Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, your annual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

How Long Should My Mortgage Be

When applying for a mortgage, the type of loan will usually determine how long youll have your mortgage. For instance, you can choose from conventional mortgages on 15-year and 30-year terms. With a shorter term, youll pay a higher monthly rate, though your total interest will be lower than a 30-year loan. If you have a high monthly income as well as long-term stability for the foreseeable future, a 15-year loan would make sense to save money in the long-term. However, a 30-year term would be better for someone who needs to make lower monthly payments.

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

Recommended Reading: How To Know How Much Mortgage I Can Afford

Should I Use A Mortgage Broker In Nova Scotia

The job of a mortgage broker is to compare the products and rates of multiple mortgage providers on behalf of their clients. This means that by using a mortgage broker, you’ll have access to multiple mortgage products without having to do the hard work yourself. Brokers are mortgage experts, and can quickly identify the products that are available on the market that will suit your needs.

Mortgage brokers also have access to a range of mortgage rates that are not accessible to the retail market. This is because they are often given volume discounts from lenders, along with unique, broker-exclusive products.

It may be convenient to apply for a mortgage directly with your current bank, but it will only be able to offer you its own products. This means you could be missing out on a mortgage with lower rates, or that better suits your needs.

So should you use a broker when you compare mortgage rates in Nova Scotia? Consultations with mortgage brokers are free, so you have nothing to lose by speaking with one.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

Getting a mortgage is a big financial commitment, and finding a great mortgage rate is one of the best things you can do to make your mortgage more manageable. Luckily, how to get a lower mortgage rate isnât a secret – all you need to do is plan ahead.

Comparing Mortgage Payment Frequency

| $134,166 | $134,009 |

There are slight interest savings to be had from increasing your mortgage payment frequency. This keeps your mortgage amortization the same, which is why you wont realize as much interest savings.

Many mortgage lenders offer accelerated payment frequencies, such as accelerated bi-weekly and accelerated weekly mortgage payments. With accelerated payments, you will be paying the equivalent monthly payments, which means that you will be making an extra payment per year. In the above table, a monthly payment would have been $2,117.

To calculate the accelerated bi-weekly payment amount, you would divide $2,117 in half to get $1,058.50. Your accelerated bi-weekly payments will be $1,058, higher than the regular bi-weekly amount of $977. This increased amount allows you to pay off your mortgage faster, which shortens your amortization and saves you interest.

Also Check: Can I Change Mortgage Companies

Tips On Finding The Best Toronto Mortgage Rates

Just like any other city, getting the lowest mortgage rates in Toronto requires comparison shopping. One cannot rely on just one lender or one mortgage broker if they want to get the best deal.

The right place to start is with a good mortgage rate aggregator . That way, you see a large representation of the mortgage market, all at once. Its especially important to focus on rate sites that show all top lenders. Unlike rates.ca, most others dont.

If youre looking for a good roadmap to finding deals, heres a simple four-step process to securing the mortgage with the lowest borrowing costs:

1. Get solid advice on the right mortgage term given your five-year plan

- The term you pick has a huge effect on your interest costs

- You can get this advice online or in-person

- It never hurts to talk to an experienced mortgage advisor, but dont put too much weight in their opinions because some bankers and brokers have a bias to one term

2. Identify the lowest rates for that term

- You can easily do this on a rate comparison website

- Read the rate notes carefully because some of the cheapest rates come with lots of fine print and restrictions

3. Ask them to list all material features and limitations of the rate in question

- Things like the prepayment penalty calculation method, porting rules and refinance options can enormously impact your borrowing costs

- Pick the mortgage with the best combination of upfront interest savings and after-closing flexibility

