Conventional Loans And The 28/36 Rule

In the U.S., a conventional loan is a mortgage that is not insured by the federal government directly and generally refers to a mortgage loan that follows the guidelines of government-sponsored enterprises like Fannie Mae or Freddie Mac. Conventional loans may be either conforming or non-conforming. Conforming loans are bought by housing agencies such as Freddie Mac and Fannie Mae and follow their terms and conditions. Non-conforming loans are any loans not bought by these housing agencies that don’t follow the terms and conditions laid out by these agencies, but are generally still considered conventional loans.

The 28/36 Rule is a commonly accepted guideline used in the U.S. and Canada to determine each household’s risk for conventional loans. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on the back-end debt. The 28/36 Rule is a qualification requirement for conforming conventional loans.

While it has been adopted as one of the most widely-used methods of determining the risk associated with a borrower, as Shiller documents in his critically-acclaimed book Irrational Exuberance, the 28/36 Rule is often dismissed by lenders under heavy stress in competitive lending markets. Because it is so leniently enforced, certain lenders can sometimes lend to risky borrowers who may not actually qualify based on the 28/36 Rule.

Save A Bigger Down Payment To Make Your Home More Affordable

Remember, your down payment amount makes a big impact on how much home you can afford. The more cash you put down, the less money youll need to finance. That means lower mortgage payments each month and a faster timeline to pay off your home loan! Just imagine a home with zero payments!

Now, were always going to tell you that the best way to buy a home is with 100% cash. But if saving up to pay in cash isnt reasonable for your timeline, youll probably wind up getting a mortgage.

If thats you, at the very least, save up a down payment thats 10% of the home price. But a better idea is to put down 20% or more. That way you wont have to pay private mortgage insurance .

PMI protects the mortgage company in case you dont make your payments and they have to take back the house . PMI is a yearly fee that usually costs 1% of the total loan value and isyou guessed ityet another expense thats added to your monthly payment.

Lets backtrack for a second: PMI may change how much house you thought you could afford, so be sure to include it in your calculations if your down payment will be less than 20%. Or you can adjust your home price range so you can put down at least 20% in cash.

Trust us. Its worth taking the extra time to save for a big down payment. Otherwise, youll be suffocating under a budget-crushing mortgage and paying thousands more in interest and fees.

Talking To Only One Lender

First-time buyers often get a mortgage from the first lender or bank they talk to, and thats a big mistake. By not comparing offers, youre potentially leaving thousands of dollars on the table.

How this affects you: The more you shop around, the better basis for comparison youll have to ensure youre getting a good deal and the lowest rates possible.

What to do instead: Shop around with at least three different lenders, as well as a mortgage broker. Try to get rate quotes all in the same day, since rates change regularly. Compare rates, lender fees and loan terms. Dont discount customer service and lender responsiveness, either both play key roles in making the mortgage approval process run smoothly, especially now when many lenders are backed up with applications. Low interest rates have led to a mortgage application boom, and some lenders are more behind on closings than others. Bankrates mortgage rate tables are a great place to start comparison shopping.

Recommended Reading: How Much Is Mortgage On 1 Million

How Can First Home Buyers Prepare For Home Ownership

If you’re a first home buyer and you’ve saved up a deposit, test yourself using a mortgage repayment calculator.

- Work out how much you currently spend on rent.

- Calculate what your monthly mortgage repayments would be with a loan amount you feel comfortable with.

- What’s the difference? Can your bank balance handle the increased costs?

To make this test more real, try it for a few months and actually remove the extra money from your spending account. Can you live without it? You may even be able to ask your HR or payroll department to actually start splitting your pay and transferring that money straight into a different high interest savings account, so you don’t even have the temptation to spend the money or be responsible for transferring it yourself.

Be sure to factor in other ongoing costs, such as home and contents insurance or body corporate fees.

You can still try this test if you’re currently living with your parents. You just need to estimate your costs for groceries and utilities along with your mortgage costs.

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

You May Like: How Much Usda Mortgage Can I Qualify For

Calculate Your Mortgage Qualification Based On Income

In this calculator you can inclue investments, annuities, alimony, government benefit payments in the other income sources. Be sure to select the correct frequency for your payments to calculate the correct annual income.

- daily: 365 times per year

- weekly: 52 times per year

- biweekly: 26 times per year

- semi-monthly: 24 times per year

- monthly: 12 times per year

- bimonthly: 6 times per year

- quarterly: 4 times per year

- semi-annually: 2 times per year

- annually: 1 time per year

This calculator defaults to presuming a single income earner. If your household has 2 income earners then you can expand the “spouse or partner” section to enter their income information. We calculate the mortgage qualification ranges using the following maths:

| Your Mortgage Qualification |

|---|

Getting Preapproved Can Tell You Your Home Buying Budget

One of the easiest ways to find your price range is to get a preapproval from a mortgage lender.

Preapproval is kind of like a dress rehearsal for your actual mortgage application. A lender will assess your financial situation as shown by your annual salary, existing debt load, credit score, and down payment size without making you go through the full loan application.

