How To Get A Mortgage Forbearance Agreement

To request forbearance on your mortgage loan, contact your loan servicer directly. Ask about the documentation you’ll need to provide to show that you need a forbearance, such as pay stubs, medical bills, a job layoff letter, and others.

Get the agreement in writing and read it thoroughly before you sign it. Make sure you can afford the terms of the agreement once your forbearance period ends so you don’t end up in a worse position than you started.

All Or Some Of The Above

Some borrowers might need a combination of actions in order to make the monthly mortgage bill manageable. Depending on your need, a lender might reduce the interest rate and extend your loan so that your monthly mortgage payment is reduced in two ways, without touching the principal balance.

The lender likely will go through a cost-benefit analysis when assessing the type of modification that makes sense for both parties.

Alternatives To Mortgage Modification

If you do not qualify for mortgage modification, ask your lender about other options they may offer to help you avoid foreclosure. Potential options include:

- Repayment plans: If you’ve missed a few mortgage payments but are able to resume regular payments, a repayment plan can temporarily increase your monthly payments until you’ve repaid the amount you missed , after which your payments will return to the normal amount.

- Mortgage forbearance: A forbearance plan suspends or reduces your payments for up to 12 months, after which you must resume regular payments and repay the payments excused during the forbearance period. Forbearance programs are designed for borrowers with temporary financial challenges.

- Refinancing: If you have good credit and interest rates are more favorable than they were when you got your original mortgage, it may be possible to refinance your mortgagethat is, replace your original loan with a new one with more affordable payments.

Don’t Miss: What Is The Mortgage Payment On 240k

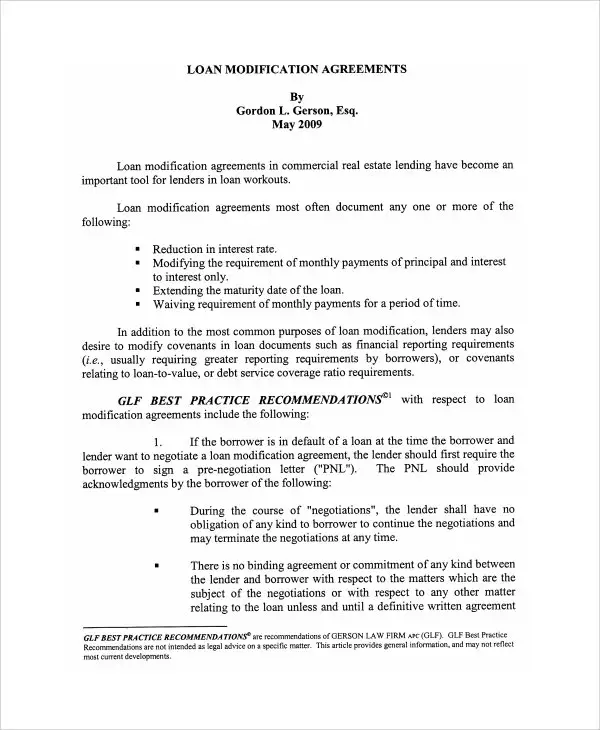

Loan Modification Is Better For The Lender

For example, the lender will almost certainly come out on top in this situation. Loan modification isnt the same as refinancing, which helps you get a better interest rate if you have a good enough credit score.

Instead, loan modification tends to be the best option for a homeowner whose credit is bad and cant refinance the loan. With loan modification, the lender changes the terms of your loan, especially when youre going through a financial hardship like losing a job or paying off some hefty medical bills. In changing the terms of the agreement, your monthly premium decreases, so that you can get back on your feet financially, find a new job, pay off those medical bills and continue paying off the loan.

On the flip side, while your monthly payments tend to decrease, the length of your loan is likely going to stretch out longer. In order to decrease the monthly premium, the lender will typically increase the term of your loan, adding more interest to the amount that youre paying over time.

Understand What A Modification Can And Cannot Do

The goals of a modification are to: prevent foreclosure and make your payments affordable so you can stay in the home.

A modification may lower your interest rate.

A modification may extend the term of your mortgage loan. This lowers your payments but increases the time over which you pay.

A modification may reduce the principal of your mortgage loan. But, principal reduction is not guaranteed and many servicers do not offer it.

The modification may increase your obligation or create a large balloon payment at the end of the loan. Only you can decide to accept a modification. Make sure you understand all the terms of the modification before you sign an agreement.