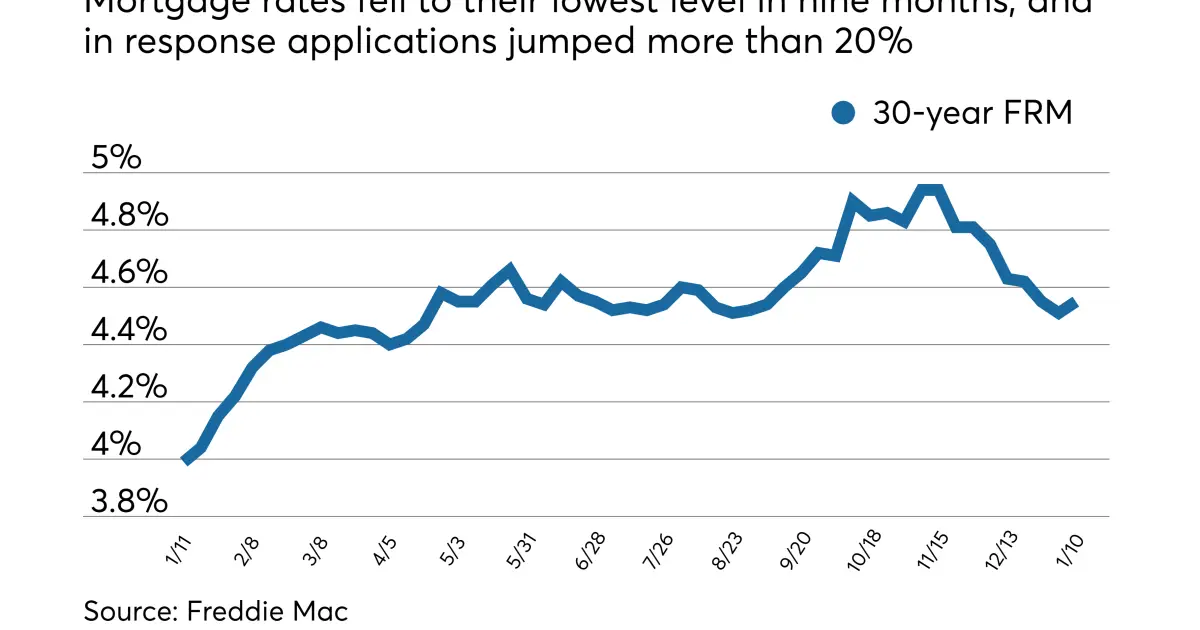

Average Us Mortgage Rates

See Mortgage Rate Quotes for Your Home

The average rate for a 30-year fixed rate mortgage is currently 3.99%, with actual offered rates ranging from 3.13% to 7.84%.

Home loans with shorter terms or adjustable rate structures tend to have lower average interest rates.

While it’s useful to know what rates you can expect on average, the mortgage rates you’ll find will also depend on your individual credit history, loan amount, and down payment.

If you’re interested in finding out what current mortgage rate you might qualify for, use our rate tool at the top of the page to check mortgage rates for your chosen loan amount and location. No credit check required for estimated results.

Recommended Reading: What Is The Average Interest Rate On Home Mortgages

How Do Your Credit Scores Affect Your Rate

Your credit scores influence your mortgage interest rate. Lenders call it risk-based pricing. Higher credit scores indicate a lower risk that youll default on a loan so you get a better interest rate. The lower your credit scores, the higher your interest rate.

» MORE:Mortgage rates and credit scores: Dont make a $30,000 mistake

How Are Mortgage Rates Set

Mortgage rates fluctuate for the same reasons the price of homes change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. But the demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

