could have a variable rate with Cap Rate Protection.

A Cap Rate Protection mortgage has fixed payments for the term of the mortgage that are calculated based on a cap rate rather than the current variable rate as rates rise more of your payments would go towards interest, and less to the principal . However, if you have an adjustable variable rate, the amount you’re paying would increase as interest rates rise.

You May Like: Can You Mortgage A Boat

What Is A Mortgage Rate

A mortgage rate is the interest lenders charge on a mortgage. Mortgage rates come in two forms: fixed or variable.

Fixed rates never change for the life of your loan and in exchange for this certainty, the rate is higher on longer loans.

Variable-rate mortgages can have lower interest rates upfront, but fluctuate over the term of your loan based on broader economic factors. How frequently a variable-rate mortgage changes is based on the loans terms. For example, a 5/1 ARM would have a fixed rate for the first five years of the loan, then change every year after that.

Very Low Mortgage Rates

Fixed rates have risen significantly from the pandemic-induced record lows, and they are expected to continue rising. As mortgage rates rise, they reduce homebuying budgets.

The impact of early rate increases on homebuying budgets will be greater than the subsequent rate increases.

Prospective homebuyers can take advantage of this effect by getting a pre-approved mortgage 4 months before making a purchase. By the time they find a place they like, rates may have risen, and competing bidders who didnt get a pre-approved committed rate might be saddled with smaller homebuying budgets.

If your bank doesnt offer a 4-month rate guarantee with their pre-approval, then talk to a mortgage broker.

You May Like: What Is The Current Interest Rate For Interest Only Mortgages