What Is Interest Rate

Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time. Your mortgage interest rate might be fixed, which means it stays the same throughout the duration of your loan. Your mortgage interest rate might also be variable, which means it might change depending on market rates.

Youll always see your interest rate expressed as a percentage. Youre responsible for paying back both the initial amount you borrow plus any interest that accumulates on your loan.

Lets look at an example. Say you borrow $100,000 to buy a home, and your interest rate is 4%. This means that at the start of your loan, your mortgage builds 4% in interest every year. Thats $4,000 annually, or about $333.33 a month.

Your principal balance is high during the beginning of your loan, and youll pay more money toward interest as a result. However, as you chip away at your principal through monthly payments, you owe less in interest and pay a higher percentage of your payment to your principal. This process is called mortgage amortization.

How Does Apr Work

Knowing what the APR is on a mortgage and how it impacts your loan is an important part of mortgage shopping. When comparing offers, its better to use the APR in order to understand the true cost of the loan.

Your APR can include:

- Closing costs

- Mortgage insurance

Your home loans APR is calculated by determining what the loan will cost you each year and is displayed as a percentage. Its important to remember that this percentage is separate from your interest rate.

Your APR could also change after taking out the loan. This can happen if you have an adjustable-rate mortgage or if you choose to refinance your home loan.

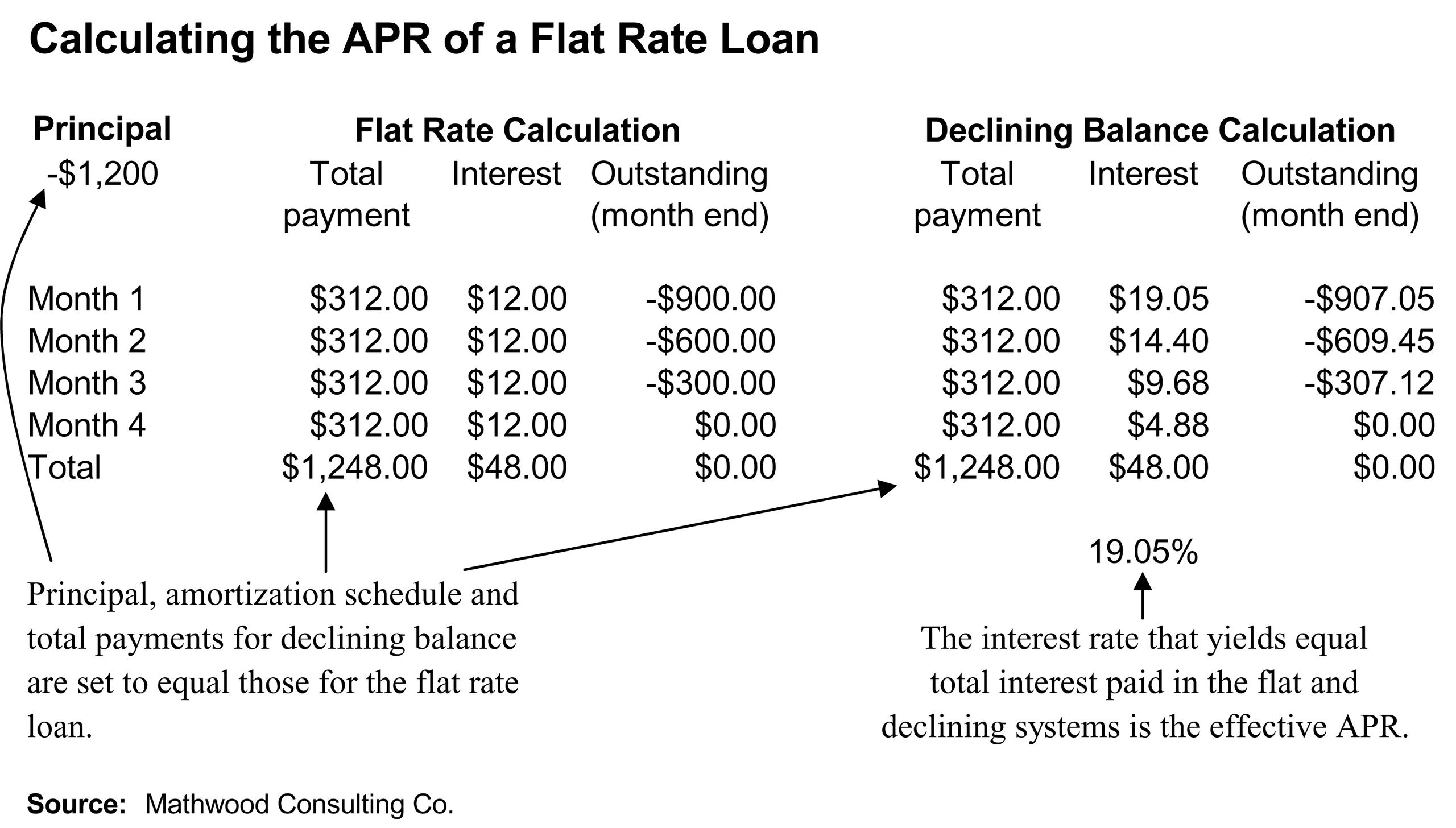

To calculate your APR, add all fees to your loan amount and determine what the monthly payment would be if all fees were included in the loan. That payment can then be converted into an interest rate.

Heres an example:

You take out a $300,000 mortgage with a 6.0% interest rate and you pay $7,000 in upfront fees. Your monthly principal and interest payment is about $1,798. If you add all fees and convert that into an annual rate, the APR would be 6.22%.

Total Mortgage has branches across the country. Find a Total Mortgage branch near you and speak to one of our friendly mortgage advisors to explore your borrowing options.

What Is An Apr

An annual percentage rate represents the cost of borrowing over the life of the loan expressed as an annual rate. People commonly reference interest rates and APRs when comparing mortgage loans. APRs are typically higher than the interest rate because they include fees associated with getting the loan, like points, origination fees and other charges, as well as interest.