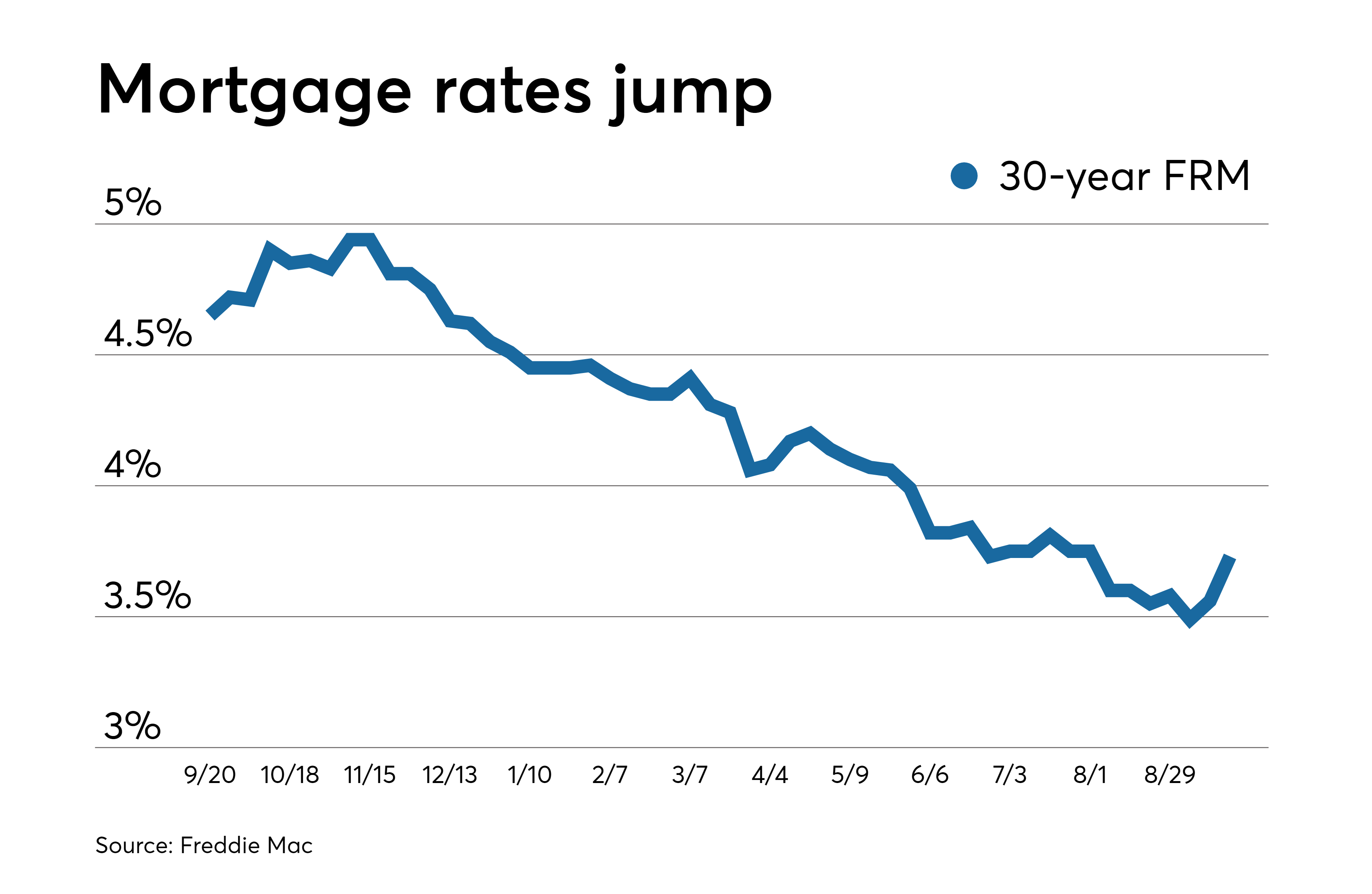

If the demand for these safer bond investments is low, the mortgage interest rate increases to attract buyers. When there is strong demand for these investments, they can be sold more easily and the mortgage interest rates decrease. Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

Read Also: How Do Mortgage Appraisals Work

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

According to FICO, only people with credit scores above 660 will truly see interest rates around the national average.

Movement Mortgage Best For Quick Closing

Overview

The South Carolina-headquartered Movement Mortgage was founded in 2008. Its a licensed mortgage lender in all 50 states and has over 650 branches nationwide.

What to keep in mind

It offers all of the most popular types of mortgages from conventional loans to FHA loans, and niche options, such as reverse mortgages. But if you want any type of home equity loan or line of credit, youll have to go with another lender.

