How The Overnight Rate Works

Think of the banks as a group of friends. The banks don’t like to hold cash and like to lend out their money whenever they can. Sometimes, Bank A might have a lot of cash on its hands while Bank B might have less. Since they’re friends, Bank A is more than happy to lend money to Bank B. But they’re banks, so they don’t want to lend their money out for free. So they charge an interest rate.

Everyday, the banks come together and make offers to borrow and lend money. The rate that they settle on is called the “overnight rate” because it’s the interest rate for borrowing cash “overnight”. The Bank of Canada is the “mom” of the group. The Bank of Canada has a “target overnight rate” and tries to keep the overnight rate close to the target. If the rate gets too low because there’s too much money, the banks can lend their money to the Bank of Canada instead. If the rate gets too high because there’s a shortage of money, the Bank of Canada acts as a “lender of last resort” and will lend out money.

Mortgage Interest Rates Forecast Next 90 Days

We expect mortgage rates to continue to hover near or just below 3% for the next few weeks. Over the next 90 days, a modest overall increase seems likely.

Based on expert mortgage rate predictions and forecasts from housing authorities, 30-year mortgage rates could go as high as 3.17% within the next 90 days.

Will Mortgage Rates Go Down In September

It seems like mortgage rates will stay in their current low range throughout September, at least until the end of the month.

Concerns around the Delta variant are still keeping rates low. And recent reports show our economic recovery slowing down.

The August jobs report released September 3 showed only 235,000 new jobs created in August. That was far below the forecast of 750,000 new jobs.

The rising number of Covid-19 cases tied to the Delta variant could result in slower job growth for two reasons, reported Wall Street Journal.

Businesses, particularly in services sectors requiring in-person contact, could hold off on hiring amid heightened pandemic uncertainty. Jobless individuals who are fearful of Covid-19 health risks might also be slower to return to the labor market until the virus abates.

Remember that the weaker the economy is, the longer interest rates will stay low.

Experts arent expecting mortgage rates to rise substantially until the Fed makes a firm announcement about when it will start tapering its bond-buying program. And, as Fed Chair Powell has said, they wont make that announcement until they see further progress toward maximum employment. This report throws a wrench in that progress.

Will we learn more about tapering plans when the FOMC meets at the end of September? And will mortgage interest rates rise as a result?

Thats yet to be seen but it seems less likely now than it did a week ago.

Read Also: What Are Mortgage Underwriters Looking For

Be Prepared To Move Quickly

While housing market inventory has increased from its record low, demand is still outstripping supply. So you should prepare everything for your home search in advance. Know how much house you can afford and what your must haves and would like to haves are. Once you find a property that you like, youll most likely need to make a quick decision on whether or not to put in an offer.

You should also be sure to get preapproved for a home loan. A full preapproval involves having a lender review your credit and other financial information. But once youre preapproved, youll know how much house you can afford, and having a preapproval letter shows the seller that youre a serious and qualified buyer.

What An Interest Rate Rise Could Mean For Your Mortgage

Unsplash

emember, remember the 4th of November. No, Bonfire Night isnt taking place a day early next month. But, if youre a homeowner with a mortgage, its still a date worth noting.

Thats because this is when well next hear from the Bank of England and its highly influential Monetary Policy Committee in connection with interest rates.

Should the MPCs nine members vote in favour to increase the Bank of England base rate in November – say by a quarter or a half of a percentage point – the decision would have an impact on the finances of savers and borrowers alike.

For example, an interest rate rise would push savings rates higher.

This would be good news for savers, especially those with cash in accounts that pay paltry returns. Rates of as little as 0.01% are not uncommon currently, even on deposits of £50,000 or more.

A rate rise, however, would be welcomed much less by anyone whos borrowed money, especially homeowners with mortgages. Thats because commercial lenders all take their cue from movements in the base rate.

Read Also: What Score Do Mortgage Companies Use

The Federal Reserve And Mortgage Rates

Currently, the Federal Reserve is purchasing $40 billion per month in mortgage-backed securities as part of its Covid stimulus program.

This is one of the single biggest factors keeping mortgage rates as low as they are.

When the Fed slows or tapers its purchasing of MBS, mortgage rates are almost certain to increase by a wider margin than weve seen this year.

And that could be coming in the not-too-distant future.

