Best Homeowners Insurance Michigan With Rates

In this article, well dive into the best Michigan homeowners insurance companies to help make your home insurance shopping a breeze.

Safeco is the cheapest Michigan homeowners insurance company, among carriers surveyed. Its average rate for Michigan homeowners is $1,452 a year, or $121 a month. Thats about $700 less than the state average of $2,153 and nearly $855 less than the national average .

But cheapest doesn’t always equal best. In this article, well dive into the best Michigan homeowners insurance companies to help make your home insurance shopping a breeze.

- Safeco is the cheapest insurance company in Michigan with an average rate of $121 per month.

- Your home’s square footage, building costs in your area, local crime rate, etc. affect your home insurance rates in Michigan.

- Bundling your insurance policies can help you save up to 19% on average in Michigan.

- Michigan Department of Insurance and Financial Services can help you in case of any dispute with your insurer.

Best For Customer Service: Allstate

Allstates average home insurance rate for Michigan is lower than most other major carriers, and in addition, Allstate also offers a host of discounts to make coverage even more affordable. While many of its discounts are standard among most major carriers, it offers a wide range of options with reasonable price breaks. It received four stars for customer service, value and for claims among Midwestern homeowners.

In addition to standard coverages, Allstate offers:

- Water back up coverage if your home is damaged by sump pump or drain back ups.

- Claim Rateguard, which means Allstate wont hike your rate for the first claim filed within a five-year period.

- Identity theft coverage.

- Special coverage for musical instruments and sports equipment.

- Green improvement reimbursement covers the additional cost of replacing damaged or destroyed covered items with more energy-efficient items.

- Extra yard and garden coverage increases the limits for the cost of items like trees, landscaping and riding lawn mowers.

- Electronic data recovery covers the cost of recovering lost personal computer data, like photos or videos.

- Added protection that increases limits for business-related items stored in your home, like inventory.

- HostAdvantage, which covers your belonging when renting out your home.

Discounts include:

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

Recommended Reading: Who Is Rocket Mortgage Owned By

How To Calculate Mortgage Insurance Premium

Related Articles

Expect to pay a percentage of your loan value in a mortgage insurance premium for Federal Housing Administration loans that don’t have at least 20 percent down payments. Terms vary slightly when it comes to insuring mortgage loans. Eliminating the insurance depends on loan type and creation date.

How To Get Rid Of Pmi

If you opt for BPMI when you close your loan, you can write to your lender in order to avoid paying it once you reach 20% equity. Were aware that the idea of writing a letter is absolutely antiquated, but the process was enshrined in federal law by Congress in the Homeowners Protection Act of 1998.

Your letter should be sent to your mortgage servicer and include the reason you believe youre eligible for cancellation. Reasons for cancellation include the following:

- Reaching 20% equity in your home.

- Based on significant improvements to your home. If youve made home improvements that substantially increase the value of your home, you can have mortgage insurance removed. If your loan is owned by Fannie Mae, you must have 25% equity or more. The Freddie Mac requirement is still 20%.

- Based on increases in your home value not related to home improvements. If youre requesting removal of your mortgage insurance based on natural increases in your property value due to market conditions, Fannie Mae and Freddie Mac require you to have 25% equity if the request is made 2 5 years after you close on your loan. After 5 years, you only have to have 20% equity. In any case, youll be paying for BPMI for at least 2 years.

For your request to cancel mortgage insurance to be honored, you have to be current on your mortgage payments and an appraisal has to be done to verify property value.

Read Also: What Banks Look For When Applying For A Mortgage

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

How To Estimate Pmi

To calculate your PMI, ask your lender for your PMI percentage or use the range listed below. Then follow these steps:

- Identify the property value. You can get the exact figure from a recent appraisal or estimate it by using the amount you plan to offer for the house.

- Find the total loan amount. To estimate your PMI for a refinance, start with your current mortgage balance. For a new mortgage, subtract your down payment from the home price.

- Calculate the LTV. Divide the loan amount by the property value. Then multiply by 100 to get the percentage. If the result is 80% or lower, your PMI is 0%, which means you don’t have to pay PMI. If it’s higher than 80%, move on to the next step.

- Estimate your annual PMI premium. Take the PMI percentage your lender provided and multiply it by the total loan amount. If you don’t know your PMI percentage, calculate for the high and low ends of the standard range. Use 0.22% to figure out the low end and use 2.25% to calculate the high end of the range. The result is your annual premium. To estimate your monthly premium, divide the result by 12.

