What Is A Good Debt

Even though youll often hear that your DTI cant be over a certain amount you might have heard of the 36% rule there is no specific number that qualifies you for a home loan. In some cases, your DTI can be in the mid-40s and you will still qualify for a mortgage.

That said, if your DTI is around 45%, youll need a very high credit score and down payment to balance it out. If your DTI is over 50%, there is little chance a lender will approve you for a loan.

What Is The Dti To Qualify For A Mortgage

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender.

Calculating Your Gross Income

Your income does not only include your regular job salary it also constitutes bonuses, regular income from dividends and interest, assistance or support payments, such as alimony or child support, and payment from tips or commissions. Adding the total will give you your gross annual income, and then dividing by 12 will yield your monthly gross income.

You May Like: What Is Loan To Value Mortgage

Importance Of Dti In Mortgages

Lenders are going to use DTI in conjunction with your to make a more realistic picture of you as a borrower.

Not just by how good you were in paying your debts in the past, but also do you have the means to take on additional debt and have enough income to cover it all every month.

Lenders want to see if you have a balance, and you dont have a ton of debts.

Also, they want to see that your income and your debts are pretty balanced. Lenders would look at how many debts can you afford as opposed to how many debts you are already paying.

If most of your income is going towards your existing debts, a lender might see this as no room left for additional debt, and your loan application may be denied.

When looking at the DTI, lenders know that people with lower DTI have a higher chance to get the desired loan.

If your DTI is low, the lender understands that there is less risk involved and would anticipate your payments accordingly.

Borrowers with low DTI are more likely to make payments with less chance of default.