In a speech on August 27, Fed Chair Jerome Powell indicated that asset purchase tapering could begin before the end of the year depending on how the Delta variant plays out economically.

Asset purchase tapering could begin before the end of the year depending on how the Delta variant plays out economically.

We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, said Powell. My view is that the substantial further progress test has been met for inflation. There has also been clear progress toward maximum employment.

He continued on to say that in light of these positive trends, he and other Fed members believe it may be appropriate to start reducing the pace of asset purchases this year.

But and its a big but the Fed still isnt clear on what the overall economic impact of the Delta variant will look like. And because of that, its not ready to make any firm plans to start withdrawing support in 2021.

Impact Of Interest Rates Rise On Mortgages

When, and if, your mortgage repayments are affected by an interest rate change will depend on what type of mortgage you have and when your current deal ends.

If you have a variable rate tracker mortgage, linked to the BoE base rate you are likely to see an immediate impact on your mortgage repayments if there is an interest rate rise.

Those on a standard variable rate mortgage will probably see an increase in their rate in line with any interest rate rise. How much is decided by your lender, so this isnt guaranteed. If you are unsure, check your mortgage terms and conditions in your original mortgage offer document.

People with fixed rate mortgages are likely to be affected once they reach the end of their current deal. An interest rate rise could make re-mortgaging more expensive.

Don’t Miss: Which Credit Reporting Agency Do Mortgage Lenders Use

Shall I Get A Variable Rate Mortgage

Variable rates are typically a little lower than fixed rates because the borrower takes on the risk of rates changing over time.

Variable rates are expected to remain low for the foreseeable future. 3 of the 7 economic forecasters that we watch expect variable rates will rise in 2022. A few months ago, only Royal Bank thought that was possible.

Mortgage Rates Rise Slightly But You Still Have A Window To Snag A Covid Deal

Its inevitable, homeowners: The pandemic-fueled low mortgage rate party will come to an end.

The economy’s open, more than 2 million jobs were created in the last three months, and COVID-19 relief programs are being allowed to wind down and expire.

Amid signs the recovery is progressing, rates on some popular mortgages have moved higher, according to a long-running and closely followed survey.

They didnt rise by much, and remain fairly close to their all-time lows. But its a sign that, even amid a brutal stretch of COVID-19 infections, the U.S. economy may be too healthy for todays ultra-low mortgage rates to stay that way for long.