You May Like: How To Get A 15 Year Fixed Mortgage

How To Avoid Lender

Another option is for your lender to pay your mortgage insurance premiums as a lump sum when you close the loan. In exchange, youll accept a higher interest rate. You may also have the option to pay your entire PMI yourself at closing, which would not require a higher interest rate.

Depending on the mortgage insurance rates at the time, this may be cheaper than BPMI, but keep in mind that its impossible to cancel LPMI because your payments are made as a lump sum upfront. If you wanted to lower your mortgage payments, youd have to refinance to a lower interest rate, instead of removing mortgage insurance.

Theres no way to avoid paying for LPMI in some way if you have less than a 20% down payment. You can go with BPMI to avoid the higher rate, but you still end up paying it on a monthly basis until you reach at least 20% equity. In that case, youre back to the original amount from the BPMI scenario.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Read Also: What Is Loan To Value Mortgage

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

How To Avoid Borrower

Borrower-paid PMI is the most common type of PMI. BPMI adds an insurance premium to your regular mortgage payment.

You can avoid BPMI altogether with a down payment of at least 20%, or you can request to remove it when you reach 20% equity in your home. Once you reach 22%, BPMI is often removed automatically.

While its possible to avoid PMI by taking out a different type of loan, FHA and USDA loans have their own mortgage insurance equivalent in the form of mortgage insurance premiums and guarantee fees, respectively. Additionally, these fees are typically around for the life of the loan.

The lone exception involves FHA loans with a down payment or equity amount of 10% or more, in which case you would pay MIP for 11 years. Otherwise, these premiums are around until you pay off the house, sell it or refinance.

The only loan without mortgage insurance is the VA loan. Instead of mortgage insurance, VA loans have a one-time funding fee thats either paid at closing or built into the loan amount. The VA funding fee may also be referred to as VA loan mortgage insurance.

The size of the funding fee varies according to the amount of your down payment or equity and whether its a first-time or subsequent use. The funding fee can be anywhere between 1.4 3.6% of the loan amount. On a VA Streamline, also known as an Interest Rate Reduction Refinance Loan, the funding fee is always 0.5%.

Read Also: Is Citizens Bank Good For Mortgages

How Mortgage Escrow Accounts Work

An escrow account is a savings account that the lender sets up to manage your homeowner’s insurance and property tax payments.

If you escrow, the payments you send to the lender each month includes insurance and taxes. The lender deposits the insurance and tax portions into the escrow account. When the bills are due, the lender withdraws money from the account to pay them.

Look at the Payment Calculation on Page 1 of the Loan Estimate to see if your loan requires an escrow and how much the lender plans to put aside each month for insurance and taxes.

Us Department Of Agriculture Loans

The USDA offers several attractive loan programs. Most are limited to rural areas, and to people who have average or below-average income. If you live outside of an urban or suburban area, it pays to learn if you qualify for a USDA loan.

USDA Loan Insurer

Guaranteed by the U.S. Department of Agriculture, USDA loans do not require a down payment. USDA loans are designed to encourage rural development.

USDA Loan Insurance Cost

USDA loans have an upfront fee and annual fee. The upfront fee is 2 percent of the loan amount. The annual fee, paid monthly, is 0.4 percent of the loan amount. USDA fees are lower than FHA fees.

Read Also: Is Closing Cost Part Of Mortgage

What Is The Ltv Ratio

The LTV or loan to value ratio is the portion of the value of the house that you are borrowing through a mortgage. In other words, the percentage of your homes value that is financed by the mortgage.

Example – Imagine that you want to purchase a house that costs $100,000 and you can only afford to make a 10% down payment. What is your LTV ratio?

Down Payment = 10% * House Price = 10% * $100,000 = $10,000

Mortgage Amount = House Price Down Payment = $100,000 – $10,000 = $90,000

LTV ratio = Mortgage Amount /Home Value = $90,000/ $100,000 = 90%

You pass the halfway point of your mortgage term – On a 30-year mortgage, for example, PMI must be removed 15 years into the loan. This is true even if the mortgage balance exceeds 78% of the original purchase price of the house.

You refinance your mortgage –The last way to get rid of PMI is to refinance your mortgage such that the new loan balance is less than 80% of the homes current value. This will allow you to avoid paying PMI after the refinancing of the mortgage.

How Much Is Mortgage Insurance In 2014

The cost of mortgage insurance partly depends on the type of loan you are using. As mentioned above, there are two basic types of coverage. Private mortgage insurance policies are applied to conventional home loans. Conventional or regular loans are not insured by the federal government. Borrowers who use government-insured FHA loans must also pay for mortgage insurance, but its different from PMI it is provided through the federal government.

