Choosing The Right Mortgage Term

Mortgage terms vary so that you can take advantages of opportunities that align with your current financial circumstances. There are advantages to both short- and long-term commitments. Well help you make the right choice.

| Term | ||

|---|---|---|

| Short | Shorter terms typically have lower rates. You have the option to renew your mortgage more often, taking advantage if interest rates decline. | You could find yourself having to renew your mortgage at a higher rate if interest rates increase. Short-term mortgages are advantageous if you foresee the opportunity to pay off your entire balance in the near future. |

| Long | Longer terms provide predictability and stability. | Committing to an interest rate for a long period of time may make it more difficult for you to obtain a lower rate if rates drop over time. |

Mortgage terms vary so that you can take advantages of opportunities that align with your current financial circumstances. There are advantages to both short- and long-term commitments. Well help you make the right choice.

Historical Mortgage Rates Chart

Following substantial hikes to the funds rate in order to curb inflation, mortgage rates have risen to their highest levels since 2002. At just under 7%, the average 30-year fixed mortgage rate is nearing its historical average.

Freddie Mac the main industry source for mortgage rates has been keeping records since 1971. Between April 1971 and November 2022, 30-year fixed-rate mortgages averaged 7.76 percent. To understand todays mortgage rates in context, take a look at where theyve been throughout recent history.

Compile Your Employment History

Compiling your employment history prior to meeting with a mortgage lender is crucial. Doing so will signal to lenders that you are serious about repaying the loan and are low risk for defaulting on your mortgage payments. Your employment history will indicate that you have been consistently employed and will likely be employed for the foreseeable future.

Also Check: How Often Do You Pay Your Mortgage

What Is Cmhc Insurance

Mortgage insurance or CMHC insurance is required for homeowners who purchase a home with a down payment of less than 20%. This insurance is meant to protect the lender, not you. The benefit is that it allows you to buy a home even if you have less than 20% of the purchase price saved for a down payment.

Conforming Loans Vs Non

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-palmetto-mortgage.jpeg)

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

You May Like: How And Why To Refinance Your Mortgage

Changes To The Cibc Prime Rate

Changes to the CIBC Prime Rate are sometimes described in terms of increases or decreases in basis points. A basis point is a unit of measure that represents 1/100th of one percent . For example, if interest rates are increased by 50 basis points, it means they were increased by 0.5%. The term basis point value simply denotes the change in the interest rate in relation to a basis point change.

How Are Variable Rates Set

Variable mortgage rates are set from lender prime rates, and ‘float’ along with any prime rate changes.

However, lenders will often offer their 5-year variable rate at a ‘discount off of prime’ to compete with other lenders. Lender discounts are each based on their mortgage-lending bottom lines and what the market will bear to attract business. The variable rate you sign up for includes your lender discount, whichstays constant for your full 5-year term, even though the rate itself may change.

Also Check: Do You Pay Interest On A Mortgage

Raise Your Credit Score

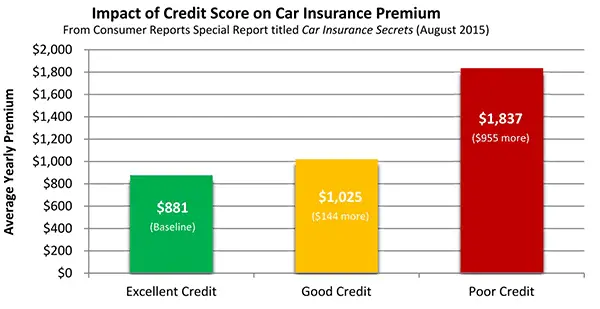

If your credit score is below 760, then you might not qualify for the very best rate lenders offer. That doesnât mean you canât get a lower rate than what you currently have, but there is room to improve your score and boost your savings. Before you apply for a mortgage refinance, check your credit score and get a copy of your credit report.

If you find any errors on your credit report, be sure to report them to both the credit bureau and the business that made the error as soon as possible. Both parties must correct the information in order for it to change on your credit report and be reflected in your credit score.

