Is An Adjustable Rate Mortgage Right For You

An ARM can be a smart financial choice if you are planning to keep the loan for a limited period of time and you will be able to handle any rate increases in the meantime.

In many cases, ARMs come with rate caps that limit how much the rate can rise at any given time or in total. Periodic rate caps limit how much the interest rate can change from one year to the next, while lifetime rate caps set limits on how much the interest rate can increase over the life of the loan.

Notably, some ARMs have payment caps that limit how much the monthly mortgage payment can increase, in dollar terms. That can lead to a problem called negative amortization if your monthly payments aren’t sufficient to cover the interest rate your lender is changing. With negative amortization, the amount you owe can continue to increase, even as you make the required monthly payments.

/1 Arm Rate Payment Example

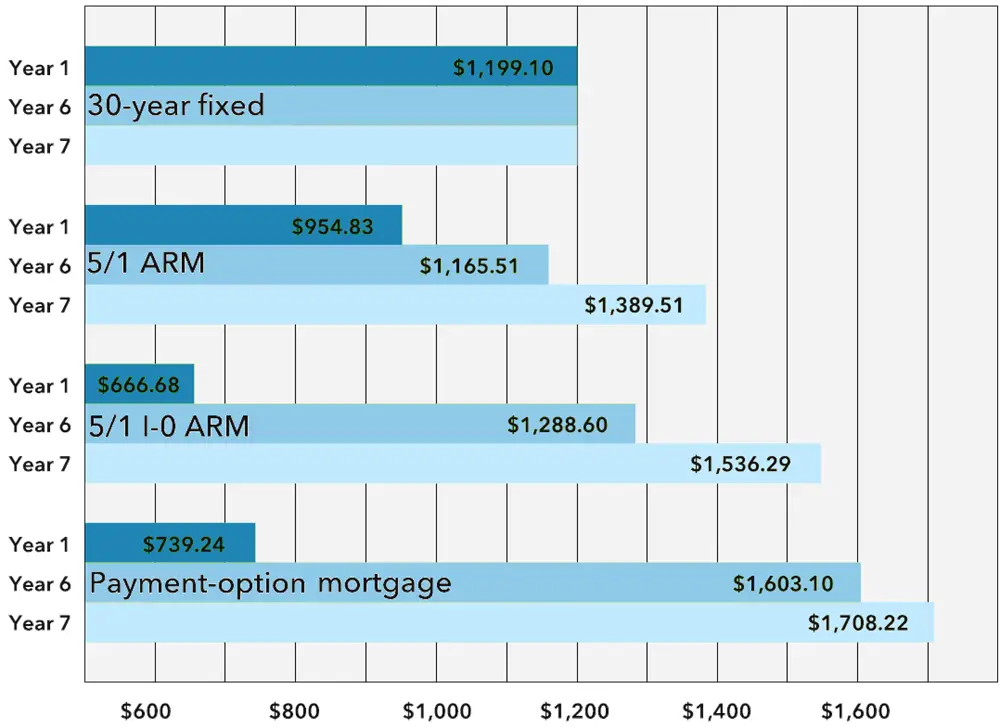

Below is an example of how much your payment could increase on a 5/1 ARM with 2/2/5 caps, an initial fixed rate of 3% and a $250,000 loan amount.

| ARM Adjustment period |

| $1,698.44 |

If you dont refinance to a fixed-rate before your ARM resets, you could pay an extra $245.33 per month on your mortgage payment with the first adjustment. In the worst case scenario, the monthly payment would jump by $644.43.

Current Mortgage Refinance Rates

The average rates for 30-year loans, 15- year loans and 5/1 jumbo ARMs are:

- The refinance rate on a 30-year fixed-rate refinance is 3.659%.

- The refinance rate on a 15-year fixed-rate refinance is 2.693%.

