Round Up Your Mortgage Payments

Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term. So if you cant afford an extra mortgage payment, round up your scheduled payments to the nearest $100 amount instead. This small move pays off in a big way.

To illustrate, if you have a mortgage payment of $1,140 and make an extra principal payment of $60 each month . In this example, youll shorten your mortgage term by three years.

Create Room In Your Budget

One of the most effective ways to pay off your mortgage faster is to pay more than the monthly amount due. That might seem obvious, but you might not realize just how far a little extra money can go.

For example, say you took out a 30-year fixed-rate mortgage of $250,000 at 5% annual percentage rate and have 25 years left on the loan. That would mean you owe $1,342.05 per month. Now imagine that you tack on just $20 extra to each payment. Youd shorten the repayment period by eight months and save $5,722 in interest. Use a mortgage calculator to help you do the math.

For an extra $20 per month, youd simply need to cut out one fancy coffee a week or a couple of takeout lunches. Obviously, putting even more money toward extra payments will result in even more savings.

Just keep in mind that you dont want to go overboard here and sacrifice other financial goals to pay down your mortgage faster. Mortgages are some of the cheapest loans out there, so be sure youre paying off other higher-interest debt and investing before you start cutting back in other areas of your budget.

If Your Circumstances Have Changed

If you’ve recently been given a pay rise at work, or come into extra cash, you might feel like it might be a good time to put some of that extra income towards repaying your mortgage faster.

If you have a lump sum of cash, you could put all of it down to make one large mortgage repayment or spread it out to increase what you currently pay each month.

However, before you do this it’s important to check the terms of your mortgage deal to ensure you won’t be hit with a penalty fee for paying off your mortgage early.

Many mortgage providers will allow you to overpay by up to 10% per year without incurring a penalty. You will need to check if any such concessions are valid over any 12-month period or simply begin in January of that year.

Also Check: Who Offers 20 Year Mortgages

Rent Out Extra Space In Your House

If you want to make extra payments but dont know where to find the money in your budget, consider putting your house to work.

Some examples of what you could do include:

- Renting out an extra room

- Turning an accessory dwelling unit into an Airbnb

- Renting out space in your garage for storage

- Renting out a parking spot

- Renting your pool or backyard out to someone for an event

Should I Pay Off My Mortgage

Just because you can pay off your mortgage early doesnt necessarily mean that you should. Of course, it would feel great to rid yourself of a huge financial burden like a mortgage. But if you really want to know if its a good decision, you have to look at the math.

There are pros and cons to paying off your mortgage early. Whether the pros outweigh the cons will depend on your overall financial situation.

Read Also: How Can I Get Help With My Mortgage

How To Pay Off Your Mortgage Early

8 Minute Read | September 13, 2021

So youre eager to join the nearly 40% of American homeowners who actually own their home outright.1 Can you imagine that? When the bank doesnt own your house and you step onto your lawn, the grass feels different under your feetthats freedom.

But the problem is youre currently stuck dragging around that ball and chain called a mortgagejust like most homeowners.

Dont worry. Well show you how to pay off your mortgage faster so you can finally join the ranks of debt-free homeowners. Lets get started.

Refinance To A Shorter Term Length

Its common for mortgage borrowers to opt for a longer repayment term in order to keep monthly payments lowtypically 30 years. However, as time goes on, your income may increase or lifestyle may change to free up more cash flow.

If thats the case, you may be able to refinance your loan to a shorter term. Since the repayment period gets crunched into a shorter time period, the monthly payments will likely increase. However, this is an effective way to pay off your mortgage much earlier and save a ton of money on interest, especially if you also qualify for a lower interest rate.

Take a look at this comparison between a $250,000 loan with a 30-year fixed-rate term versus a 15-year fixed-rate term:

| 30-year fixed rate |

|---|

Recommended Reading: Can You Refinance Your Mortgage

Increase Your Monthly Payment Amount

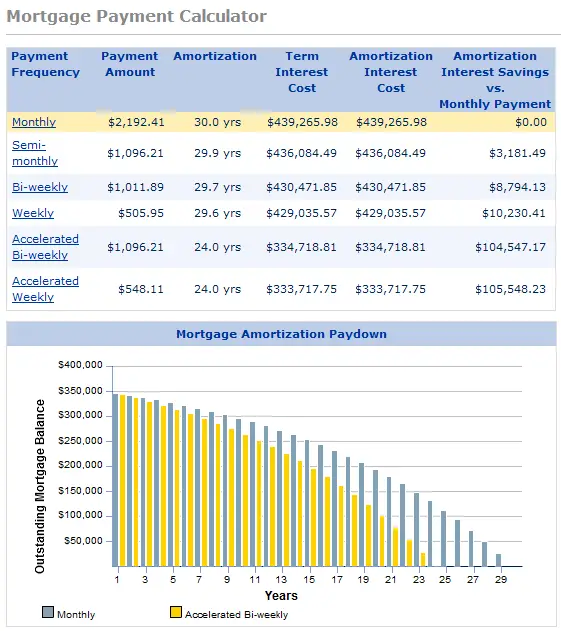

The biweekly example above shortens your 30-year loan term four years by paying about $100 extra per month, but what if you could afford more?

