How To Lock In A Mortgage Rate

In a rising rate environment, its important to lock your rate so you can take advantage of optimal interest rates. You can use Rocket Mortgage to lock your rate online. Heres how it works:

Rocket Mortgage is available 24/7, so you can lock your rate whenever you want.

Extending Mortgage Locks For New Construction

When you want to lock a rate for a new construction set to be built months from now, a 15-day lock wont give you peace of mind on your expected monthly payments. Thats why some lenders offer 180-day lock programs for new constructions.

Making the decision to go with a longer lock period is about weighing two things against each other:

|

The risk of rates increasing in the future |

The extra cost youll pay for a longer lock |

Talk to your lender about what whether or not you should purchase an extended lock for a new construction. Your mortgage adviser will consult with you to provide the best advice and options to protect you throughout the process.

What If I Lock My Interest Rate And Rates Go Down

When you lock your interest rate, you’re protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take advantage of a lower rate, you may be able to pay a fee and relock at the lower interest rate. This is called “repricing” your loan.

Note: If you’re using a Bond program, contact your home mortgage consultant to see if the bond program you’ve chosen allows you to modify your rate.

Also Check: What Are The Different Types Of Mortgages

Should I Lock My Mortgage Rate Today

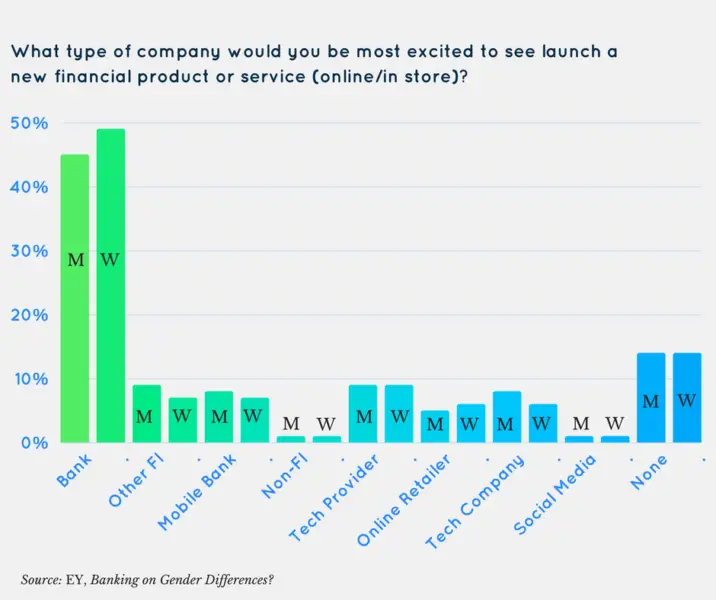

Explore todays mortgage rates for your area and credit score to get a benchmark for your mortgage rate, and ask your loan officer for input about where rates are headed.

Locking in the rate today makes sense if:

-

The rate is affordable and compares well with those offered by other lenders.

-

The rate lock term is long enough to carry you through to closing.

-

You think rates may go up.

-

You want the certainty of a locked mortgage rate.

Tips For A Purchase Mortgage Rate Lock

When you buy a home, your closing date is set by the purchase contract. Your rate lock should expire on or after that date to avoid having to pay for a lock extension. Its best to give yourself a cushion in case the home inspection reveals repairs that need to be completed before your closing.

Locks are typically offered in 15-day increments, and the extra cost of locking your rate for 45 days instead of 30 days may give you the wiggle room if any last-minute delays pop up with your closing date. The longer lock period may also keep you from paying costly extension or relock fees if you go past the deadline for a shorter lock.

There are also scenarios when a mortgage lock may not make sense:

Youre buying a fixer-upper home. While you may get a great deal on the price of a home that needs major repairs, unexpected complications like labor shortages or cost spikes can make timing your closing difficult. With a regular loan, repairs have to be completed before you can complete your closing. It may be worth it to consider a fixer-upper loan like the Fannie Mae Homestyle® or the FHA 203 program you can roll the cost of repairs into one loan and lock your rate in and close before the improvements are completed.

Also Check: Are Mortgage Interest Rates Going Up

The Best Time To Lock A Mortgage Rate

Whether you’re getting ready to buy your first home or you’ve done this before, you’ll benefit from discovering the best time to lock in a mortgage rate. Understanding how it works and what it’s for can help make the homebuying process a little easier.

