Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Get A Mortgage With Trussle Today

-

Voted the UK’s best mortgage broker

-

Advice in under 24 hours and a mortgage decision in 5 days, or we’ll pay you £100

-

100% fee free advice

-

5-star Trustpilot rating from over 4,400 reviews

-

12,000 mortgage deals from 90 lenders

-

Skip the paperwork: apply online any time

-

Free mortgage monitoring: we’ll tell you when it’s time to remortgage

Qualifying For Mortgage Default Insurance

There are some requirements you have to meet in order to qualify for mortgage default insurance:

- The maximum amortization for insured mortgages is 25 years.

- If the purchase price is between $500,000 – $999,999 a higher down payment is required. The minimum down payment is 5% of the first $500,000, and 10% of the remaining amount.

- Mortgage default insurance is not available on homes purchased for more than $1 million this means that a 20% down payment is required on these homes.

There are several other requirements in order to be approved for CMHC coverage. These requirements changed on July 1st, 2020 in response to the economic downturn. To be eligible for CMHC insurance coverage after July 1st, borrows must:

- Have a Gross Debt Service ratio of less than 35

- Have a Total Debt Service ratio of less than 42

- Have a credit score of at least 680

- Must not borrow money for their down payment

Don’t Miss: Mortgage Recast Calculator Chase

Isnt It More Likely For Me To Become Disabled Than To Die

Actually, yes it is more likely for an individual under 50 to become disabled than to die of natural causes. The good news is that many of the companies that offer Mortgage Protection Insurance also have an optional rider that provides for the insurance company to pay you a monthly benefit while you are totally disabled and cannot work. This monthly benefit combined with disability insurance or social security disability will likely allow you to continue your mortgage payments and negate your chance of foreclosure by the lender.

Dont Confuse Mortgage Insurance With Pmi

Mortgage insurance may sound similar to Private Mortgage Insurance , but theyre entirely different.

PMI protects the bank or lender in case a homeowner stops paying a mortgage. If youve purchased a home with less than 20% down, your lender probably required you to purchase PMI.

While mortgage protection insurance will pay off your loan when you die, PMI is intended to cover a portion of your loan if you default. The benefit is paid to your lender, not your family.

PMI is designed to reduce lender risk. PMI might make it easier for you to get a mortgage, but you need another form of life insurance, such as mortgage protection insurance, to guarantee your loan can be paid off should you die.

Read Also: What Does Rocket Mortgage Do

Mpi Vs Homeowners Mortgage And Life Insurance

| MPI | |||

|

|

|

|

Neither homeowners insurance nor mortgage insurance either private mortgage insurance or mortgage insurance premium are required by state law, but you may need both if you’re purchasing a home and financing it with a mortgage.

If you have a mortgage, your lender will require homeowners insurance to protect your home and belongings and to protect you from liability if an injury happens on your property. If the mailman slips and falls on your sidewalk, the dog bites a guest, a tree falls on your roof, or a kid is injured using your swimming pool, homeowners insurance can protect you.

If you have a mortgage and your down payment is less than the average 20%, your lender will require mortgage insurance to protect them in case you default on your mortgage payments.

We Compare Premiums From Ireland’s Leading Mortgage Protection Providers

Compare, Switch, Save

bonkers.ie is a trading style of Bonkers Money Ltd. registered office Nutley Building, Nutley Lane, Dublin 4. Registered in Ireland, company number 477742. Our logo and the word bonkers® are registered trademarks of Bonkers Money Limited and may not be used or reproduced without prior written permission. Bonkers Money Limited, trading as bonkers.ie, is regulated by the Central Bank of Ireland.

Contact

Recommended Reading: Rocket Mortgage Qualifications

What Affects The Cost

When it comes to protection insurance, its not simply a case of signing up to the cheapest policy.

Theres no one size fits all and your monthly payments also known as premiums will depend on a number factors. These include:

- the product youre taking out

- how long youre taking it out for

- age

- whether you smoke or have smoked

- lifestyle for example, do you do extreme sports?

- health your current health, weight, family medical history

- job some professions are higher risk than others

- any add-ons that you want to include

- whether youre taking out a single or joint policy.

How much cover you might need will depend on:

- your take-home pay

- debts

- mortgage/rent.

Its useful to weigh up the costs of a policy against the risks of being uninsured. For example:

- how much would you lose if you became ill and found yourself unable to work?

- how would you cover your essential costs, such as mortgages or rent?

- how would your family cope financially after you die if theres no life insurance in place?

