Average Mortgage Interest Rate By Year

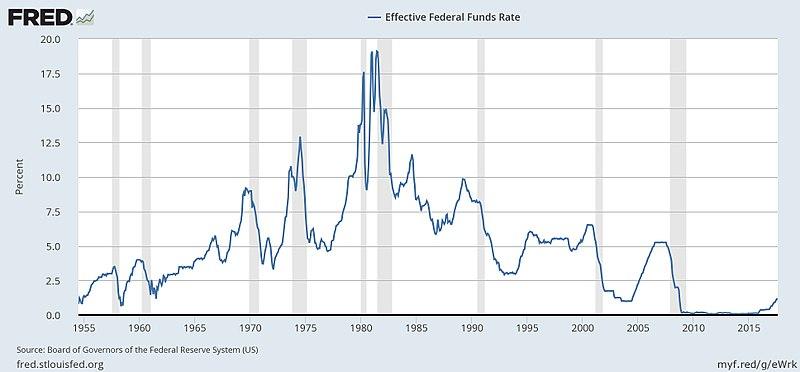

Mortgage rates are constantly in flux, largely affected by what’s happening in the greater economy. Generally, mortgage interest rates move independently and in advance of the federal funds rate, or the amount banks pay to borrow. Things like inflation, the bond market, and the overall housing market conditions can affect the rate you’ll see.

Here’s how the average mortgage interest rate has changed over time, according to data from the Federal Reserve Board of St. Louis:

| Year |

Will The Fed Move To Lower Interest Rates

The Federal Reserve doesnt control mortgage rates. But its had an outsized impact on them during the pandemic.

The Fed has bought billions of dollars worth of consumer mortgages over the past year in a bid to keep rates low during COVID. This combined with a general low-interest-rate policy helped keep mortgage rates at or near record lows throughout most of 2020 and the beginning of 2021.

But rates are beginning to rise. And experts believe the Fed wont move to stop them.

Although its unwelcome news for borrowers, rates are bound to rise as the economy starts to improve. And, as COVID becomes less of a concern, the Fed will eventually roll back its mortgage rate interventions and the two will resume a more normal relationship.

What Are The Mortgage Rate Trends For 2021

The expectation for mortgage rates in 2021 is that they will grow as the economy recovers. However, our economic recovery is unlikely to follow a straight line, so there will be ups and downs along the way.

To start the year, the average 30-year mortgage rate climbed to 3.18% by the end of March. That was followed by a month-long retreat for rates all the way back down to under 3%, before mortgage rates returned to 3% in late May. So even though the long-term overall trend will be rising rates, there will be ups and downs from month to month. But overall, rates are expected to remain historically favorably for months to come.

You May Like: Is A Reverse Mortgage Good Or Bad

Will Current Mortgage Rates Save You Money If You Refinance

You should consider refinancing your home loan if your current mortgage rate exceeds today’s mortgage rates by more than one percentage point. Mortgage refinance fees and closing costs would cut into your savings. You also have to consider whether your credit score would qualify you for today’s best refinance rates.

Many online lenders can give you free rate quotes to help you decide whether the money you’d save in interest charges justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could enhance interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments may be higher, but you could save thousands in interest charges over time, and you’d pay off your house sooner.

What Is The Prime Rate

When you apply for a loan with a variable interest rate, your lender will give you an annual interest rate thats tied to the banks prime rate. All kinds of loans are based on this rate, including certain mortgages, car loans, personal lines of credit, and even some credit cards. Think of the prime rate as the anchor these other interest rates are based on. As the prime rate moves up or down, so too does the rate of interest you pay on your loan.

Read Also: Will Mortgage Pre Approval Hurt Credit Score

How The Fed Has Impacted Mortgage Rates Lately

Normally, the Feds impact on mortgage rates is indirect at best .

But the Federal Reserve does have one avenue to directly impact mortgage rates.

Thats through quantitative easing .

