Calculate Weekly Monthly Quarterly And Semi

Depending on the payment frequency, you need to use the following calculations for rate and nper arguments:

- For rate, divide the annual interest rate by the number of payments per year .

- For nper, multiply the number of years by the number of payments per year.

The below table provides the details:

| Payment Frequency | |

| annual interest rate / 2 | years * 2 |

For instance, to find the amount of a periodic payment on a $5,000 loan with an 8% annual interest rate and a duration of 3 years, use one of the below formulas.

Weekly payment:

Semi-annual payment:

=PMT

In all cases, the balance after the last payment is assumed to be $0, and the payments are due at the end of each period.

The screenshot below shows the results of these formulas:

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youâll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

How Do You Calculate Amortization

An amortization schedule calculator shows:

This means you can use the mortgage amortization calculator to:

To use the calculator, input your mortgage amount, your mortgage term , and your interest rate. You can also add extra monthly payments if you anticipate adding extra payments during the life of the loan. The calculator will tell you what your monthly payment will be and how much youll pay in interest over the life of the loan. In addition, youll receive an in-depth schedule that describes how much youll pay towards principal and interest each month and how much outstanding principal balance youll have each month during the life of the loan.

Read Also: What Can My Mortgage Be

Understanding Mortgage Principal And Interest

When you take out a mortgage loan to buy a home or pretty much any other type of commercial loan, the financial institution you’re borrowing from isn’t lending to you out of the goodness of its heart. The bank or other institution is looking to make money, and that comes from charging you interest, which is almost always proportional to how much you have outstanding on the loan.