If you paid $200 extra per month on your 30-year fixed loan at 3.625 percent on a home purchase of $300,000 with 10 percent down, youd save $42,969 in interest and pay off your loan six years and eight months years early.

If you paid $300 extra per month, youd save $57,122 in interest and pay off your loan eight years and 11 months early.

And if you paid $400 extra per month, youd save $68,426 in interest and pay off your loan 10 years and 10 months early.

Once you go higher than this, its worth looking at whether your budget can accommodate a 15-year loan, because rates on 15-year loans are about 0.5 percent lower than 30-year fixed loans, which means $113 less interest per month versus the 30-year loan.

Thats a clear interest cost savings, but your budget is higher: you pay $1,881 per month for a 15-year loan versus $1,231 per month for a 30-year loan .

Pay A Little More Toward Your Principal Each Month

Another trick is to divide your current mortgage payment by 12, and then add this much to each monthly payment. So if your mortgage payment is $1,400 a month, make an extra principal payment of $116 each month. At the end of the year, you would have made the equivalent of one extra mortgage payment.

Also Check: Should You Buy Down Mortgage Rate

When To Pay Off Your Mortgage On Time

Its not always a good idea to put extra money toward your mortgage. Ask yourself these questions to figure out if you should pay your mortgage on time instead of early:

- Do I have other debts to pay off? Credit cards and loans typically have higher interest rates than mortgages, so they accrue interest faster. Youll save more money if you pay down high-interest debts first.

- Do I have other financial obligations to consider? Contributing money to your retirement account and emergency savings account are important financial goals. If these financial goals are lacking, consider funding these before putting extra money toward your mortgage.

- Do I have other big expenses coming up? If you need to save up for something big, like your childs college tuition or a new car, then you might want to focus on these goals before paying down your mortgage.

- Does my lender charge a prepayment penalty? If youre not sure whether your mortgage comes with this fee, call the lender and ask. Youll need to calculate the penalty and figure out if you still come out ahead.

Own Your Home Faster And For Less

Of all the benefits to refinancing your home, paying off your mortgage in less time is the biggest. Reducing the term of your loan by refinancing can not only shave years of payments. It can save you tens of thousands of dollars in the process over the life of your loan.

Because paying off your home earlier reduces the overall amount of interest youll pay, it could let you to retire earlier, travel more, or put extra cash in your pocket. Youll increase your homes equity faster. Youll not only own your home in less time, but youll pay much less to own it. Talk to one an Ark Mortgage Advisor to see how you could benefit from refinancing your home to shorten your term.

Also Check: How Many Times Annual Salary For Mortgage

Term Reduction Refinance Faqs

There are four simple ways that you can pay your mortgage off faster.

- Make biweekly payments Rather than making one monthly payment, you can make half the payment every two weeks. If your mortgage payment is $2,000 a month, you would pay $1,000 every other week. Because there are 52 weeks in a year, a biweekly payment schedule will result in the equivalent of 13 full monthly payments per year. The extra payment that youd be making each year can help you pay your mortgage off 5 years sooner and eliminate 5 years of interest as well.

- Make extra principal payments Most mortgage lenders allow you to make an extra payment every month and mark it principal only. This payment will go directly to pay down the principal , rather than both the principal and interest.

- Refinance into a shorter-term loan If you currently have a 30-year mortgage, refinancing it as a 15-year loan will help you pay it off in half the time, potentially at a lower interest rate as well.

- Put unexpected money you receive into your mortgage payments If you put the proceeds of tax refunds and annual bonuses towards the principal of the loan, youd be pleasantly surprised at how quickly you can pay off your mortgage.

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Don’t Miss: Can You Get A Mortgage While In Chapter 13

How To Pay Off Your Mortgage In 5 Years

Assuming your lender allows you to pay off your mortgage faster and that an early payoff is financially worthwhile, youll want to determine what the most realistic course of action will be based on your finances.

Many people who set the goal of paying off their mortgage in 5 years are a part of whats called the FIRE movement.FIRE stands for Financial Independence, Retire Early. These are aggressive plans to achieve financial independence, but they can be useful in helping a borrower with the means to do so reduce their debt faster.

So, how do you pay off your mortgage in 5 years?

There are a few steps that youll need to take in order to meet this goal. Regularly putting extra money toward your payments will prove to be worthwhile in the long run, but this should be done strategically. Lets take a look at the process.

Make Extra Principal Payments

Another way to pay off your home loan faster is to simply payextra when youre able.

Most mortgage loans issued after Jan. 10, 2014, do not chargeprepayment penalties.

This means you can pay extra money toward yourmortgage balance each month or make a larger, lump sum payment on yourprincipal each year without facing a penalty for paying off your loan early.