Convert The Result To A Percentage

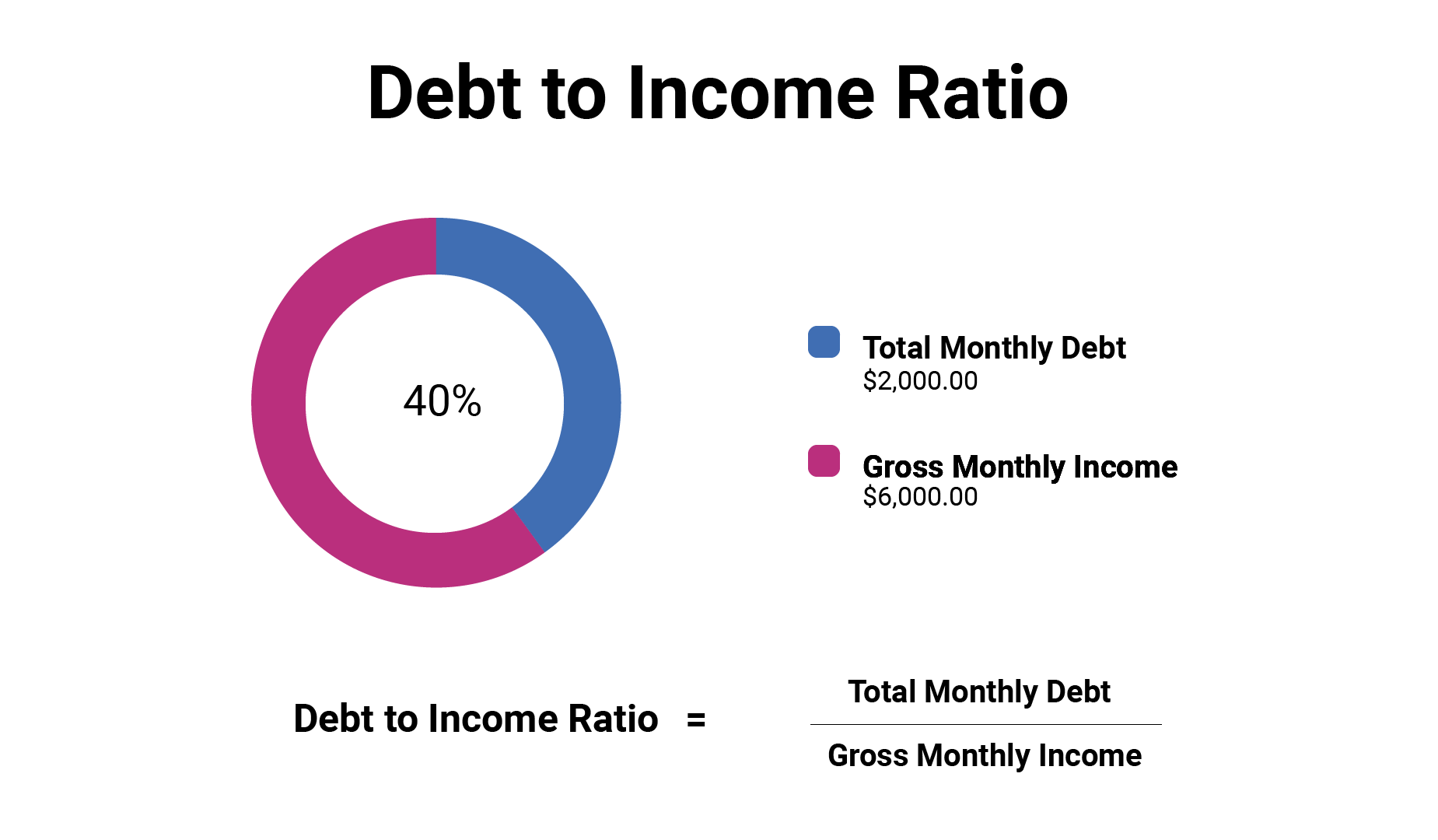

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100.In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Don’t Miss: How Much Is The Mortgage On A $300 000 House

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

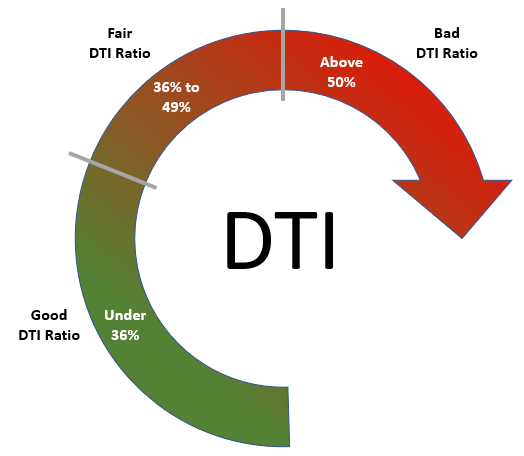

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

Check Your Mortgage Eligibility

Estimating your DTI can help you figure out whether youll qualify for a mortgage and how much home you might be able to afford.

But any number you come up with on your own is just an estimate. Your mortgage lender gets the final say on your DTI and home buying budget.

When youre ready to get serious about shopping for a new home, youll need a mortgage pre-approval to verify your eligibility and budget. You can get started right here.

