Home Owners Loan Corp

During the late 1930s, the HOLCa federal agencywas created under the New Deal. The New Deal was a series of programs enacted by then-President Franklin Delano Roosevelt intended to help the U.S. recover from the Great Depression. The HOLC drafted Residential Security maps of major cities as part of its City Survey Program.

To create the maps, HOLC examiners classified neighborhoods on a perceived level of lending risk based on information gathered from local appraisers, bank loan officers, city officials, and real estate agents. According to the National Community Reinvestment Coalition, the examiners graded the neighborhoods based on factors including:

- The age and condition of the housing

- Access to transportation

- The closeness of popular amenities such as parks

- Proximity to undesirable properties such as polluting industries

- The residents economic class and employment status

- The residents ethnic and racial composition

The neighborhoods were color-coded on maps, with each color representing the areas perceived risk to lenders.

Neighborhoods with predominantly racial and ethnic minority populations were colored redhence, redlined. These areas were considered high risk for lenders. According to the University of Richmonds Mapping Inequality project, Conservative, responsible lenders, in HOLC judgment, would refuse to make loans in these areas only on a conservative basis.

How Redlining Impacted Black Homebuyers

Black homebuyers were disproportionately affected by redlining for several reasons. First, because the systems racist framework favored White homebuyers, it was incredibly difficult for a Black homebuyer to get approval for funding in neighborhoods with high appraisal values that were anticipated to rise over time.

Because lenders shut them out of these neighborhoods, Black homebuyers had to turn to unattractive neighborhoods that, in some cases, were situated near industrial sites. Prices were more affordable, but Black homebuyers ended up paying more in interest because the neighborhoods were deemed risky based on the age and condition of the homes and their proximity to industrial areas.

Because of those higher rates, Black homeowners were left with very little financial wiggle room to take care of repairs and improve their homes. As a result, Black homeowners were caught in a vicious cycle purposely perpetuated by federal housing agencies and lenders in which their neighborhoods were suffering but there was very little they could do to improve or escape their situation, while White homebuyers, which the system unjustly favored, enjoyed rising property values and low interest rates.

Continued Impact Of Redlining

The impact of redlining goes beyond the individual families who were denied loans based on the racial composition of their neighborhoods. Many neighborhoods that were labeled Yellow or Red by the HOLC back in the 1930s are still underdeveloped and underserved compared to nearby Green and Blue neighborhoods with largely White populations. Blocks in these neighborhoods tend to be empty or lined with vacant buildings. They often lack basic services, like banking or healthcare, and have fewer job opportunities and transportation options. The government may have put an end to the redlining policies that it created in the 1930s, but it has yet to offer adequate resources to help neighborhoods recover from the damage that these policies have caused and continue to inflict.

Read Also: What’s Refinancing A Mortgage

Housing And Civil Enforcement Cases Documents

UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA

CLYDE HARGRAVES, et al.,

Civ. Action No. 98-1021

CAPITAL CITY MORTGAGE CORP.,

BRIEF OF THE UNITED STATES AS AMICUS CURIAE IN SUPPORT OF PLAINTIFFS’ OPPOSITION TO DEFENDANTS’ MOTION FOR JUDGMENT ON THE PLEADINGS OR, IN THE ALTERNATIVE, FOR SUMMARY JUDGMENT

This case raises the novel question of whether the Fair Housing Act and the Equal Credit Opportunity Act prohibit certain racially targeted predatory lending practices, typically referred to as “reverse redlining.” Congress enacted the Fair Housing Act “to provide, within constitutional limitations, for fair housing throughout the United States.” 42 U.S.C. § 3601. ECOA prohibits certain forms of discrimination with respect to all credit transactions. 15 U.S.C. § 1691.

Through various federal agencies, the United States has responsibility for enforcing both statutes. In particular, the United States Department of Justice has the authority to commence an action under either the Fair Housing Act or ECOA. 42 U.S.C. § 3614 15 U.S.C. § 1691e. Accordingly, the United States has a substantial interest in resolution of the legal issue raised by Defendants, and an interpretation of the Fair Housing Act and ECOA by the United States may assist this Court in applying those statutes to the facts of this case.

For the foregoing reasons, Defendants’ Motion for Judgment on the Pleadings or in the Alternative Summary Judgment should be denied.

BILL LANN LEE

How Redlining Works

The term redlining was coined by sociologist John McKnight in the 1960s and derives from how the federal government and lenders would literally draw a red line on a map around the neighborhoods where they would not invest based on demographics alone.

Black inner-city neighborhoods were most likely to be redlined. Investigations found that lenders would make loans to lower-income white borrowers but not to middle- or upper-income African Americans.