Many homeowners make extra payments on their loans principal when they get an income tax refund. Extra principal payments can have a big impact.

Heres an example.

- Lets say you took out a home loanfor $300,000 on a 30-year term and rate of 4%

- Thats a principal and interest payment of$1,370

- 360 payments of $1,370 per month meansyoull have paid $492,500 over the life of the loan thats $192,500 in interest payments over 30 years

Using the same numbers for theloan amount and interest rate:

- If you make extra principalpayments of $250 per month, youd shave seven years and four months off yourterm

- And, youd save more than $59,000 total ininterest payments

There are benefits aside from interest savings, too.

Paying off your mortgage early lets you use the money youwould have paid each month for other purposes, like investing.

Lets continue with the example above. Instead of paying$1,370 per month on the mortgage, you could put the same amount of money in aninvestment account.

Also Check: How To Calculate Principal And Interest For Mortgage

Pour Every Bit Of Extra Cash Into Your Mortgage

Dedicate every windfall a bonus, raise, or holiday or graduation gift you receive toward paying down debt, recommends Marilyn Lewis in Money Talks News.

Obviously, the highest-interest debt takes priority. But if you have an adequate emergency savings fund and your mortgage is your only debt, dont even ask yourself what youll do with extra money when it falls into your hands: Add it to your mortgage payment, designating it as additional principal.

Mistakes To Avoid When Paying Off Your Mortgage Early

If you can afford to pay off your mortgage ahead of schedule, youll save some money on your loans interest. In fact, getting rid of your home loan just one or two years early could potentially save you hundreds or even thousands of dollars. But if youre planning to take that approach, youll need to consider if theres a prepayment penalty, among other possible issues. Below are five mistakes that you should avoid when paying your mortgage off early. A financial advisor can help you figure out your mortgage needs and goals.

You May Like: How Much Second Mortgage Can I Afford

Refinance To A Shorter Term

The 30-year home loan is mostpopular, but lenders offer shorter loan terms, too. A 15-year loan is acommon alternative, and many lenders also offer 10-, 20-, and 25-year loans.

Shorter repayment periods mean higher monthly payments, butless interest over the life of the loan.

Lets compare a 20-year term to a30-year term.

Most 20-year mortgages carry lowerrates than 30-year mortgages. Typically, 20-year rates can beanywhere from one eighth to a quarter percent lower.

- Lets say youre financing a$250,000 loan on a 30-year term at 3.75%. Your principal and interest paymentswould be about $1,150 per month

- Using the same loan amount, but with a20-year term at 3.625%, your monthly payment would be $1,450

- Youd pay a few hundred more per month, butyou would be mortgage-free a decade sooner

The best part? The savings in interest onthat 20-year mortgage would be over $65,000 if you kept the loan untilit was paid off.

Another benefit of refinancing toa shorter term is that you dont have to start over with 30 more years.

For many homeowners who are wellinto their original mortgage term, starting over with another 30 years worth of interest mightnot make sense.

But with a 15-year refinance, you could lock in a low interest rate and a shorter loan term to pay off your mortgage faster. Just note: the shorter your mortgage term, the higher your monthly mortgage payments will be.

Paying Off Your Mortgage Early: Pros And Cons

Although it is often a wise decision to pay off your mortgage early, there are a few situations where it might make sense to do something else with your extra cash. If youre thinking about reducing your mortgage, there are a few things to keep in mind.

Paying off your mortgage early requires a huge amount of money and this will divert funds from other areas of your finances. Before you commit all of your capital, think about whether you have any expensive debt to prioritise paying off ahead of paying off your mortgage quickly.

Equally, if you dont have a pension scheme, consider whether to start a pension pot and contribute here, as pensions offer a tax-efficient way to save for retirement and the earlier you start contributing to a pension, the more time you have for your retirement fund to build.

Don’t Miss: What Percent Down Payment To Avoid Mortgage Insurance

Reduce The Amount Of Debt You Have

Mortgage debt is a significant undertaking, especially if you have additional debt from student loans, credit cards, etc. By paying off your mortgage early, youll reduce a substantial portion of your debt and free up more funds to make your other monthly payments. The faster you pay off all your debts, the sooner youll achieve financial freedom.

Remortgage For A Cheaper Shorter Deal

If your current mortgage provider is making it expensive or difficult to pay off your mortgage early, consider getting a remortgage deal. By switching to a new mortgage provider, you can often get a cheaper mortgage interest rate for up to 5 years of the mortgage term. You may also be able to get a shorter mortgage term.

Just be careful as remortgaging will probably activate the early repayment penalty fee on your current mortgage, and you will probably have to pay a fee to switch mortgage providers. Do the sums before to see if you could save. Remortgage deals generally work out better when you are coming close to the end of your current fixed rate mortgage deal, but its always good to shop around well in advance just in case.

Don’t Miss: How Much Interest Will I Pay Mortgage Calculator