QE happens when the Fed injects money into the U.S. economy in order to keep rates low and by extension, keep consumers borrowing money and dollars circulating.

Just look at what the Fed did in the early stages of the COVID-19 pandemic. Since March 2020, its bought billions of dollars worth of consumer mortgages on the secondary marketplace.

More capital in the secondary marketplace means lower rates for borrowers. Thanks to the Feds cash injection, mortgage rates hit and stayed at record lows for over nine months.

The normal refrain youll hear from mortgage professionals the Fed doesnt control mortgage rates is still true. Mortgage interest rates are not directly tied to the Fed Funds rate.

But that statement now comes with a big asterisk, as its become clear what a big impact the Federal Reserve can have on interest rates when need be.

Where Is The Market Headed

Expert economists predicted the economy would rebound in 2010. However, the economy was sluggish with slow growth rates for many years beyond that. The economy contracted in the first quarter of 2014, but in the second half of 2014 economic growth picked up. The Federal Reserve tapered their quantitative easing asset purchase program & the price of oil fell sharply. Consumer perception of inflation and inflation expectations are set largely by the price they pay at the pump when they refill their gas. With growth picking up the consensus view is interest rates will continue to head higher for the next couple years into 2020, or until a recession happens. The following table highlights 2019 rate predictions from influential organizations in the real estate & mortgage markets.

Recommended Reading: Who Is Rocket Mortgage Owned By

Federal Reserve Bank Controlling Mortgage Interest Rates

Homeowners often become very interested in the Federal Reserve Bank system. Every time the board of directors meets, mortgage interest rates are at risk.

Federal Reserve Bank

The Federal Reserve System acts as the central bank of the United States. Created in 1913, the Federal Reserve sets monetary and financial policies for the financial industry and trades currency with foreign countries. The Federal Reserve also acts as the bank for the federal government. When you send a check in with your tax return, it ends up in the Federal Reserve.

The Federal Reserve System is made up of 12 branch offices. The New York office is the primary office with other branches located across the country.

The primary job of the Federal Reserve is to manipulate fiscal policy. The goal is to fine-tune the economy to create a stable, predictable situation in which businesses can function. Wildly fluctuating economic keys, such as interest rates, can lead to chaos. In the late 1970s, for instance, interest rates shot up into the high teens, causing a major economic slow down.

The Federal Reserve effectively controls mortgage interest rates in a unique manner. Many people mistakenly believe interest rates are actually set by the Federal Reserve. They clearly are not. Instead, the Federal Reserve directly dictates the rates at which one bank can loan money to another. Lets take a closer look.