Is Mortgage Protection The Same Thing As Life Insurance

Yes and no. Like life insurance, mortgage protection policies pay out a benefit when the policyholder dies, but the beneficiary is always the mortgage lender â not your family or some other beneficiary who you designate. It’s helpful to consider mortgage protection as a limited type of life insurance with more specific rules about who and how much is paid by the policy.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

How Do I Purchase Mpi

Now that youve learned more about MPI, talk to a real estate agent or lender to purchase MPI. Make sure to take the time to call around for quotes and find features that will benefit your situation. If youre interested in MPI, check in with A.M. Best, a company that rates the financial health of insurance providers before making a purchase.

Comparing Traditional Mortgage Protection To Guaranteed Level Term

Compare State Farms mortgage protection plan above to State Farms Select Term policy with a level death benefit:

For the same 44 year old male in good health, a 30 year select term policy costs $149.94/month or $1,723.25/year.

So right off the bat, the policy is cheaper.

Next, if this man were to die at age 70, the policy would pay out the full $575,000 benefit, which would pay off that mortgage, AND provide additional financial benefits for his family.

Thats a great improvement over the cost and the death benefit of their old-fashioned mortgage protection insurance!

RELATED:Check Sample Life Insurance Rates by Age

Don’t Miss: Recast Mortgage Chase

Case Study #: 37 Year Old Man Needs Mortgage Insurance To Cover A $500000 Mortgage

Now, for a younger person, say a 37 year old non-smoker, male, preferred rating, with a $500,000 mortgage, we find that the old-fashioned policy for $500,000 America General Term policy for 30 years will cost almost $52/month for a total of $18,652 over the life of the policy.

However the Protective Mortgage plan would cost only $44.57/month for a total of $16,045 over the course of 30 years. Any way you slice it, the Protective Mortgage Protection plan is a winner!How Much is Mortgage Protection Insurance Per Month?

If you want a quote from us for straight term, , please see our Life Insurance Rates by Age page, where we offer free ballpark quotes, with no personal information required.

However, if youd like to protect your mortgage with our new Protective strategy, youll need to call us directly at 888-603-2876 for a customized quote, as our quoter is unable to handle these customized rates at this point.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Is It Worth Getting Mortgage Protection Insurance

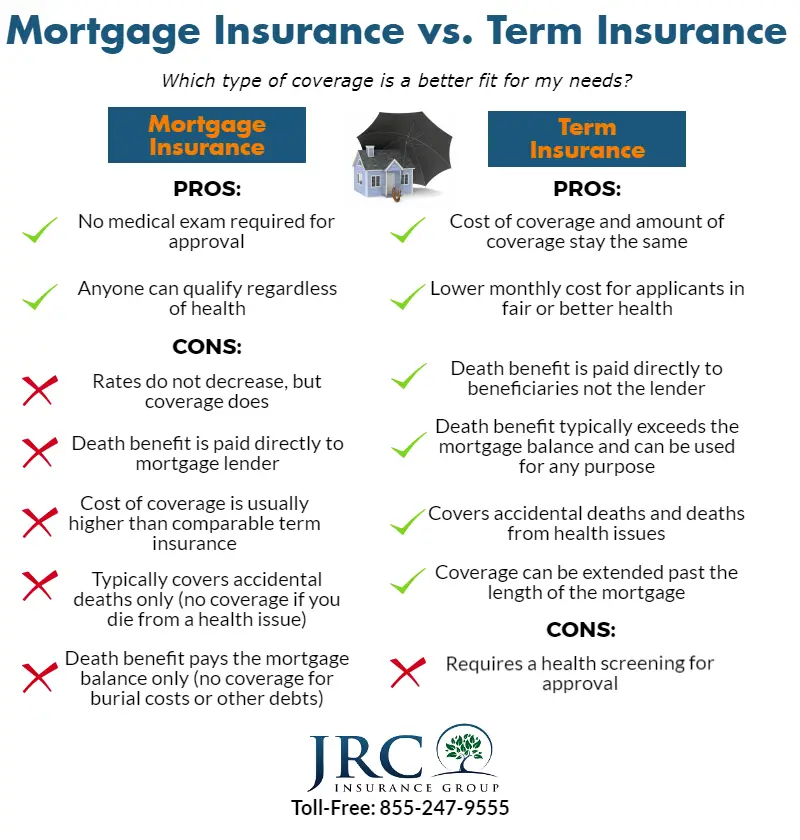

If you have frequent health issues or you are a senior citizen, it can be difficult to get a good life insurance policy at affordable rates. Thats when mortgage protection insurance can be your best and even only option. To find the right policy that matches your needs, you should research the best mortgage protection insurance companies.

