Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

How To Beat Mortgage Interest Rate Rises

If you’re on a variable-rate deal such as a discount or tracker mortgage, changes to the Bank of England base rate or your bank’s standard variable rate will have an immediate impact on how much you’re paying each month.

If this happens, it’s worth investigating whether you could save money by remortgaging.

A rate rise can also hit you hard when you reach the end of an initial deal period – for example, if you’ve reached the end of your fixed-rate mortgage’s introductory period, which might be two or five years.

When this period runs out, youll usually revert to your lenders standard variable rate , which is likely to be a lot higher.

In most cases, youll be able to get a better deal if you remortgage your home at this point, as youll have built up more equity in your property and introductory rates on new deals will almost always be cheaper than your current lenders SVR.

Mortgage Fees And Charges

Mortgage lenders dont just make their money from the interest they charge on the loan most products come with an application or product fee too.

These are often around £1,000, and can be paid either up-front or added to your mortgage balance, though doing the latter will cost you more as you’ll pay interest on it.

Lenders may also offer fee-free deals – but you’ll usually pay for this through a higher interest rate.

For example, a mortgage deal might have a 2.09% interest rate and come with a £999 product fee. However, there may also a fee-free version available at 2.39%.

In this particular example, the version with the fee would be cheaper over the long term. But that won’t always be the case.

It will all depend on the size of the fee, and the difference between the two interest rates.

You can calculate the difference between fee-free and fee-paying mortgage deals yourself with our mortgage repayment calculator.

Don’t Miss: Is 720 A Good Credit Score For Mortgage

What The Early Mortgage Payoff Calculator Does

Do you want to pay off your mortgage early? Maybe you have 27 years remaining on your home loan but you would rather pay it off in 18 years instead. The early payoff calculator demonstrates how to reach your goal.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month so you can pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

There are many reasons you might want to accelerate the mortgage’s payoff, but the motivation usually boils down to either or both of these:

-

You want to own your home free and clear by a milestone in life, such as your retirement or the beginning or end of your kids’ college years.

-

You want to reduce the total interest you pay over the life of the loan.

To steadily pay off the mortgage early, you need to know how much more to pay toward the principal balance every month to accomplish that goal. This calculator lets you do that.

When paying down the principal on a mortgage faster, keep in mind that each servicer has its own procedures for assuring that your extra payments go toward the principal balance instead of toward future payments. Contact your servicer for instructions.

Mistake #: Not Asking If Theres A Prepayment Penalty

Mortgage lenders are in business to make money and one of the ways they do that is by charging you interest on your loan. When you prepay your mortgage, youre essentially costing the lender money. Thats why some lenders try to make up for lost profits by charging a prepayment penalty.

Prepayment penalties can be equal to a percentage of a mortgage loan amount or the equivalent of a certain number of monthly interest payments. If youre paying off your home loan well in advance, those fees can add up quickly. For example, a 3% prepayment penalty on a $250,000 mortgage would cost you $7,500.

In the process of trying to save money by paying off your mortgage early, you could actually lose money if you have to pay a hefty penalty.

Don’t Miss: What Banks Look For When Applying For A Mortgage

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

I Want To Pay Off My Debt Quicker What Are My Options

Typically, there are three options to choose from although not all lenders will offer them so it depends on the terms of your loan. You can opt to increase your monthly payments, switch your debt to a new provider offering a lower interest rate, or pay off some or all of the debt with a lump sum. More information and advice regarding these options can be found in our Knowledge Base.

Read Also: How To Purchase A House That Has A Reverse Mortgage

How Much Extra Should You Pay To Payoff Your Mortgage Early

You dream of paying off your mortgage early.

You long for the day when you are debt free.

But how do you do it?

How much must you pay each month to be out of debt by a certain date?

What if you wanted to pay off your mortgage in 15 years instead of 30? How much would you save?

The good news is this mortgage payoff calculator makes figuring out your required extra payment easy.

You choose how quickly you’d like to pay off your mortgage, and the calculator will tell you the required extra monthly payment to get it done. It will also tell you how much interest you’ll save!

However, before you start making your extra payments, there are a few factors you’ll want to consider first . . . .

How Much Will My Mortgage Cost

The cost of your mortgage will depend on several different factors, including how much you are borrowing, your mortgage term, and the rate of interest youre paying. For example, the longer the mortgage term you choose, the cheaper your monthly payments will be, but the more youll end up paying back overall. If you choose a shorter term, your monthly payments will be higher, but youll reduce the total amount of interest you pay back.

Mortgages often come with arrangement fees, which can also have an impact on how much your monthly mortgage payments cost if youve chosen to add these to the amount you are borrowing.