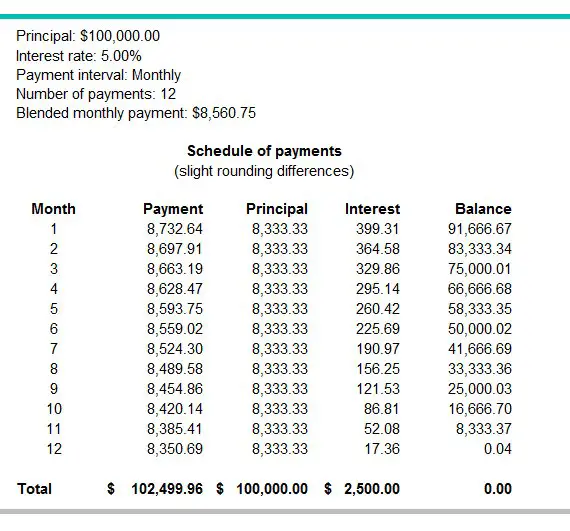

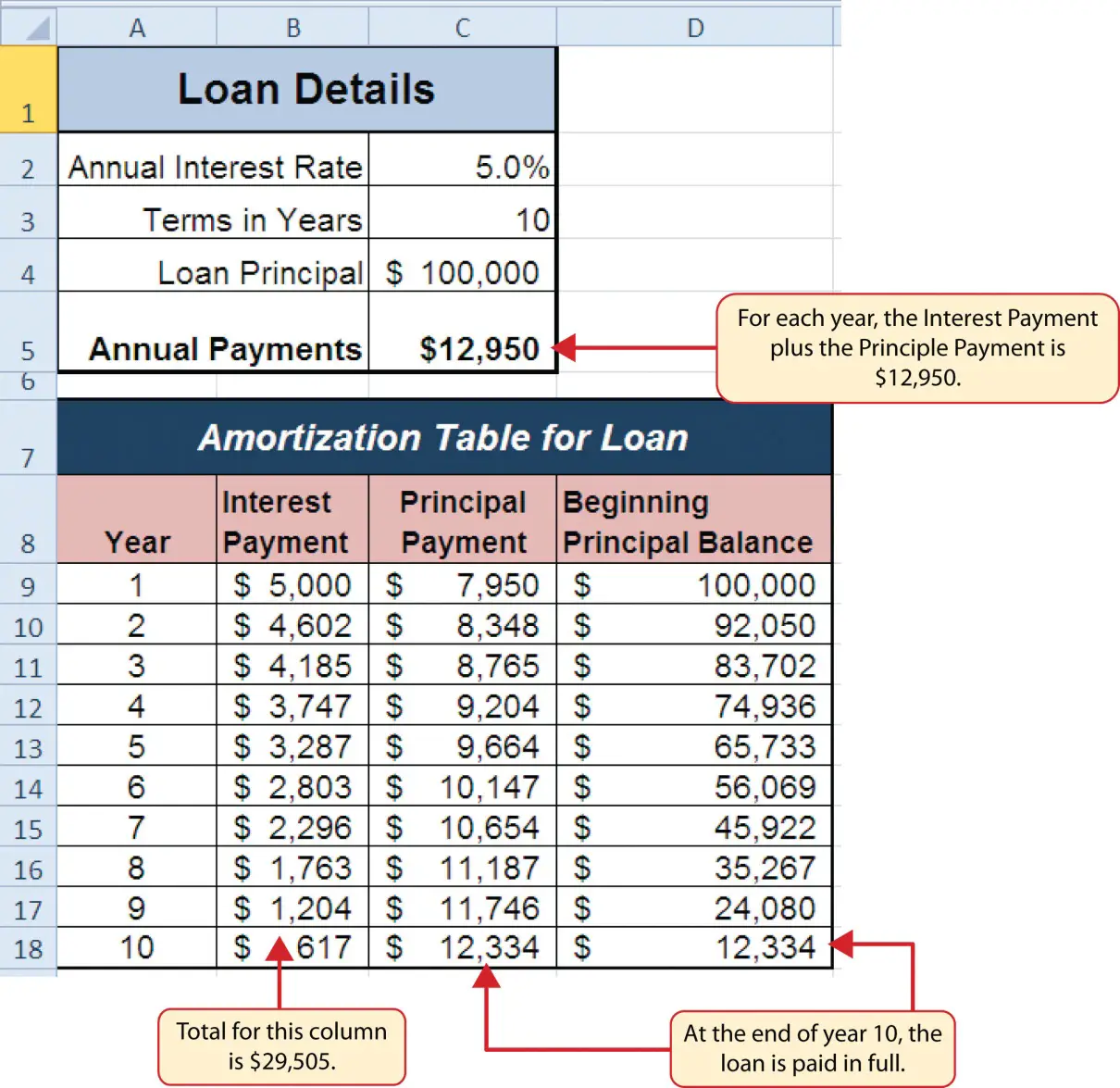

The initial loan amount is called the principal of the loan, and each monthly payment you make on your mortgage will include a portion paying interest and a portion paying principal. Generally with a fixed-rate mortgage, you will pay the same payment amount over the course of the loan.

Early on after you take out the mortgage, a large portion of your payments each month will be interest because there is still a lot of principal remaining on the loan to incur interest. As you gradually pay off the loan, a greater portion of each month’s payment will be principal.

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home. You also may pay a different type of mortgage insurance if you have another mortgage, such as an FHA mortgage.

You May Like: How Much Mortgage Can I Afford For 2500 Per Month

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnât pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnât mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youâll have on-hand after you make the down payment. Itâs best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youâre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youâll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youâre comfortable withâjust because a bank pre-approves you for a mortgage doesnât mean you should maximize your borrowing power.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Read Also: What Are Mortgage Interest Rates Based On

Save On Interest With Principal Mortgage Payments

Let’s say you take out a $300,000 30-year fixed rate mortgage with a 5.5% interest rate.

If you pay only your principal and interest every month for 30 years , youâll pay $313,415 in total interest.

But pay $100 extra toward principal every month , and youâll save $46,334 in long-term interest. Plus, youâll pay off your mortgage almost four years sooner. Double that extra payment to $200 dollars , your interest savingsjump to $79,767.

| Monthly PI payment |

| 23 years, 5 months |

| Based on a $300,000 loan for 30-year mortgage with a fixed interest rate of 5.5% |

The more you can pay toward the principal over the life of your loan, the more youâll save in interest â and youâll own your home outright sooner, too!

Basic Mortgage Payment Calculator

This calculator requires the use of Javascript enabled and capable browsers. This script calculates the monthly payment of a typical mortgage contract. Enter the dollar amount of the loan using just numbers and the decimal. Next, enter the published interest rate you expect to pay on this mortgage. Finally, enter the number of years to pay on the mortgage. Click on the Calculate button and the monthly payment, principal and interest only, will be returned. You may click on Clear Values to do another calculation. In our example, a loan of $100,000.00 for 30 years at 6% will yield a payment of just less than $600.00 a month for principal and interest. Designation

Also Check: What Would Be The Mortgage Payment On 200 000

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed. If the amount you pay into escrow isn’t enough to cover your taxes when they come due, you’ll have to pay the difference, and your mortgage payment will likely increase going forward.