Unable to get regular mortgages, Black residents who wanted to own a house often were forced to resort to exploitatively priced housing contracts that massively increased the cost of housing and gave them no equity until their last payment was delivered. Chicago’s Contract Buyers League was formed in the 1960s by a group of inner-city residents to fight these practices.

Also Check: Will Mortgage Prequalification Affect Credit Score

What Can Be Done

In Roses view, legislation is not enough to reverse the legacy of redlining. Lenders need to be ready to change their pricing models in order to level the playing field for nonwhite borrowers.

At some point the financial institutions have to make a decision about what they want to be able to accomplish in this field, Rose said.

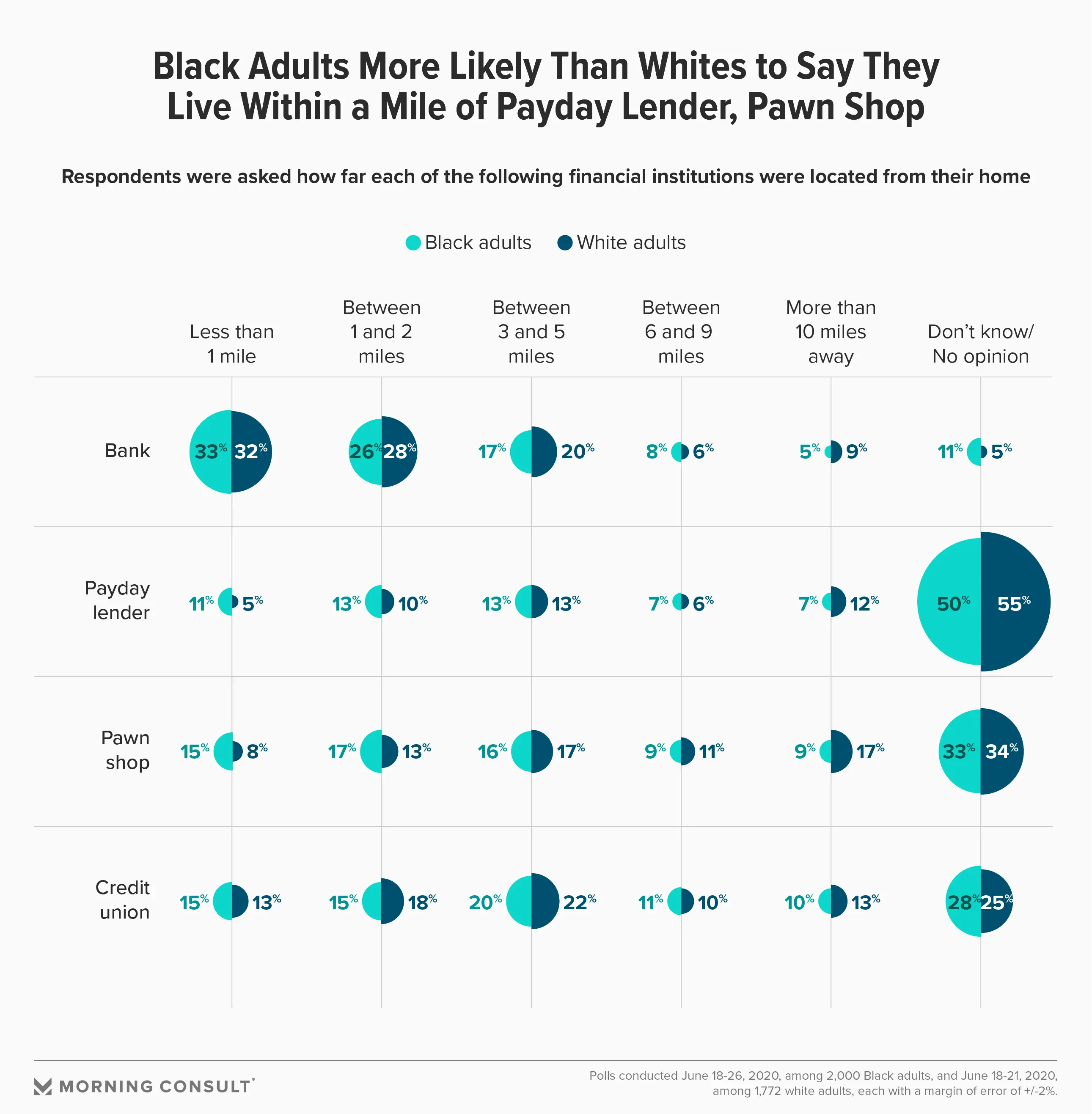

Currently, financing in historically risky neighborhoods comes more from predatory, fringe institutions instead of mainstream legacy banks.

Nowadays what that looks like is currency exchanges where, in addition to exchanging currency, you can borrow against the value of your car, you can get payday loans, Rose said. Theres a huge disconnect between what the consumer is willing to do and what the consumer is willing to put up with, compared to where legacy financial institutions are willing to invest.