However, before you do that, you must look at traditional term life insurance policies first. A term life policy can provide you more bang for your buck than MPI. It can offer you more flexibility by allowing you to choose your policy length and the coverage amount. It may also be cheaper than mortgage protection insurance. Therefore, it is worth comparing term life insurance and mortgage protection insurance quotes to see which of them is the best value for your money.

Read Also: Reverse Mortgage For Condominiums

Mortgage Insurance Isnt A Bad Thing

Private mortgage insurance is usually required if you put less than 20% down on a house.

Many homebuyers try to avoid PMI at all costs. Why? Because unlike homeowners insurance, mortgage insurance protects the lender rather than the borrower.

But theres another way to look at it.

Mortgage insurance can put you in a house a lot sooner. You might pay more than $100 per month for PMI. But you could start earning upwards of $20,000 per year in home equity.

For many people, PMI is worth it. Its a ticket out of renting and into equity wealth.

Is Mortgage Protection Insurance Better Than Term Life Insurance

If you have a mortgage and you don’t qualify for traditional life insurance due to health issues, mortgage protection insurance is a good option. Like other no medical exam term life insurance policies, MPI will be more expensive because there is no health exam to determine your insurance risk.

Your MPI policy terminates when your mortgage is paid off. If you pay off your mortgage early or pay it before you die, then you’ll be left without a death benefit unless you have other life insurance. Is it worth it to have two premiums for separate MPI and term life insurance policies? Probably not, especially if you have a large death benefit from your term life insurance policy that can cover your mortgage and other expenses.

The best life insurance policy for you depends on your budget and financial situation. It’s wise to consult an accountant and financial advisor to determine which policy fits your financial needs and goals. It’s worth taking the time to find the best policy for you, because once you’ve signed on the dotted line, it’s a lot more difficult to make changes if you need to adjust your coverage.

Ronda Lee is an associate editor for insurance at Personal Finance Insider covering life, auto, homeowners, and renters insurance for consumers. She is also a licensed attorney who practiced litigation and insurance defense.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Payment Of The Policy May Depend On How A Policyowner Dies

Some mortgage life insurance policies will only pay a death benefit if you die from an accident, similar to accidental death insurance. Regular life insurance has fewer exclusions usually suicide within the first two years or an illness that was intentionally not disclosed in the application process than mortgage life insurance on whether a policy will pay out death benefits.

How Does Mortgage Protection Help My Spouse Partner And Loved Ones

Mortgage protection allows your spouse, partner, or family to grieve properly after your death.

We frequently help people, who have suffered through the recent loss of a loved one. They are suffering emotionally, they are trying to cope with the sudden loss of a loved one, and they are concerned about what will happen to them and their families, financially, in the coming years.

A mortgage protection plan takes the financial worries from the family, so they can grieve properly and support each other throughout the grieving process.

Also Check: Can You Refinance A Mortgage Without A Job

How Much Does Private Mortgage Insurance Cost

See Mortgage Rate Quotes for Your Home

The cost of private mortgage insurance is based on the loan amount, the borrowers’ creditworthiness and the percentage of a homes value that would be paid out for a claim. Generally, all companies that sell mortgage insurance price their policies this way. Regardless of the value of a home, most mortgage insurance premiums cost between 0.5% and as much as 5% of the original amount of a mortgage loan per year. That means if $150,000 was borrowed and the annual premiums cost 1%, the borrower would have to pay $1,500 each year to insurance their mortgage.