You can typically find your property tax rate on your local government’s website.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Donât Miss: Can I Have Multiple Mortgages

You May Like: How Much Do You Pay Back On A Mortgage

Your Home Becomes Collateral

A HELOC turns your home into collateral. There are significant risks if you fall behind on payments, but you can stretch out your loan to minimize your monthly payments. HELOCs give you multiple years to strengthen your finances before the draw period gives way to the repayment period. Any loan involving collateral increases the risk for the borrower, but these loans typically have lower interest rates, and in the case of a HELOC, you have more time to anticipate the loans repayment period.

Principal And Interest Example

Suppose you purchase a house that costs $250,000. You put down 20%, or $50,000. Your mortgage principal is the house price minus the down payment, or $200,000.

Letâs say you want to repay the $200,000 in principal over 30 years. To loan you this money, the lender needs an incentiveâthe opportunity to earn interest at a fixed rate of 3% per year for 30 years.

Using an online mortgage principal and interest calculator , you can see how much paying 3% interest on your loan balance over 30 years will cost you: $843 per month in principal and interest. Check out the calculatorâs amortization schedule and scroll down to the payoff date. It will show that youâll pay $103,601.28 in interest over 30 years to borrow $200,000 in principal.

Recommended Reading: When Is Private Mortgage Insurance Required

How To Pay Off Your Mortgage Faster

You can pay off your mortgage faster by making additional principal payments. The key to making this strategy work is that you must specify that the extra money youâre sending in is a payment of additional principal. If you donât, your mortgage servicer might apply it toward your next monthly payment, which wonât give you the result youâre looking for.

Do you get an annual bonus, have an irregular income or get a large tax refund? One way to pay off your mortgage faster is to make one extra payment per year when this extra income arrives. On a 30-year mortgage where you make one extra principal payment per year, you will pay off your mortgage about 3.5 years sooner. In our example of a $200,000 mortgage at 3% interest, you would save a little over $14,000 in interest by using this strategy to pay off your mortgage early.

Is your income steady throughout the year? In that case, you might want to pay additional principal with each monthly payment. You may be able to set up this arrangement through your servicerâs website so it happens automatically each month.

What Is Your Interest Payment

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate and determine your mortgage rate in terms of an annual percentage rate . is the actual amount of interest that you pay on your loan per year . For example, if you borrow $100,000 at an APR of 5%, youd pay a total of $5,000 per year in interest. At the beginning of your loan , most of your monthly payment goes toward paying off interest.

Just a few percentage points of interest can make a huge difference in how much you eventually end up paying for your loan. For example, lets say you borrow $150,000 at a 4% interest on a 30-year loan. With this loan, your monthly payment would be $716. If you take the same loan with a 6% interest rate, youd pay $899 each month.

You May Like: What Is The Biggest Mortgage I Can Get

Bond: Predetermined Lump Sum Paid At Loan Maturity

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer when the bond matures, assuming the borrower doesn’t default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond’s value at maturity, a bond’s market price can still vary during its lifetime.

What’s The Formula For Calculating Mortgage Payments

For the maths-inclined among us, the mortgage payment formula isnt that complicated. Just remember, this doesnt account for variable rates, which can change.

Youll need these numbers to get started:

- r = Annual interest rate /12

- P = Principal of the loan

- n = Number of payments in total: if you make one mortgage payment every month for 25 years, thats 25*12 = 300

Heres the formula:

If we wanted to figure out the payment for an average mortgage, it might look like this:

- r = 0.033/12 = 0.00275

- N = 25*12 = 300

If you cant tell from the points above, this is a £350,000 mortgage at 3.3% APRC and a 25-year term.

Lets plug those numbers into the formula:

And we’ll simplify:

And thats it! It may not be as easy as a calculator, but it’s quite possible to do yourself.

If you enjoyed this article, dont forget to subscribe for updates here. Thanks for reading!

Recommended Reading: Are Mortgage Interest Rates Expected To Rise

How Do You Calculate A Mortgage Payoff

Youâll need to know the mortgage payoff amount if you want to refinance or sell your home. Your lender will have the exact sum, which will be date specific, but you can get an idea of what youâll owe.

| ð° Save thousands on commission. Try Clever Real Estateâs free agent matching service. Compare top local realtors, get full service for a 1% listing fee. Learn more. |

How A Mortgage Calculator Helps You

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living.

Using NerdWallets mortgage calculator lets you estimate your mortgage payment when you buy a home or refinance. You can change loan details in the calculator to run scenarios. The calculator can help you decide:

Recommended Reading: How To Figure Out Mortgage Interest

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

Read Also: What Is Mortgage Insurance For Fha Loan

You May Like: Is Quicken Loans A Mortgage Company