Don’t Miss: What Are Mortgage Underwriters Looking For

Options If The Modification Application Is Denied

Unfortunately, lenders can permanently deny a borrower for a modification. If they do, there are several options depending on the reasons for the denial:

1. Resubmit / Supplement a resubmission of parts of the same application without resending the entire package. For example sending more documentation or proof of income to support an existing application.

2. Reapply Start a new application and submit an entirely new package. Needed where the issues are beyond minor issues that need to be reworked.

3. Adjustments to the Application If an application is denied for a particular, identifiable reason, the adjusted or new application needs to make necessary adjustments. For example if an application is denied for lack of income, the remedy is to show more income. If the reason for the denial is that the arrears are excessive, then a large downpayment will potentially address that issue.

4. Appeals Appeals directly with the investor are used to correct some kinds of mistake made by the lender. There are times when the lender will confuse the information provided by the borrower and not use income correctly.

5. Complaint to Government Agency However, borrowers do have the ability to file complain with the Consumer Financial Protection Bureau to file a complaint directly with the investor should the servicer act in bad faith.

Lenders Are Not All Equal

Unfortunately, not all lenders are willing to offer loan modification agreements and those that do often have clauses in the contracts that are less than consumer friendly. Whenever a loan modification agreement is offered, it is important to carefully review the contract and understand how the language will impact you over the longer term. Many consumers are not aware that once you have modified your mortgage, you may be ineligible for a future modification which could create additional problems.

Also Check: Are Mortgage Rates Going To Rise

Procedure After The Modification Application Is Submitted

Once the file has been submitted to your lender with all required and up to date information, it may take an estimated 2 weeks for your lender to complete the initial review of your file. During the first 2 weeks, your lender will assign a point of contact who is responsible for reviewing the file and gathering internal information. Once this process is complete your file will be turned over to the underwriter for a decision on the application.

Is My Income Too Low For Loan Modification

The most common reason homeowners get turned down for a workout with their lender is: income too low for loan modification. It sounds backwards in that if the borrowers income were higher, they wouldnt be asking for assistance in the first place, but turn downs citing income too low for loan modification are unfortunately quite common.

Also Check: How To Get Assistance With Mortgage Payments

Tips To Avoid Being Scammed

What Happens To My Mortgage Payments During The Trial

The Making Home Affordable trial modification period lasts three months. It provides you immediate relief from your normal payment and stops foreclosure proceedings. Your original loan terms remain intact during the trial period until you make all trial payments as scheduled and your lender offers you a permanent modification plan.

Recommended Reading: How To Become A Mortgage Broker In Massachusetts

A Loan Modification Might Reduce Your Monthly Payments And Prevent A Foreclosure

If your mortgage has become unaffordable, a loan modification might reduce your monthly payments and keep you out of foreclosure. With a modification, the lender agrees to change the terms of the loan to, hopefully, make the payments more within your means. To decrease the payment amount, a modification usually involves lowering the interest rate and extending the term of the loan. The lender also typically adds any overdue amounts to the unpaid principal balance to bring the loan current.

But who qualifies for a modification? Eligibility is based on guidelines that the lender developsand not everyone will be approved. Though, if you meet the program guidelines and take all the necessary steps, you’ll get one.

In this article, you’ll learn what a servicer ordinarily looks for when evaluating a borrower for a modification and what steps you’ll need to take in the process.

How Mortgage Loan Modification Works

With a loan modification, the total principal amount you owe wont change.

But the lender may agree to a lower interest rate, reduced loan length, or a longer payoff period, says Elizabeth Whitman, attorney and managing member of Whitman Legal Solutions, LLC.

Any of these strategies could help reduce your monthly mortgage payments and/or the total amount of interest you pay in the long run.

Modification can also include switching from an adjustablerate mortgage to a fixedrate mortgage and rolling late fees into your principal, adds Condor.

Note, loan modification is intended to make a mortgage more affordable monthtomonth. But it often involves extending the loan term or adding missed payments back into the loan which may increase the total amount of interest paid.

Refinancing into a new loan, on the other hand, often reduces the monthly payment and the total interest cost.