You can bump up your credit score by paying off credit card debt and reducing how much you use your cards. If you do use credit cards for rewards and points, try to pay them off immediatelyâdonât wait for your monthly statement to come in because your score can change daily.

Avoid applying for new lines of credit before you apply for a mortgage refinance, as credit applications can bring down your score. However, submitting multiple mortgage applications in an effort to get the lowest rate possible wonât hurt your score.

Dont Miss: Historical Savings Account Interest Rates

Qualifying For A Lower Mortgage Rate

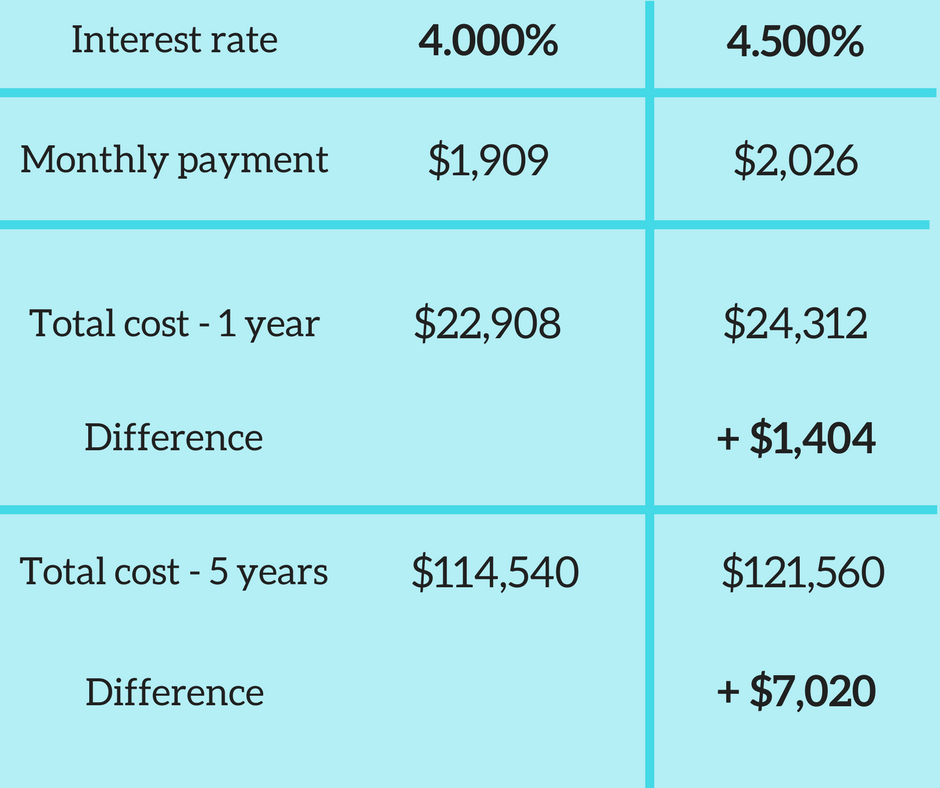

It may be helpful to improve your credit score before applying for a mortgage so you can qualify for a lower mortgage rate and save tens of thousands of dollars over the life of the mortgage. The money you save on your mortgage is well worth the time and effort to improve your credit score.

If you have a low credit score, review your credit reports to see the items that are affecting your credit score. You can raise your credit score by making timely payments on all your bills, paying down your credit card debt, removing errors from your credit report, and paying off outstanding delinquent balances. In some cases, just a few points can make a big difference in your mortgage rate.

Continue to monitor your credit score in the weeks leading up to your mortgage application to see how your credit score improves.

Don’t Miss: How Can I Get Help With My Mortgage

When Buying In A High Interest Rate Environment:

- Prepare a larger down payment. Borrowing doesnt make as much sense in a high interest rate environment. Accordingly, consider preparing a larger down payment for the properties you buy or buy them all in cash.

- Be choosy. Competition is low and the environment typically favors buyers, so you can afford to be choosier when selecting properties to add to your portfolio.

- Consider refinancing. Mortgage interest rates may be high now, but that doesnt mean theyll remain high in the future. If interest rates drop, you can always refinance and take advantage of the new rates.

