Fast Financing From Private Lenders

What happens if you are faced with a sudden emergency expense, such as home or automotive repairs resulting from a flood or accident? If like many Canadians, you lack sufficient savings to cover an expense of a few thousand dollars while maintaining regular bill and mortgage payments, the most obvious options are taking out another loan, or deferring payments for your existing mortgage.

Both these options have merit, but what if you need the money fast faster than banks can provide it?

The major banks in Ontario are required to follow a comprehensive and time-consuming mortgage approval process. There is no possible way to have a bank speed up its mortgage process. Aside from the aforementioned reasons, this can also be an issue for property sales that require money quickly. Private lenders can provide mortgage money much faster than banks can. If required, a private lender can provide funding in as little as one day. Our network of private lenders and private mortgage companies can lend on real estate in every city and town in Ontario. Call one of our private mortgage brokers to discuss your mortgage and get money from private lenders.

Mortgage Insurance In Australia

The two main mortgage insurers in Australia are Genworth Financial and QBE LMI. Mortgage insurance is payable if the loan-to-value ratio is above 80%, or above 60% for low document loans. Some non-bank lenders obtain mortgage insurance for every loan irrespective of the LVR however it is paid for by the lender if the loan is below 80% LVR.

LMI premiums are calculated using a sliding scale based on the loan amount and LVR. State government stamp duty may be payable on the premium. The premium can often be capitalised on top of the loan amount free of charge. Unlike in other countries, the LMI premium is a once off fee in Australia.

Many of the larger Australian lenders have the ability to auto approve lenders mortgage insurance in house without the need to refer a loan application directly to their preferred insurer. This is known as a Delegated Underwriting Authority .

You Can Request That Your Lender Cancel Pmi

If you canât wait until you have 22% equity in the home, you can actually ask your mortgage lender to cancel your home once youâve reached 20% equity .

The lender might oblige if you meet certain criteria, like having a good payment history and not having any liens on the house. They might also require you to get an appraisal to make sure the home hasnât depreciated. Borrowers typically pay for the appraisal , so if you go this route, you should be confident that your home hasnât depreciated.