How Are Mortgage Rates Set

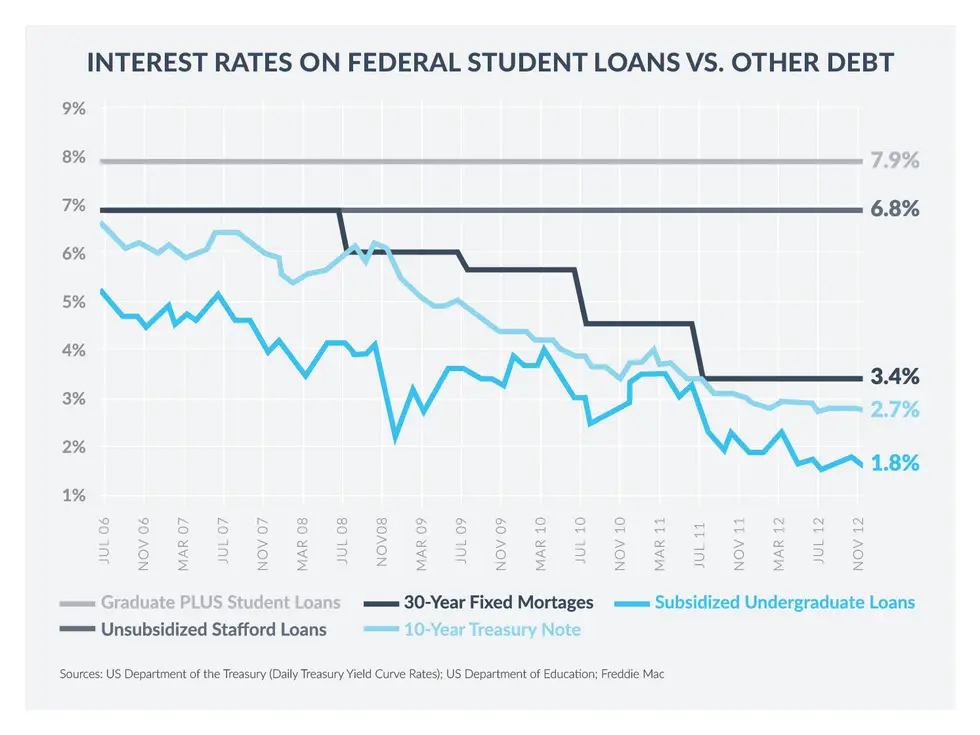

Mortgage rates fluctuate for the same reasons the price of homes change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. But the demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

If the demand for these safer bond investments is low, the mortgage interest rate increases to attract buyers. When there is strong demand for these investments, they can be sold more easily and the mortgage interest rates decrease. Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

You May Like: How Much Are Monthly Payments On A 200 000 Mortgage

Interest Rates Affect The Ability Of Consumers And Businesses To Access Credit

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

Why does the Fed cut interest rates when the economy begins to struggleor raise them when the economy is booming? The theory is that by cutting rates, borrowing costs decrease, and this prompts businesses to take out loans to hire more people and expand production. The logic works in reverse when the economy is hot. Here, we take a look at the impact on various parts of the economy when the Fed changes interest rates, from lending and borrowing to consumer spending to the stock market.

When interest rates change, there are real-world effects on the ways that consumers and businesses can access credit to make necessary purchases and plan their finances. It even affects some life insurance policies. This article explores how consumers will pay more for the capital required to make purchases and why businesses will face higher costs tied to expanding their operations and funding payrolls when the Fed changes the interest rate. However, the preceding entities are not the only ones that suffer due to higher costs, as this article explains.

Renting Vs Buying A Home

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

Also Check: What Documents Do I Need To Get A Mortgage

Mortgage Rate Predictions For Late 2021

Experts are split on their mortgage rate predictions for fall and winter of 2021.

Fannie Mae and the National Association of Home Builders see average 30-year rates staying below 3% through Q4 2021, while agencies like Freddie Mac and the Mortgage Bankers Association predict 30-year rates as high as 3.3 to 3.4% by the end of the year.

In any case, mortgage interest rates should stay in the low- to mid-3% range throughout the second half of 2021. No one is expecting a dramatic spike any time soon.

| Housing Authority |

How Fed Statements Can Impact Mortgage Rates

The Fed does more than just set the fed funds rate. It also gives economic guidance to markets.

For rate shoppers, one of the key messages to listen for is what the Fed says about inflation. Inflation is the enemy of mortgage bonds and, in general, when inflation pressures are growing, mortgage rates are rising.

The link between inflation rates and mortgage rates is direct, as homeowners in the early-1980s experienced.

High inflation at the time led to the highest mortgage rates ever. 30-year mortgage rates went for over 17% , and 15-year loans werent much better.

The Fed doesnt control mortgage rates, but the link between inflation and mortgage rates is direct.

Inflation is an economic term describing the loss of purchasing power. When inflation is present within an economy, more of the same currency is required to purchase the same number of goods.

We experience inflation at the grocery store.

A gallon of milk used to cost $2. Today, it costs $3. More money is required to purchase the same amount of milk because each dollar holds less value.

Meanwhile, mortgage rates are based on the price of mortgage-backed securities and mortgage-backed securities are U.S. dollar-denominated. This means that a devaluation in the U.S. dollar will result in the devaluation of U.S. mortgage-backed securities as well.

