How Does My Ltv Ratio Affect Remortgaging

Just as when you first buy a home, your LTV ratio will affect the choice and quality of the mortgage deals you will be offered. However, this time some additional factors are involved: how much of your mortgage you have already paid off, and how much your home has risen in value.

If you have been paying off your loan for a while, and your home has also gone up in price, then your LTV will be lower than it was when you first took out your mortgage. This means that better deals may now be available, with lower interest rates. Alternatively, you may be able to keep similar interest rates but borrow more money against your equity . Remortgaging therefore tends to be easier in a rising property market less so if prices are falling.

Ask your mortgage broker if you can get a better deal from your improved LTV ratio.

Let us match you to your perfect mortgage adviser

Whats Behind The Numbers In Our Loan

This calculator helps you unlock one of the prime factors that lenders consider when making a mortgage loan: The loan-to-value ratio. Sure, a lender is going to determine your ability to repay including your , payment history and all the rest. But most likely, the first thing they look at is the amount of the loan youre requesting compared to the market value of the property.

An LTV of 80% or lower is most lenders sweet spot. They really like making loans with that amount of LTV cushion, though these days most lenders will write loans with LTVs as high as 97%.

Lets see how your LTV shakes out.

What Is Loan To Value And How Is It Calculated

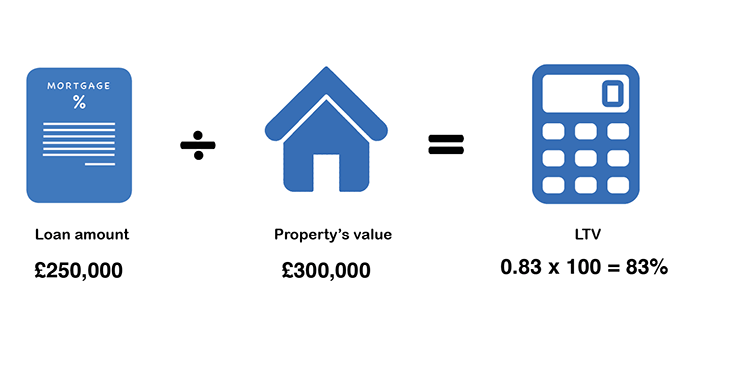

The loan to value of a mortgage is defined as the amount of the loan, in dollars as a percentage of the value of the property, in dollars.

This is calculated by dividing the mortgage loan amount by the value of the property.

Example

If a borrower wished to purchase a property for $400,000 and he or she had $50,000 as a down payment, the loan to value would be calculated using the following formula:

Mortgage Amount / Property Value

To obtain the mortgage amount, the amount of the down payment must first be subtracted from the purchase price.

Purchase Price Down Payment = Required Mortgage Amount

$400,000 $50,000 = $350,000

The mortgage amount is then divided by the property value

$350,000 / $400,000 = 0.875 or 87.5% loan to value

Bill C-37, enacted in 2007 by the federal government, contains legislation that changed the definition of conventional and high ratio mortgages in Canada. By amending section 418, subsection 1 of the Bank Act, the federal government changed what constitutes a high ratio mortgage in Canada from 75% loan to value to 80% loan to value.

Mortgage brokering in Ontario is regulated by the Financial Services Commission of Ontario and requires a license. To obtain a license you must first pass an accredited course. The Real Estate and Mortgage Institute of Canada Inc. is accredited by FSCO to provide the course. For more information please visit us at www.remic.ca/getlicensed or call us at 877-447-3642.

The following is the text of the amendment:

Don’t Miss: Are Mortgage Discount Points Worth It

Saving For A Property

The first rule of buying a property is to save, then save again. The greater your deposit the better the property youll be able to afford without stretching the limits of what you can afford.

With a significant deposit you can afford a lower LTV ratio, meaning you will get a better deal and pay less in interest payments over the term of your mortgage.

However, make sure you estimate what you can afford correctly. While the deposit is the most significant cash outlay when buying a home there are plenty of other costs to consider.

