Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Type In Your Search Location And Maximum Budget We’ll Find The Perfect Rental Apartment That Fits Your Criteria

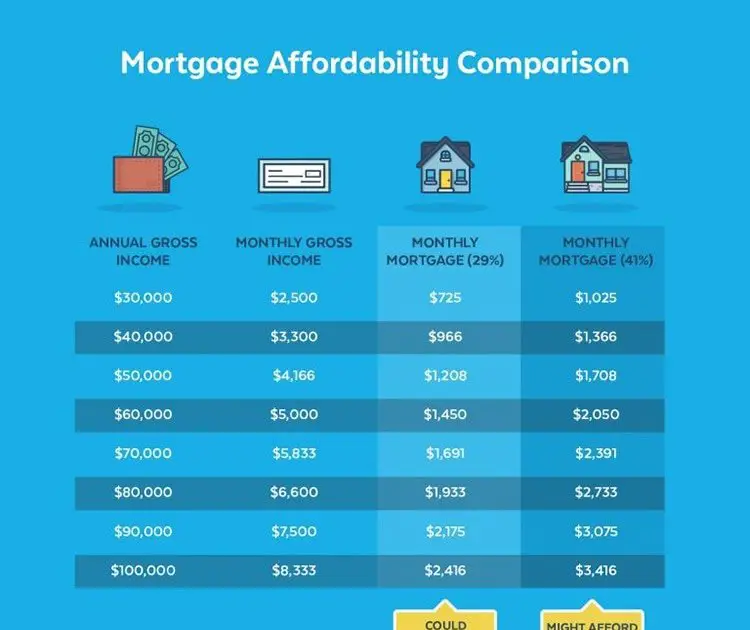

Your total monthly household income is $5,833 before tax. That makes your after tax income approximately $5,000 . We then deduct $0 from your income to pay for major expenses , leaving $5,000 for you to spend every month.

With $5,000 at your disposal every month, we recommend that you spend approximately $1,500 on rent which is about 26% of your monthly net income. You’ll be left with $3,500 to spend on other common living expenses. Part of this remaining money should go to savings while part of it should go to daily neccessities such as groceries, transportation, clothing, dining out, home utilities, etc.

If you’d like to live in luxury, you may choose to spend more money on rent and save up less. However, we recommend you pick a place that costs at most $2,000 per month in rent. Living at a place that exceeds your affordable range will leave you little money to spend on other neccessities and negatively impact the quality of life of your household. In addition, you should try to save up as much money as possible each month to account for unexpected expenses such as medical emergency, broken appliances, rental price increase and others.

Understanding your budget helps you make better decision while finding a place to live. Use the search function above to find apartments that fit your budget!

Likely Rate: 3222%edit Rate

Loan details

Down payment & closing costsNerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed and the card’s rates, fees, rewards and other features.

Income and debts

Annual household incomeYour income before taxes. Include your co-borrowers income if youre buying a home together.

Minimum monthly debtThis only includes the minimum amount you’re required to pay each month towards things like child care, car loans, credit card debt, student loans and alimony. If you pay more than the minimum, that’s great! But don’t include the extra amount you pay.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a . As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

For more on the types of mortgage loans, see .

Don’t Miss: Rocket Mortgage Conventional Loan

How Much Do You Have For A Down Payment

Your down payment affects the amount you can borrow to buy a home and the size of your payments. This will impact your monthly budget.

You must have at least 5% for a down payment if the home purchase price is less than $500,000.

If the home purchase price is between $500,000 and $999,999.99, you must have at least 5% for the first $500,000 and 10% for the remaining amount.

For home prices $1 million or over, the down payment must be 20%.

If you are a first-time home buyer, you can borrow up to $35,000 from your RSP towards your down payment.1

1. First time home buyers can withdraw up to $35,000, in a calendar year, from their RSPs for a home purchase . They then have 15 years to repay their RSP . Find out more about the RSP Home Buyers’ Plan.