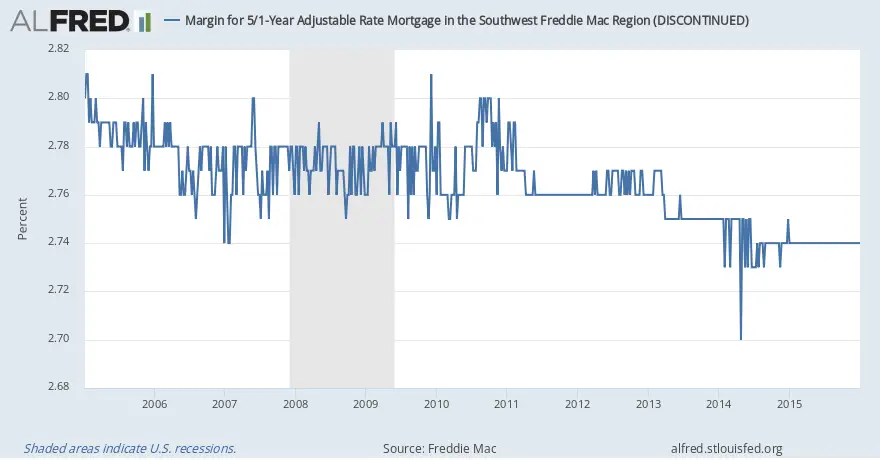

- The refinance rate on a 5/1 jumbo ARM is 2.764%.

- The refinance rate on a 7/1 conforming ARM is 3.77%.

- The refinance rate on a 10/1 conforming ARM is 4.184%.

Recommended Reading: How Much Income For Mortgage Calculator

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How To Get A 5/1 Mortgage

Shop around for your 5/1 ARM just as you would for any loan product. Get quotes from several lenders and financial institutions, and compare their interest rates and . Make sure you get the full breakdown of terms.

Consider making use of one of one of the many 5/1 ARM calculators available online to get a realistic idea of what your payments are likely to be and how much they might fluctuate.

Recommended Reading: How Do You Know If You Can Get A Mortgage

/1 Arms Are Cheap But Will Likely Adjust Higher

- While the start rate on a 5/1 ARM can be enticing

- Expect the rate to be higher in year six and beyond

- Since ARMs typically adjust higher, not lower

- But if you only keep it for a short time it can be a big money-saver

Currently, both ARMs and mortgage indexes are super low, but theyre expected to rise in coming years as the economy gets back on track, which it will eventually.

And you should always prepare for a higher interest rate adjustment if youve got an ARM.

In fact, during the loan application process mortgage lenders typically qualify you at a higher expected rate to ensure you can make more expensive mortgage payments in the future should your ARM adjust higher.

To that end, qualifying shouldnt be any easier relative to fixed-rate mortgages.

So thats the big risk with the 5/1 ARM. If you dont plan to sell or refinance before those first five years are up, the 30-year fixed may be the better choice.

Although, if you sell or refinance your mortgage within say seven or eight years, the 5/1 ARM could still make sense given the savings realized during the first five years. And most people either sell or refinance within 10 years despite taking out fixed loans with 30-year terms.

The big question is where will refinance rates be when it comes time to make your move? And home prices.

What Is A 15

Like 5/1 ARM rates, 15-year fixed mortgage rates are generally lower than 30-year fixed rates .

But, theres a key difference between 15-year fixed loans and 5/1 ARMs.

With a 15-year fixed-rate mortgage as the name implies your interest rate is fixed for the full loan term of 15 years. That means your rate and payment will never change, no matter whats happening with the economy.

When you have a fixed-rate mortgage, the only way your loan terms can change is if you decide to refinance .

Thanks to the security they offer, most borrowers choose a 30- or 15-year fixed-rate mortgage over a 5/1 ARM.

But there are certain scenarios where ARM loans become more popular usually when rates are on the rise, or when a homeowner only wants to stay in their home a few years. .

