Historical Home Loan Variable Rates Fixed Rates And Discount Rates

The data set includes the historical discount interest rates back to 2004. Discount rates are the special interest rates that apply to the different packages that the banks offer . In most cases the annual fees range from $350-$395 which gets you a range of loan features and entitles you to the additional discount which in most cases ranges between 0.9% and 1.65%. The variable rates above will typically be circa 1.0%-1.50% lower than above.

How The Subprime Crisis Created The 2007 Banking Crisis

As home prices fell, bankers lost trust in each other. They were afraid to lend to each other because if they could receive mortgage-backed securities as collateral. Once home prices started falling, they couldn’t price the value of these assets. But if banks don’t lend to each other, the whole financial system starts to collapse.

How Does Your Rate Compare

Wondering if your current interest rate is competitive? If not, this does not mean that you cant do anything about it.

You may qualify to refinance at a lower rate with a private lender. Keep in mind that borrowers refinancing federal loans with a private lender lose government benefits like access to income-driven repayment programs and the potential to qualify for loan forgiveness.

Credible makes refinancing your student loans easy. You can compare options from top lenders without having to share any sensitive information or authorizing a hard credit pull.

Recommended Reading: How Much Mortgage Do You Pay A Month

Bailouts And Failures Of Financial Firms

Several major financial institutions either failed, were bailed out by governments, or merged during the crisis. While the specific circumstances varied, in general the decline in the value of mortgage-backed securities held by these companies resulted in either their insolvency, the equivalent of bank runs as investors pulled funds from them, or inability to secure new funding in the credit markets. These firms had typically borrowed and invested large sums of money relative to their cash or equity capital, meaning they were highly leveraged and vulnerable to unanticipated credit market disruptions.

As a result of the financial crisis in 2008, twenty-five U.S. banks became insolvent and were taken over by the FDIC. As of August 14, 2009, an additional 77 banks became insolvent. This seven-month tally surpasses the 50 banks that were seized in all of 1993, but is still much smaller than the number of failed banking institutions in 1992, 1991, and 1990. The United States has lost over 6 million jobs since the recession began in December 2007.

The FDIC deposit insurance fund, supported by fees on insured banks, fell to $13 billion in the first quarter of 2009. That is the lowest total since September 1993.

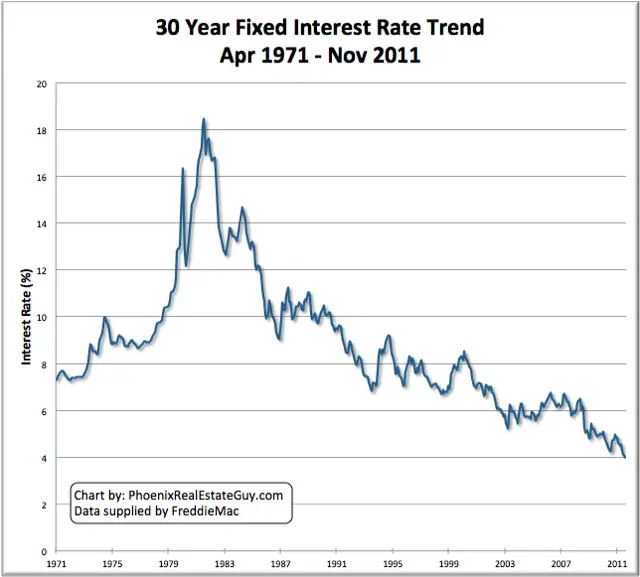

Mortgage Rates From The 1970s To 2019

Since the housing crisis ended around 2008, borrowers have been able to get mortgage rates between 3.5% and 4.98% for a 30-year fixed rate loan. Borrowers who can afford a 15-year payment have enjoyed rates as low as 2.9%.

What was the highest mortgage rate in history?October of 1981 saw the highest 30-year fixed mortgage rate in history. The rate was around 18.63%. That’s 14.13% higher than the average 30-year fixed mortgage rate today.

What was the lowest mortgage payment in history?November of 2012 saw the lowest 30-year fixed mortgage rate in history. The rate dropped all the way down to 3.31%. Interest rates remained in that range until June 2013, when interest rates increased to 4.3% to 4.5%.

What was the highest 15-year fixed rate mortgage in history?December of 1994 saw the highest 15-year fixed mortgage rate in history. The rate was around 8.89%. That’s 5% higher than interest rates are today on the average 15-year fixed loan.

What was the lowest 15-year fixed rate mortgage in history?The lowest 15-year fixed mortgage rates in history occurred during May 2013. At that time, 15-year rates were just 2.56%. A $100,000 mortgage would cost just $670 per month.

