Will 2021 Be A Good Time To Buy A House

The 2021 housing market is improving Because fall 2021 is looking like it’ll be a better time for buyers. If the experts are right, more homes will come onto the market in October. And prices could moderate after recordbreaking increases. … Get busy in October as homes for sale become more numerous and affordable.

How Much Do You Need To Qualify For The Biggest Mortgage

However, in order to qualify for the lowest mortgage rates and, thus, the largest loan amount you must also have a high credit score, few debts, and a substantial down payment. Most mortgage doors will be open to you if you have all of these variables in place and a yearly income of $100,000 or more.

Dont Miss: 10 Year Treasury Yield And Mortgage Rates

Do I Qualify For Mortgage

You’ll need to have a FICO® Score of at least 620 points to qualify for most types of loans. You should consider an FHA loan if your score is lower than 620. An FHA loan is a government-backed loan with lower debt, income and credit standards. … These government-backed loans require a median FICO® Score of 580 or more.

You May Like: What Is The Effect Of Paying Extra Principal On Mortgage

I Make $120000 A Year How Much Home Can I Afford

The home affordability calculator will give you a rough estimation of how much home can I afford if I make $120,000 a year. As a general rule, to find out how much house you can afford, multiply your annual gross income by a factor of 2.5 4. If you make $120,000 per year, you can afford a house anywhere from $300,000 to $480,000.

Recommended Reading: How Much Is Mortgage On 1 Million

How Much Will Stamp Duty Be In 2021

During the stamp duty holiday, the stamp duty rate was reduced to 0% on residential property purchases up to £500,000. Until 30 September 2021 there is a ‘tapered’ stamp duty holiday extension in England and Northern Ireland on purchases up to £250,000. It will go back to £125,000 the normal rate on 1 October 2021.

You May Like: What Is The Mortgage On 800k

How Much Can I Afford

How much you can afford to spend on a home in Canada is primarily determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation.

How Much Can I Borrow On 12k A Year

A lot of people in lower salary brackets believe that they wont be accepted for a low income mortgage, often because of misinformation or because they have been rejected by a lender in the past.

However, there are lenders that specialise in mortgages for borrowers on a lower wage.

Sometimes these mortgages can come with higher interest rates, so always speak to a mortgage broker before applying as they will have access to a range of lenders, some of which may be able to offer you a better, more affordable deal.

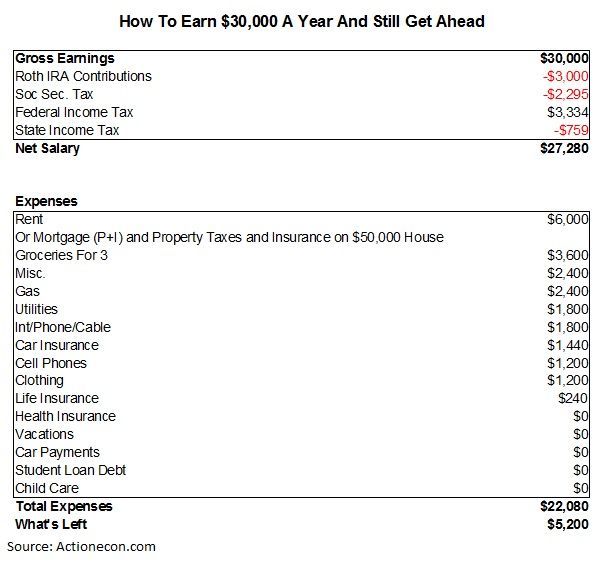

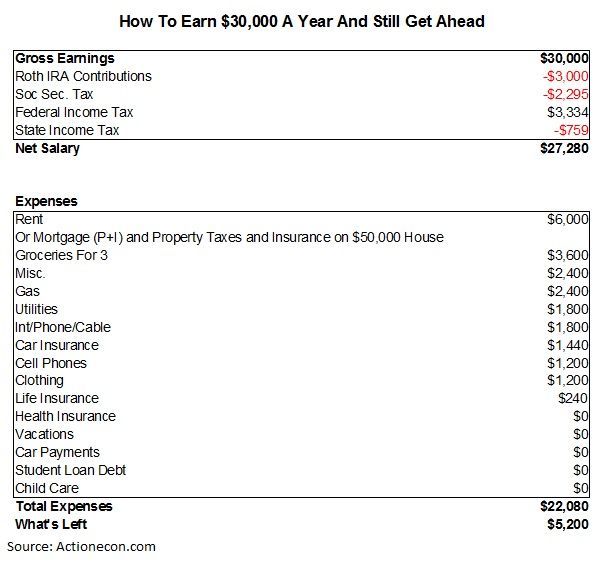

Take a look at the chart below to see how much you could borrow depending on your salary and potential income multiple.