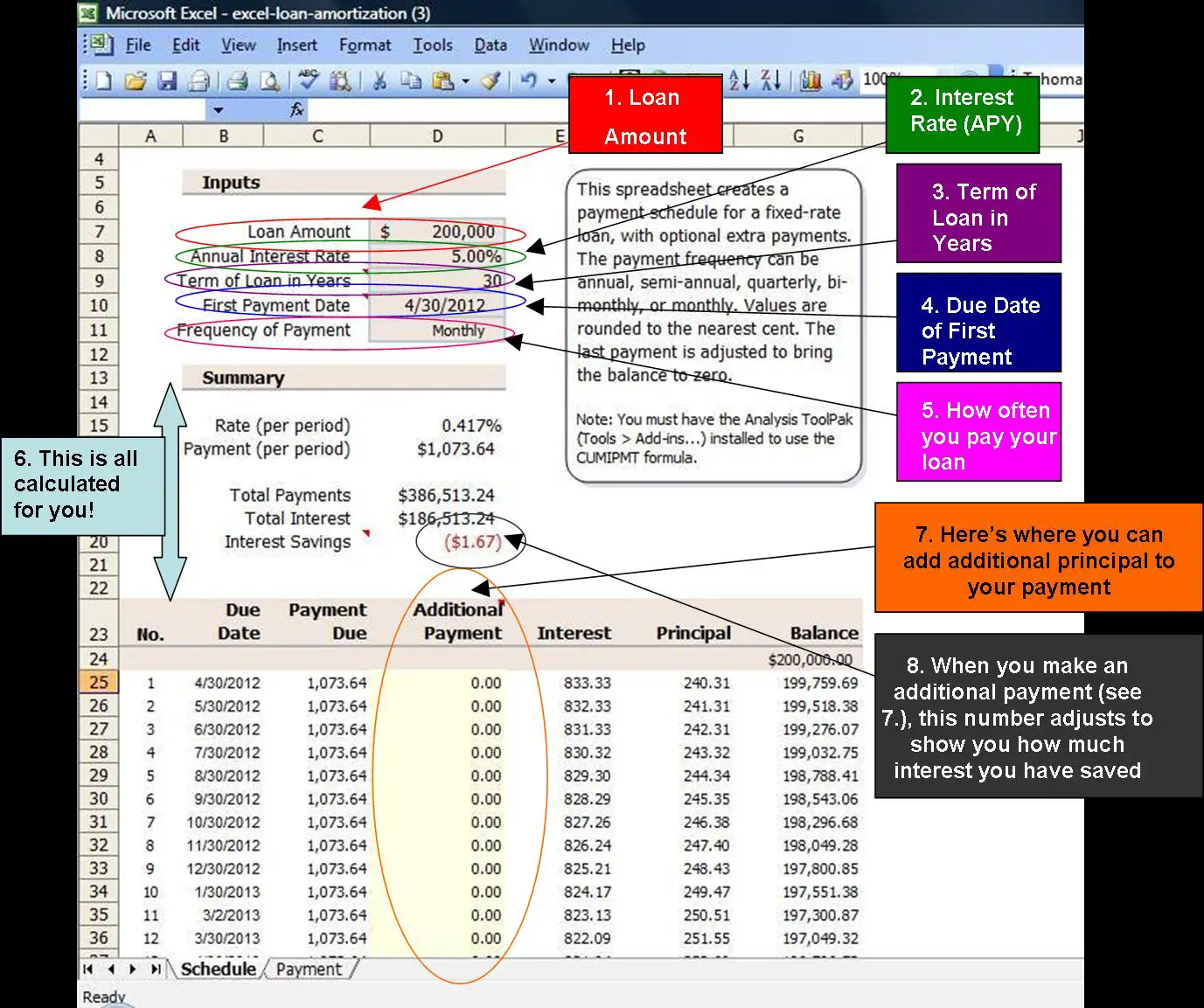

When paying off a mortgage, buyers need to pay interest on the money borrowed. The money that you borrow initially is called the principal, and the interest gets charged as a percentage of that principal.

The interest rate for your mortgage will ultimately determine how much interest you’ll pay over the life of the loan. Therefore, the lower the mortgage interest rate is, the better.

Should You Lock Your Mortgage Rate

Many borrowers often wonder if they should lock their mortgage rate now or wait until their closing process is underway. If youre happy with your rate when you get approved, locking it in is a smart choice. It’s best to lock your rate when youre comfortable with the amount of your monthly mortgage payment.

If youre thinking about floating your mortgage rate, make sure to consider the impact a higher rate may have on your finances. Even a slight increase in the rate can add hundreds of dollars to your mortgage payments each year. Locking your mortgage rate provides security in knowing how much youll pay each month.