Popular Articles

You May Like: How Do You Calculate Self Employed Income For A Mortgage

How Can I Lower My Debt

How to lower your debt-to-income ratio

Front End And Back End Ratios

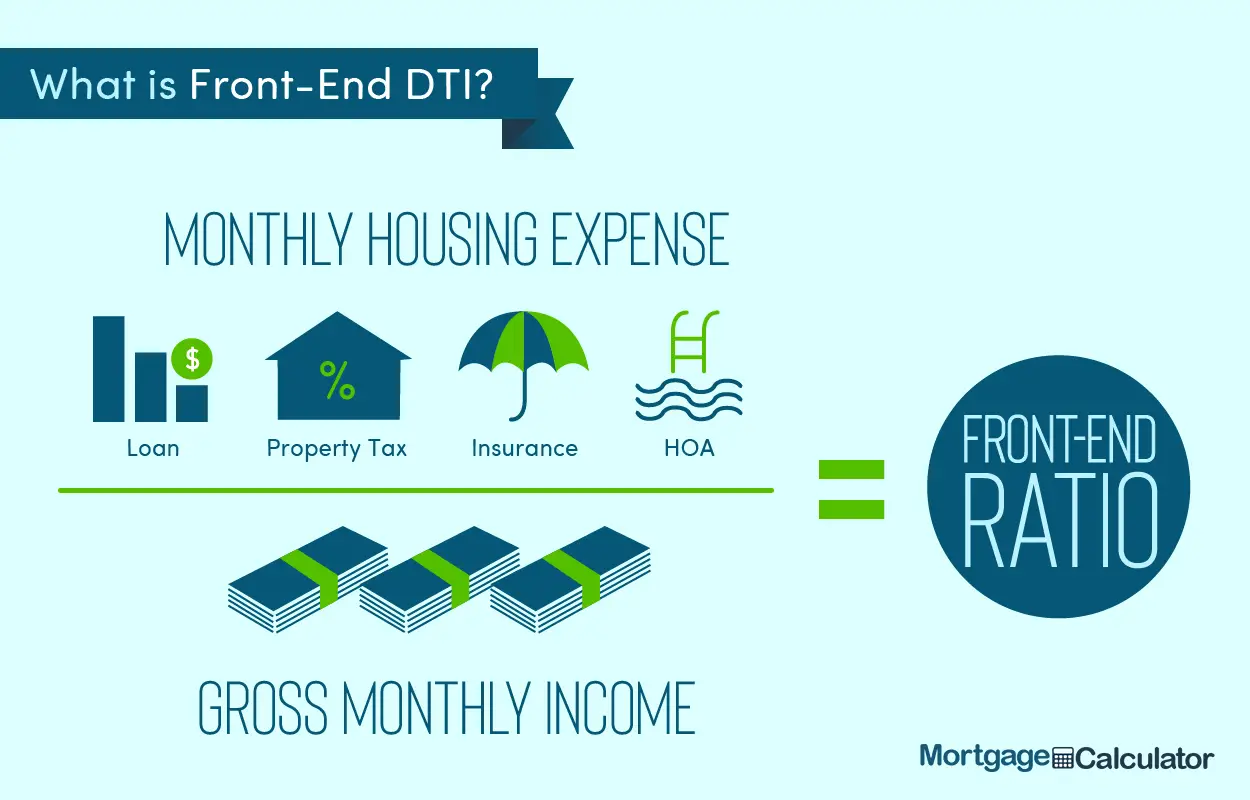

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Don’t Miss: Can A Locked Mortgage Rate Be Changed

What’s Included In Your Debt

Mortgage lenders actually calculate your debt-to-income ratio twice, because they look at a front-end DTI and a back-end DTI.

Calculating the front-end DTI is easy because the focus is only on the new mortgage obligations. Lenders look at your new housing payment, including principal, interest, taxes, and insurance, and they compare total housing costs to gross income. Most lenders like this ratio to be below 28%.

Calculating your back-end DTI becomes a little more complicated, though. This time, lenders look at all of your current debt obligations when they decide whether or not to approve you. That means a lot more debts count, including:

- Your new monthly mortgage payments

- Minimum monthly payments on medical debt

- Your monthly car loan payment

- The monthly payments on any personal or business loans you may have

- Alimony or child support payments

- Any other required monthly payments

Lenders will take a close look at your and may ask for financial account statements in order to determine all of the obligations you have.

They’ll add up the monthly payments for all of these different expenses and then compare that to income. For example, say that your total monthly obligations add up to $2,000 when taking into account all your minimum payments and your new mortgage — and say your income is $6,000. You’d divide $2,000 divided by $6,000 to see your DTI is .333 or 33.3%.

Open A Debt Consolidation Loan Or Balance Transfer Credit Card

Debt consolidation may help you get a better interest rate and pay down your balances sooner, ultimately helping you bring down your debt-to-income ratio.