Step 5 of 6

Bmo Bank Of Montreal Mortgage Affordability

Before you get a mortgage from BMO, it is important to know how BMO calculates your mortgage affordability. BMO takes into account the following factors:

- Your household income

- Your heating costs

- Any applicable condo fees or maintenance costs

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

BMO includes the cost of mortgage insurance in your mortgage affordability calculation. This allows you to borrow more with a smaller down payment.

BMO calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to BMO, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

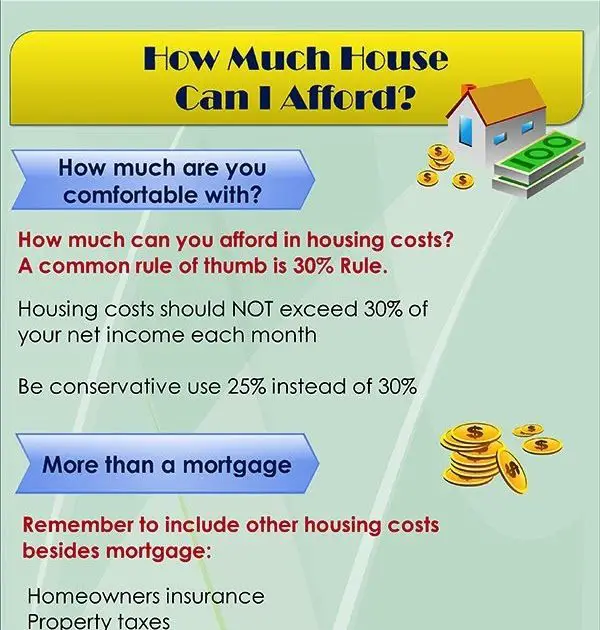

Rule : Consider Your Total Housing Payment Not Just The Mortgage

Most agree that your housing budget should encompass not only your mortgage payment , but also property taxes and all housing-related insurancehomeowners insurance and PMI. To find homeowners insurance, we recommend visiting . Theyre what we call an insurance aggregator, which means they compile all the best rates from around the online marketplace and present you with the best ones.

As for just how big a percentage of your income that housing budget should be? It all depends on whom you ask.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Gross Debt Service Ratio

View Affordability From Two Perspectives:

- Your overall monthly payments which included household expenses, mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Also Check: Can You Get A Reverse Mortgage On A Condo

The Myth Of Home Ownership

Buying a house is a big decision, financially, emotionally, and socially.

Financially, a house is the most expensive thing youll ever buy. Its so costly people take 30 years to pay it off.

Emotionally, buying a house is a significant milestone and a source of pride. You are growing older, building a family, and settling down.

And socially, buying a house is an ego-driven status game. You might feel pressured to buy a home as large as your siblings, coworkers, or friends. Perhaps a place that symbolizes your success?

I recognize its not easy to decide how much house can I afford. The answer is financially involved and emotionally and socially sensitive.

Well break it down, one by one. Lets start with the financials.

Will I Qualify For A Mortgage +

To know if you will qualify for a mortgage based on your current income, try our Mortgage Required Income Calculator. You will need to supply information about the cost of the Mortgage, down-payment, interest rates, and other liabilities, after which the calculator responds with the required minimum income to qualify for the loan.

Also Check: Can You Do A Reverse Mortgage On A Condo

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

A Simple Formulathe 28/36 Rule

Here’s a simple industry rule of thumb:

- Housing expenses should not exceed 28 percent of your pre-tax household income. That includes your monthly principal and interest payments plus all the such as property taxes and insurance.

- Total debt payments should not exceed 36 percent of your pre-tax incomecredit cards, car loans, home debt, etc.

Read Also: How Much Is Mortgage On 1 Million

How Much House Can I Afford Based On My Salary

To calculate how much house you can afford, use the 25% rulenever spend more than 25% of your monthly take-home pay on monthly mortgage payments.

That 25% limit includes principal, interest, property taxes, home insurance, private mortgage insurance and dont forget to consider homeowners association fees. Whoathose are a lot of variables!

But dont worry, our full-version mortgage calculator makes it super easy to calculate those numbers so you can preview what your monthly mortgage payment might be.