There are two types of mortgage interest rates: Fixed and adjustable. A fixed rate stays the same throughout your loan. A adjustable or variable rate changes with an index such as the prime rate which is based on the Federal Funds Rate outlined by the Federal Reserve Board . This means that if you get a loan with an adjustable rate, your interest rate could change depending on changes in the index The APR for a variable rate loan estimates how the rate could change over time, but actual changes could be very different.

Also Check: Requirements For Mortgage Approval

How Annual Percentage Rate Works

Every time an individual or entity borrows money in the form of a traditional loan , there is a cost for the privilege of borrowing money, known as interest. The annual percentage rate is the percentage of interest the borrower must pay on the loan, which ultimately adds up to the total cost of the loan.

Lets consider an example to explain the concept further. An individual takes out a $25,000 loan to buy a car. The loan comes with a fixed APR of 5% and must be paid back over the course of five years. This means that the individual will need to make regular monthly payments of around $470.

However, the monthly payment is used toward paying back both the principal loan amountPrincipal PaymentA principal payment is a payment toward the original amount of a loan that is owed. In other words, a principal payment is a payment made on a loan that reduces the remaining loan amount due, rather than applying to the payment of interest charged on the loan. and the interest due on the loan. The monthly payment amount remains the same, but the breakdown changes as more payments are made.

As the individual progresses through the payments over the course of five years, the yearly amount paid in interest changes. In our example, the individual begins by paying $1,500 per year in interest, but the amount will change as the borrower makes payments. In the end, the individual ends up paying $28,306.88 total: repayment of the principal of the $25,000 loan and $3,306.88 in interest.

What Is An Annual Percentage Rate Vs Interest Rates

The APR is important because it can give you a good idea of how much youll pay on an annual basis for the funds borrowed.

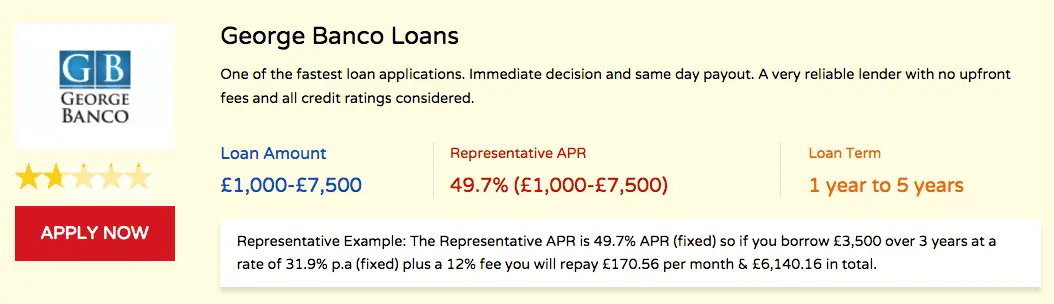

Lenders are obligated to disclose the in addition to the interest rate. Since lenders charge different fees, this disclosure was meant to help consumers understand the actual rate for the funds borrowed, which includes the finance charges in addition to the interest rate charged on the principal balance of the loan.