Read Also: Rocket Mortgage Launchpad

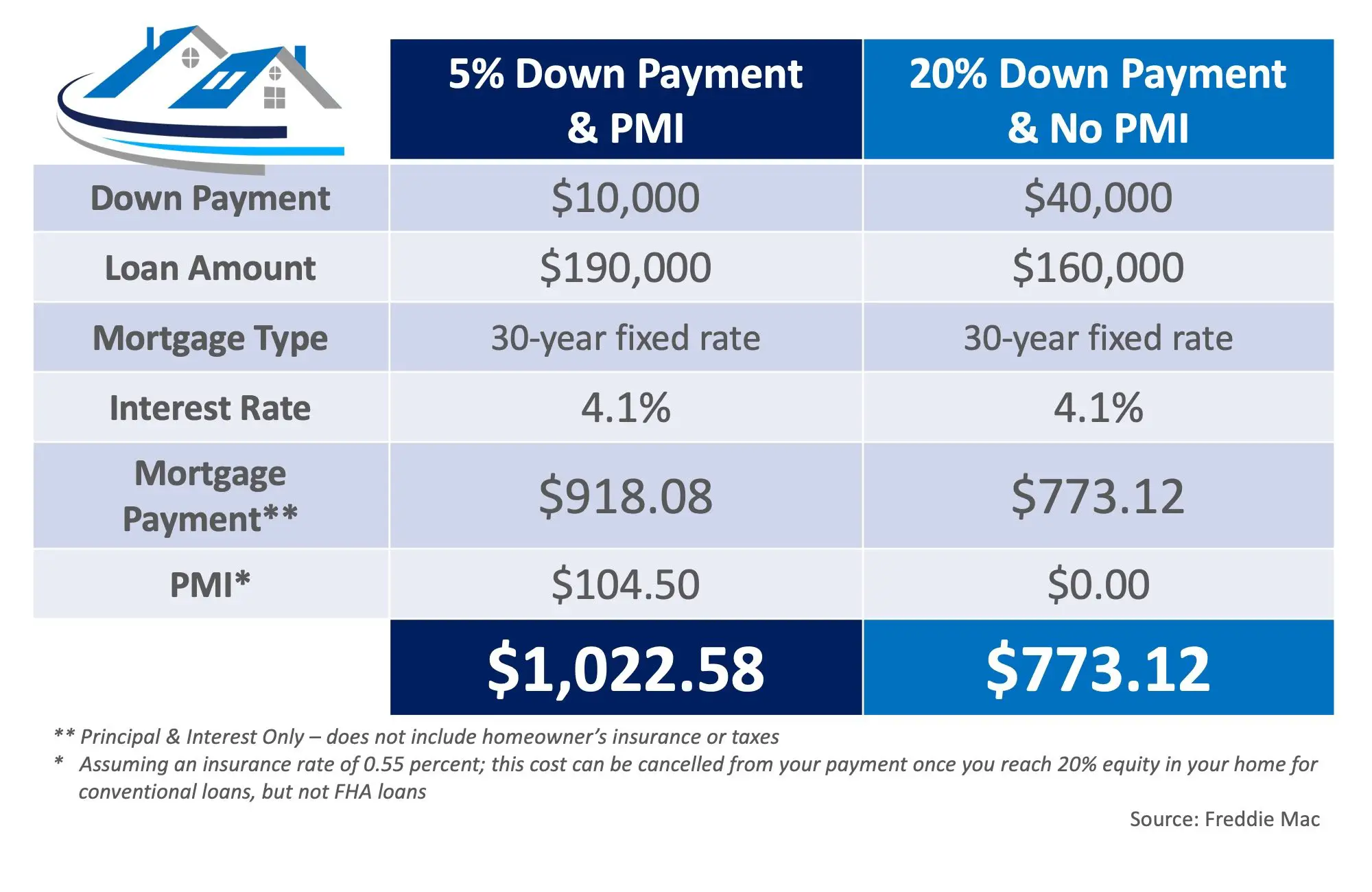

Cost Of Private Mortgage Insurance

The cost of your PMI premiums will depend on several factors.

- Which premium plan you choose

- Whether your interest rate is fixed or adjustable

- Your loan term

- Your down payment or loan-to-value ratio

- The amount of mortgage insurance coverage required by the lender or investor

- Whether the premium is refundable or not

- Your credit score

- Any additional risk factors, such as the loan being for a jumbo mortgage, investment property, cash-out refinance, or second home

In general, the riskier you look according to any of these factors , the higher your premiums will be. For example, the lower your credit score and the lower your down payment, the higher your premiums will be.

According to data from Ginnie Mae and the Urban Institute, the average annual PMI typically ranges from .55% to 2.25% of the original loan amount each year. Here are some scenarios: If you put down 15% on a 15-year fixed-rate mortgage and have a credit score of 760 or higher, for example, you’d pay 0.17% because you’d likely be considered a low-risk borrower. If you put down 3% on a 30-year adjustable-rate mortgage for which the introductory rate is fixed for only three years and you have a credit score of 630, your rate will be 2.81%. That happens because you’d be considered a high-risk borrower at most financial institutions.

