Use A Home Equity Investment From Point

Your homes value will generally go up in the future, but what if you could use that money today? Thats what a Home Equity Investment from Point does.

It has the advantage of giving you a lump sum which you can use to get out of a reverse mortgage if you wish and doesnt require any payments until the 30-year term is up. In addition, its more flexible than a reverse mortgage. For example, your heirs can take over the HEI if theyd like to keep the house.

If replacing your reverse mortgage with another debt product doesnt make sense for you, looking into an HEI can be a better option. Make sure to consult with a financial advisor so that you can be sure to select the best choice for you.

Can I Get Rid Of Monthly Mortgage Payments

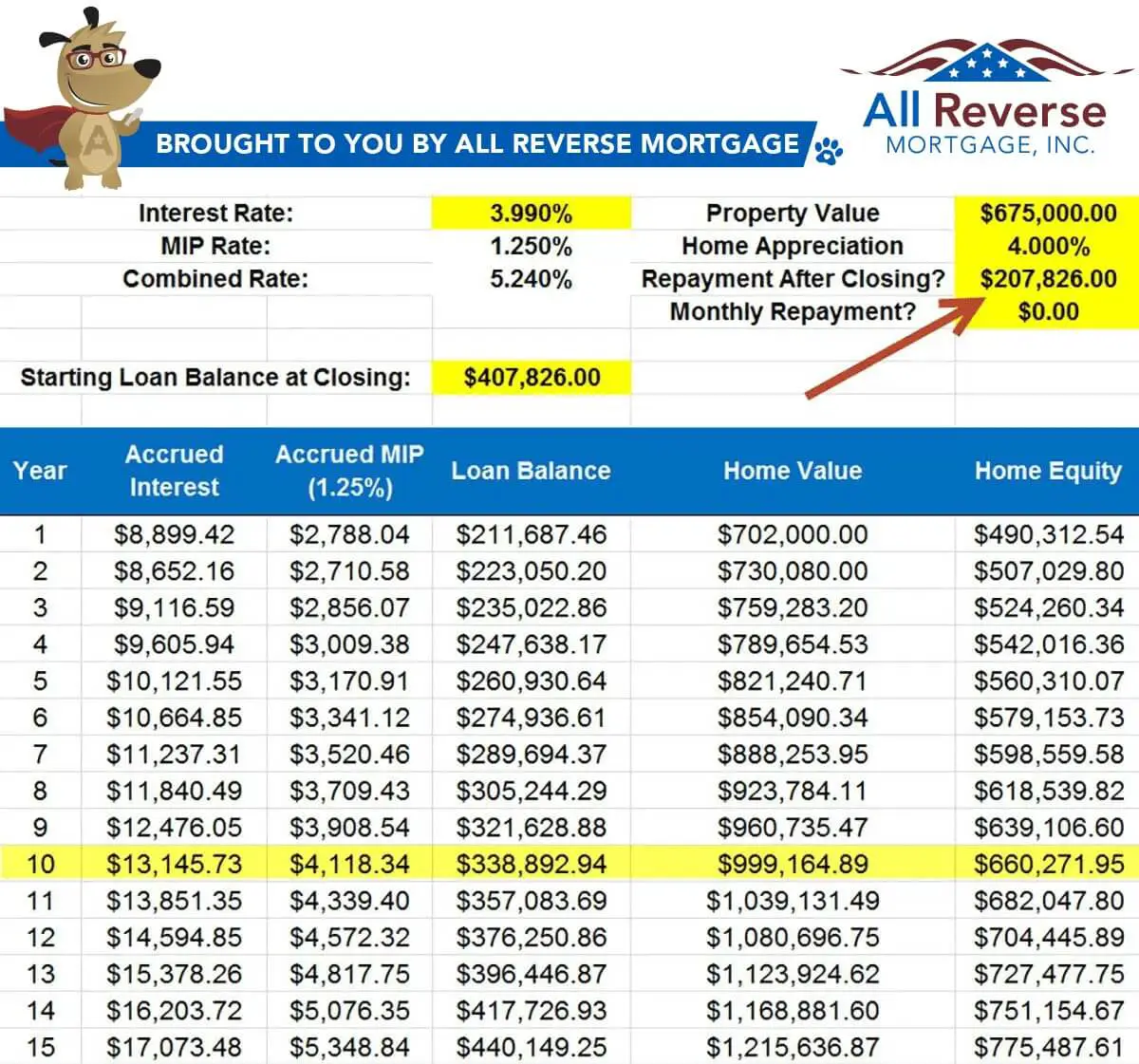

Yes. If theres a traditional mortgage on your home, the cash from the HECM loan is initially used to repay that loan. Since no monthly mortgage payments are needed on the HECM1, you’ll be able to get rid of that monthly bill and keep more income to use as you see fit.