Read Also: How Long Is The Mortgage Process

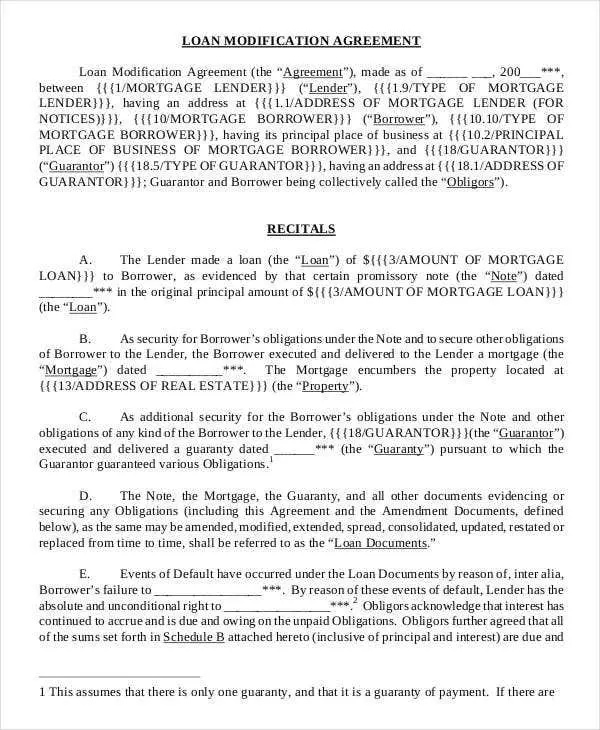

Preparation For Submitting An Application For A Mortgage Modification

Although the forum may be different, there are specific requirements that all lenders use to qualify a borrower for a home loan modification. Although most lenders have their own internal policies, they all have similar specific criteria in terms of applications, proof of income, proof of expenses, proof of existing debt, and other documentation. There is a need to prepare the application package in a manner where it is complete, free of missing/defective documents or information and is optimized by a modification professional in order to maximize the probability of acceptance. Important in assessing how to present the clients application is a strategy which takes into account many criteria used by lenders to evaluate a modification application application including:

A. Housing Ratio Borrowers must fall between a very specific Housing Ratio The Housing Ratio is the percentage of a borrowers monthly gross income goes towards the monthly contractual payment.

B. Debt to Income Ratio Lenders also calculate a borrowers Debt-To-Income to qualify for assistance. The DTI is the percentage of a borrowers monthly gross income goes towards all a borrowers monthly expenses.

D. Loan HistoryLenders will also take the history of the loan into consideration. For example, most loans must have a minimum of 12 consecutive contractual payments to qualify for home retention after any alteration such as a modification or refinance and after origination.

Mortgage Loan Modification Requirements

To be eligible for a mortgage modification, along with meeting other investor-specific guidelines, you’ll generally need to show that:

- the home is your primary residence

- you’ve gone through a financial hardship like you had to take a lower-paying job or you went through a divorce and experienced a loss of household income, and

- that you have enough steady income to make regular payments under a modification.

In most cases, you’ll have to complete a trial period plan, often for around three months, to demonstrate you can afford the new modified amount.

Recommended Reading: What Is A Good Dti For A Mortgage

Who Qualifies For Va Loan Modification

You may not qualify for a VA loan modification unless you meet certain VA and/or lender criteria. That can include being delinquent or facing imminent default at the time you apply for the modification. You and your lender will discuss the most appropriate measures to help save your home. What could qualify you in the realm of imminent default?

- Job loss

- Other situations that affect your ability to repay your mortgage under the original loan

How Does Loan Modification Work

Getting a mortgage loan modification could mean extending the length of your term, lowering your interest rate or changing from an adjustable-rate mortgage to a fixed-rate loan. Though the terms of your modification are up to the lender, the outcome is lower, more affordable monthly mortgage payments. Foreclosure is a costly process for lenders, so many are willing to consider loan modification as a way to avoid it.

Foreclosure is a costly process for lenders, so many are willing to consider loan modification as a way to avoid it.