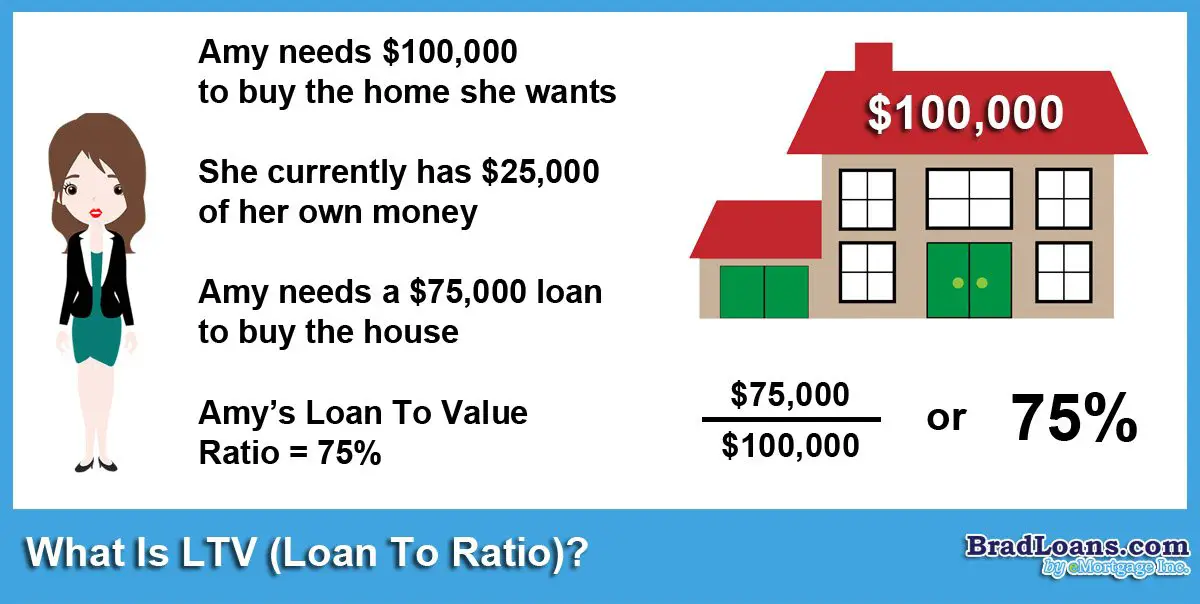

How Do You Calculate Mortgage Default Insurance

To understand how mortgage default insurance is calculated and paid for quickly, watch the video below. Scroll down further for more details on the calcultions.

Let’s say you just purchased a home for $300,000 and made a $40,000 down payment. Your mortgage default insurance premium would be calculated as follows:

You May Like: Chase Recast Calculator

Differences Between Mpi Pmi And Mip

Mortgage protection insurance can easily be confused with another abbreviation, PMI, or private mortgage insurance. While the letters and terms for these insurance products are almost identical, they are distinctly different. As described above, MPI protects you PMI protects the lender that loaned you your mortgage, and is required on conventional loans when the borrower puts less than 20 percent down.

To make all of this even more confusing, there is yet another acronym, MIP, which stands for mortgage insurance premium and applies to FHA loans. Like PMI, MIP protects the lender, not the borrower. However, unlike PMI, MIP cannot be removed on an FHA loan unless the borrower made a down payment of at least 10 percent.

Has Covid Increased The Cost Of Mortgage Protection

Although our recent survey showed many UK workers think the price of insurance has increased as a result of Covid-19 this is not the case for Life Insurance or Accident & Sickness Insurance policies.

Many insurers have included blanket Covid-19 exclusions on new policies however as we return to business as usual these will be removed.

You May Like: Rocket Mortgage Requirements

Do You Need Mortgage Protection Insurance

The inflexibility of mortgage life payouts means youre usually better off with a regular term policy with enough coverage to pay off your mortgage. Then, when you die, your family has options:

-

They can use the death benefit to pay off the house and keep any leftover cash.

-

They can also choose to skip paying off the mortgage and use the money as they see fit it’s their money, not the lender’s.

A mortgage life insurance policy locks your loved ones into paying off the mortgage, even if other bills and needs are more pressing.

The biggest benefit of mortgage protection insurance is its convenience. It lines up exactly with your mortgage balance and theres usually no life insurance medical exam required to buy a policy.

If youre denied for term life insurance or whole life insurance for medical reasons, mortgage life insurance may be an option to financially protect your home.

Mortgage protection coverage can also supplement an individual life insurance policy. For example, if your mortgage is paid off with money from a mortgage life policy, then your family could use all the benefits from your term or whole life insurance policy for bills and other expenses.

How We Chose The Best Insurance Companies For Mortgage Protection

In building this list of mortgage protection insurance options, we looked at 13 of the best term life insurance companies. Like your mortgage, term policies last for a specific period of time and are a more affordable option than permanent policies, so term is our suggested coverage option for mortgage peace of mind.

To choose our top picks, we considered factors such as availability, product features, and both included and optional benefits. We compared pricing, as well as evaluated consumer satisfaction and third-party industry ratings to determine which carriers can offer you the most trusted, affordable, and feature-rich coverage available.

Don’t Miss: Chase Recast Mortgage

How Much Is Mortgage Protection Insurance

The premiums on mortgage protection insurance depend on many things.

Income protection can be as little as £10 a month, though most people pay more than £50 a month.¹

How much you pay depends on:

-

how much income you are covering

-

how long the policy runs for. It can run for a âtermâ of a few years or be a âwhole of lifeâ policy

-

the deferral period. This is how long you can wait before the insurance starts paying after youâre not working

-

indexation. This is if the money you get goes up with inflation

-

how long the policy will pay out for after claiming

If the cost of your policy stays the same over time, itâs known as âguaranteed premiumsâ.

You can also take out policies where the amount you pay changes over time.

Or have âreviewable premiumsâ, where the insurer can change its terms.

There are also policies that cost more as you get older, called âage banded premiumsâ.