If youre not sure which mortgage deal is likely to be most cost-effective for you based on your individual circumstances, seek professional advice from one of our advisers who can run you through all the available options.

Don’t Miss: Can A Locked Mortgage Rate Be Changed

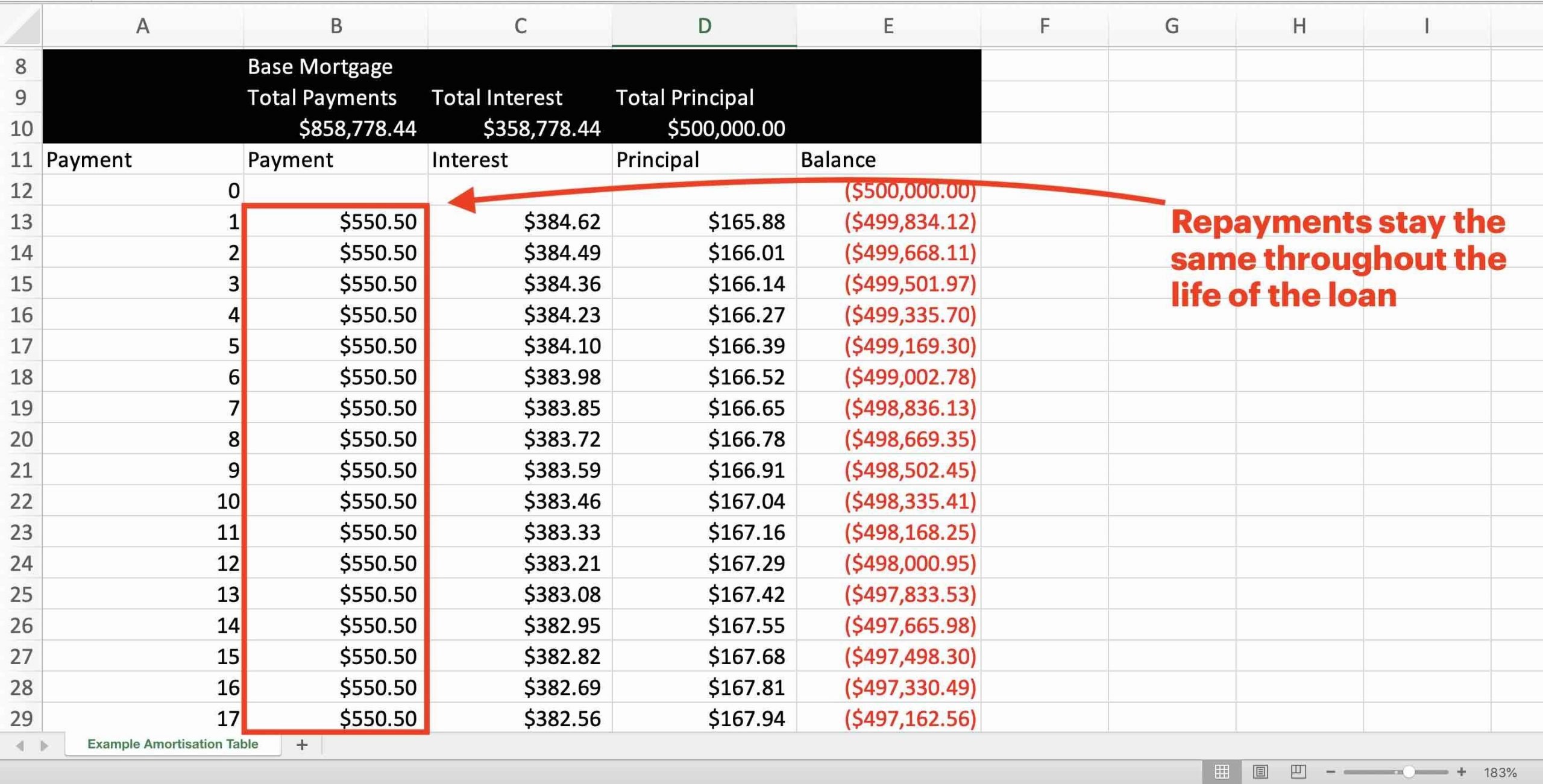

What Is Mortgage Interest

Interest is charged by lenders in exchange for allowing you to borrow money. For borrowers, mortgage interest is charged based on your mortgage principal balance. The mortgage interest charged is included in your regular mortgage payments. This means that with every mortgage payment, you will be paying both your mortgage principal and your mortgage interest.