Recommended Reading: How Is Home Mortgage Interest Calculated

Historic Mortgage Rates: From 1981 To 2019 And Their Impact

TheStreet

Talk about a toboggan ride.

U.S. historical mortgage rates from the early 1970s to 2019 have been on a decidedly downward trend.

The charts tell the story, painting a remarkable picture of the history of U.S. mortgage rates over the past five decades.

Over the long-term, the relationship between historical mortgage interest rates and current mortgage interest rates is tenuous, aside from the common theme that mortgage rates are a huge factor in determining if property buyers can achieve the American Dream of owning their own home.

The fact is, not many Americans, especially those hard-working Main Street Americans in the nation’s middle class, can buy a home without landing a home mortgage.

In that light, taking a look at the historical growth of mortgage rates is a worthwhile endeavor.

Let’s do just that.

What Is A Mortgage

A mortgage is a type of secured loan provided by a financial institution to cover the cost of buying a home should you not have enough cash to pay for it upfront. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

You May Like: What Is Rocket Mortgage Interest Rate

Determine Your Buying Power With A Mortgage Calculator

The charts and graphs on this page show the way 30year fixedrate mortgages have changed over time and continue to change.

To see how todays mortgage rates affect your borrowing power, use our mortgage calculator that includes PMI and other added costs.

Todays historically low interest rates have increased buying power by lowering monthly payments for borrowers throughout the spectrum.

Can 30year Mortgage Rates Go Lower

The short answer is that mortgage rates can always go lower. But you shouldnt expect them to.

Mortgage rates operate in their own market. Lenders have control over the rates they set, and many are content to keep rates a little higher.

This helps stem the tide of home buyers and refinancers and keep their workload manageable.

In addition, mortgage rates have to answer to end investors.

When rates fall too rapidly, investors start paying less for mortgagebacked securities the financial instruments that drive mortgage rates.

This is because investors assume homeowners will refinance, paying off their loans faster and reducing the returns on interest.

Less money from investors, in turn, means lenders have to keep their rates a little higher, or charge borrowers bigger fees for lower rates.

So dont expect mortgage rates to keep falling in lockstep with the rest of the market.

They could push lower, but theyre just as likely to stay stagnant. And sooner or later, theyre bound to rise again.

Read Also: How Do You Know If You Can Get A Mortgage

Average Mortgage Interest Rate By Year

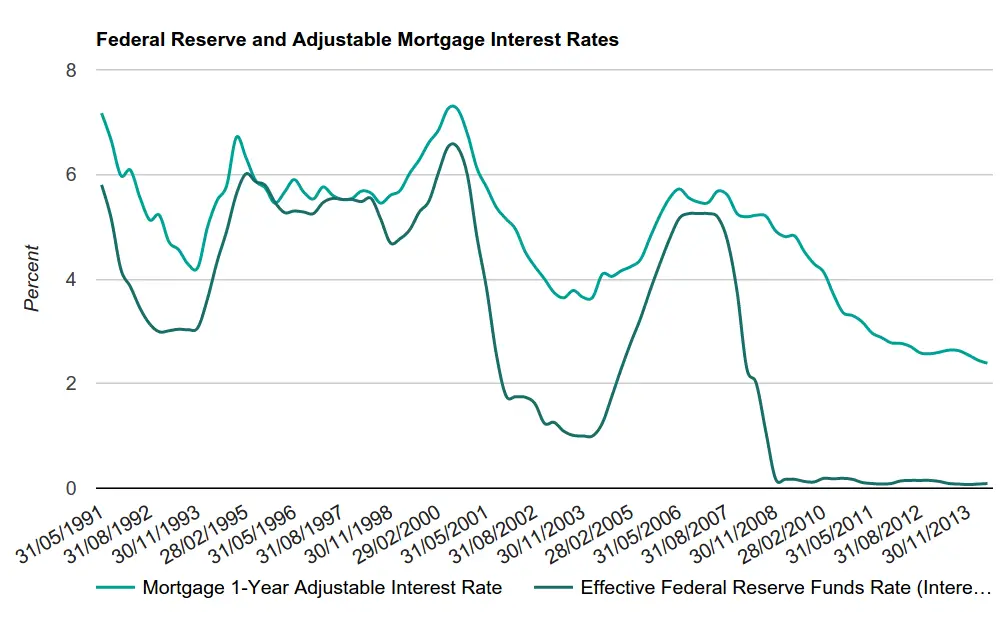

Mortgage rates are constantly in flux, largely affected by what’s happening in the greater economy. Generally, mortgage interest rates move independently and in advance of the federal funds rate, or the amount banks pay to borrow. Things like inflation, the bond market, and the overall housing market conditions can affect the rate you’ll see.