This can tell you whether youre qualified for a mortgage and how much home you might be able to afford.

You could also learn whether you can afford a 15year loan term or whether you should stick with a 30year mortgage. And, a preapproval can show whether youd be better off with an FHA loan or a conventional loan.

Finally, your preapproval shows you the added monthly costs of homeownership such as home insurance, real estate taxes, HOA fees, and mortgage insurance if necessary.

Don’t Miss: What To Expect When Applying For A Mortgage Loan

Making Decisions Based On Emotion

Buying a house is a major life milestone. Its a place where youll make memories, create a space thats truly yours and put down roots. Its easy to get too attached and make emotional decisions, so remember that youre also making one of the largest investments of your life, says Ralph DiBugnara, president of Home Qualified in New York City.

With this being a strong sellers market, a lot of first-time buyers are bidding over what they are comfortable with because it is taking them longer than usual to find homes, DiBugnara says.

How this affects you: Emotional decisions could lead to overpaying for a home and stretching yourself beyond your budget.

What to do instead:Have a budget and stick to it, DiBugnara says. Dont become emotionally attached to a home that is not yours.

Cash Reserve And Your Ability To Pay Your Mortgage

| Cash Reserve | |

|---|---|

| $1,425 | 17.5 |

The table above is for a $250,000 home in Kansas City, Missouri. The mortgage payments assume a 20% down payment, and they include property taxes and home insurance.

Think of your cash reserve as the braking distance you leave yourself on the highway – if thereâs an accident up ahead, you want to have enough time to slow down, get off to the side or otherwise avoid disaster.

Your reserve could cover your mortgage payments – plus insurance and property tax – if you or your partner are laid off from a job. It gives you wiggle room in case of an emergency, which is always helpful. You donât want to wipe out your entire savings to buy a house. Homeownership comes with unexpected events and costs , so keeping some cash on hand will help keep you out of trouble.

Recommended Reading: How Long Does Fha Mortgage Insurance Last

Debt Payments: 36 Percent Of Income Or Less

Lenders know you have other debt to pay besides your mortgage payment. In general, they want to see your total household debt – including your mortgage payment and other loan payments – add up to no more than 36 percent of your gross monthly income. This is also known as your “back-end” ratio or debt-to-income ratio.

Figuring your DTI ratio isnt challenging: Simply add up all of your monthly bills, including your rent or mortgage payment, student loans, car notes and minimum credit card payments. If you pay alimony or child support, include that too. Then, divide the sum by your gross monthly income. You can also use Bankrate’s debt-to-income ratio calculator.

Most lenders look for the DTI ratio to be below 36 percent, but if yours is higher, it doesnt necessarily mean you wont be able to get a mortgage. Government-backed loans have their own DTI ratio limits, and some conventional mortgage lenders might approve you, though they’ll charge you more to offset their risk.

Work With A Buyers Agent We Trust

For more guidance on buying a house you can afford, work with a real estate agent. A good agent will help you set the right expectations when shopping for a home in your price rangethey may even be able to find you a home sale others dont know about.

For a quick and easy way to find an agent we trust, try our Endorsed Local Providers program. We only recommend agents who actually care about the financial path youre on and wont push you to overspend on a house just so they can bring home a bigger commission check.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Don’t Miss: Can I Get A Mortgage With A Fair Credit Score

How Much House Can I Afford Calculator

Maximum Mortgage Payment

How Much House You Can AffordBased on a interest rate on a -year fixed mortgage.

Now that you know what you can afford, get your mortgage here or try our full mortgage calculator.

As you can see from our calculator, how much house you can afford really depends on the relationship between your income and mortgage.

To figure out how much mortgage you can afford with your income, different lenders use different guidelinesbut most lenders dish out mortgages that are way too expensive and keep borrowers in debt for decades!

We want to help you buy a home thats a blessing, not a burden. And the only way to do that is to calculate your home-buying budget the smart wayand stick to it!

Thats what our calculator does for you. How does it work? Well show youget ready for some math!

Calculating: How Much House Can I Afford

Banks come up with the amount and interest rate for your loan based on factors that impact the risks of loaning you the money. If you are seen as less likely to pay your loan back for instance, if you have a low or fair credit score the bank will offer you less total value in the loan and charge higher interest to loan that money to you.

However, youll need to , and you may want to consider making a 50/30/20 budget, where 50% is spent on needs or required expenses, 30% on wants, and 20% on savings. This way, you know whether it will be a stretch to make that payment every month, says R.J. Weiss, CFP® and founder of the personal finance site The Ways To Wealth.

Youll be able to know what the opportunity cost of that monthly payment will be. For example, does it take away from other financial goals you may have or general wants you enjoy having in your life right now, such as travel?