- Consider selling. Higher interest rates typically mean lower prices, so if it works for your strategy, you can buy a house in a high interest rate environment, sell it in a low interest rate environment, and cash in on the pricing difference when it comes.

So just how important is the mortgage interest rate when buying a rental property? While its not as important as other factors, like the location of the property and the total price you pay, its a very important consideration. Make sure you understand the current interest rate environment before planning your purchase, and strategize accordingly.

Historical Comparison Of Fixed

Variable-rate mortgages have been historically proven to be less expensive. That said, According to Mortgage Professionals CanadaOpens a new website in a new window – Opens in a new window, about 77% of all mortgages are fixed rate, while the remainder are variable rate , or a combination of fixed and variable rate .

You May Like: How To Get Pre Approved For A Mortgage

Are The Lowest Mortgage Rates Usually Online

For the last few years, the best rates in Canada have usually been found online. Thats because internet-based lenders have been more competitive and often accept smaller profit margins. Even big banks are now joining the bandwagon with special pricing for online mortgage shoppers. RATESDOTCA tracks dozens of lenders and aggregates the best deals all in one place.

Also Check: How Much Is Mortgage On 1 Million

The Constant Maturity Treasury Rate

Constant Maturity Treasury rates, or CMT rates, refer to a yield thats calculated by taking the average yield of different types of U.S. Treasury securities with varying maturity periods, and using it to adjust for a number of time periods.

Some mortgage lenders will use this rate to determine interest for adjustable-rate mortgages . If the CMT rate goes up, you can expect any loans tied to it to increase their interest rates as well.

Also Check: What Are Bank Mortgage Rates

Current Mortgage Rates For Jan 9 202: Major Rate Decreases

This last week mortgage rates were varied, but the 30-year rate shrank significantly. The Fed’s interest rate hikes are increasing costs for prospective homebuyers.

While a closely followed mortgage rate trended down, rates in general were varied over the last seven days. While 15-year fixed mortgage rates made gains, interest rates on 30-year fixed-rate mortgages sank. For variable rates, the 5/1 adjustable-rate mortgage climbed.

Mortgage rates increased dramatically in 2022, as the Federal Reserve hiked interest rates repeatedly throughout the year. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. But the Fed’s actions, designed to mitigate the high rate of inflation, had an unmistakable impact on mortgage rates.

The outlook for 2023 remains uncertain. Though higher rates are likely to here to stay, the biggest increases may be behind us. That noted, trying to time the market is tricky. If inflation persists, more interest rate hikes could follow. As such, you may have better luck locking in a lower mortgage interest rate now instead of waiting after all, you can always refinance later on. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

Can You Negotiate Your Mortgage Interest Rate

The short answer is yes, but not always.

You may be able to negotiate on the interest rate a bit. It pays to compare rates from various lenders. If you find a lower rate elsewhere, by all means ask your lender if they can match it or do even better.

Often, youll have the most luck negotiating if you have an attractive mortgage application. That includes a good down payment and credit history, stable income and low debt service ratio. If you already have other products with the lender you may also get a better rate.

Don’t Miss: How To Become A Mortgage Broker In Massachusetts

How The Overall Economy Affects Mortgage Rates

Both the Federal Reserve and the overall markets are reacting to the ups and downs of the economy as a whole. Here are a few examples.

Generally, if people believe were in prosperous times, theyll move their money into stocks and away from bonds for the chance at a higher return. Mortgage rates end up moving up. If investors believe were looking at a downturn in the future, money gets moved back into bonds and mortgage rates go down.

Inflation also plays a role. When inflation is higher, people are more incentivized to invest in stocks. The reasoning is that the guaranteed rate of return on bonds gets eaten into as inflation rises.

If a bond pays you back 5% and the money supply is increasing at a rate of 3% per year, youre only getting an effective 2% return. Its worth noting that, if you already have a fixed-rate mortgage, your payment wont change based on inflation.

Finally, unemployment plays a part. If more people are unemployed than the Fed would like to see, they tend to lower interest rates to stimulate borrowing, which in turn may be used to help grow a workforce.