The APR also helps consumers compare overall costs from one lender to the next. Be careful when comparing the APR of a fixed rate loan with the APR of adjustable or variable rate loans, or when comparing the APRs of different adjustable rate loans. You should also know the fees included in the APR, because lender fees and other costs can vary from lender to lender.

Recommended Reading: Recast Mortgage Chase

How To Find The Best Mortgage Deal

When thinking about APR vs. interest rate, remember its not one or the other. You can look at both numbers.

When deciding which mortgage to opt for, consider both the interest rate and the APR, recommends Davis.

You can first use the interest rate as a tool to filter down your options. Then, once you shortlist the most preferred interest rate offers, you can compare the APRs on those offers carefully to get the best possible deal.

Also, if you have a high credit score, use it to your advantage.

If you have great credit but are undecided between two lenders who have similar repayment terms with one boasting a lower interest rate but higher APR and the other offering a lower APR but higher interest rate try to negotiate terms with both, Davis advises.

Aim to get either the fees or interest rate reduced to match or beat the other offer.

When in doubt, and for best results, consult a mortgage professional who can help you determine the best loan deals based on APR vs. interest rate.

Why Use An Apr Mortgage Calculator

Your lender will figure your APR for you, and will advertise it in loan offers. However, you may wish to see yourself how the APR will vary if you make certain changes in the loan, such as buying more or fewer points. Or you may want to compare loan offers from lenders with different fee schedules and want to see how different fee schedules affect the APR and total cost of the loan.

FAQ: It is also helpful if you: Are working with a tight budget and need to know exactly how much you can afford.

FAQ: You want to compare the true total monthly payment required from two or more providers. For the best way to do this, .

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

How Does Apr Work On A Mortgage Loan

Understanding how an APR affects your home loan is an important part of the decision-making process. You may choose one option over another based on the APR a lender offers.

When it comes to the APR of a mortgage loan, there is more involved than just interest. Along with interest, the APR can include processing and underwriting fees, mortgage points and private mortgage insurance. The APR determines the total annual cost of borrowing money from a lender. It’s important to learn as much as you can about your loan before you accept and sign because APR fees can vary from lender to lender

Does Apr Affect Your Monthly Payment

Yes, your APR affects your monthly payment. With loans like a mortgage, youll pay a monthly interest payment in addition to your principal for the duration of your loan term. The higher your APR, the more youll pay in interest each month and the longer it will take for you to start making a significant dent in your principal balance.

Depending on the type of loan you choose, a fixed or variable APR can also impact how much interest youll pay each month over the life of the loan. At first, youll pay more toward the interest every month, since your interest is a percentage of the principal balance owed. As you move through your monthly payments, youll pay less and less in interest each month and more in principal, lowering your overall loan balance. To get an estimate of your monthly mortgage payments over time, use our amortization calculator.

Recommended Reading: 70000 Mortgage Over 30 Years

Why Does Apr Matter

If you dont pay attention to the APR when shopping for a loan or credit card, you could end up paying substantially more over the long term. A loan with an interest rate of 5% and an APR of 10% will still cost you more than one with 6% interest and 9% APR.

The terms of an APR may also influence how you use a new credit card. If theres a 0% APR introductory grace period, for instance, you may want to make larger purchases during that time. As long as you pay them off in full before the grace period ends, youll be saving money by not having to pay the APR. Just be sure you can pay off those purchases quickly, otherwise youll be saddled with the high interest payments once the grace period ends.

What Is Apr And How Does It Affect Your Mortgage

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Annual percentage rate, or APR, reflects the true cost of borrowing. Mortgage APR includes the interest rate, points and fees charged by the lender. APR is higher than the interest rate because it encompasses all these loan costs.