Conventional Loans And The 28/36 Rule

In the U.S., a conventional loan is a mortgage that is not insured by the federal government directly and generally refers to a mortgage loan that follows the guidelines of government-sponsored enterprises like Fannie Mae or Freddie Mac. Conventional loans may be either conforming or non-conforming. Conforming loans are bought by housing agencies such as Freddie Mac and Fannie Mae and follow their terms and conditions. Non-conforming loans are any loans not bought by these housing agencies that don’t follow the terms and conditions laid out by these agencies, but are generally still considered conventional loans.

The 28/36 Rule is a commonly accepted guideline used in the U.S. and Canada to determine each household’s risk for conventional loans. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on the back-end debt. The 28/36 Rule is a qualification requirement for conforming conventional loans.

While it has been adopted as one of the most widely-used methods of determining the risk associated with a borrower, as Shiller documents in his critically-acclaimed book Irrational Exuberance, the 28/36 Rule is often dismissed by lenders under heavy stress in competitive lending markets. Because it is so leniently enforced, certain lenders can sometimes lend to risky borrowers who may not actually qualify based on the 28/36 Rule.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

Find Out How Much Mortgage You Can Afford

Weâll help you figure out what home price you may be able to afford.

Ready to start looking for your dream home? Donât just dream about it â let the TD Mortgage Affordability Calculator help you begin your search. Enter a few key details and the calculator will guide you in determining, with confidence, what house price may be within reach.

Step 1 of 6

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

Your Savings And Investments

Now that youve looked at your DTI and any debt you may have, think about your budget. How does a mortgage payment fit in? If you dont have a budget, keep track of your income and expenses for a couple of months. You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools.

In the mortgage process, its important to look at your budget and savings for a couple of reasons. One, you might need savings for a down payment, which well discuss in a later section. However, for now, lets go over something called reserves. These may be required, depending on the type of loan youre getting.

Why You Should Consider Buying Below Your Budget

There is something to be said for the idea of not maxing out your credit possibilities. If you look at houses that are priced somewhere below your maximum, you leave yourself some options. For one, you will have room to bid if you end up competing with another buyer for the house. As an alternative, youâll have money for renovations and upgrades. A little work can transform a home into your dream house â without breaking the bank.

Perhaps more importantly, however, you avoid putting yourself at the limits of your financial resources if you choose a house with a price lower than your maximum.

You will have an easier time making your payments, or you will be able to pay extra on the principal and save yourself money by paying off your mortgage early.

You May Like: Does Rocket Mortgage Service Their Own Loans

How Much Of A Mortgage Payment Can I Afford

When answering the question, How much of a mortgage payment can I afford? several criteria come into play to arrive at that magic number.

Obtaining a mortgage to buy a home is probably the biggest personal transaction the majority of people make. A number of factors will determine how much you can borrow including things like your total income, credit score, debt-to-income, and the ratio of the mortgage amount to your total income.

So, how much of a mortgage can I afford?

As a rule of thumb, most homebuyers can afford a mortgage that works out at between two and two and a half times their total income . Using this as a guideline, if you earn a total of $200,000 a year, you should be able to afford a $400,000 to $500,000 mortgage comfortably, but this is just a ballpark figure.

Really, it isnt how much you can afford, its how much you can borrow based on the mortgage companys prerequisites. Every lender will have its own rules and regulations when it comes to calculating the amount and term of a loan they will offer you.

Generally, every lender will determine how much they are willing to lend you depending on the following:

- Gross Income

Your gross income is the total of all your income before any taxes and other deductions and can include not only your salary but any other earnings from sources like part-time work, Social Security benefits, self-employment, etc. This is the starting point in any mortgage offer calculation.

- Income ratios

1) Debt to Income Ratio

How Much House Can You Afford

| Monthly Pre-Tax Income | |

|---|---|

| $3,000 | $523,000 |

The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value. The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City, Missouri. Plug your specific numbers into the calculator above to find your results. Since interest rates vary over time, you may see different results.

In practice that means that for every pre-tax dollar you earn each month, you should dedicate no more than 36 cents to paying off your mortgage, student loans, credit card debt and so on. This percentage also known as your debt-to-income ratio, or DTI. You can find yours by dividing your total monthly debt by your monthly pre-tax income.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home