While locking your rate can save you money over time, you should also check with the mortgage lender beforehand to learn if there are any charges associated with this option. Some banks and financial institutions charge rate lock fees, depending on the type of mortgage youre using. You can pay this fee upfront or include it in your closing costs.

Don’t Miss: Which Bank Is Best For Mortgage

What Is A Mortgage Rate Lock Float Down

A mortgage rate float down is a special program some lenders have in place to allow you to take advantage of falling interest rates, even if your rate is already locked. Youll typically need to meet the following criteria in order to be eligible:

- Your loan must be conditionally approved. Lender float-down policies usually only apply if your loan has been approved based on a review of your credit, income and assets.

- Your rate must drop by a certain amount. In most cases you cant float down your rate unless it drops a quarter- to half-percentage point.

- Youll need to pay a fee. Because the lender has to renegotiate your lock with the investor you already committed to, youre usually charged a fee of up to 0.50% of your loan amount.

How Much Will A Long Rate Lock Cost Me

However, such a long lock period comes at a price.

In some instances, a lender will add a premium to current mortgage rates — 0.125 percent to 0.5 percent is common — to allow you to lock in this new interest rate. Others will allow you to lock at today’s low rate, but you’ll pay non-refundable, percentage-based fees in the form of “points.” Each point is a fee of 1 percent of the loan amount, and you could see a two or more point fee to get such a long rate lock.

You May Like: Why Are Mortgage Closing Costs So High

Reasons You Should Lock In Your Mortgage Rate

Determining whether you should lock your mortgage rate depends on several factors. It could be beneficial if:

- Your current rate is affordable and competitive with others in the area.

- Market conditions are volatile and your closing day is several weeks off.

- You want peace of mind knowing your rate will remain the same until closing and you wont be socked with an unexpectedly higher monthly payment.

What It Means To Lock A Mortgage Rate

When you lock a mortgage rate, it means you and your lender have reached an agreement on your loans interest rate and discount points, and the lender has put its commitment in writing.

Rate locks protect you from an increase in mortgage rates between today and your closing date. They offer peace of mind that even if mortgage rates rise, the bank cant assign you the new, higher rate.

But the mortgage rate lock works both ways: If mortgage rates dip, the bank wont assign you the new, lower rate.

Don’t Miss: What Does Apr Mean On Mortgage Rates

Choose A Rate Lock Period

Next, you need to select a rate lock period. The amount of time you choose will depend on whether or not you’re under contract on a home. Make sure the rate lock period you choose is long enough to last until closing otherwise you may have to pay to extend it.

Maguire-Feltch recommends locking your rate shortly after you’ve found a home, since mortgage rates fluctuate frequently.

“If you find a house you love, and you are comfortable with the payment, we suggest locking that rate so you have certainty of what your payments will look like on your home loan,” she says.

What Are The Main Elements To Loan Locks

When deciding to lock a loan, there are three points to consider:

- Length of the lock period

If you’re still shopping around and need more time but want to keep a loan locked, you’ll pay extra for an extended loan lock. The lender might increase the interest rate or use points to reflect the loan lock fee. That’s because the lender is taking on more riskthe risk that rates could go up while the transaction is processed. This can cause the lender to lose money if they fund a loan at a lower-than-market interest rate.

You May Like: Can I Refinance My Mortgage With A Judgement

Timing Your New Construction Rate Lock

There have been times in recent history when locking in a 360-day rate would have paid off. For example, a home builder in August of 2021 could have locked in a 30-year fixed rate of 3 percent. Eleven months later, in July of 2022, that same home builder may pay 6% over a 30-year loan term.

Even if that extended rate lock cost $5,000, the extra cost would have paid off many times over the life of the loan.

That said, its very difficult to predict what will happen with mortgage rates in the future.

Theres always a possibility that rates will rise. So if you can afford the home you want now and have a chance to lock a rate, it may be wise to do so. But your lenders policies and rate lock fees will play into the decision.

You should work closely with your loan officer to analyze current interest rates, how the market is moving, and your own home buying budget. Together, the two of you will decide when it makes sense to lock a new construction mortgage rate.

Does My Loan Type Affect The Mortgage Rate Lock

Different types of mortgages may affect the specifics around your mortgage rate lock, including whether theyre eligible for a lock and if the lock can be extended. Although your loan type can impact aspects of your mortgage, deciding when to lock in your interest rate is part of the mortgage process regardless of the loan product you choose.

