Pay Off Lines Of Credit

A second mortgage is a popular way to pay off a line of credit. For example, a small business owner may take out a line of credit to purchase inventory. Then, they may want to pay it off before the business has time to make a profit.

Alternatively, a second mortgage can be used as a down payment on a new property purchase.

Fannie Mae And Freddie Mac

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. However, they require mortgage insurance until the ratio falls to 80%.

For FHA, VA, and USDA loans, there are streamline refinancing options available. These waive appraisal requirements so the home’s LTV ratio doesn’t affect the loan. For borrowers with an LTV ratio over 100%also known as being “underwater” or “upside down”Fannie Mae’s High Loan-to-Value Refinance Option and Freddie Mac’s Enhanced Relief Refinance are also available options.

What Are Tds Gds And Ltv Ratios

As you can see, Linda and Bill are below the GDS standard, but their TDS is a little bit higher than lenders like to see. Both of Eds ratios are too high according to industry standards. What if my ratios are higher than the industry standard? The first thing to remember is that these ratio percentages are simply industry guidelines and vary from lender to lender, both within the same category of lender as well as across different types of lenders . Therefore, they are not set in stone. Some lenders will emphasize other factors when determining the validity of an applicant. For instance, the loan-to-value ratio is much more important to B lenders, as they are lending based on equity and income can simply be stated to alter the TDS/GDS ratios. The LTV is a simpler calculation its the ratio of the size of the loan to the value of the property.

Don’t Miss: How Long Is The Mortgage Process

Saving For A Property

The first rule of buying a property is to save, then save again. The greater your deposit the better the property youll be able to afford without stretching the limits of what you can afford.

With a significant deposit you can afford a lower LTV ratio, meaning you will get a better deal and pay less in interest payments over the term of your mortgage.

However, make sure you estimate what you can afford correctly. While the deposit is the most significant cash outlay when buying a home there are plenty of other costs to consider.

You will have to pay legal fees, assessment fees and, if your property value is above the limit, stamp duty. You will also have to put money aside for extra unforeseen expenses that you could incur as a result of damage to the property.

If the boiler breaks within the first week of moving in for instance and needs to be replaced you will need some significant savings left over to avoid being driven into debt.

Wait & Pay More Mortgage Payments

Another way to improve your LTV when you refinance is to simply wait. As you make your mortgage payments, even if you do not pay extra, you are paying down your loan and building equity in your home.

Also, if prices in your neighborhood are rising, waiting until the appraised value of your home goes up will lower your LTV.

Read Also: How To Get A 15 Year Fixed Mortgage

How Your Loan To Value Ratio Affects Your Loan Options

If you have a lower LTV, you have more of your own money invested in the property.

Mortgage lenders see a lower LTV as a less risky loan because you are more likely to continue making your mortgage payments to protect your equity.

That means that the lender is more likely to approve the loan, and you may get a better rate.

What Is The Ltv Ratio

First, lets understand what LTV means.

The loan to value ratio or LTV ratio is used to assess the size of a loan. For example, you have an LTV ratio of 70%. This means you owe 70% of your car or property price. So a borrower with lower LTV is considered less likely to default on their loan.

That said, it is also used by banks and other lenders to assess the lending risk before approving your loan. High LTV ratios are considered high-risk loans. This ratio is implemented to safeguard against borrowing an amount that is beyond an individuals capacity.

The loan to value ratio is one of the many factors considered when assessing car and home loans. Other factors include:

- Income available for monthly payments

- The condition or quality of the property or car youre buying

Lastly, there are regulations for lenders based on maximum loan to value ratios for home and car loans. If youre thinking of taking out a loan, you need to know about the maximum LTV.

Don’t Miss: Does Rocket Mortgage Affect Your Credit Score

Second Mortgage Brokers In Toronto

After you understand your options, you can get our 2nd mortgage broker in Toronto to help to navigate them. The next step is to contact us and speak with our second mortgage broker in Toronto.