Here’s how the average mortgage interest rate has changed over time, according to data from the Federal Reserve Board of St. Louis:

| Year |

How Much Can I Borrow For A Mortgage

How much you can borrow for a mortgage varies by person, and depends on your financial situation: your credit, your income, and the amount of cash you have available for a down payment. The general rule of thumb for a conforming mortgage is a 20% down payment. On a $400,000 home, that would mean you need $80,000 up front.

Note that this calculation may be different if you qualify for a different type of mortgage like an FHA or VA loan, which require smaller down payments, or if you’re looking for a “jumbo loan” over $548,250 in most parts of the US in 2021 .

You don’t have to go with the first bank to offer you a mortgage. Like anything else, different servicers offer different fees, closing costs, and products, so you’ll want to get a few estimates before deciding where to get your mortgage.

Don’t Miss: Which Credit Reporting Agency Do Mortgage Lenders Use

Not Everything Is Coming Up Perfectly Roses Says One Housing

A row of middle class houses on an American suburban street

Rates for home loans declined as bonds caught a bid, offering some breathing room for stretched home buyers.

The 30-year fixed-rate mortgage averaged 4.83% in the Nov.1 week, down 3 basis points, mortgage finance provider Freddie Mac said Thursday. The 15-year fixed-rate mortgage averaged 4.23%, down from 4.29%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 4.04%, a 10-basis point drop.

Fixed-rate mortgages move in line with the U.S. 10-year TreasuryTMUBMUSD10Y, 1.621% note, although with a slight delay.

Bond yields tumbled late last week as investors fled to the perceived safety of fixed-income assets in the wake of a sharp stock sell-off. As prices rise, bond yields decline.

Meanwhile, momentum in the housing market has waned enough that its starting to worry many observers. Home prices rose at the slowest pace in nearly two years in August, according to the S& P CoreLogic Case-Shiller report released Tuesday.

See:House price gains lurch to a 20-month low, Case-Shiller says

Many analysts hope a more moderate pace of price increases will bring market conditions back into equilibrium, and help some frustrated buyers gain a foothold. Thats what happened in San Francisco, one of the priciest metros in the country, where home values increased by double digits on an annual basis throughout 2015, then slowed to half that pace, before resuming acceleration late in 2017.

Mortgage Rate Trends In The 1990s

The 1990s saw a dramatic shift in the 30-year rates movement, as it plunged to an average of 6.91 percent in 1998, according to Bankrate data. This was spurred by the dot-com bubble, an era when investors rushed to buy stocks from technology companies that were overvalued. When these stocks plummeted, investors turned their focus to fixed-income investments, such as bonds. As bond prices rose and yields fell, mortgage rates, which follow the 10-year Treasury yield, also declined.

Read Also: Is 720 A Good Credit Score For Mortgage

Visualizing The 200 Year History Of Us Interest Rates

U.S. interest rates will stay near zero for at least three years as the Federal Reserve enacts measures to prop up the economy.

But are low interest rates a new phenomenon? Interestingly, one study by the Bank of England shows that this pattern of declining interest rates has taken place globally since the late Middle Ages. In fact, it suggests that these downward-sloping rate trends have taken place even before modern central banks entered the sceneillustrating an entrenched, historical trend.

This Markets in a Minute chart from New York Life Investments tracks the history of U.S. interest rates over two centuries, from the creation of the first U.S. Bank to the current historic lows.

History Of The Bank Rate In Canada

TheBank of Canada fixes the bank rate,which is the amount it charges for the relatively infrequent loans it makes tothe chartered banks. Canadas central bank was formed by an Act of Parliamentin 1934 to help the federal government better manage the national economy.

Untilthe First World War, almost all Canadian government borrowing took place outside ofCanada, in the United Kingdom. The reliance on foreign loans resulted in a lotof volatility in the Canadian economy. After the war, the Canadian governmentand its chartered banks sought credit within the Canadian market. However, theswitch to the Canadian market did not reduce economic volatility. Following theGreat Depression, the Canadian government decided to form a central bank to helpincrease the money supply and generate cheap money a loan, or credit, witha low interest rate. The belief that guided this policy was that cheap moneyfrom low bank and interest rates would result in full employment .

The drive to providefull employment met a serious challenge in the late 1950s, when inflation, ora rise in prices, started to impact the Canadian economy. Toconfront inflation, Bank of Canada Governor James Coyne ordered a reduction in the Canadian money supply and raised the bankrate.