Youre in a system where there is a ready market of people that can access the system and can afford to access the system, but you systematically charge them more and you make it harder, Rose said. If you remove those barriers, how much more steam will our economy be able to pick up if you allow them equitable access?

He recommends that banks consider shifting away from risk-based pricing for their loans to some other system that would not lean so heavily on historical real estate trends.

Rose said banks may be able to learn from the world of professional sports.

Redlining And Contract Buying

The practice of contract buying worked hand in hand with redlining to obliterate the generational wealth of Black homeowners and often left them without any equity. In contract buying, the buyer would make a down payment and monthly installment payments, which were often unfairly inflated by unscrupulous sellers who wanted to take advantage of Black Americans. The seller would keep the deed to the home and require the homebuyer to meet a series of often unfair and discriminatory conditions before the deed was passed over.

Shut out of nicer neighborhoods because of redlining, and fighting against a lending system that often made mortgages either too expensive or impossible to get, Black homebuyers, particularly those in Chicago, turned to contract buying as a last resort.

If the homebuyer violated any conditions of the contractsay, being late on a mortgage payment just one timethe houses owner could kick them out. The homebuyer would lose their down payment and all of their installment payments. Furthermore, because they didnt own the deed to the home, the homebuyer wasnt entitled to any equity the house achieved while they lived in it.

Read Also: How To Get A Mortgage To Build A House

The History Of Lending Discrimination

Systemic racism still bolsters the racial wealth gap

Laws today protect borrowers from discriminatory lending practices, but that wasnt always the case. For decades, U.S. banks denied mortgages to Black familiesand those belonging to other racial and ethnic minority groupswho lived in certain areas redlined by a federal government agency called the Home Owners Loan Corp. .

What Factors Are Lenders Allowed To Consider

Banks may legally take the following factors into consideration when deciding whether to make loans to applicants and on which terms:

- Lenders may legally evaluate an applicants creditworthiness as determined by FICO scores and reports from credit bureaus.

- Income: Lenders may consider an applicants regular source of funds, which can include income from employment, business ownership, investments, or annuities.

- Property condition: A lending institution may evaluate the property on which it is making the loan as well as the condition of nearby properties. These evaluations must be based strictly on economic considerations.

- Neighborhood amenities and city services: Lenders may take into account amenities that enhance or detract from the value of a property.

- The lending institutions portfolio: Lending institutions may take into account their requirements to have a portfolio that is diversified by region, structure type, and loan amount.

Housing discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with HUD.

Lenders must evaluate each of the above factors without regard to the race, religion, national origin, sex, or marital status of the applicant.

You May Like: How To Get A 600 000 Mortgage

Civil Rights Act Of 1866

In addition to ECOA and FHA, the Civil Rights Act of 1866, as amended, provides that “ll citizens of the United States shall have the same right, in every State and Territory, as is enjoyed by white citizens thereof to inherit, purchase, lease, sell, hold, and convey real and personal property”. 42 U.S.C. § 1982.

Lower Loan Approval Rates

In a 2020 mortgage market activity and trends study conducted by the Consumer Financial Protection Bureau, results show that Black and Hispanic white borrowers had higher denial rates than those of non-Hispanic white and Asian borrowers. For Black loan seekers, the denial rate in 2020 was 18.1% and for Hispanic white loan seekers was 12.5% alternatively, the denial rate for Asian applicants was 9.7% and for non-Hispanic white applicants was 6.9%.

Black and Hispanic white applicants had higher denial rates for all enhanced home-purchase loans, except FHA. For FHA home-purchase loans, Asian applicants had higher denial rates than Hispanic white applicants but lower rates than Black applicants.

You May Like: Should I Refinance With My Current Mortgage Company

The Federal Government Begins Redlining

The federal government was not involved in housing until 1934 when the Federal Housing Administration was created as part of the New Deal. The FHA sought to restore the housing market after the Great Depression by incentivizing homeownership and introducing the mortgage lending system we still use today. Instead of creating policies to make housing more equitable, however, the FHA did the opposite. It took advantage of racially restrictive covenants and insisted that the properties they insured use them. Along with the Home Owners Loan Coalition , a federally funded program created to help homeowners refinance their mortgages, the FHA introduced redlining policies in over 200 American cities.

Beginning in 1934, the HOLC included in the FHA Underwriting Handbook residential security maps used to help the government decide which neighborhoods would make secure investments and which should be off-limits for issuing mortgages. The maps were color-coded according to these guidelines:

These maps would help the government decide which properties were eligible for FHA backing. Green and blue neighborhoods, which usually had majority-White populations, were considered good investments. It was easy to get a loan in these areas. Yellow neighborhoods were considered risky and red areas were ineligible for FHA backing.