There are two types of home finance professionals who can help:

- private second mortgage lenders

- second mortgage brokers

Second mortgage brokers in Toronto offer a range of financial services. Some are oriented towards helping you get approved, either from a home equity lender or a bank. They can help you put together a portfolio so you can present your case for a low interest rate to the home equity loan provider.

Toronto second mortgage brokers, in particular, can do an in-depth assessment of your financial needs. Then they can do a lot of the legwork for you.

Brokers can connect you with home equity loan providers and secure quotes. Well dive deeper into the services second mortgage brokers provide, and how they differ from lenders, later in this guide.

When Do You Pay Pmi

There are a few ways to handle PMI payments. Some lenders may let you choose a payment method. Others require you to agree to a specific option. The most common PMI payment methods include:

- Monthly premium: Paying a monthly premium is the most common PMI option. In this case, your lender automatically adds PMI to your monthly mortgage payment. You wont have to make a large upfront payment, but your monthly payments will be higher.

- Upfront premium: Rather than paying every month, you may have the option to pay the full cost at once. In this case, your lender arranges for you to pay PMI when you close on the loan. While it’s an additional closing cost, your monthly mortgage payment will be lower.

- Monthly and upfront premiums: Alternatively, your PMI might come in a combination of the two methods above. In this case, your lender arranges for you to pay a portion of your PMI at closing and adds the rest to your monthly mortgage payments.

Recommended Reading: Who Can Get A Fha Mortgage

Home Equity Lines Of Credit

The HELOC acts more like a credit card, so it has a draw period and a repayment period . The rate with a HELOC will most often be variable, making it a bit riskier than the other options in this regard. It is also common to overdraw a bit with a HELOC and incur harder-to-handle payments of interest-and-principal.

However, the HELOC can be a smart move when you have a series of smaller costs, perhaps spread out over a short time, and want to handle them fluidly. The ability to pay interest-only, and only on the amount you draw makes this option attractive for many borrowers.

HELOCs and home equity loans are typically approved in a 2 to 4 week period, with the approval process rarely taking more than 6 weeks.

HELOCs are popular with consumers, and lenders have created a variety of hybrid products that help expand the possibilities for affordable borrowing. Some offer fixed rates or a combination of variable and fixed. As this segment of the market grows you can expect more banks to offer additional lending products to cater to the consumer demand.

Home Equity Loans In Toronto

There are a growing number of second mortgage providers who are based in Toronto, Ontario or have branches here.

Each home equity loan provider will have its own method of calculating the interest rate on a home equity loan. Applying with over forty providers takes time and will damage your credit score when you have multiple potential second mortgage brokers in Toronto do a credit check. Rushing through the application process can result in denials or a worse interest rate than you would have gotten otherwise.

Before heading directly to a second mortgage provider, consider some of these next steps.

Recommended Reading: Who Is Rocket Mortgage Owned By

The Mortgage Relief Refinance

Over the years, there have been a number of mortgage relief refinance programs designed to help homeowners who are underwater on their loans.

Being underwater means you owe more on the home than it is currently worth. As a result, your LTV is over 100%.

For example, imagine you have a mortgage out for $150,000 on a home thats also worth $150,000. But your home loses value, and is now worth only $125,000. Your new loan to value ratio is 120%.

Having an LTV above 100% would normally disqualify you from refinancing. But with a special mortgage relief program, you can refinance an underwater home into a lower rate to make your mortgage more manageable.

You can read about current mortgage relief refinance programs here.

Second Mortgage Financing Options In Toronto

The first step to getting approved by a lender is to learn about your financing options. Then, you can consider what resources youll need to apply for a second mortgage successfully.

A second mortgage gives you access to equity without changing the terms of your primary mortgage.

There are financing resources in Toronto that Ontario homeowners can take advantage of. Once you understand the processes, youre more likely to be approved than you might think.