You will have to pay legal fees, assessment fees and, if your property value is above the limit, stamp duty. You will also have to put money aside for extra unforeseen expenses that you could incur as a result of damage to the property.

If the boiler breaks within the first week of moving in for instance and needs to be replaced you will need some significant savings left over to avoid being driven into debt.

Significance Of Equity In Your Home

As we mentioned above, the amount of equity you would have in the home has a big impact on how low or high your mortgage rate will be and how much of a risk youre viewed as to your mortgage lender.The more equity you have in a home means youre less likely to default on your mortgage and in the event you did default, your lender would have a good chance of recouping the full amount owed in a foreclosure sale.

Don’t Miss: How To Get Approved For Mortgage With Low Income

How To Impact Your Ltv

One of the best ways to help reduce your loan-to-value ratio is to pay down your home loans principal on a regular basis. This happens over time simply by making your monthly payments, assuming that theyre amortized . You can reduce your loan principal faster by paying a little bit more than your amortized mortgage payment each month .

Another way to impact your loan-to-value ratio is by protecting the value of your home by keeping it neat and well maintained.

High Vs Low Loan To Value

As you would expect, the higher the ratio of the loan the riskier it is for the lender offering the mortgage, and hence the higher the interest rates are likelier to be .

Conversely low LTV ratios represent a lower-risk for both borrowers and lenders, with lower interest repayments. Lower LTV ratios are typically more suitable for those with higher deposits or higher-risk borrowers, including people with a history of bad credit, who wouldnt otherwise be offered a mortgage.

Higher LTV ratios on the other hand are more commonly used for those with excellent credit scores who lenders deem low risk. Higher LTV ratios can be extremely dangerous however due to the high interest repayments and increased risk of defaulting on the loan.

Higher LTV ratios were widely implicated in the house price crashes of 2010 and 2011 when a large number of borrowers defaulted on loans that, as was subsequently revealed, were of a 100% LTV or higher.

As a result it was extremely difficult to find high LTV ratio mortgages in recent years, although this has since changed.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

What Are Ltv Bands

Most mortgage lenders separate their mortgages into loan-to-value bands, which usually go up in increments of 5%. With each band, you qualify for a new mortgage rate.

If you can find a bigger deposit even by just a few thousand pounds or a cheaper property, you might be able to drop into a lower LTV band. This can then give you a better rate and save you potentially thousands of pounds across the full term of the mortgage.

What Is A Good Ltv

If you’re taking out a conventional loan to buy a home, an LTV ratio of 80% or less is ideal. Conventional mortgages with LTV ratios greater than 80% typically require PMI, which can add tens of thousands of dollars to your payments over the life of a mortgage loan.

Some government-backed mortgages allow you to get away with very high LTV ratios. For example, the minimum down payment for a Federal Housing Administration loan is 3.5% . Loans through the U.S. Department of Agriculture and the Department of Veterans Affairs don’t require any down payment at all . Those loans typically require a forms of mortgage insurance or include extra fees in the closing costs to offset the risk connected with their higher LTVs.

LTV ratio is a less crucial factor with auto loans. While you might pay higher interest on a car loan with a higher LTV ratio, there’s no threshold comparable to the 80% LTV that earns the best mortgage loan terms.

Don’t Miss: How To Purchase A House That Has A Reverse Mortgage

How Does Ltv Affect Re

Unless you have an interest-only mortgage, youll be slowly shrinking the size of your mortgage balance with every monthly repayment – and gradually reducing your LTV at the same time. And if your home has gone up in price, then your loan-to-value ratio may be even lower.

If the terms of your mortgage allow, you may also be able to make extra payments without having to pay a penalty , accelerating this process still further.

This means that if you want to re-mortgage at some point, you might be able to apply for a different LTV band: one that gives you access to better deals and lower interest rates.