Economic And Racial Segregation From Redlining Persists

The immediate effect of redlining was that residents in racial and ethnic minority neighborhoods couldnt access capital to improve their housing or for other economic opportunities. Of course, the impacts of redlining didnt magically end when the FHA was passed in 1968. Instead, as a 2018 study by the NCRC shows, the economic and racial segregation created by redlining persists in many cities today.

- 74% of neighborhoods that the HOLC graded as hazardous more than 80 years ago are LMI today.

- 64% of the hazardous-graded areas are racial and ethnic minority neighborhoods.

The median net worth of Black families is about 12.8% of that of White families Latinx/Hispanic families median net worth is about 19%.

According to the Mapping Inequality project of the University of Richmond, As homeownership was arguably the most significant means of intergenerational wealth building in the United States in the twentieth century, these redlining practices from eight decades ago had long-term effects in creating wealth inequalities that we still see today.

Read Also: What Credit Card Can I Pay My Mortgage With

The Fair Housing Act And The Community Reinvestment Act

The Fair Housing Act was enacted in the year 1968. The purpose of the act is to prevent discrimination in the:

Financing of houses

On the sole basis of race, color, gender, nationality, religion, physical disability, or family status of the applicant. The enactment was brought to curb the practice of redlining and reverse redlining in the United States. Initially, gender was not a part of the Act. It was added in the amendment of 1974. Family status and physical disability were added in 1988.

The States have the power to enact another law or make any other rule that provides additional protection. But the laws and rules cannot override the Fair Housing Act. The Act is enforced by the Department of Housing and Urban Development at the national level.

Under the said Act, the U.S. Department of Justice has the power to file a suit against a person who has practiced redlining or reverse redlining.

The Community Reinvestment Act was passed in the year 1977. It is a federal law. It was also passed to encourage commercial banks to assist and provide financial services like mortgages, loans, and insurance to all parts of the community. This included the persons in low- and middle-class income groups.

After the passing of the above-mentioned laws, the practice of redlining and reverse redlining has become unlawful. It is believed that the practice is still prevalent in the United States even after the same has been declared illegal by the government.

Predatory Lending: Redlining In Reverse

The proverbial American dream of owning a home has become an all-too-real nightmare for a growing number of families. Take the case of Florence McKnight, an 84-year-old Rochester widow who, while heavily sedated in a hospital bed, signed a $50,000 loan secured by her home for only $10,000 in new windows and other home repairs. The terms of the loan called for $72,000 in payments over 15 years, after which she would still owe a $40,000 one-time payment. Her home is now in foreclosure.

Unfortunately, this is not an isolated incident. Predatory lending has emerged as the most salient public policy issue in financial services today. If progress has been made to increase access to capital for racial minorities, low-income families and economically distressed communities, that progress has always come with great struggle. And it appears there are few, if any, permanent victories. The emergence of predatory lending practices demonstrates that the struggle against redlining has not been won, but has simply taken some new turns.

One cost of the sudden increase in subprime lending has been an increase in foreclosure rates. According to the Joint Center for Housing Studies, borrowers with subprime loans are eight times more likely to default than those with prime conventional loans. Yet, it has been estimated that between 30 and 50 percent of those receiving subprime loans would, in fact, qualify for prime loans.

Read Also: What Is The Minimum Down Payment Required For A Mortgage

What Is Lending Discrimination

Lending discrimination happens when lenders base credit decisions on factors other than the borrowers , including any of the protected classes defined under federal law. Today, three federal laws offer protection against lending discrimination:

How The New Deal Government Defined Black Neighborhoods As An Undesirable Population

Mortgages looked very different in the 1930s, typically requiring a 50% down payment and repayment within five to 10 years, as opposed to today’s common 30-year timeframe. In other words, mortgages in the 1930s weren’t easy to get.

Around the early 1930s, the mortgage lending market was also dysfunctional. In 1932, things got so bad that 1,000 homeowners were defaulting on their mortgages daily, and the next year, half of all American mortgages were in arrears, per Investopedia. President Roosevelt’s New Deal kickstarted various programs to get things working again including the Home Owners’ Loan Corporation and Federal Housing Administration to provide federal insurance for mortgage loans.

Roosevelt’s housing policy was ultimately successful. Nationwide home ownership rates rose from a low of 44% in 1940 to more than 60% within two decades, per census data, and they’ve basically stayed that way.

But there’s a catch. The FHA and HOLC were set up before the civil rights era, and their guidance for mortgage lenders reflected and reinforced a segregated mindset. The HOLC in particular color-coded and divided residential neighborhoods across the country into four grades. Its “residential security maps” identified, among other things, neighborhoods that had an “undesirable population.” And residents of those neighborhoods couldn’t get access to credit. Basically, the government was telling lenders not to give out mortgages in Black neighborhoods.

You May Like: What Banks Use Experian For Mortgages