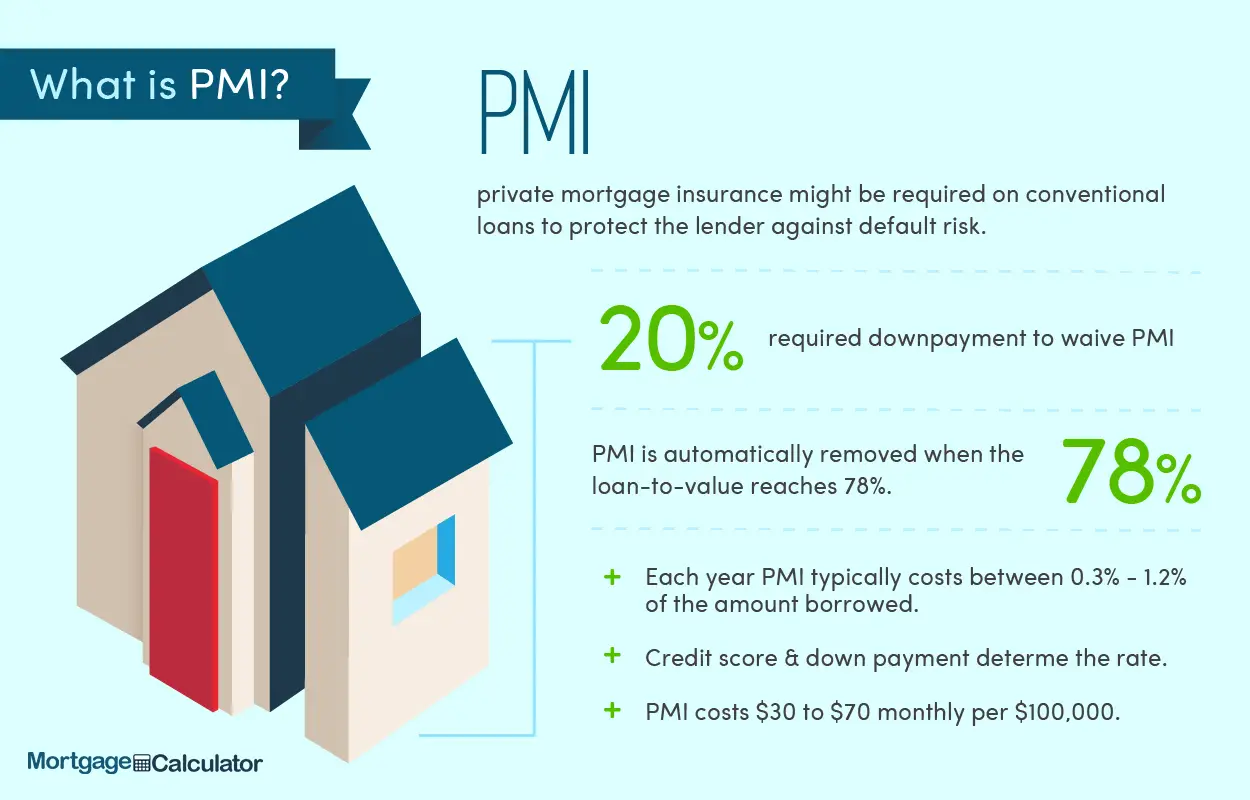

When Is Private Mortgage Insurance Required

Private mortgage insurance protects lenders in case the borrower cant afford their mortgage payments. The lender will probably require that the borrower pay mortgage insurance if they take out a mortgage and put 20% or less down for their down payment. Or, in other words, if the loan-to-value ratio is 80% or higher. Loan-to-value ratio is determined by dividing your mortgage loan amount by the appraised property value of your home.

When a mortgage lender gives you a loan, theyre essentially investing in you. They trust that youll pay back the loan, with interest. A down payment is one way borrowers establish trust with a lender, so when a down payment is 20% or lower, the lender might want some additional insurance to protect their investment.

Its worth noting that private mortgage insurance does not protect you from foreclosure if you fail to make your loan payments.

Recommended Reading: Rocket Mortgage Requirements

Get Your Home Appraised

One of the quickest ways to get rid of PMI is to keep track of your home value. Ask your lender for a new home appraisal if you think your home value has appreciated more than the 20% equity.

As long as your loan to value ratio is less than 80% of the new appraisal, you can write to your lender and ask to cancel PMI.

How Is Private Mortgage Insurance Used

Private insurance companies provide PMI for the benefit of mortgage lenders. In most cases, it is when you have a conventional loan that you will be required to pay PMI, this means as a borrower, you will make an initial payment of less than 20% of the value of your home. Hence, the higher the purchase price of your home, the higher the PMI, though it is still the same less than 20% rate. This is why borrowers often say PMI is costly.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

What Is Pmi How Private Mortgage Insurance Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Buying a home usually has a monster obstacle: coming up with a sufficient down payment. How much you put down on a conventional mortgage one that’s not federally guaranteed will determine whether you’ll have to buy PMI, or private mortgage insurance.

Typically a lender will require you to buy PMI if you put down less than the traditional 20%.

What To Consider Before Choosing A Loan With Pmi

Private mortgage insurance can be a great means of getting into a home without having to scrape together a full 20% down payment. If youre ready to own a home, you dont see a 20% down payment as a reality anytime in the near future, and youre willing to pay the cost of PMI to get into a home, it could be a good choice for you. But its not an expense everyone chooses to take on.

First, its an extra cost that adds to the price of owning a home. If youre already worried about ongoing loan payments and other homeownership costs, PMI could increase that stress.

If you want to avoid PMI, you can take the following actions:

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

When Can I Cancel Pmi

PMI cancellation should happen automatically when your loan balance falls to 78% of your homes original purchase price.