Also Check: What Is The Mortgage Rate In Florida

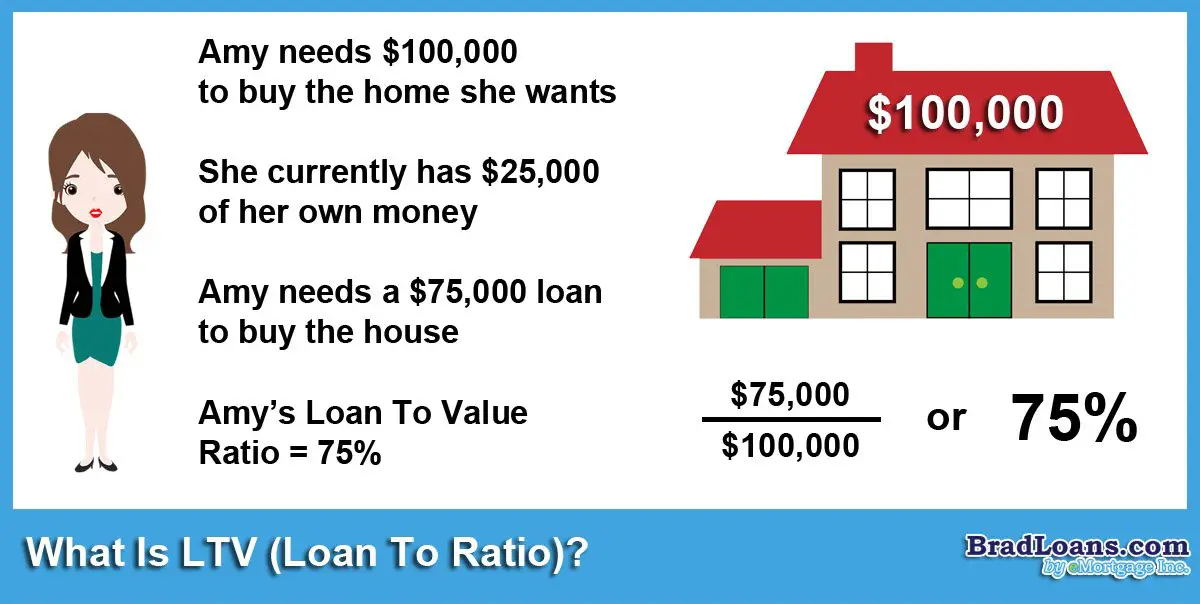

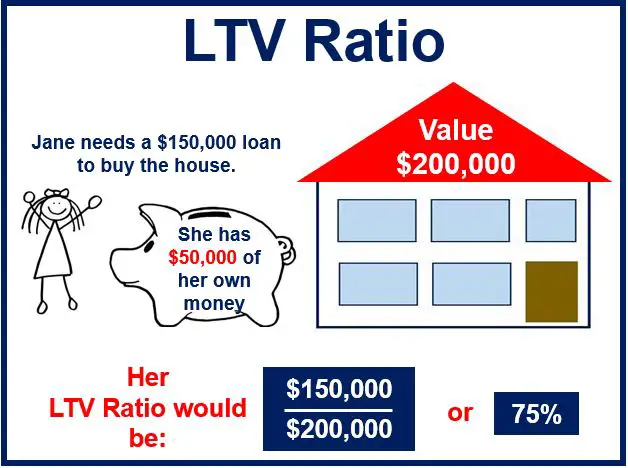

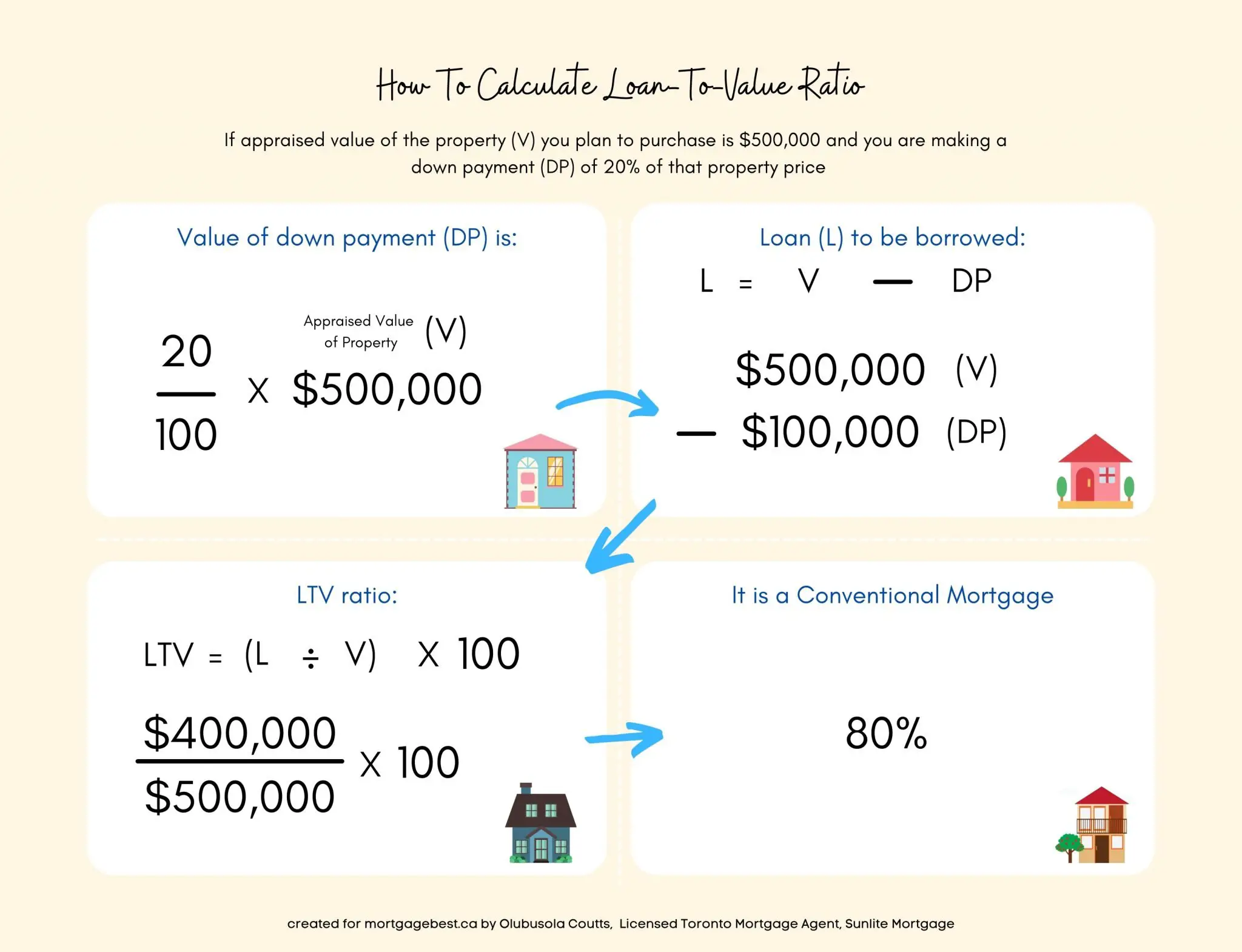

How Do You Calculate Loan

Divide the amount of the loan by the appraised value of the asset securing the loan to arrive at the LTV ratio.

As an example, assume you want to buy a home with a fair market value of $100,000. You have $20,000 available for a down payment, so you’ll need to borrow $80,000.

Your LTV ratio would be 80% because the dollar amount of the loan is 80% of the value of the house, and $80,000 divided by $100,000 equals 0.80 or 80%.

You can find LTV ratio calculators online to help you figure out more complicated cases, such as those including more than one mortgage or lien.

The Bottom Line: Loan To Value Ratio

Whether itâs for a house that you plan to live in or a real estate investment, before you go to a mortgage lender and apply for a loan, take a good look at your loan to value ratio and other factors that may affect your ability to secure the mortgage.

If your LTV is higher than 80%, you may be able to get another type of loan other than a conventional mortgage.

Some other types of loans, like a VA loan if you qualify, will allow you to borrow more than 80% of the value of the property.