Your regular mortgage payment amount is set by your lender so that youll be able to pay off your mortgage on time based on your selected amortization period. This is why your mortgage payment amount can change when yourenew your mortgageorrefinance your mortgage. This can change your mortgage rate, which will impact the amount of mortgage interest due. If you now have a higher mortgage rate, your mortgage payment will be higher to account for the higher interest charges. If youre borrowing a larger amount of money, your mortgage payment may also be higher due to interest being charged on a larger principal balance.

However, mortgage interest isnt the only cost that youll need to pay. Your mortgage might have other costs and fees, such as set-up fees or appraisal fees, that are necessary to get your mortgage. Since youll need to pay these extra costs in order to borrow money, they can increase the actual cost of your mortgage. Thats why it can be a better idea to compare lenders based on theirannual percentage rate . A mortgages APR reflects the true cost of borrowing for your mortgage.

What Will You Spend On Mortgage Interest

The amount of money you end up spending on mortgage interest will depend on a number of factors:

- The amount of your mortgage

- The interest rate you snag on your loan, which will hinge heavily on your credit score

- The amount of money you put down on your home

- The length of your loan

Now, let’s say you take out a $200,000 mortgage on a $250,000 home so that you’ve made a 20% down payment on that property. Here’s the amount of money you could end up spending on interest in the course of your repayment period:

| Length of Repayment Period | |

|---|---|

| Fair | $54,890 |

Keep in mind that the above figures are based on average mortgage rates today, which can change over time. Also, if you have a great , you might easily snag an interest rate that’s 1% lower than what someone with fair credit will qualify for.

So what can we learn from these numbers? The main takeaway is that the higher your credit score and the shorter your loan term, the lower an interest rate you’re likely to have — and the less interest you’re likely to pay on your mortgage all-in.

In fact, if you have great credit, based on our example, paying off your home in 15 years versus 30 could save you $69,549 in interest throughout your repayment period. That’s a lot of money.

If your credit score could use some work, you can boost it by:

- Paying all incoming bills on time

- Paying off some credit card debt to lower your

- Correcting that could be working against you

Recommended Reading: Can There Be A Cosigner On A Mortgage

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How To Find Mortgage Payment

What Other Expenses Does Homeownership Entail

It’s important to recognize that the estimated total cost of your home purchase is only an estimate and not necessarily representative of future conditions. There are many factors that are not taken into account in the calculations we illustrated above we include a few below for your consideration.

Taxes

While these fixed fees are charged regularly, they have a tendency to change over time, especially in large metropolitan areas like New York and Boston. New-home purchases often have their values reassessed within a year or two, which impacts the actual taxes paid. For that reason, your originally forecasted tax liability may increase or decrease as a result of new assessments.

HOA Dues

For buyers considering condos, homeowners associations can increase their monthly dues or charge special HOA assessments without warning. This can make up a large portion of your housing expenses, especially in large cities with high maintenance fees. You might also be subject to increased volatility in HOA fees if the community you live in has issues keeping tenants or a troubled track record.

Maintenance Costs

Finally, typical mortgage expenses don’t account for other costs of ownership, like monthly utility bills, unexpected repairs, maintenance costs and the general upkeep that comes with being a homeowner. While these go beyond the realm of mortgage shopping, they are real expenses that add up over time and are factors that should be considered by anyone thinking of buying a home.

When Mortgage Payments Start

The first mortgage payment is due one full month after the last day of the month in which the home purchase closed. Unlike rent, due on the first day of the month for that month, mortgage payments are paid in arrears, on the first day of the month but for the previous month.

Say a closing occurs on January 25. The closing costs will include the accrued interest until the end of January. The first full mortgage payment, which is for the month of February, is then due March 1.

As an example, lets assume you take an initial mortgage of $240,000, on a $300,000 purchase with a 20% down payment. Your monthly payment works out to $1,077.71 under a 30-year fixed-rate mortgage with a 3.5% interest rate. This calculation only includes principal and interest but does not include property taxes and insurance.

Your daily interest is $23.01. This is calculated by first multiplying the $240,000 loan by the 3.5% interest rate, then dividing by 365. If the mortgage closes on January 25, you owe $161.10 for the seven days of accrued interest for the remainder of the month. The next monthly payment, which is the full monthly payment of $1,077.71, is due on March 1 and covers the February mortgage payment.

You May Like: Is Closing Cost Part Of Mortgage

What Factors Affect How Much Interest You’ll Pay On A Mortgage

While you may see headlines about how interest rates have climbed or fallen, the rate you read about in a news story isn’t necessarily the one you’ll receive on your mortgage. As with other types of loans, the rate you receive can depend on your creditworthiness and the loan’s specifics.

With mortgages, the following can affect your interest rate:

Why Should I Use A Mortgage Calculator

Also Check: Can You Refinance Mortgage Without A Job