Don’t Miss: Are Online Mortgage Calculators Accurate

What Is A 5/1 Arm

A 5/1 adjustable rate mortgage is anadjustable-rate mortgage with an interest rate that is initially fixed for five years then adjusts each year. The 5 refers to the number of initial years with a fixed rate, and the 1 refers to how often the rate adjusts after the initial period.

The initial fixed interest rate is typically at a low introductory level. After the initial fixed period, the new, adjustable rate, which changes annually, is tied to an interest rate index that moves based on a variety of economic and financial market factors. After the introductory period, your interest rate will reset to the indexed rate and then go up if the index rises, and drop if it falls. If you dont refinance, youd pay off the loan in 30 years.

The Final Word On 5/1 Arms

As a mortgage borrower, you can choose from many home loan products. If you plan to stay in your home for a long time and want the security that comes with having a fixed rate for the life of your mortgage’s repayment period, then a 5/1 ARM may not be a great choice for you. But if you’re only planning to live in your home for a handful of years, or you’re comfortable taking on the risk that your loan’s interest rate might rise, then a 5/1 ARM may allow you to reap savings on your mortgage payments for half a decade .

If you’re going to get a 5/1 ARM, be sure to shop around for different loan offers. One lender may offer you a lower 5/1 ARM rate than another, so comparing your options with multiple mortgage lenders is a good way to end up with a great deal.

Don’t Miss: Who Should You Get A Mortgage From

Current Mortgage Rates: 5/1 Jumbo Adjustable

- The 5/1 ARM rate is 2.463%.

- Thats a one-day increase of 0.051 percentage points.

- Thats a one-month increase of 0.268 percentage points.

An adjustable-rate loan will start off with a fixed introductory or teaser rate that will become adjustable after a number of years. A 5/1 ARM, for example, will start with a fixed rate for five years, after which the rate will start resetting every year. There are different ARM terms you can choose from, including a 7/1 ARM and a 10/1 ARM.

How To Find Personalized 5/1 Arm Rates

We’re showing today’s average mortgage rates, but you can find personalized rates based on your down payment amount, credit score, and debt-to-income ratio.

If you’re a little further along in the homebuying process, then you can speak with multiple lenders to receive personalized rates to compare and contrast rates before choosing a lender.

Read Also: What Are Mortgage Underwriters Looking For

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

What Are Todays 5/1 And 15

Rates for 5/1 ARMs and 15-year fixed loans often track each other fairly closely. Be sure and get quotes for both programs when you contact competing lenders for mortgage quotes.

Also remember that mortgage rates depend a lot on the homebuyer.

Your credit score, debt-to-income ratio, loan term, and down payment will affect your actual rates with any kind of mortgage.

Rates also vary by lender. Many buyers can save a lot simply by shopping around and finding the lender that can offer them the lowest interest rate and fees.

Popular Articles

Step by Step Guide

You May Like: What Lender Has The Lowest Mortgage Rates

How Do Fha Loans Help Home Buyers

FHA loans make borrowing to own a home easier by providing extra assurance that the loan will be repaid. Because the government itself insures the loan, FHA lenders are typically able to offer better terms than they would otherwise be able to. Some homeowners might not be able to qualify for a mortgage loan at all without FHA insurance.

As mentioned, FHA loans allow for lower down payments than traditional loans this means that you need less money up front to secure the loan. Closing costs are also lower, which helps significantly because many borrowers arent prepared for high closing costs when trying to purchase a home. The FHA also expands the credit range with which you can qualify for a loan, giving potential homeowners access to lower interest rates even if they have less-than-perfect credit.

In addition, FHA programs may allow borrowers to include in their loans other costs such as the cost of home improvements and materials to make the home more energy-efficient. Though additional assessments are required to make sure that the improvements are cost-effective and that the home uses enough energy to make the upgrades worthwhile, the programs can cover improvements ranging from new doors and windows to solar installations that reduce overall energy costs.

What’s The Best Loan Term

When picking a mortgage, you should consider the loan term, or payment schedule. The mortgage terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Another important distinction is between fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are set for the duration of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only the same for a certain amount of time . After that, the rate fluctuates annually based on the market rate.