One of the largest benefits of HECM loans is that repayment is deferred. This means that repayment of the loan is not due until after the final borrower no longer resides within the home. The decision is yours as to whether or not you would like to pay off the reverse mortgage in advance. You will have no prepayment penalties with a Home Equity Conversion Mortgage. And with optional mortgage payments1, you have the flexibility to pay as little or as much as you would like, as regularly as youd like.

Use Your Right Of Rescission

Reverse mortgages have a 3-day period directly after you close on your loan in which you can cancel the transaction with no penalty. This is known as the right of rescission and it allows you to change your mind should you have buyers remorse right after you sign the closing documents. Within 20 days, the lender will return all fees, closing costs and unused funds paid by the borrower.

If you decide to practice your right of recission, you will need to inform your lender in writing. Remember, this window of time lasts up to only 3 days after you close. After that, you cannot cancel your loan without penalty.

Also Check: Is Property Tax Included In Mortgage

A Wise Move Under The Right Circumstances

Refinancing a reverse mortgage can be a wise move for seniors who fit the criteria.

âA refinance can pay off your existing reverse mortgage and possibly provide you with a lump sum or monthly payment tapped from available additional equity â money that can come in handy as you age,â Fleysher said.

However, be sure to inspect your reverse mortgage loan documents to learn if there are any fees related to prepayment, âand check with your refinancing lender or agent regarding closing costs involved,â he recommended.

My Will States That My Home Goes To My Daughter When I Die What Effect Will Taking Out A Reverse Mortgage Have On That Provision

A reverse mortgage will become due upon the death of the last borrower. Your daughter will be given an opportunity to pay of the balance of the reverse mortgage. However, if the balance of the loan is not paid off, the property will go into foreclosure and eventually be auctioned off. The proceeds of the auction will go toward paying off the loan balance. New York is a non-recourse state, which means that even if the proceeds from the sale of the home do not cover the loan balance, your lender cannot go after you or your estate for the remaining loan balance. If, on the other hand, there is money left over after the loan is paid off, your heirs will be given an opportunity to claim the surplus.

Recommended Reading: What Is A Mortgage Originator

How Long Do You Have To Get Out Of A Reverse Mortgage

If youve taken out a reverse mortgage, you dont need to pay it back as long as you continue to live in the home as your main residence, you make timely property taxes and home insurance payments, and you keep the property in good repair.

But when you inherit a home with a reverse mortgage, there are a few deadlines you need to follow. Youll usually have three options: sell the property, buy it, or allow the lender to foreclose. While repayment of the loan is due within 30 days of the time the estate receives a demand letter, you may be able to have up to six months to get out of the reverse mortgage by selling the home or obtaining financing.

How Can I Apply For A Reverse Mortgage

Your reverse mortgage application will look the same as the application for your typical mortgage although there are a few additional criteria to be met to be eligible for a reverse mortgage. These are:

- Every person named on the property title must be aged 55 or over.

- If you still have a mortgage or any other lien on the property, it will have to be paid from the reverse mortgage proceeds or other sources of funds. The remaining amount will be advanced to the applicants.

- A reverse mortgage can only be registered to your primary residence.

When filling out your reverse mortgage application, you must provide the account numbers and balances for every debt you wish to repay with these funds.

Once your lawyer has signed and completed all the necessary paperwork, the reverse mortgage lender will provide the predetermined amount of funds for you to pay off your debt.

Also Check: What Is A Reverse Mortgage Foreclosure

What Are The Red Flags I Need To Look For During The Reverse Mortgage Process

Always be wary if the lender:

Additional red flags

- Someone tries to sell you something and suggests you pay for it with a reverse mortgage.

- If it seems like you are getting free money, you arent. Talk with someone else to better understand what you are getting and what the costs will be.

- The deal sounds too good to be true. You may be missing some important information.

- A company charges a fee to find a reverse mortgage lender.

- Liens on your home appear on the title that you do not understand.