However, you may be able to cancel PMI a little sooner when you reach the 80% threshold by contacting your loan servicer.

Keep in mind that these rules apply only to conventional loans. Mortgage insurance works differently for subsidized loans such as USDA and FHA mortgages.

FHA mortgage insurance premium

FHA loans, backed by the Federal Housing Administration, require their own type of mortgage insurance. This is known as mortgage insurance premium, or MIP.

MIP charges two separate fees: an upfront payment and an annual one

- Upfront mortgage Insurance Premium costs 1.75% of the loan amount. It can be paid at closing but most home buyers roll it into the loan balance

- Annual mortgage insurance premium costs 0.85% of the loan amount per year, split up into 12 installments and paid monthly with the mortgage payment. This is due the life of the loan unless you put at least 10% down. In that case, the MIP payments will cancel after 11 years

Of course, a homeowner could refinance out of an FHA mortgage to get rid of their MIP payments. If the homes loantovalue ratio has fallen below 80%, refinancing into a conventional loan could help eliminate MIP later on.

USDA and VA loans

USDA loans also charge both an upfront and ongoing mortgage insurance fee. However, USDA mortgage insurance rates are slightly lower, with a 1% upfront fee and 0.35% annual charge.

Private Mortgage Insurance: A Pmi Primer

Depending on your down payment, private mortgage insurance may be required. We walk you through PMI basics.

Private mortgage insurance, known as PMI, is generally required if your down payment is less than 20% of the cost of the home. We offer insight into what PMI is, how to budget for it when purchasing a home, insurance changes to remember, how to avoid PMI and what you can do to stop paying PMI.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

A Point Of Caution Regarding Automatic Pmi Removal

There have been many people who say that making extra payments on loans, or having an appraisal improving the value portion of the LTV equation will accelerate the process of automatically removing PMI.

Unfortunately, the wording in the Homeowners Protection Act is quite clear and contradicts those claims .

The document states in plain English that the thresholds for determining LTV are based solely on the initial amortization schedule, in the case of a fixed-rate loan, or on the amortization schedules, in the case of an adjustable-rate loan, regardless of the outstanding balance.

What this means is that on no date other than the date determined by the original amortization schedule when the loan reaches the desired LTV can the PMI be canceled.

I learned about that when I got my Hardest Hit Fund assistance payment$50,000 went to the lender for principal reduction but it didnt change the recalculation of the automatic PMI cancellation date.

I had to go through the regular process of paying $350 for an appraisal and hoping that it would come back with enough of a valuation that I could get the PMI canceled.

Then I had to file a request for the cancelation of PMI from my mortgage account.

Thankfully, that ended up happening!

How Much Does Mortgage Insurance Cost

Conventional mortgage insurance rates vary usually, the lower your down payment and/or the lower your credit score, the higher the premiums. The rate you receive for your private mortgage insurance will depend on your credit score, the amount of money you have for your down payment, and insurer. But typically the premiums for private mortgage insurance can range from $30-70 per month for every $100,000 borrowed. So, if you bought a home with a value of $300,000, you might pay about $150 per month for private mortgage insurance.

On FHA loans, there is an up-front MIP and annual premium which is collected monthly.

You May Like: Chase Mortgage Recast Fee

Private Mortgage Insurance Protects The Lender While Mortgage Insurance Protection Is For The Borrower

By Amy Loftsgordon, Attorney

Many homeowners are confused about the difference between PMI and mortgage protection insurance. These two kinds of insurance are very different, and it’s important to understand the distinction between them.

It’s not uncommon for homeowners to mistakenly think that PMI will cover their mortgage payments if they lose their job, become disabled, or die. But this belief isn’t correct. PMI is designed to protect the lendernot the homeowner. On the other hand, mortgage protection insurance will cover your mortgage payments if you lose your job or become disabled, or it will pay off the mortgage when you die.

Mortgage Insurance Isnt A Bad Thing

Private mortgage insurance is usually required if you put less than 20% down on a house.

Many homebuyers try to avoid PMI at all costs. Why? Because unlike homeowners insurance, mortgage insurance protects the lender rather than the borrower.

But theres another way to look at it.

Mortgage insurance can put you in a house a lot sooner. You might pay more than $100 per month for PMI. But you could start earning upwards of $20,000 per year in home equity.