Don’t Miss: How Many Months Bank Statements For Mortgage

Con: You May Feel Pressured To Buy A House

Once you lock your interest rate, the clock starts ticking. Although a 45-day rate lock usually allows you enough time to close on a house, some buyers are sensitive to that time pressure. A 30-day rate lock only amps up the stress. Even if you think youve found a good mortgage rate, waiting to lock that rate in until you know youll be able to close your deal in time can give you added peace of mind during a stressful experience.

More From GOBankingRates

Can You Change Lenders After Locking A Rate

Yes, you can change lenders even after locking a rate. Its legal and doesnt carry a specific fee or penalty.

Sometimes borrowers choose to switch lenders in the middle of the transaction. While this isnt ideal for you, it may be necessary if your mortgage adviser is unresponsive or slow and if they lose paperwork or cant close on time.

Recommended Reading: How To Get Rid Of A Reverse Mortgage

Initial Rate Lock Fee

Some lenders choose to tack on a separate fee for locking. Others account for the initial lock fee by integrating it into your interest rate. Be sure you know whether and how you will be charged for an initial lock.

Heres an example breakdown of what you may expect in terms of fees for mortgage locks:

|

Lock |

|---|

|

$270 |

How Can I Improve My Mortgage Pre Approval

7 Tips to Get Approved for a Higher Loan Amount

Read Also: Why Do Mortgage Need Bank Statements

What Are The Risks If The Loan Is Not Locked

Let’s say you decide to wait. You’ve narrowed down where you will get a mortgage and looked at all your loan choices. Maybe you’ve even decided on the loan product you want. But the housing market is falling. The Federal Reserve has cut interest rates twice, and you expect them to drop further. So you decide not to lock.

This is no different from gambling. Rates may go down, and your gamble could pay off. In that case, you would have been a little worse off if you had locked your loan. But if rates go up, you have no protection. You will pay a higher rate if you remain with that lendera lock would have prevented the increase.

The Bottom Line: Locking In Is Usually The Right Move

Is locking in your mortgage rate worth it? It can be, depending on the cost and what rates are doing.

Talk to your lender and find out exactly what their rate lock policy is. Ask what it would cost to extend the period and what would happen if you face delays and your rate lock expires. If youre interested, ask about float-down options.

In general, the security of protecting yourself from any rate spikes will be worth it. Its hard to time the market to perfectly suit your needs. Turning your mortgage process into a game of trying to get the lowest possible rate is risky, and you could end up losing a comfortable rate.

When youre ready to begin, you can start your mortgage application online through Rocket Mortgage.

Don’t Miss: Can I Just Pay The Interest On My Mortgage

After I Lock My Interest Rate Will My Rate Change

If there are no changes to your loan application and your loan closes on or before the rate lock expiration date, we will close your loan at the locked interest rate.

However, your interest rate may change from the time of your initial rate lock if there are changes to the factors used to determine your interest rate. These kinds of changes may also be called “rate or price adjusters” because they can raise or lower the interest rate on your loan.

Here are some examples of changes that may raise or lower your interest rate:

- The appraised value of the property is different than the value used when you initially locked your loan.

- Your credit profile or qualifying income changes between the time you initially locked your loan and the loan closing.

- Your requested loan amount increases or decreases after you initially locked your loan.

- The type of loan you are applying for changes.

- Your down payment amount changes.

- Some of your income information, such as bonus or overtime income, cannot be verified.

If your interest rate or costs associated with the interest rate change, we will send you an updated Interest Rate Lock Agreement.

What You Need To Know

- Mortgage rates can change while youre applying for a mortgage loan. By locking a mortgage rate early on, you protect yourself from sudden rate increases

- Mortgage rates are affected by changes in the federal funds rate, market fluctuations the state of the economy, inflation and mortgage demand

- Shorter lock periods usually mean a lower interest rate because theres less chance for market fluctuations, but you risk having your rate lock run out before you close

Recommended Reading: Why Get A Reverse Mortgage

Sign No : Youre On The Cusp Of Qualifying For Your Loan

If youre borrowing near the limits of what your financial profile will allow, locking in is smart because it could keep rate fluctuations from leading to a nasty surprise when you close.

Heres why: Typically a house payment should be no greater than 28% of your gross monthly incomeso, for instance, if youre making $6,000 per month before taxes, that means a house payment of no more than $1,680. If a higher interest rate pushes that payment above that 28% threshold, then your lender may balk at loaning you the money, causing the whole deal to fall through.

An early rate lock means there are no hidden surprise down the road, says, president of Cornerstone First Financial, a mortgage lender in Washington, DC. Because after all, last-minute surprises are the last thing you want when youve put all this time and effort into buying a home.