Read Also: How To Get A 15 Year Fixed Mortgage

Current Mortgage Rates Tick Lower

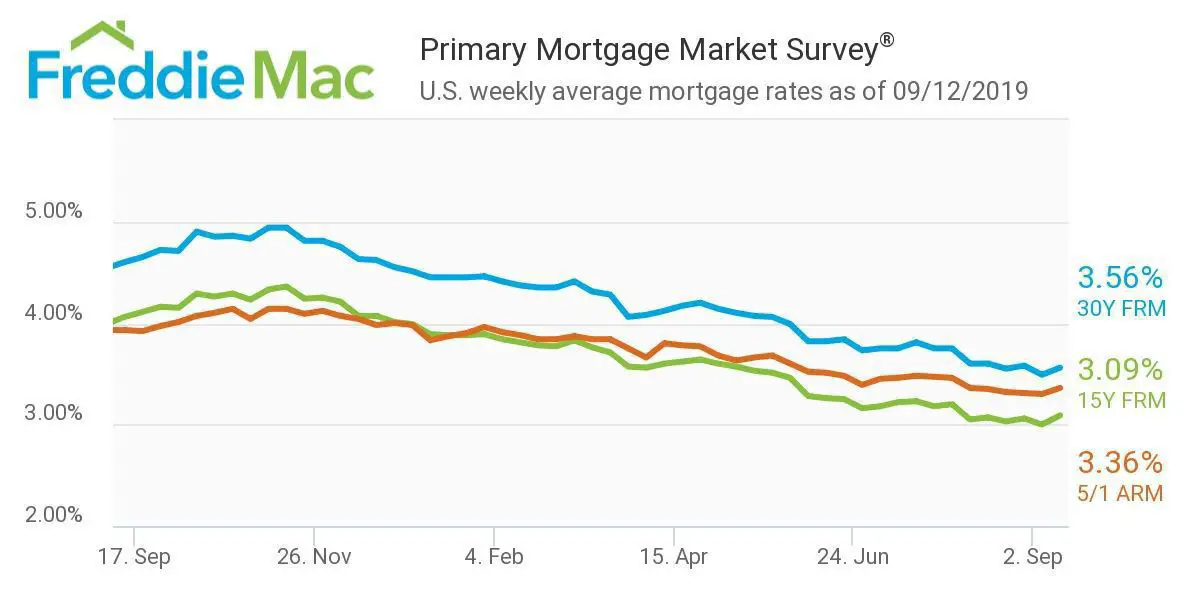

The 30-year fixed-rate loan is averaging 2.86% for the week ending September 16, down just 0.02 percentage points from last week, according to Freddie Mac’s benchmark survey.

Rates have been hovering between 2.86% and 2.88% since August 12. Earlier this year, there was more weekly movement, with the 30-year rate reaching a high of 3.18% on April 1. Since then, rates have been trending lower with occasional bumps.

“It’s Groundhog Day for mortgage rates, as they have remained virtually flat for over two months. The holding pattern in rates reflects the markets’ view that the prospects for the economy have dimmed somewhat due to the rebound in new COVID cases,” said Sam Kahet, Freddie Mac’s chief economist. “While our collective attention is on the pandemic, fundamental changes in the economy are occurring, such as increased migration, the extended continuation of remote work, increased use of automation, and the focus on a more energy-efficient and resilient economy. These factors will likely lead to significant investment and new post-pandemic economic models that will spur economic growth.”

The direction of rates for various types of loans continues to be mixed this week:

How Do You Raise Mortgage Rates Without Actually Raising Them

The hope is new borrowing rules will take some steam out of house and property prices without giving the rest of the economy a whack

Those fortunate to be able to afford a home loan will now have to prove they can pay 3% above the interest rate the bank is offering. It is a new measure introduced ironically not to ensure people will be able to pay when rates increase, but because rates are not about to increase at all.

What happens when you have the cash rate at 0.1%, and the average mortgage rate of 3.03% is well below anything seen in the past 60 years?

As we all know, house prices surge.

This surge means we are about to break the record for the level of housing debt to income:

If the graph does not display click here

That is not something that is sustainable given our weak economy, but if you are the Reserve Bank you dont want to raise interest rates to stop prices rising, because that will increase business loan rates as well and that would hurt the same weak economy.

How do we know the economy is weak? Well, for a start the cash rate is at 0.1% and the government just delivered a $134bn deficit and is set to deliver another one around $100bn this year.

That only happens when things are not going well. Despite all that massive stimulus, wages are still barely growing at 2% and the RBA doesnt expect inflation to be above 2.5% until at least 2023.

And yet house prices are exploding.

So what to do?

The answer is macroprudential tools.

Recommended Reading: Who Is Rocket Mortgage Owned By

How To Prepare For An Interest Rate Rise

Interest rates can have an impact on a wide range of areas including mortgages, borrowing, pensions and savings. The Bank of England sets the bank rate for the UK, which is currently 0.1%. This, in turn, can influence the cost of borrowing or the rate of interest charged when financial institutions, such as banks, lend money.

Whats in this guide

What This Means For Borrowers

Now that weve discussed likely interest rate trends for the rest of the year, its important that we also share what this means for borrowers and what you can do with this information.

First, if youve thought about refinancing your mortgage, consider doing so sooner rather than later. If experts are correct and mortgage rates rise in June, and throughout the next year, then there isnt likely to be a cheaper time to refinance.

Next, if youve been planning to buy a home and have your finances in order, it may also be worth buying soon, before rates have a chance to increase. By purchasing a home today rather than six months from now, you could potentially be saving yourself tens of thousands of dollars in interest.

But what if youre not quite ready to buy yet?

It can be easy to feel that youre missing out by not buying while rates are low. And yes, waiting to buy might mean a higher interest rate. But ultimately, its better to wait until youre financially ready for a mortgage than to lock in a low interest rate before youre really ready.

And remember, the current market rate isnt the only thing that affects your mortgage rate. Your , debt-to-income ratio, and down payment will all factor into the rate youre able to get.