Heres a primer on the difference between APR and interest rate, and how to use it to evaluate mortgage offers.

» Looking for information on?

Don’t Miss: Mortgage Recast Calculator Chase

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

How Your Apr Is Determined

The annual percentage rate is determined by your financial institution, since its composed of costs that vary from lender to lender.

According to the Truth in Lending Act , your lender must disclose the APR in all of your mortgage documents. But they might not include every fee in the APR.

To understand what youre paying for, ask your lender to explain how it calculates your rate.

Also Check: Reverse Mortgage Mobile Home

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV. Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.

Compare Loans Using Apr

When youre shopping for the best deal on a loan, compare APRs rather than interest rates. Fees may vary widely from lender to lender, so using the all-inclusive APR should provide you with a more meaningful comparison. Borrowers sometimes believe that the loan with the lowest interest rate is their best choice, only to discover later that the fees charged on that loan outweigh any cost savings in interest.

- Will the lender be charging you simple interest or compound interest ?

- Is the interest rate fixed or variable ?

- What fees and other costs will be included?

- What is the loans repayment term?

Also Check: Rocket Mortgage Conventional Loan

The Difference Between Interest Rate And Apr

The difference between an APR and mortgage interest rate is relatively straightforward. Heres a quick breakdown of how the two costs differ:

- Interest rate: Annual cost you pay to borrow money

- Annual cost you pay to borrow money, plus other charges

In short, think of the APR as your interest rate plus other charges youll have to pay to get that loan. While the difference between the two might seem small, it can have a significant impact on your total costs.

Comparing APRs across loan offers can give you a better idea of what youll pay on a home loan.

Tip:

- Title or abstract fee

- Appraisal

Credible helps give you a better sense of what youll pay in total for a home loan from one of our partner lenders by displaying the APR. This makes it easier to compare loans and lenders as some have more fees than others.

If youre shopping around for a home loan, let Credible help you can see what mortgage rates you prequalify for in just a few minutes.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Average Mortgage Interest Rate By Year

Mortgage rates are constantly in flux, largely affected by what’s happening in the greater economy. Generally, mortgage interest rates move independently and in advance of the federal funds rate, or the amount banks pay to borrow. Things like inflation, the bond market, and the overall housing market conditions can affect the rate you’ll see.

Here’s how the average mortgage interest rate has changed over time, according to data from the Federal Reserve Board of St. Louis:

| Year |

Also Check: Can You Do A Reverse Mortgage On A Condo

Mortgage Interest Rate Vs Annual Percentage Rate

| Mortgage Interest Rate | |

| Is a percentage of the amount of money you borrowed | Is based on your interest rate, points, broker fees, and other costs. |

| Can be found under “Loan Terms” on your loan estimate | Can be found under “Comparisons” on your loan estimate |

| Is typically lower than your annual percentage rate because it’s just one component of your APR | Is usually higher than your mortgage interest rate |

Your annual percentage rate is a more complete picture of how much it costs you to borrow.

Mortgage Loan Apr Explained

A mortgage loan APR stands for annual percentage rate, a way of showing the true cost of a home loan or other type of loan. It takes into account not only the interest rate you pay, but also the closing cost fees that are charged as part of the loan and expresses them in terms of an annual percentage. Our mortgage APR calculator makes it easy to calculate the numbers and compare lenders.

FAQ: Shopping for a mortgage can be confusing. Borrowers have to sort through a mix of interest rates, fees, points and all the rest to try to figure out what’s the best deal. Many borrowers make the mistake of focusing solely on the mortgage interest rate when they go shopping for a home loan. But the mortgage rate is only part of the picture. Closing costs and other fees can significantly affect the total cost of a mortgage. Discount points in particular can reduce your rate but mean much higher costs up front. The mortgage APR takes all of these into account and expresses them in terms of an interest rate.

Mortgage APR is defined as the annualized cost of credit on a home loan. It is the interest rate that would produce the same monthly payment on your loan amount with no fees as you would pay if you rolled all your fees into the loan itself.

That’s what this mortgage APR calculator can determine for you, in addition to calculating your interest costs and producing a full amortization schedule.

You May Like: 10 Year Treasury Yield Mortgage Rates