How Do I Avoid A Reverse Mortgage Scam

-

Be wary of sales pitches for a reverse mortgage, especially if a salesperson implies a reverse mortgage is a solution for all your problems, pushes you to take out a loan, or has ideas on how you should spend the money from a reverse mortgage.

-

If you decide to get a reverse mortgage, shop around before deciding on a particular seller.

-

Resist any pressure from reverse mortgage salespeople to buy other financial products, like an annuity or long-term care insurance. If you buy those kinds of financial products, you could lose the money you get from your reverse mortgage. You dont have to buy any financial products or services to get a reverse mortgage.

-

Some salespeople try to rush you through the process. Stop and check with a counselor or someone you trust before you sign anything. A reverse mortgage can be complicated, and isnt something to rush into.

-

The bottom line: If you dont understand the cost or features of a reverse mortgage, walk away. If you feel pressure or urgency to complete the deal walk away. Do some research and find a counselor or company you feel comfortable with.

You May Like: How Much Is A Fixed Rate Mortgage

What A Borrower’s Death Means For Heirs

When a person with a reverse mortgage dies, the heirs can inherit the house. But they won’t receive title to the property free and clear because the property is subject to the reverse mortgage.

So, say the homeowner dies after receiving $150,000 of reverse mortgage funds. The heirs inherit the home subject to the $150,000 debt, plus any fees and interest that have accrued and will continue to accrue until the debt is paid off.

Could Be A Bridge Loan

Many people have more money in home equity than they do in their retirement savings account. And unlike a 401 account, payments from a reverse mortgage are tax-free.

In some cases, people who want to delay taking Social Security payments, say, until they reach full retirement age, can use a reverse mortgage as a bridge for a few years. And setting a reverse mortgage line of credit can be handy if you run into unexpected expenses, particularly if you have paid off your mortgage.

The government requires a counseling session for good reason. Reverse mortgages are complicated, a circumstance some scammers exploit to defraud older homeowners. It’s good to have someone outline all the costs involved and ensure you are dealing with reputable lenders.

Ideally, you should be able to live off Social Security, a pension and retirement savings when you retire. But you shouldn’t overlook your biggest asset: your home.

Editor’s note: This article was originally published Oct. 19, 2019. It has been updated with more recent information on housing prices and reverse-mortgage interest rates.

John Waggoner has been a personal finance writer since 1983. He was USA Today‘s mutual funds columnist from 1989 through 2015 and has worked for InvestmentNews, Kiplinger’s Personal Finance, the Wall Street Journal and Morningstar.

You May Like: How Do Mortgage Interest Rates Affect The Price Of Housing

The Rules Depend On Your Relationship To The Borrower

Reverse mortgages allow an older person to tap the accumulated equity in their home without having to sell it. Eventually, however, the money will have to be paid backa responsibility that often falls to the borrowers heirs.

Here is what heirs need to know about reverse mortgages.

How A Reverse Mortgage Works

Reverse mortgages work differently from forward mortgages. With a forward mortgage, a homeowner borrows money to purchase a home and makes payments to the lender until the borrower pays off the loan in full. As a forward mortgage progresses, the portion of the home the borrower owns increases, and the loan balance decreases.

But when a homeowner takes out a reverse mortgage, instead of making payments, they receive payouts from the lender based on how much equity is in the home. As a reverse mortgage continues, equity decreases and the amount the homeowner owes the lender increases. Interest and fees also accrue, causing the loan balance to grow.

Also Check: What Will Mortgage Rates Do Tomorrow

You Don’t Plan To Move Soon

You should plan on remaining in your home for the near future if you’re considering a reverse mortgage. This rule of thumb isn’t unique to reverse mortgages it also usually doesn’t make sense to get a new forward mortgage on a home you’re about to sell. The reason? Loan closing costs.

| Typical Reverse Mortgage Closing Costs |

|---|

| Cost |

| Required if the home doesn’t meet the FHA’s minimum property standards |

It may not make financial sense to pay these sums if you’re going to move before the loan’s financial benefits outweigh the costs. Moving is one of the events that make your reverse mortgage due and payable. After paying seller fees and repaying your HECM, the proceeds from selling your house may not be enough to support your next step, whether it’s downsizing, assisted living, or paying a relative for caregiving.

How To Get Out Of A Reverse Mortgage

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

A reverse mortgage is a unique type of home loan that many homeowners turn to supplement their income as they age. But often, homeowners who choose this type of loan find themselves wondering how to get out of a reverse mortgage due to a change of circumstances or long-term plans. Fortunately, borrowers seeking an alternative to reverse mortgages have options.