Movement Mortgage prides itself on quickly closing loans, and claims that 75% are closed within seven business days. It also gives a large amount of its profits to charity.

You May Like: Could I Qualify For A Mortgage

Hybrid Adjustable Rate Mortgage

Hybrid Adjustable Rate Mortgages offer the consumer a low interest rate for a certain period of time. Then, they increase or adjust to the current rate after fixed rate period has elapsed. These rates can be an entire point lower than 30 year fixed rates. Therefore, there may be significant savings in terms of interest paid to the lender. Some common hybrid ARMs are 1 year fixed, 1 year adjustable rates 5 years fixed, 1 year adjustable and 7 years fixed, 1 year adjustable . The adjustable rates will be based upon the federal rate when the fixed term elapses. These loans are also appealing to investors or home buyers who plan to sell in a short period of time.

What Factors Affect The Mortgage Rate I Get

The mortgage rate that you qualify for will depend on a number of factors, some of the most important of which are:

- Your down payment – The size of your down payment will determine the amount of insurance your mortgage will require. The larger your down payment, the less insurance your mortgage will require. Though it may seem counter-intuitive, uninsured mortgages actually have higher rates. This is because lenders take on more risk for these mortgages since they cannot get insurance on them. Though you may not get the lowest rate, it is usually always better to put a larger down payment if you can afford it because you wonât have to pay for mortgage insurance.

- Your amortization period – Mortgages with amortization periods greater than 25 years are not usually insurable and therefore come at a higher rate. However, a longer amortization period allows you to have a lower monthly payment.

- What the property will be used for – Will you be living in the property? Mortgage rates for rental properties are typically higher than for those that are owner-occupied.

- Mortgage type – Mortgage rates for refinances are usually higher than rates for renewals and purchases.

- Your credit score – Your credit score may affect the type of lenders that will work with you. If you have bad credit, you may not qualify for a Big Bank mortgage.

You May Like: What Is A 5 1 Arm Mortgage

Jamie David Business Director Of Mortgages

Jamie David is the Business Director of Mortgages at Ratehub.ca. A graduate of the Systems Design Engineering program at the University of Waterloo, she has over 15 years of business, marketing, and engineering experience in the financial technology, banking, education, energy and retail industries. She has worked in top organizations like TD Bank, Trading Pursuits, Petro-Canada, and the TTC. Her passion for personal finance, investing, education, and business strategy brought her to Ratehub.ca where she heads a very talented, cross-functional team that is dedicated to providing Canadians with the best mortgage experience all the way through from online search to funded mortgage.

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W-2 forms or pay stubs to prove a steady income. If youre self-employed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

Don’t Miss: What Lender Has The Lowest Mortgage Rates

Scoring A Low Interest Rate

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

Shop Around To Find Your Best Interest Rate

Mortgage lenders personalize your interest rates based on your credit history and other details about your financial life. So you wont know for sure what your rate options look like until you apply and get pre-approved.

The first rate youre quoted may not be your best interest rate. Be sure to apply with several lenders so you can compare Loan Estimates and find your best deal.

Popular Articles

Resources

You May Like: How To Modify Mortgage Loan

Bankrate Survey: Young Americans Plan To Continue Delaying The Homebuying Process

Many Americans are postponing at least one major life event because of the coronavirus pandemic, according to a new Bankrate survey. 39 percent of respondents say theyve delayed buying or leasing a car, buying a home, getting married, having a child or taking another significant step.

Some 12 percent of respondents to Bankrates survey say they delayed buying a house, relieving some of the pressure on a booming housing market characterized by a sharp shortage of inventory. More than half of homebuyers who delayed real estate purchases anticipate waiting nine months or longer. Younger buyers were more likely to say theyre waiting.

The supply of existing homes for sale is near record lows, in part because homeowners decided not to sell during the coronavirus pandemic. Meanwhile, homebuilders havent ramped up to historical levels. While theres a shortage of homes for sale, theres a glut of buyers vying for homes. That has resulted in bidding wars and soaring prices.