Recommended Reading: Can A Locked Mortgage Rate Be Changed

This Could Be A Smart Time To Lock Down A Rate

LumineImages / Shutterstock

Even with the BoCs insistence that it wont be raising rates any time soon, many observers believe mortgage rates in Canada seem poised to rise.

The surge in interest rates would undoubtedly stall or reverse if we see a third wave of new variant COVID cases in advance of a full rollout of the vaccines in Canada, says Sherry Cooper, chief economist at Dominion Lending Centres, in a recent report.

But Cooper adds that an ultimate rise in interest rates cannot be far off, given rising oil prices and government actions to stimulate the Canadian and other economies.

So if youre looking to purchase a home, try to lock a low rate now because youll be able to hold onto it for up to 120 days.

What Type Of Mortgage Do You Need

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

You May Like: Can You Get A Mortgage While In Chapter 13

Should I Change My Investments

Savers should use the time before interest rates rise to review their personal finances and investments. A sharp rise could have knock on effect for Isas and pensions, warned Becky OConnor of Interactive Investor, the stockbroker.

Rising interest rates can dampen the stock market so making sure your investments are diversified is a really good strategy to make sure you can sleep at night during changing times. Rates have been so low for so long that it is hard to predict how markets will react, she said.

Annuity rates, which have languished at lows over recent years, could start to rise. The income paid on annuities depends largely on interest rates and the yield on British government bonds.

Those looking for guaranteed income in retirement could benefit from a rise, getting more for their money if they lock in when rates go up.

Will Mortgage Rates Go Up In 2021

Throughout 2021, the consensus has been that higher mortgage rates are coming.

But two big questions remain: When will rates actually rise? And by how much?

We asked 10 industry experts for their mortgage rate predictions to find out.

Some believe average mortgage rates could go as high as 3.5% or even 4.25% before the end of 2021. Others predict a more modest rise, to around 3.2%.

The good news is, todays rates are still near historic lows. So home buyers and homeowners can lock in a great deal for the time being.

In this article

Recommended Reading: How Much Is Mortgage Insurance In Michigan

Whats Driving Mortgage Rates Right Now

To better understand what may happen with mortgage rates, pay attention to the broader economic situation.

Mortgage rates and inflation

High inflation numbers have the biggest potential to drive mortgage rates up in 2021.

Expectations for higher inflation drifted up mortgage rates in March nearly 3.2 percent, says Nadia Evangelou, senior economist and director of forecasting for the National Association of Realtors .

Nevertheless, she says, the Federal Reserve has repeatedly reported that it considers any inflation to be temporary without affecting the Feds policy. As a result, rates recently dropped again to below 3 percent.

Evangelou says investors who ultimately determine mortgage rates will closely monitor inflation over the next several months.

COVID cases and vaccinations

Another influence on mortgage rates this year? Easing of coronavirus lockdowns and an uptick in vaccination numbers throughout the country.

Thats leading to a revival of economic growth, and it may be associated with an increase in interest rates to come, explains Preetam Purohit, head of hedging and analytics for Embrace Home Loans.

However, he continues, the Federal Reserves quantitative easing, the increase in bank demand for mortgagebacked securities, and a compression in the primarysecondary spread has provided some cushion that can soften mortgage rate increases.

In other words, mortgage interest rates could rise at any time. But were not likely to see sharp spikes.

United States Rental Market Trends & Statistics 2021

The rental market appears poised to turn the corner and demand for rental units is expected to surge in 2021. While rising rents is a good sign for rental property owners, it will certainly put millions of renters hit hard by pandemic-related income loss in an even more difficult position, and further government intervention will likely be needed to avoid a painful wave of evictions. In general, there are some significant early signs of trend reversals from what the rental market saw throughout the majority of 2020. These shifts, however, dont come as a total surprise, as the rental market tends to pick up in the New Year after the holiday season.

Below you’ll find various rent reports that highlight year-over-year rent trends and price fluctuations that renters may be experiencing in various parts of the United States. We highlight a few takeaways from multiple sources having an impact on the overall rental market. The multifamily industry continues to face steep challenges brought in by the pandemic. The federal government has included $50 billion as rental assistance as well as other support for apartment residents in the recently passed COVID relief package. However, the latest months data is more evidence of a recovering economy and the resilience of the multifamily industry.

National Average Rent Price Trends

State Average Rent Price Trends

You May Like: Does Bank Of America Do Mortgage Loans