In the case of refinancing, if you can, pay a little more each month toward your mortgage payment to lower the amount you owe on your home when you refinance. Even if you canât afford a higher monthly payment, your LTV will continue to go down as you make your payments and build equity in your home.

The bottom line is that a loan to value ratio of 80% or lower will boost your chances of securing the loan, eliminating the need for paying PMI and lowering your interest rate when you are approved.

You May Like: Can There Be A Cosigner On A Mortgage

Why Do You Need To Know The Maximum Ltv

Because they will help you determine how much down payment youll need to pay. And how expensive of a property you can afford.

But there are several factors to take into account to determine the LTV ceiling for your home loan. One of which is the number of housing loans you have.

Heres an overview of the LTV limits for home loan borrowers in Singapore. You can find additional details about the rules of new housing loans on the Monetary Authority of Singapore website.

| Outstanding housing loans | |

|

|

| One | |

| 35% or 15% | 25% |

From the table above, you can see that a lower LTV ratio means paying more down payment. This means more cash upfront. But this actually helps you save money in the long run. Since youre starting with a smaller loan balance, youll be paying less interest throughout your loan tenure.

Maintaining And Increasing The Value Of Your Property

By keeping your house ‘in order’ you will minimise any loss of value if house prices go down. You can even increase your property’s value by carrying out home improvements like replacing the windows and doors with uPVC, upgrading the kitchen or bathroom and adding things like an en-suite. These may well increase the value of your property and give you a bigger equity in the process. This could, in turn, help lower your LTV when it’s time to remortgage.

You May Like: What Credit Agency Do Mortgage Lenders Use

Rbi Guidelines On Ltv

According to the guidelines issued by the Reserve Bank of India , the LTV ratio for home loans can go up to 90% of the property value for loan amounts of Rs.30 lakh and below. For loan amounts that are above Rs.30 lakh and up to Rs.75 lakh, the LTV ratio limit has been set to up to 80% while for loan amounts above Rs.75 lakh, the LTV ratio can go up to 75%.

This implies that if the LTV ratio is 90%, you will have to pay at least 10% of the property value from your pocket and rest of the amount can be funded by taking a home loan. LTV ratio is needed to calculate the minimum down payment that you would have to make towards purchasing a home or property.

Summary: Ltv Is Just One Factor

Remember, your LTV is only one piece of your mortgage application. The lower your LTV, the lower your interest rates and mortgage insurance is likely to be. Understanding your LTV can help you determine if youre ready to get a mortgage and show you what home loans are available to you.

Our Home Loan Experts can guide you through each loan option and help you decide what will work for you. Visit Rocket Mortgage®or give us a call at 785-4788.

Recommended Reading: What Is Needed For Mortgage Application

Choose A Less Expensive Home

If youre unable to make a larger down payment and are on a strict budget, the other option is to focus on less expensive homes. This will lower your LTV and might help you get a preferable loan option.

Remember, you already have the equation. That means you can manipulate the variables to get a lower, preferable LTV. Finding a home with a lower property value will improve your LTV ratio.

For example, if you know you only have $10,000 to use toward a down payment, this is how the price of a home can lower your LTV:

Home One

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Don’t Miss: Which Credit Reporting Agency Do Mortgage Lenders Use

Usda Loan: Up To 100% Ltv Allowed

USDA loans are insured by the U.S. Department of Agriculture. USDA loans allow for 100 percent LTV, with no down payment required.

Many also know the program as Rural Housing. You can find USDA loans in rural parts of the country, but also in many suburbs.

Learn more about USDA financing and how to qualify here.

Build Sweat Equity With Home Improvements

Paying off principal on a loan will lighten the top shelf, but you can stabilize the bottom shelf in an existing home by increasing the property value. Several studies have found that a well-designed landscape can increase property value.

One study found that 68.2% of respondents agreed that a well-designed landscape could influence their decision to rent or buy a home. There are plenty of ways to build sweat equity in your home before you get it reappraised.

You May Like: How Much Is Mortgage On 1 Million