As you can see, even a slightly higher salary can make a big difference:

| Salary |

|---|

Read Also: When Is A Mortgage Payment Considered Late

How To Use Credit Karmas Home Affordability Calculator

If youre planning to buy a house, youll need to get a sense of how much home you can afford.

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and closing costs. This calculator provides an estimate based on the information you provide. It doesnt consider other costs associated with home ownership, such as maintenance and utilities.

Keep in mind that home price isnt the only factor that affects affordability. The interest rate on your home loan, your down payment and your loan term can all affect how much you end up paying for your home.

Our home affordability calculator considers the following factors:

How Much House Can I Afford With A Usda Loan

USDA loans for qualifying rural areas are much more flexible than regular loans. They dont require a down payment and can include the mortgage insurance fee in the loan. This means you can actually finance 102% of the value of the house and avoid paying this fee upfront.

Keep in mind, however, that there are parameters for income eligibility and for the price and size of the house itself. Even if you can afford a certain amount, the eligibility might be for a less expensive home.

In order to see these requirements in detail, you can go to the USDA website and look at the qualifying areas and income by county.

You May Like: How To Pay Down Your Mortgage Faster

How Much Do I Need To Make To Buy A $300k House

Assuming that you are going to make the average percentage that a regular American household will make for their down payment, which is 6%, and that you will choose a 30-year term, then you will need to have a monthly income that ranges from $72,000 to $82,000. For shorter-term repayment, you should expect that the monthly income you are earning should be at least 10 to 20 thousand more per year for every 5 years that you deduct from your term. To get more exact estimates based on your down payment and the interest rate you can use a mortgage calculator to determine the exact income you will need to earn annually.

Home Buying Examples: See You Much You Can Afford On $100k Per Year

The amount you can borrow for a mortgage depends on many variables and income is just one of them.

That means two people who each make $100,000 per year, but have different credit scores, debt levels, and savings, could have vastly different home buying budgets.

Here are a few examples of how much home someone might afford on a $100K salary when those other requirements are factored in.

Buying a house with a $100K salary and low credit

First, lets look at an example of a homebuyer who makes $100,000 per year, but has a lower credit score and relatively high debts.

This could be someone who recently graduated with student loans and hasnt had a chance to build up their credit yet. Or, someone who has existing debt from a few different lines of credit like credit cards and an auto loan.

Whatever the case, a lower credit score and higher debts mean your home buying budget will be on the lower end of the spectrum.

$100K salary and low credit buys a home below $300K

- Income: $100,000/year

*Interest rates shown are for sample purposes only. Your own rate will be different

This borrower makes a $100k salary and has a 650 credit score.

They are looking for an FHA mortgage with a low down payment. And, they owe about $1,000 in nonmortgage debts each month.

Assuming that the lender offers a 4.5% interest rate which is higher than current averages because of their credit score and debts this borrower may be able to buy a $288,500 home.

- Income: $100,000/year

Recommended Reading: What Is Llpa In Mortgage

How Much Is The Average Monthly Mortgage Payment Uk

What is the average mortgage repayment rate in the UK? The average mortgage repayment rate in the UK is £ 723, with an interest rate of 2.48%. This is based on the latest survey conducted by Santander in 2018.

How much is the average monthly mortgage payment?

Read our editorial standards. The average mortgage payment is $ 1,159 for a 30-year fixed mortgage, and $ 1,747 for a 15-year loan. However, an accurate estimate of what the average U.S. would spend on their debt each month would be averaging: $ 1,609 in 2019, according to the U.S. Bureau of Statistics.

How much per month is a 200k mortgage UK?

| £ 200,000 Loans Various Terms |

|---|

Recommended Reading: Reverse Mortgage Mobile Home

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, andinsurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of39% and a maximum total debt service ratio of44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Also Check: What Are Mortgage Interest Rates At

Don’t Miss: How To Pick The Best Mortgage Lender

Can I Get A Mortgage With 3 Months Employment

Yes. It is possible to obtain a mortgage if your contract has recently changed with the same employer. However, the issue is that you may not have earnings history for last 3 months as required by many lenders and as a result they may consider your application in the same way that they would consider a change of job.

What Mortgage Can I Afford On 70k Salary

So if you earn $70,000 a year, you should be able to spend at least $1,692 a month and up to $2,391 a month in the form of either rent or mortgage payments.

What is a good annual income?

A good annual income for a credit card is more than $39,000 per annum for a single individual or $63,000 per year for a household. Anything lower than that is below the median yearly earnings for Americans.