Recommended Reading: When Can You Refinance Your Mortgage

How Does Reverse Mortgage Work

As a mortgage progresses, home equity increases as the loan balance decreases. As homeowners take out reverse mortgages or the equity of their homes decreases, they owe more and more to the lender.

The homeowner gets to choose which payments they prefer and only pays interest on the money used. If the homeowner moves or passes away, any money gained from selling the home pays back to the lender who provides a reverse mortgage.

When Reverse Mortgages Are Assigned To Hud

Because most of the loans that are assigned to HUD are lower equity situations, the longer they wait the more of a loss they will sustain. They would much rather have heirs pay the loans off, but they know this is not the typical outcome when there is not a lot of equity in the property.

HUD will contact an appraiser to perform an appraisal and if it is clear there is no equity in the property, they see that no one has made any attempt to change the title from the deceased borrowers, its pretty clear that no one is making any positive steps to repay the loan in a timely manner, if at all.

Reverse mortgage lenders and servicers have been sued for giving information to the wrong people without borrower consent. They dont know who they can release information to unless they have a written consent from the borrower, a court order or a trust that has a successor trustee who has had the trust certified.

Otherwise, if they just start working with just anyone who contacts them and claims to be the heir, they can be subject to civil penalties and lawsuits if anyone is injured as a result.

Therefore, if they receive a letter or call from someone who does not have the proper clearance to act on behalf of the borrower, they cannot release any information at all. Its not the lender or HUD being hard-nosed, it is the law and the result of lawsuits.

Don’t Miss: What Is A Prepayment Penalty On A Mortgage

Refinance Your Reverse Mortgage

Another option is refinancing out of a reverse mortgage into one with better terms. For example, if interest rates have decreased significantly since taking out your reverse mortgage, or your homes value has increased, and you would qualify for a larger loan amount, it might benefit you to refinance your reverse mortgage. With this path, a new reverse mortgage loan replaces the current one.

When Does The Reverse Mortgage Need To Be Paid

You may not be required to make monthly payments on your reverse mortgage, but the loan will come due eventually and you will need to pay it back. A reverse mortgage must be repaid:

- When the borrower no longer resides in the home or the home is no longer their primary residence.

- When the borrower sells the home or transfers the house title.

- If the borrower doesnt uphold their loan obligations, including paying their property taxes and homeowners insurance.

Don’t Miss: Can You Increase Mortgage For Renovations

How A Reverse Mortgage Also Can Be Paid Off Early

The process of paying off a reverse mortgage is not very complicated. But it is advised that you contact a reverse mortgage specialist to avoid potential issues.

Step 1: Choose a date to pay off your reverse mortgage. Request your lender no further draws against the credit line of the equity and a payoff statement that includes the month when the mortgage is to be paid off.

The payoff statement lists all payments made over the course of the mortgage, accumulated interest, and costs associated with borrowing the loan.

Step 2: The statement may also include 34 days of interest, which provides padding if the payment is posted after the first of the month.

Since a reverse mortgage is backed by the Federal Housing Authority, the posting takes place on the first business day of the month, and a weekend could push it to the third day of the month.

Step 3: If you are selling the home, you may claim reimbursement if you had prepaid the insurance for an entire year. So let your insurance agent know the expected payoff day.

Step 4: It is worth letting your title closing agent handle the mortgage paperwork and the lien releases on your behalf. The process requires release for the lender and the FHA for the mortgage insurance premium.

On the other hand, if you handle the payoff on your own, send a cashier check for the money through overnight mail or wire transfer to the lenders bank. Follow up to make sure that the lender has received the funds.

Learn When This Strategy Does And Doesn’t Make Sense

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

A reverse mortgage is a loan for homeowners aged 62 and older who want to borrow against their home equity without having to make monthly payments. This mortgage product can help seniors who are short on funds for living expenses. It can also benefit those who want to diversify their sources of retirement income and hedge against risks such as market downturns and outliving savings.

Taking out a reverse mortgage also means spending a significant part of your home equity on loan fees and interest. In addition, the loan terms can put the homeowner, spouse, and heirs at risk of losing money and a place to live.

Here are four situations where a reverse mortgage might be a good choice and four where it might not be.

Read Also: Can I Get A Mortgage And Rent The Property