In this article

You May Like: What Is A Mortgage Inspection

What Mortgage Can I Afford On 70k

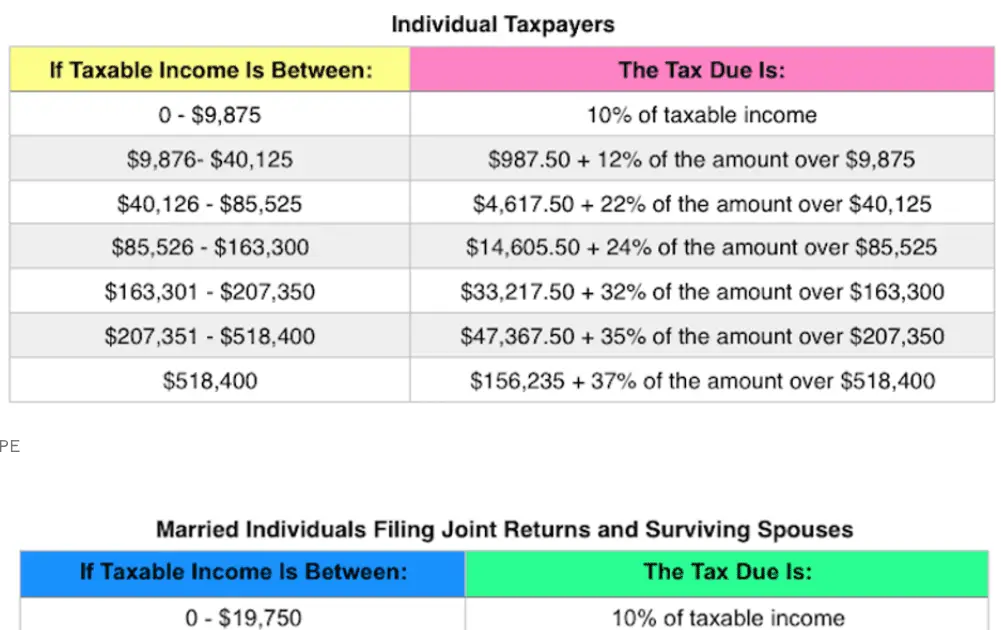

How much should you be spending on a mortgage? According to Brown, you should spend between 28% to 36% of your take-home income on your housing payment. If you make $70,000 a year, your monthly take-home pay, including tax deductions, will be approximately $4,328.6 2020 .

How Does Your Down Payment Affect Mortgage Affordability

Your down payment plays a big role in your mortgage’s affordability. The size of your down payment affects the amount of the monthly payment you’ll be making to cover the rest of the mortgage amount a bigger down payment decreases your monthly payment and vice versa. So, if you’re worried about your DTI affecting your mortgage eligibility, coming up with a larger down payment can help you qualify.

For example, if you’re buying a $250,000 home with a 4% interest rate over 30 years, a $20,000 down payment would give you a monthly principal-and-interest payment of $1,098. But if you put down $40,000, your monthly payment would drop to $1,003and you’d also save nearly $35,000 in interest over the life of your loan.

While a 20% down payment is a standard recommendation from mortgage experts, it’s not a requirement. In fact, many lenders allow down payments as low as 3% or 5% of the loan amount.

If you don’t have a lot of cash for a down payment and you’re a first-time homebuyer, there are several programs and grants that can provide you with down payment assistance or even loans with no down payment requirement.

Consider more than just your monthly payment as you decide how much money to put down. For example, if you drain your savings for a down payment, you could experience some difficulties if you have a financial emergency in the near future.

Also Check: How Much Would I Get Pre Approved For A Mortgage

How Much Do I Need To Earn To Get A Buy

Some Buy to Let mortgage providers will require you to earn a minimum of £25,000 per year in order to apply for a Buy to Let mortgage.

That being said, some lenders will also take the amount of potential rental income youre likely to achieve into consideration.

As a general rule of thumb, most lenders will expect you to charge 25% 45% more than your mortgage repayment in rent as this provides sufficient income to pay your mortgage as well as any unexpected bills or repairs that may need doing.

Many Americans Spend More Than They Should On Housing These Guidelines Can Help You Avoid That Trap

Buying a new home is a big decision that involves a whole lot of smaller ones. Many people focus on the number of bedrooms or the quality of the kitchen appliances as they contemplate where they want to live.

But new homebuyers shouldnt let considerations like those persuade them to buy a home thats more expensive than they can comfortably afford.

With home prices on the rise in many parts of the U.S., keeping things affordable is getting harder to do. In May the median listing price for a home rose 6 percent from the previous year, to $315,000, a record high, according to a report by Realtor.com. Meanwhile, the number of homes priced above $750,000 rose 11 percent from a year ago.

Buyers say that those high prices are forcing them to spend more than they planned. One-third of buyers report that they spent more than they expected to on their home, and nearly one-third put down a higher down payment than they anticipated, according to a by CoreLogic, a real estate data analytics firm.

Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget. Yet the average married couple with children between the ages of 6 and 17 spends 32 percent of their budget on housing, and single people spend almost 36 percent, according to data from the Bureau of Labor Statistics.

To make sure you dont spend more than you should, here’s some advice on getting a mortgage you can afford.

Don’t Miss: How Do You Calculate Self Employed Income For A Mortgage