When choosing between a fixed-rate and adjustable-rate mortgage, you should think about how long you plan to stay in your house. Fixed-rate mortgages might be a better fit for those who plan on staying in a home for a while. While adjustable-rate mortgages might offer lower interest rates upfront, fixed-rate mortgages are more stable over time. If you don’t have plans to keep your new home for more than three to 10 years, however, an adjustable-rate mortgage might give you a better deal. There is no best loan term as a general rule it all depends on your goals and your current financial situation. Make sure to do your research and think about what’s most important to you when choosing a mortgage.

You May Like: Can There Be A Cosigner On A Mortgage

Lower Rates Help You Build Equity Faster

The obvious advantage of an adjustable-rate mortgage is that they carry lower interest rates during the fixed period of the loan. At the time of writing, the lowest rate advertised on a major mortgage site for a 5/1 ARM was about 3.2% compared to a rate of 3.9% for a 30-year fixed loan.

While the difference amounts to a mere 0.70 percentage points, it can make a big difference in your payment. The 30-year fixed mortgage carries a monthly payment of $943 per month, while the ARM carries a payment of about $865.

The smart thing to do might be to take out a 5/1 ARM but make monthly payments as if it were a 30-year fixed mortgage. By the end of the 5-year fixed period, the borrower will have made a much larger dent in their balance than the borrower who uses a 30-year fixed mortgage.

Here’s the math based on a $200,000 mortgage at current mortgage rates.

|

Mortgage |

|

|---|---|

|

$943 |

$173,360 |

After five years of equally sized payments, the buyer who used the 5/1 ARM instead of a 30-year mortgage would be more than $7,200 closer to paying off the home in full.

Having more home equity is a powerful buffer should interest rates rise. If, at the end of five years, your rate rises by more than 1 percentage point , your monthly payment will simply match that of the 30-year fixed-rate mortgage. Of course, the $7,200 in additional home equity you built up is yours to keep.

What Is An Fha Loan

FHA loans are loans that are insured by the Federal Housing Administration , which is part of the U.S. Department of Housing and Urban Development . The FHA has been insuring loans and helping potential homeowners get the money they need since 1934, and the FHA loan program is available to both first-time homeowners and repeat home buyers alike.

Its important to keep in mind that FHA loans arent provided by the FHA directly. Instead, FHA loans are provided by partner lenders that work to find you a better interest rate because your loan is insured by the FHA. In many cases, an FHA-insured loan will have terms that you wouldnt be able to get otherwise due to hiccups in your credit history or other issues with your loan application. You can also typically get away with having a lower down payment on an FHA loan than whats required for more conventional loans.

Recommended Reading: How To File A Complaint Against A Mortgage Lender

What Is A 5’1 Arm Mortgage Loan

5/1 adjustable-rate mortgageARMmortgage loanadjustable-rate mortgage

A 5/1 ARM can work out in your favor under the right conditions. Here’s when a 5/1 ARM might be a good idea. The advantage of a 5/1 ARM is that during the first phase, you get a much lower interest rate and payment. If you plan to sell in less than six or seven years, a 5/1 ARM could be a smart choice.

Also Know, should you do an ARM mortgage? If your monthly payments during the initial fixed-rate period would put a strain on your budget, an ARM isn’t a good choice for you. Starting interest rates on ARMs are usually lower than on fixed-rate mortgages, so your monthly payments will likely be lower for at least a few years.

Subsequently, question is, how does an ARM mortgage work?

An adjustable-rate mortgage is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time, after which it resets periodically, often every year or even monthly.

Are 10 1 ARMs a good idea?

Choosing a 10/1 ARM could save you money on your monthly mortgage payment. Because of this, it is essential that you be sure you can still afford the monthly payments if interest rates go up. Most 2/1 ARM’s will have a lifetime payment cap that limits how much the interest rate on your loan can rise.