You May Like: Does My Husband Have To Be On The Mortgage

Mortgage Forbearance Agreement Explained

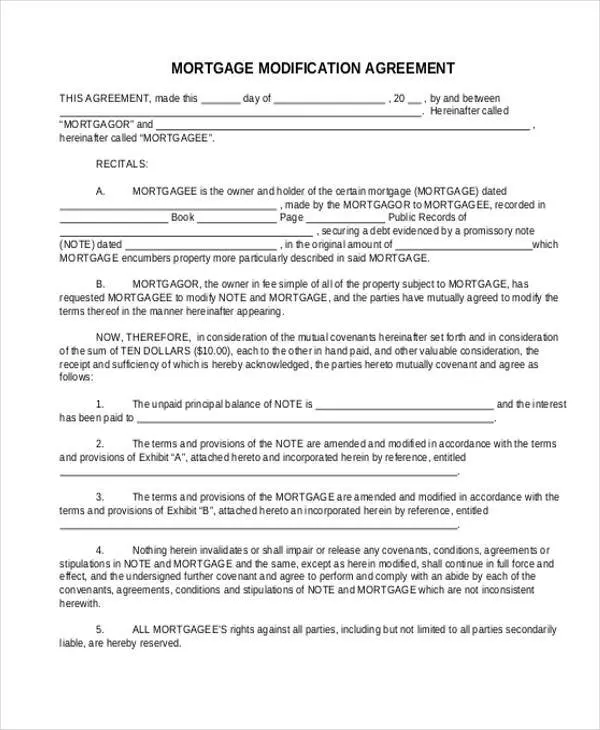

A mortgage forbearance agreement is a contract between a mortgage lender and a borrower wherein the lender agrees not to foreclose on the home and the borrower agrees to a plan that eventually gets them caught up on their monthly payments.

Learn more about how a mortgage forbearance agreement works, whether or not you need one, alternative options for borrowers, and how to get one.

A Mortgage Modification Agreement May Help Your Underwater Loan

A mortgage modification agreement may help you if you are in financial trouble and risk losing your home. The most important thing for you to do is learn what options are available.

- What is a mortgage modification agreement?

- How does a mortgage modification work?

Then take action by collecting your financial records, gathering your mortgage documents, reaching out to a HUD-approved counselor, and calling your bank.

You May Like: Why Would A Mortgage Be Declined

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Different Forums And Modes Of Applying For A Mortgage Loan Modification

There are different forums that can be used to modify a mortgage as follows:

Direct Modification Negotiations with Lender Borrowers can deal directly with the lender. By dealing directly with a lender, you can resolve the delinquency immediately and avoid foreclosure. This process must be started immediately to avoid your lender from hiring an attorney to start a state action against you and repossess the collateral property.

State Court Foreclosure Settlement Conferences Modifications and can be reviewed during the beginning stages of a foreclosure litigation where the Supreme Court Judge assigned to a case or their clerk reviews with the partys attorneys progress toward settlement and/or modification and encourages both sides to engage in good faith negotiations.

Bankruptcy Loss Mitigation Hearings The benefit of requesting a loan modification through a bankruptcy chapter 13 or 11 case is that both sides need to regularly at loss mitigation hearings report to the bankruptcy court progress in seeking a modification and/or other settlement. Lenders therefore have less of an ability to act in bad faith because of this close supervision. The Bankruptcy Judge assigned to the case will give both the lender and the borrower a timeline to produce all documentation. The lender is usually on its best behavior and are less likely to be arbitrary or to make a mistake in fear of being sanctioned by the judge.

Recommended Reading: What Is A 30 Year Fixed Jumbo Mortgage Rate

New York Foreclosure Laws

New York foreclosure may only proceed through a process called judicial foreclosure. This means the lender must file paper with the court to begin the foreclosure process and may take as much as 60 days before being finalized. In addition, borrowers who face foreclosure may find even after they lose their home they are liable for the difference between the amount of money the home sold for and how much the lender was owed. Lenders may request and be granted a deficiency judgment for this difference. Borrowers can save their homes in one of two ways: Loan modification or by filing bankruptcy.

What Do You Have To Do To Get A Loan Modification

The lender also normally adds any past-due amounts to the unpaid principal balance as part of the modification. To get a loan modification, youll likely have to show the bank that you cant make your current mortgage payment due to a financial hardship, but you can afford to make a lower monthly amount from now on.

Also Check: Does Rocket Mortgage Affect Your Credit Score

What Are The Pros And Cons Of Loan Modification

The Pros and Cons of a Loan Modification. Homeowners who are having a hard time making their mortgage payments may decide to fight to hold on to their home. A loan modification may lower monthly payments and make them more affordable, but for many Long Island homeowners and residents of the five boroughs a loan modification is not a good solution.