DIDYOU KNOW?

Recommended Reading: What Is A Mortgage Inspection

What To Do Today

First off, dont stretch yourself too thin. If you are house shopping, dont forgot that mortgages are long-term commitments and lots of things can change over the duration.

While we can all hope and pray mortgage rates dont climb into double-digits again, its a safe bet they will rise at least a few percentage points above where they are right now. So factor that in when calculating all your carrying costs so you dont find yourself facing an eviction notice soon after your policy comes up for renewal.

Many mortgage professionals are now advising that people signing up or renewing mortgages today should opt for the fixed rate products. The logic being that since the Bank of Canadas prime rate is pretty much guaranteed to rise, it may push variable rates much higher than the best fixed rates currently available.

Ultimately, thats a call for you to make based on your guess on how high the rates could climb and your comfort level with risk. Truly risk-averse borrowers may even want to lock in to a 10-year term and buy themselves a decade of stability.

Regardless of the type of product you choose, here are two ways to minimize your risk, and the total cost of borrowing over the life of the mortgage.

Understanding Your Monthly Mortgage Payment

In this article, we compare monthly payments for a $200,000 home loan at a variety of interest rates.

Understand that these examples show only principal and interest the amount youre paying each month toward your loan balance and interest generated.

Overall, your monthly mortgage payment will be higher than just principal and interest. Thats because there are other costs bundled in, including:

- Property taxes City and county governments levy annual property taxes to pay for public services. These taxes are usually prorated over 12 months and paid to your loan servicer along with your mortgage payment

- Homeowners insurance Homeowners insurance premiums average about $1,000 a year. As with property taxes, homeowners insurance premiums can be spread out over 12 months and paid with your mortgage via an escrow account

- HOA fees Condos, apartments, and gated communities may charge annual Homeowners Association fees which can be broken down into monthly payments added to the mortgage

- Mortgage insurance FHA loans, USDA loans, and conventional loans with less than 20% down payment require the borrower to pay for mortgage insurance. Mortgage insurance costs around 1% of the loan amount each year, although rates vary depending on the loan type and down payment. For a $200,000 loan that would equal $2,000 a year or $166 per month added to the mortgage payment

You May Like: Does My Husband Have To Be On The Mortgage

Interest Credit And Loans

Interestrefers to the amount of money that a borrower pays for moneyborrowed. Interest payments do not reduce the principal amount . Interest is usually paid in increments. To calculate themoney owed at each increment, a percentage rate or interest rate is set andagreed upon. For example, a $100 loan with a 3 per cent monthly interest ratemeans that the borrower will owe the lender 3 per cent of the remaining balanceof their debt at the end of the payment period. The interest arrangement meansthat if the borrower continues to owe the full $100 after the first paymentperiod, he or she will be charged $3 in interest and will owe the lender $103.Interest is integral to credit and loan agreements because it allows borrowersto delay repaying the full amount of money they borrowed. Interest also createsan incentive for lenders to release money into circulation.

Creditis a contractual arrangement between a borrower and a lender in which the lender ispre-approved for a loan. The lender provides the borrower with something ofvalue, and the borrower agrees to return that value to the lender at an agreedupon date. In most credit relationships, interest provides incentive for thelender to part with something of value and for the borrower to repay what theyowe. Credit repayments can be made either in instalments or on a revolving basis .

Federal Reserve And Other Central Banks

The central bank of the US, the Federal Reserve, in partnership with central banks around the world, took several steps to address the crisis. Federal Reserve Chairman Ben Bernanke stated in early 2008: “Broadly, the Federal Reserve’s response followed two tracks: efforts to support and functioning and the pursuit of our macroeconomic objectives through monetary policy.”

The Federal Reserve Bank:

According to Ben Bernanke, expansion of the Fed balance sheet means the Fed is electronically creating money, necessary “because our economy is very weak and inflation is very low. When the economy begins to recover, that will be the time that we need to unwind those programs, raise interest rates, reduce the money supply, and make sure that we have a recovery that does not involve inflation.”

The New York Times reported in February 2013 that the Fed continued to support the economy with various monetary stimulus measures: “The Fed, which has amassed almost $3 trillion in Treasury and mortgage-backed securities to promote more borrowing and lending, is expanding those holdings by $85 billion a month until it sees clear improvement in the labor market. It plans to hold short-term interest rates near zero even longer, at least until the unemployment rate falls below 6.5 percent.”

Also Check: What Does A Co Signer Do For A Mortgage