Conventional LoansHow much is private mortgage insurance, on average? PMI fees are generally expressed as a percentage of the loan amount. They can range from about 0.3% to 1.15% of the amount being borrowed. This is the amount you pay each year.

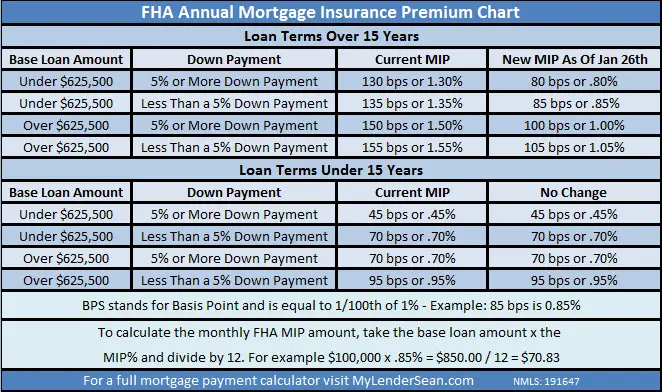

FHA LoansThe cost of FHA mortgage insurance is a bit more complicated. FHA loans actually require two types of mortgage insurance premiums , annual and upfront. Heres the difference between them, in terms of cost:

- The upfront premium is currently set at 1.75% of the base loan amount. This rate applies to all borrowers, regardless of the loan size or LTV ratio.

- The annual mortgage insurance premium on FHA loans will vary based on the size of the loan and LTV ratio. In most cases, the annual MIP ranges from 0.45% to 1.55% of the base loan amount.

| FHA Annual MIP | |

|---|---|

| Base Loan Amount $625,500 or less | Base Loan Amount above $625,500 |

| LTV 95.01% or more 1.35%LTV 95.00% or less 1.30% | LTV 95.01% or more = 1.55%LTV 95.00% or less = 1.50% |

Read Also: Can You Refinance Mortgage With Poor Credit

Department Of Insurance And Financial Services

The Department of Insurance and Financial Services is a great resource both for Michigan homeowners purchasing coverage for the first time or those who are already insured. The DIFS website has helpful information about how to shop for home insurance, what to prioritize when selecting your coverage, information about state insurance laws, customer complaint forms, and more.

Is Pmi Tax Deductible

PMI is tax-deductible! Just like other forms of mortgage insurance, PMI can be deducted when you file yourincome taxreturn. With theFurther Consolidated Appropriations Act of 2020, Congress allowed for deductions until December 31st, 2020. It is also available for 2019 and 2018.

How to Calculate your PMI cost?

In order to use the calculator provided above, you will need to input some of the specifics on the home you are trying to purchase and the mortgage you are applying for. First and foremost, if your down payment is 20% or more, you wont need to pay for private mortgage insurance at all. Next, in order to calculate your monthly mortgage insurance premium, the following will be needed:

Home purchase price When all other variables stay fixed, the higher the home purchase price, the higher your private mortgage insurance will be. This is because the mortgage insurance rate is multiplied by the loan amount to find your annual mortgage insurance. For the same down payment, a higher home purchase price means that the loan amount will be bigger, and this exposes the lender to more risk, therefore the private mortgage insurance premiums will be higher as well.

Mortgage Insurance Rate As mentioned above, the mortgage insurance rate is multiplied by the loan amount to find out the premium. A higher mortgage insurance rate means that you will pay a bigger amount on private mortgage insurance.

Also Check: How Much Mortgage Do You Pay A Month

Do I Have To Use A Specific Title Company In Michigan

Ultimately, the person paying for the insurance policies has the right to choose whom to select for the title insurance services. If a sales agreement specifies the title company then both parties are contractually bound to use the agreed upon company.

Typically, the fees are split between buyer and seller, therefore, each party can select what title company they chose to purchase their title insurance through. If the buyer and the seller choose to purchase title insurance and close through separate companies, this is called a split closing.

Mortgage Life Insurance Rates

Mortgage life insurance rates change from year to year. But the table below gives you an example of mortgage life insurance premiums based on TDâs rates in 2020. This table shows the monthly mortgage life insurance rate based on age at the time of application and mortgage amount.

| Age | |

|---|---|

| $1,000,000 | $300 |

As you can see, the mortgage life insurance rates increase as your age and mortgage amount increase. For example, if youâre 30 years old and your mortgage is $250,000, youâll pay $25/month for mortgage life insurance.

However, if youâre 30 but have a $500,000 mortgage, youâll pay $50/month. Similarly, if you have a $250,000 mortgage but youâre 40 years old, youâll pay $52.50/month.

You May Like: Can You Get A Mortgage While In Chapter 13