Ltv For Mortgage Vs Refinance

Lenders use loan-to-value calculations on both purchase and refinance transactions. But the math to determine your LTV changes based on the purpose of the loan.

For a home purchase, LTV is based on the sales price of the home unless the home appraises for less than its purchase price. When this happens, your homes LTV is based on the lower appraised value, not the homes purchase price.

With a refinance, LTV is always based on your homes appraised value, not the original purchase price of the home.

Loan to value is especially important when using a cash out refinance, as the lenders maximum LTV will determine how much equity you can pull out of your home.

Read Also: Can There Be A Cosigner On A Mortgage

What Does Ltv Mean

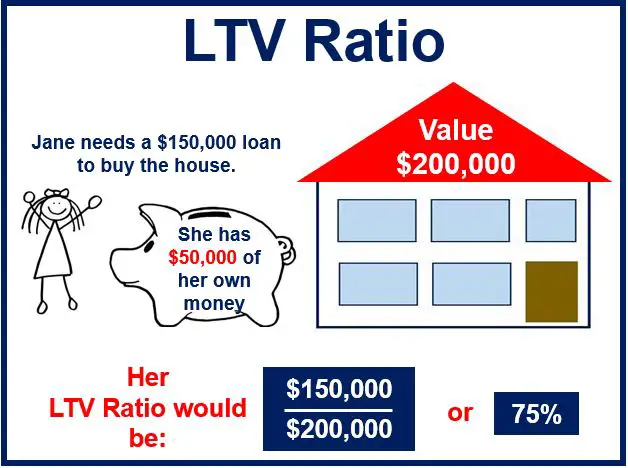

Your loan to value ratio compares the size of your mortgage loan to the value of the home.

For example: If your home is worth $200,000, and you have a mortgage for $180,000, your loan to value ratio is 90% because the loan makes up 90% of the total price.

You can also think about LTV in terms of your down payment.

If you put 20% down, that means youre borrowing 80% of the homes value. So your loan to value ratio is 80%.

LTV is one of the main numbers a lender looks at when deciding to approve you for a home purchase or refinance.

Looking To Apply For A Loan

Whether youre applying for a mortgage, car loan, or any other similar type of loan that typically requires some form of down payment, your loan-to-value ratio matters. In addition, the type of loan product you choose and the lender you work with also matter. When youre ready to apply for a loan, get in touch with Loans Canada to help guide you to the right lender and loan product for your needs.

Don’t Miss: How Much Is The Mortgage On A $300 000 House

Definition And Examples Of Maximum Loan

A maximum loan-to-value ratio is a hard limit on the amount of money a lender is willing to provide you when you take out a secured loan. It refers to the amount of money they are willing to lend relative to the value of the property guaranteeing the loan. Maximum loan-to-value ratios apply when you take out secured loans with assets acting as collateral.

Lenders that extend mortgage and car loans generally establish maximum loan-to-value ratios. For example, Fannie Mae offers first-time homebuyers and homeowners looking to refinance with Fannie Mae various options for loans with a 97% maximum loan-to-value ratio.

The maximum LTV ratio is calculated by dividing the amount you want to borrow by the appraised market value of the collateral guaranteeing the loan. This number is usually expressed as a percentage. For example, if you want to purchase a home valued at $250,000, and the maximum LTV ratio is 97%, the maximum amount of financing the lender would provide you would be $242,500 .

Traditionally, many conventional mortgage lenders set a maximum loan-to-value ratio of 80%, which means you have to make a 20% down payment to purchase a home. The 80% is the amount that the lender is willing to finance of the home’s market value.

However, many lenders now offer alternatives that allow for lower down payments and higher maximum LTV ratios.

How Do You Calculate Loan

Divide the amount of the loan by the appraised value of the asset securing the loan to arrive at the LTV ratio.

As an example, assume you want to buy a home with a fair market value of $100,000. You have $20,000 available for a down payment, so you’ll need to borrow $80,000.