Two common strategies of consolidating debt is with a personal loan or a balance transfer credit card:

| Debt consolidation vs. balance transfer |

| Debt consolidation loan |

Read Also: How 10 Year Treasury Affect Mortgage Rates

How Can I Lower My Debt To Income Ratio Quickly

How to lower your debt-to-income ratio

Whats Considered A Good Debt

The lower the DTI, the better. More specifically, a DTI of 36% or below is generally considered good, while a DTI of 37-42% is considered manageable. A DTI of 43% or higher will likely mean you wont qualify for a loan, as anything 43% or higher is considered cause for concern. A DTI of 50% or higher is considered dangerous.

Why 43%? Lenders came up with this number as a result of mortgage-risk studies that analyzed the type of borrowers who are most likely to have trouble making repayments and ultimately default on their loans.

Your DTI is a factor lenders consider when determining the rates and terms of your loan. In general, youre more likely to get a better rate with a lower DTI.

You May Like: How Much Do You Pay Back On A Mortgage

What Is A Good Debt To Income And How To Lower It

Any DTI above 43% the lenders see it as a red flag and wont lend any more debts if your DTI is above 43%. This ratio depends on the lender to lender and programs to programs.

Some mortgage programs may have a maximum DTI at 55%. And some lenders may consider a maximum DTI at 50%. Any DTI lower than 36% is regarded as an excellent debt to income ratio.

Obviously, the lower the better, but 36% is counted as ideal DTI. Lenders might also consider not more than 28% of it to be coming from mortgage payments.

Hypothetically, let us say your DTI is above the 43% mark, there are only two simple solutions to lower your DTI, make more money, or reduce your debts.

To make more money, you can always work part-time or open a small side business which would help you to not only increase your monthly income but also keep your debts to a minimum.

Any financial advisor will suggest not to get into unnecessary debts. Avoid getting unnecessary appliances, electronics, or any things that do not have a good depreciation value.

This way, you can always keep your debts to a minimum, and making sure you qualify for bigger loans when you actually need it.

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

Also Check: Are Mortgage Discount Points Worth It

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

How Student Debt Affects Dti For Fha Loans

If youre a first-time homebuyer with student loan debt, the great news is its going to get a lot easier to qualify for an FHA loan.

An FHA loan is a type of mortgage backed by the Federal Housing Administration . To qualify for an FHA loan, you generally must have a FICO score of at least 580 and a debt-to-income ratio of 43% or less, including student loans.

Under the old FHA lending guidelines, 1% of your student loan balance goes toward your DTI. If your student loan balance is $100,000, that means $1,000 goes toward shop around and compare home loans to find the best option for your situation.

Don’t Miss: Does Chase Allow Mortgage Recast

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over 19 years experience in the industry.

What Is An Ideal Debt

The choice of an ideal debt-to-income ratio for a mortgage is highly dependent on the lender, type of loan, and other mortgage requirements. However, most lenders prefer borrowers with a front-end ratio of not more than 28% and a back-end ratio not higher than 36%. In most cases, you will need to have a DTI score of not more than 50% to qualify for a home loan.

Recommended Reading: Is 3.99 A Good Mortgage Rate

What Should You Do To Make Sure Your Dti Ratio Doesn’t Derail Your Mortgage Application

Although a lower DTI is better, some lenders are more flexible than others. In fact, you may be able to find loan options with a DTI as high as 50% in some cases. If you have a high ratio, you’ll need to shop around more carefully to find a lender willing to work with you.

Another option may be to pay off debt. If you’re able to reduce what you owe and eliminate some debts or lower your monthly payments, you should hopefully be able to get your DTI to a level that makes you a more competitive borrower.

Since this can also help your , you may just find that you’re offered a much better deal on a mortgage if you work to pay down some of your debt before applying for one. The savings on interest over time can be considerable, so it’s worth working on debt paydown if you can.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

You May Like: How Much Interest Do I Pay On A Mortgage

How To Improve Debt

If youre denied a loan, or if you know your DTI is too high, there are steps you can take to lower it. Your DTI is just a snapshot in time of your current monthly debt in relation to your income and can improve with a little work. Consider these options: