Who Is This Calculator For

This calculator is most useful if you:

- Are a new potential homeowner needing to know your budget constraints

- Have decided on a new home but want to ensure you can afford it

- Are looking to plan and budget for the future

Once you’re entered your information and obtained your results, you can use the Get FREE Quote box at right to request personalized rate quotes tailored to you from mortgage lenders. This will give you a better idea of what interest rate to expect and help gage your ability to qualify for a mortgage.

How Much Income Do I Need To Show For A Mortgage

3.9/5incomeincomewill

Also, how much income do you need to qualify for a $200 000 mortgage?

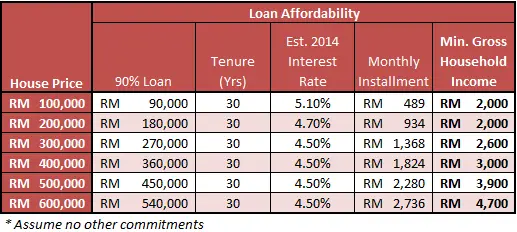

Example Required Income Levels at Various Home Loan Amounts

| Home Price | |

|---|---|

| $70,000 | $76,918.59 |

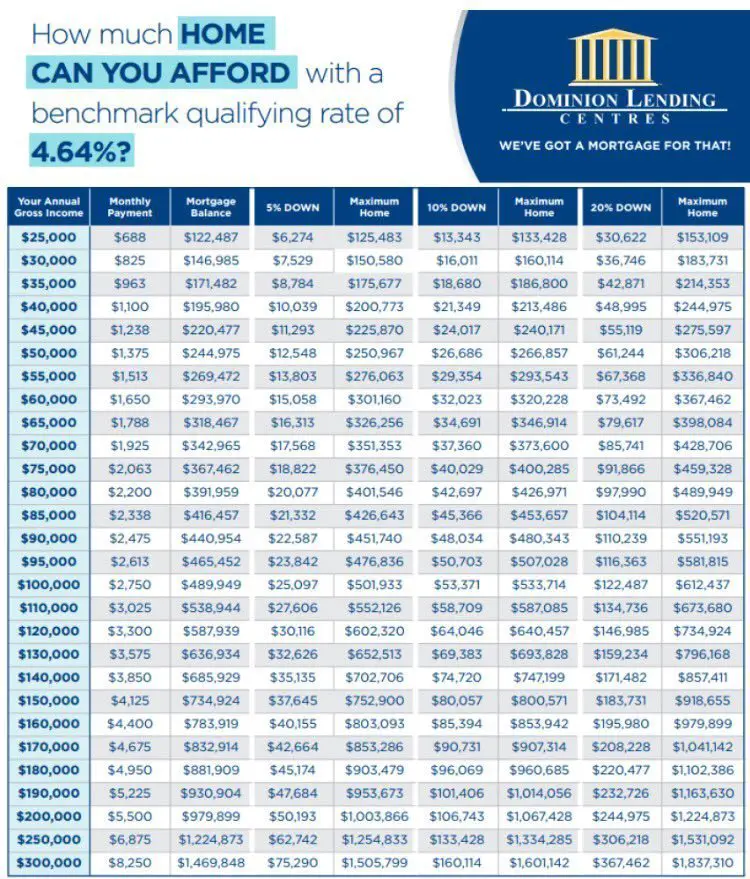

Additionally, what income do you need for a 800000 mortgage? To afford a house that costs $800,000 with a down payment of $160,000, you‘d need to earn $138,977 per year before tax. The monthly mortgage payment would be $3,243. Salary needed for 800,000 dollar mortgage.

Also to know, how much income do I need for a 250k mortgage?

To afford a house that costs $250,000 with a down payment of $50,000, you’d need to earn $43,430 per year before tax. The monthly mortgage payment would be $1,013. Salary needed for 250,000 dollar mortgage.

How many times your salary can you borrow for a mortgage 2019?

Every lender works within the parameters of its own guidelines, therefore, some can be more generous than others. Most mortgage lenders use an income multiple of 4-4.5 times your salary, some offer a 5 times salary mortgage and a few will use 6 times salary, under the right circumstances.

can700can

How To Increase Your Maximum Mortgage Affordability

If youve used our mortgage affordability calculator, and youre unhappy with your results, there are several steps you can take to increase your mortgage affordability:

- Increase your down payment: This will give you the ability to increase your affordability and purchase a more expensive home.

- Pay off your debts: This will lower your TDS ratio and free up more of your income for your mortgage payment, ultimately giving you the ability to carry a larger mortgage and therefore more expensive home.

- Increase your income: This is the tougher option, but it will allow you to afford a larger monthly mortgage payment, which will increase the overall size of the mortgage you can afford to borrow and repay. Alternatively, you can apply for your mortgage with your partner, or get a co-signer, such as your parents, to guarantee your mortgage.

You May Like: Who Should You Get A Mortgage From

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Save Enough Down Payment

Besides checking your income, debts, and credit score, its important to prepare enough down payment. Ideally, financial advisors recommend paying 20% down on your homes value. This eliminates PMI cost and substantially reduces your principal loan amount. For example, in , the U.S. Census Bureau announced that the median sales price for home sales was $330,600. If this is the price of your house, you must prepare a down payment of $66,120.

In practice, however, a 20% down payment is too hefty for most borrowers. Credit reporting agency Experian reported that the average down payment for homebuyers in 2018 was 13%. Meanwhile, those who bought houses for the first time only made a 7% down payment, whereas repeat buyers paid 16% down.

Though paying a 20% down payment may not be required, its still worth making a large down payment on your mortgage. Here are several benefits to paying 20% down on your home loan.

Factor in the Closing Costs

Closing costs are fees charged by lenders to process your mortgage application. This typically ranged between 2% 5% of your loan amount. For example, if your loan is worth $320,000, your closing costs can be anywhere between $6,400 to $16,000. This is a large sum, so be sure to include it in your budget. But the good news is closing costs can be negotiated with lenders. So make sure to talk to them about reducing your fees.

Read Also: What Is The Current Va Mortgage Rate

How Do You Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the top amount you can pay for a house, as well as your estimated monthly payment.

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

You May Like: How Long After Bankruptcy Can You Get A Mortgage

How To Calculate How Much House You Can Afford

To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages. Generally speaking, and depending upon your location, they will generally range from about 0.5% to about 2.5% for Taxes, and 0.5% to 1% or so for Insurance.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all your regular obligations . The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%.

How Much House Can You Afford

Modified date: May. 9, 2021

Buying your first home is one of the most important and exciting financial milestones of your life. But before you hit the streets with a realtor, you need to have a good sense of a realistic budget. Just how much house can you afford? You can determine how much house you can afford by following three simple rules based on different percentages of your monthly income.

Read Also: How To Select A Mortgage Lender

What Income Do You Need For A $400k $500k Mortgage

Start here to compare mortgage rates

Coverage and rates tailored to fit your needs

Lower rates

Compare multiple quotes and choose the most economical one

Reputable providers

We work in a network of trusted providers

Owning a home is a dream for many. However, purchasing one is a complex process. From making an offer to negotiating closing costs, the financial aspects of home-buying can be frustrating for even the savviest shopper.

What We’ll Cover

However, one thing that shouldnt feel challenging should be figuring out the income you need to qualify for a mortgage. If youre looking for a jumbo loan between $400K and $500K, read on to learn more.

My Result Shows I Can Afford My New Home What Should I Do Next

First of all, congratulations! You are now one step closer to owning the home you desire. The next step is to reach out to our team of top-notch mortgage lenders and get started on securing yourself the perfect deal.

Click Get FREE Quote, answer a few simple questions about yourself and the loan you are seeking to obtain personalized rate quotes from lenders doing business in your area. This service is totally FREE of charge and makes it easy to comparison shop for your best deal on a home loan. Take your next step today – it couldnt be simpler!

Read Also: How Does A Reverse Mortgage Work When The Owner Dies

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Homes price

-

Loan term

-

Mortgage interest rate

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease

-

Minimum credit card payment

-

Personal loan, child support and other regular payments

Monthly property tax

Monthly homeowners insurance

Monthly homeowners association fee

How Much House Can I Afford

https://money.com/how-much-house-can-i-afford/

How much house you can afford is directly related to the size and type of mortgage you can qualify for. Understanding how much you can comfortably spend on a new mortgage while still meeting your existing obligations is crucial during the homebuying process.

Read on to learn about home affordability, and use our home affordability calculator to find out if you can afford the house of your dreams.

1Add Your Info

Gross income is the amount you receive before taxes and other deductions.

In order to get the most accurate estimate, select the credit score that best represents your credit history.

Not sure which loan type to choose? Go with a 30 Year Fixed Rate Loan, 90%+ of Americans do.

If your cash down payment is less than 20% of your loan amount, we will automatically apply PMI to your results.

In order to get the most accurate estimate, select the credit score that best represents your credit history.

Not sure which loan type to choose? Go with a 30 Year Fixed Rate Loan, 90%+ of Americans do.

Moneys calculator results are for illustrative purposes only and not guaranteed. Money uses regional averages, so your mortgage payment may vary.

You can afford a house worth:

$—,—

Thank you for your service! 0% downpayment and $0 PMI applied.

3What is Today’s Rate?

Rate for yesterday Sep 19 was

Recommended Reading: What Is A Mortgage Holder

Getting Preapproved Can Tell You Your Home Buying Budget

One of the easiest ways to find your price range is to get a preapproval from a mortgage lender.

Preapproval is kind of like a dress rehearsal for your actual mortgage application. A lender will assess your financial situation as shown by your annual salary, existing debt load, credit score, and down payment size without making you go through the full loan application.

This can tell you whether youre qualified for a mortgage and how much home you might be able to afford.

You could also learn whether you can afford a 15year loan term or whether you should stick with a 30year mortgage. And, a preapproval can show whether youd be better off with an FHA loan or a conventional loan.

Finally, your preapproval shows you the added monthly costs of homeownership such as home insurance, real estate taxes, HOA fees, and mortgage insurance if necessary.

Mortgage Affordability And Your Down Payment

Because Canada has minimum down payment rules in place, the amount of money you’ve saved for a down payment can limit your maximum mortgage affordability. The minimum down payments in Canada are:

- 5% of the purchase price up to $500,000, plus

- 10% of any part of the price between $500,000 and $1 million, or

- 20% of the total purchase price for homes valued at over $1 million.

Let’s consider an example. If your down payment amount is fixed at $15,000, the maximum home price you will be able to afford is $15,000 divided by 5%, or $300,000. If your down payment is $30,000, then your maximum affordability will increase to $550,000. You can run the numbers yourself on our mortgage affordability calculator.

You May Like: Is Taking Out A Second Mortgage A Good Idea

How Much Income Is Needed For A 250k Mortgage

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Your Debt And Salary Limit What You Can Afford

Besides showing you how much income you need to afford the home you want, this calculator also shows how your debts can compromise your chance for a mortgage. You can see how paying down debts directly affects your buying power. The fewer debts you have, the more of your salary can go toward the home, allowing you to afford a more expensive property. At the same time, more debts mean less money available, based on your current salary, to pay for – and qualify for – the home you want.

You can use this calculator to visualize how a higher or lower salary could change your ability to afford the home of your dreams. What if you got a raise? Or took a weekend job? You can vividly see how you could afford different homes with more income, or less.

Recommended Reading: How Much Is Mortgage On 1 Million

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Much A $200000 Mortgage Will Cost You

For a $200,000, 30-year mortgage with a 4% interest rate, youd pay around $954 per month. But the exact costs of your mortgage will depend on its length and the rate you get.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Your mortgage size depends on the homes price and the down payment youre making. If you buy a home priced at $255,000, for example, and put down a 20% down payment , youll need a mortgage worth $200,000.

Youll then pay off that balance monthly for the rest of your loan term which can be 30 years for many homebuyers.

Before you start shopping around, though, youll want to get pre-approved. Getting pre-approved will let you know if you can afford a $200,000 mortgage and demonstrate to sellers that youre a serious buyer. Credibles pre-approval process is simple it only takes a few minutes to see if you qualify for a streamlined pre-approval letter, and it wont affect your credit score.

Learn more about what goes into those payments and how much a $200,000 mortgage loan will cost you:

Recommended Reading: Should I Take Out A Mortgage

Is Your Dti Ratio Within A Good Range

Debt-to-income ratio or DTI is a risk indicator that measures how much of your monthly salary goes to your debts. In particular, DTI ratio is a percentage that compares your total monthly debts to your gross monthly salary. Generally, a high DTI ratio means you are not in a good position to acquire more debt. Likewise, a low DTI ratio is a sign that you have enough salary coming in to pay for your mortgage and other debt obligations.

If you have a high DTI ratio, make sure to reduce it before applying for a mortgage. This increases your chances of securing approval. You can lower your DTI by paying off or reducing large debts, such as high-interest credit card balances.

The 2 Main Types of DTI Ratio

Front-end DTI: The percentage of your salary that pays for housing expenses. It includes monthly mortgage payments, property taxes, home insurance, homeowners association dues, etc.Back-end DTI: The percentage of your salary that goes to housing expenses as well as other debt obligations. This includes credit card debt, student debt, car loans, any personal loans, etc.

Lenders assign different DTI limits depending on the type of loan. Most homebuyers obtain conventional loans in the market. These are common mortgages that come with thorough credit and background requirements.

The Two Main Types of Conventional Loans

Meanwhile, borrowers have the option to choose from the following government-backed loans:

Government-Backed Mortgage Programs

Know Whats Standing In Your Way

Unfortunately, not everyone is financially ready to buy a home. This Mortgage Income Calculator will show some people that buying, at least at this point, is not within their grasp and offer an understanding of what financial obstacles stand in the way.

This calculator may show you that not enough down payment is your problem. Or maybe its too much debt. Perhaps you simply need to earn more to buy the home you want and need. Or, if you reassess your ambitions, can you afford a less-expensive home?

Also Check: How Long Does It Take To Get A Mortgage Commitment