When inflation is present in the economy, then, the value of a mortgage bond drops, which leads to higher mortgage rates.

Recommended Reading: What Is The Current Rate For A 30 Year Mortgage

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you plan on living in your home will impact your decision.

If you plan on living in your new home long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages, and being able to lock in low rates is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans. So if you plan on only keeping your home for three to 10 years, then you may be able to pay less interest with an ARM.

Example Of Federal Reserve Affecting Mortgage Rates

In response to the global financial crisis of 2008, the Federal Reserve took the unusual step of embarking on a quantitative easing program in which it bought up mortgage-backed securities and government debt in the form of Treasury bonds. The program, which began in November 2008 and ended in 2014, increased the money supply in the nations financial systems.

This encouraged banks to lend money more easily. It also drove up the price and drove down the supply of the types of securities that the Fed bought. All these actions had the effect of keeping lending rates, including mortgage rates, low.

Don’t Miss: How Many Times Can I Apply For A Mortgage

Personal Loan Interest Rates

The interest rates on personal loans aren’t directly tied to the prime rate or the federal funds rate, but they can be influenced by it. In other words, changes in the federal funds rate can eventually lead to changes to personal loan rates, but that correlation is neither as guaranteed nor as immediate as it is with credit cards.

What’s more, many personal loans have fixed interest rates, meaning if you already have a personal loan, the rate will remain the same for the life of the loan — regardless of how the fed funds rate changes. Loans with variable interest rates can fluctuate as the fed funds rate changes.

How To Find The Best Mortgage Lender

The best mortgage lender for you will be the one the can give you the lowest rate and the terms you want. Your local bank or credit union probably writes mortgage loans with rates close to the current national average. A loan officer in your local branch could guide you through the process.

Online lenders have expanded their market share over the past decade. You could get pre-approved within minutes. Your loan amount combined with current mortgage rates could define your price range for home prices in your area. Many online lenders also assign a dedicated loan officer to offer continuity as you shop.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s veracity, ask for its NMLS number and search for online reviews.

Also Check: What Do Mortgage Rates Follow

The Cost Of Owning Goes Beyond The Mortgage

Moving from renting to buying also means paying for things beyond the down payment or closing costs. Prospective buyers should also think about what kind of money theyll need after the purchase is complete, says Allen Brewington, a licensed associate real estate broker with Triplemint in New York City.

Owning a home comes with additional expenses and buyers who dont have sufficient savings are most at risk, Brewington says. When you rent, the landlord should fix everything that breaks in accordance with your lease agreement. When you own and the dishwasher breaks, youll have to fix it or purchase a new one yourself.

Renters who intend to stay in the same home for a long time should buy, rather than rent.

Brian Davis, a real estate investor and co-founder of Spark Rental

If you dont have emergency savings, Brewington says these added expenses can be more difficult to deal with. Setting up a separate savings account for home maintenance and repairs can help you prepare for the occasional financial blip that owning a home entails.

Bank Of Canada Maintains Rate But Lowers Qe Program

The Bank of Canada held its 5th meeting of the year on July 14th, 2021. Highlights from the meeting include:

- the Target Overnight Rate will remain at 0.25%.

- CPI inflation reached 3.6% in May, but is believed to be due to mainly base-year effects and transitory bottlenecks.

- The Bank of Canada’s Quantitative Easing program has decreased down to $2 billion a week from $3 billion a week, the 2nd drop in a row.

- The Bank of Canada expects a rate hike as early as the second half of 2022

While CPI inflation has reached the top of the Bank of Canada’s inflation-control range, they believe that the inflation will be transitory and that “extraordinary monetary policy support” is still necessary for Canada’s economic recovery. As a result, the BoC still believes that a rate hike will be necessary only in H2 2022.

You May Like: How Much Would I Get Pre Approved For A Mortgage