Your LTV ratio would be 80% because the dollar amount of the loan is 80% of the value of the house, and $80,000 divided by $100,000 equals 0.80 or 80%.

You can find LTV ratio calculators online to help you figure out more complicated cases, such as those including more than one mortgage or lien.

Also Check: How Much Interest Do I Pay On A Mortgage

What Is Ltv And How Is It Calculated

Your loan-to-value ratio is how much money youre borrowing, also called the loan principal, divided by how much the property you want to buy is worth, or its value.

For example, if you plan to make a down payment of $50,000 on a $500,000 property, borrowing $450,000 for your mortgage, your LTV ratio $450,000 divided by $500,000, multiplied by 100 would be 90 percent.

Why Ltv Is Important

The higher your LTV ratio, the higher the mortgage rate youll be offered. Why? With a higher LTV, the loan represents more of the value of the home and is a bigger risk to the lender. After all, should you default on the loan and your home goes into foreclosure, the lender will need the house to sell for more to get its money back. Put another way, in a foreclosure, your down payment is the haircut the lender can take on the sale price of your house. So the smaller the haircut , the less likely the lender will get all of its money back.

Additionally, when your LTV is high and your down payment is relatively small, you have less to lose if you default and walk away from the loan . In other words, youre more likely to stick around if you put down 20% down than a 3%.

You May Like: How Do You Calculate Self Employed Income For A Mortgage

What Is A Loan

A loan-to-value ratio basically measures the loan amount against the value of the asset being purchased with the loan. The loan balance is divided by the value of the asset to calculate the loan-to-value ratio.

A higher LTV ratio means that you need a higher loan amount to pay for the purchase of the asset. Over time, your LTV will decrease as you continue making loan payments and as the assets value appreciates.

Do you know what the true cost of borrowing is? Find out here.

What About Combined Ltv

If you already have a mortgage and want to apply for a second one, your lender will evaluate the combined LTV ratio, which factors in all of the loan balances on the property the outstanding balance on the first mortgage, and now the second mortgage.

Lets say you have an outstanding balance of $250,000 on a home that is appraised at $500,000, and you want to borrow $30,000 in a home equity line of credit to pay for a kitchen renovation. Heres a simple breakdown of the combined LTV ratio:

$280,000 / $500,000 = 56 percent CLTV

If you have a HELOC and want to apply for another loan, your lender may look at a similar formula called the home equity combined LTV ratio. This figure represents the total amount of the HELOC against the value of your home, not just what youve drawn from the line of credit.

Don’t Miss: Does Chase Allow Mortgage Recast

How Do I Calculate My Loan To Value Ratio

If you are preparing to buy your first home, a key element will be the size of your deposit, i.e. the cash lump sum you have saved up to use alongside the mortgage. Once you know this, you can calculate your LTV ratio. Subtract your deposit from the total value of the property, and the result is the size of the mortgage loan you will need. Your LTV ratio is your mortgage expressed as a percentage of the total property value.

For example, if you have saved up a £20,000 deposit and you are buying a £200,000 house, your deposit is 10 per cent of the total value. Your mortgage will have to cover the remaining 90 per cent, so your LTV ratio would be 90 per cent.

What If Your Loan

Having a high LTV ratio can affect a homebuyer in a couple of different ways. For one thing, if your LTV ratio is higher than 80% and youre trying to get approved for a conventional mortgage, youll have to pay private mortgage insurance . Fortunately, youll eventually be able to get rid of your PMI as you pay down your mortgage. Your lender must terminate it automatically when your LTV ratio drops to 78% or you reach the halfway point in your amortization schedule.

If your LTV ratio is too high, taking out a mortgage loan will also be more expensive. By making a small down payment, youll need a bigger loan. In addition to paying PMI, youll probably pay more interest.

A high LTV ratio can prevent a homeowner for qualifying for a refinance loan. Unless you can qualify for a special program , youll likely need to work on building equity in your home.

Read Also: How 10 Year Treasury Affect Mortgage Rates