Why is mortgage based on gross income? If youre looking to apply for a mortgage, your gross income is key to knowing how much you can afford. Mortgage lenders and landlords use your gross income to determine your financial reliability. Lenders want to know what percentage of your income will go to a mortgage payment.

How much mortgage can I get with a 650 credit score? With a credit score of 650, your mortgage interest rate would be approximately 3.805%, which would cost you about $203,541 in interest on a $300,000, 30-year loan. If you could increase your credit score by even 30 points, you stand to save over $25,000.

Don’t Miss: Does Charles Schwab Offer Mortgages

Who Is The Mortgage Qualifying Calculator For

This calculator is most useful if you:

- Are a potential homeowner needing to know your budget constraints

- Have decided on a new home but want to ensure you can afford it

- Are looking to plan and budget for the future

If you’re ready to connect with a trusted lender and receive exact figures, fill out this short form here and request personalized rate quotes tailored to you. This will give you a better idea of what interest rate to expect and help gauge your ability to qualify for a mortgage.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross household income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Recommended Reading: How To Get Mortgage Statement Online

How Much Mortgage Do I Qualify For If I Make $20000 A Year

As discussed above, a home loan lender does not want your monthly mortgage to surpass 28% of your monthly income, which means if you make $20,000 a year or $1,676 a month, your monthly mortgage payment should not exceed $469. Once again this is only based on your salary and not on the other financial factors that a mortgage lender will consider before pre-approving you. If you use the 2.5 to 3 times your salary rule, your max budget for a home would be $60,000. Again, these calculations are only based on income which is not all a mortgage lender looks at.

On BestRates, you can compare mortgages rates easily. All you have to do is click on the button below, enter your zip code, and choose whether you are looking to purchase or refinance your home. Then, you’ll be redirected to BestRates, which will automatically compare the best mortgage rates in your area. Click the button below to get started.

How Much Do I Need To Earn For A 100k Mortgage Uk

So with this is mind, roughly how much salary is needed for a £100k mortgage? Say the lender you approach will loan a maximum of 4x your income, the very minimum you would have to earn would be £25,000 .

How much do I need to earn for a 200k mortgage UK?

So, based on a lender cap of 4.5x your income, you would need to earn £44,445 a year to be eligible for a £200k mortgage although this does not take into account other variables mortgage providers take into account when assessing affordability.

Recommended Reading: How Is The Mortgage Industry Doing

Homeready And Home Possible

The HomeReady and Home Possible loan programs help income-challenged borrowers qualify for conventional loans.

For example, Fannie Maes HomeReady program lets you document income from your roommate to strengthen your loan application. Or, you could even qualify with income from family members who wont live in the home with you.

Home Possible, from Freddie Mac, can help you turn sweat equity into a larger down payment.

Any of these advantages can end up lowering your monthly payment, making it easier to afford the same home on the same income.

How To Interpret The Results

The calculator shows two sets of results:

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

Don’t Miss: Where To Compare Mortgage Rates

How Are Mortgage Repayments Calculated

Monthly repayments on a repayment mortgage are calculated based on the outstanding mortgage amount, the interest rate that applies at the time of repayment and the length of the mortgage term.

As you pay off your mortgage, part of each monthly repayment covers the monthly interest owed on the mortgage balance and part goes towards reducing the mortgage debt. The outstanding mortgage balance will reduce each year, but your monthly payment will always be based on the interest rate that applies to your mortgage at the time of repayment. So if you have a fixed-rate mortgage, youll pay a fixed amount each month. If you have a variable-rate mortgage, your repayments will fluctuate.

Start With A Better Homebuying Experience

At Better Mortgage, we know buying a home can be an overwhelming endeavor. Thats why were dedicated to making the entire homebuying and mortgage process faster, simpler, and less expensive.

Weve partnered with real estate agents across the country that can help make your homeownership dreams a reality.

Our Better Real Estate agents:

- Provide personalized guidance, not pushy sales tactics

- Help you secure affordable financing whether thats through Better or another lender

- Connect you with our trusted network of providers, such as home inspectors, appraisers, insurance agents, contractors, and more

When youre ready to look for homes, we can help you move fast by issuing you an official pre-approval letter online in minutes. Getting amortgage pre-approvalshows sellers youre a serious buyer. The pre-approval can also help solidify your homebuying budget and increase the likelihood that your offer will be accepted.

Our entire mortgage process from application through funding is 100% online, so updates are always just a few clicks away. Using a combination of effective technology and financial savvy, we can originate your loan for less money, and we pass those savings on to you. In fact, with Better Mortgage, youll never have to pay unnecessary lender fees or loan officer commissions, leaving you with more cash for your new place.

Are you ready to see how much you qualify for so you can find your dream home? Get pre-approved today.

You May Like: How To Calculate P& i Mortgage