For many people, PMI is worth it. Its a ticket out of renting and into equity wealth.

Recommended Reading: Rocket Mortgage Loan Requirements

How Much Is Pmi On An Fha Loan

Although PMI is not applicable to FHA loans, youll pay two types of FHA mortgage insurance UFMIP and MIP mentioned above. The UFMIP is 1.75% of your loan amount and is added to your loan amount. The MIP is 0.85% of your loan amount with a 3.5% down payment charged annually, divided by 12 and added to your monthly payment.

Different Types Of Private Mortgage Insurance

Monthly BPMI. Monthly borrower-paid mortgage insurance is the most common choice. The premium is based on a percentage of your loan amount and is part of your monthly mortgage payment.

Single premium. This may also be called upfront PMI and allows you to prepay the premium in a lump sum to avoid paying it monthly.

Lender paid. If you agree to a bump in your mortgage interest rate, your lender may offer lender-paid mortgage insurance . The lender pays the PMI insurance premium on your behalf with this option.

Split premium. You can mix and match monthly and single premiums, paying a portion of the PMI upfront and adding the remaining balance to your monthly payment.

Read Also: Mortgage Rates Based On 10 Year Treasury

What Is A Piggyback Loan

Borrowers with less than 20% down are sometimes allowed by their bank or lender to finance their home purchase with two separate loans. A piggyback loan is his second loan placed on top of the first mortgage. The first loan has an 80% LTV ratio. The second loan is a revolving line of credit, called a home equity loan .

HELOCs are generally used to finance upgrades and improvements to the home. With a piggyback loan, you would simply use a HELOC to finance a certain portion of your loan to get your LTV ratio to 80%. If you had a $100,000 home, put $15,000 down, and used a HELOC loan for the extra $5000, you would achieve the 80% LTV ratio. This would be an 80-15-5 loan ratio.

A HELOC is a line of credit available for you to use as needed, typically for a limited term, such as five or 10 years. The repayment period may be up to 20 years. A HELOC will have an adjustable interest rate that goes up and down, depending on the current interest rates.

You can cancel your PMI when you have 20% equity in your home. With the piggyback loan, youll be stuck with this extra loan until you pay it off.

The interest rate on your HELOC will depend on your credit history. The best interest rates for HELOC loans typically go to people with credit scores of at least 740.

After calculating the factors of a piggyback loan versus HELOC, if one is lower than the other, you should have enough information to decide which loan option is more beneficial to you financially.

When Does Mortgage Insurance Fall Off The Loan

Once the borrower has built up a certain amount of equity in the house, typically 20% equity, private mortgage insurance usually may be canceled which will reduce your mortgage payment and allow you pay less money every month. The lender usually wont automatically cancel PMI until youve reached 22 percent equity based on the original appraised value of the home, or unless you contact them to request cancellation at 20 percent of the current market value. So if you own a home with a value of $100,000 and have paid down $20,000 in principal, you can request to cancel your PMI. Be sure to contact your lender once youve hit 20 percent equity.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

Use Pmi As A Wealthbuilding Tool

Homeownership is the primary means of wealth building in the U.S. Each monthly mortgage payment can be considered an investment in the future.

Owning a home is no path to quick riches. Rather, its an investment that pays off gradually over time, even considering cyclical downturns.

Longterm housing data supports this fact.

According to the government lending agency FHFA, home real estate values are up more than 140% since 1991. That means a home worth $100,000 in January 1991 is worth $240,000 today.

Over that time, inflation has risen 75%, says the Bureau of Labor Statistics. A firsttime home buyer in 1991 has beaten inflation, plus made an additional 65% return on investment.

Inflationadjusted return is a tangible way to look at wealth increases, but there are nontangibles, too.

For instance, a homeowner who purchased a home in 1991 is likely near the end of their 30year fixed mortgage. Soon, the homeowner will be mortgagefree. Their cost of living will drop.

The owner holds a considerable asset, too.

Yet, a person who chose to rent in 1991, and continued to do so, now pays everincreasing rental prices.

Worse, its likely this person has no sizable asset unless he or she has contributed to a retirement account or other investment consistently over two or three decades. Many have not been this forwardthinking.

So what does PMI have to do with this? It starts the wealthbuilding process sooner. You can be on the winning side of rising home values.

But not quite.