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

| 5.57% |

You May Like: What Banks Offer 20 Year Mortgage

Home Equity Line Of Credit Special Offers

| Home Equity Line of Credit**** | |

| Mortgage Rates*** |

5.95% HSBC Prime Rate + 0.00% |

Offer is available to all new HSBC Home Equity Line of Credit applications that start between February 28, 2022 to September 30, 2022 subject to credit approval.

The HSBC Premier advantage

HSBC Premier customers can take advantage of our mortgages in addition to the benefits of HSBC Premier1, a leading banking solution that gives you access to unlimited day-to-day banking2 and exclusive worldwide benefits.

HSBC Premier eligibility

To qualify for an HSBC Premier mortgage you must have an active HSBC Premier chequing account. The monthly fee of $34.95 is waived when you maintain:

1. Personal deposits & investments totalling $100,000 or more or

2. Hold a personal mortgage with an original amount of $500,000 or greater

OR achieve the thresholds noted in points 1 and 2 above by combining you and your spouse or common law partners balances through our Household Qualification Program. OR

3. $6,500 minimum monthly income deposits or

4. You qualify for HSBC Premier in another country

Discover all the advantages of HSBC Premier

Together, We Advance

Our HSBC Advance customers can access our Mortgage solutions in combination with HSBC Advance3. With our online and mobile banking services, youll have access and control of your money wherever you need it, wherever you are.

HSBC Advance eligibility

Discover all the advantages of HSBC Advance

Moneys Daily Mortgage Rates For December 1 2022

Almost all loan types inched higher yesterday, according to Moneyâs daily mortgage report.

The average rate on a 30-year fixed-rate mortgage increased by 0.026 percentage points to 7.826%. Rates on adjustable-rate loans also increased across the board. On the other hand, the rate on a 15-year fixed-rate loan moved down.

- The latest rate on a 30-year fixed-rate mortgage is 7.826%.

- The latest rate on a 15-year fixed-rate mortgage is 6.217%.

- The latest rate on a 5/6 ARM is 7.215%.

- The latest rate on a 7/6 ARM is 7.281%.

- The latest rate on a 10/6 ARM is 7.242%.

Moneyâs daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each dayâs rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on mortgage application data submitted to Freddie Mac by thousands of lenders across the country. The weekly rate averages are based on applications for conventional, conforming loans for borrowers with excellent credit who made a 20% down payment and no longer include discounts for points/fees paid.

Also Check: Can I Add Someone To My Mortgage Without Refinancing

How Do Interest Rate Hikes Affect Inflation

When interest rates are higher, they encourage people to save. Since it is a good time for people to save, less borrowing and spending tends to happen. When this happens, companies may increase their prices at a slower pace or even lower prices to get people to spend again. This reduces inflation since the costs of goods arent going up in price as quickly as they would otherwise.

Lower interest rates work in the opposite way. Not only does it cost less to borrow money when interest rates are low, but you also earn less from keeping your money in savings, which means you may end up spending more money. This increase in consumer spending could cause prices to rise as consumers are willing to pay more.

The Bank of Canada actively uses interest rate increases and decreases to control inflation. The BoC tries to keep inflation at 2% a year as most of the population can handle that level of year over year change.

Cant Decide Between A Fixed Or Variable Mortgage

You dont have to feel tied down by the decision. With Scotiabanks Scotia Total Equity® Plan , you can protect against interest rate changes by customizing your mortgage solution to your risk tolerance.2 STEP allows customers to combine up to three different mortgages with either a fixed or variable rate as well as with different terms or length for each mortgage. A ScotiaLine® is another option with STEP that can provide additional flexibility as there is no term or length associated with a line of credit. STEP helps you customize your debt so that it meets your changing life needs.

Don’t Miss: How To Figure Mortgage Rates

Loan Amount And Home Price

Your loan amount will follow this basic formula:

Home price + closing cost down payment = loan amount

Your mortgage insurance and closing costs might be included in your home loan depending on your financial circumstances or mortgage loan type. You may also know the price range of the property you want to purchase, if you have already started shopping. If, however, you have just started, real estate websites can be a good source to get you started, providing you with an idea of what typical prices are in each area.